Automotive Steering Systems Market Size & Overview:

Get More Information on Automotive Steering Systems Market - Request Sample Report

The Automotive Steering Systems Market Size was valued at USD 36.65 billion in 2023 and is expected to reach USD 43.61 billion by 2031 and grow at a CAGR of 2.2% over the forecast period 2024-2031.

The automotive steering system market is growing due to rising car demand and innovative technologies like Steer-by-Wire (SbW). SbW improves steering response, reduces vibrations, and simplifies autonomous car design. This tech is already being used in luxury vehicles. Another growth factor is the increasing demand for smooth operation in construction and hybrid vehicles. Modern steering systems with various assistance features enhance ride quality, driver feedback, and even fuel efficiency, which consumers are looking for. Traditionally, steering systems have evolved from manual to power-assisted, demonstrating constant improvement. However, these advancements can raise vehicle costs, potentially slowing market growth. Thus, the automotive steering system market benefits from more cars on the road and cutting-edge tech, but rising costs due to these advancements could be a hurdle.

MARKET DYNAMICS:

KEY DRIVERS:

-

Fuel Efficiency Drives Automotive Steering System Market Growth

The demand for fuel-efficient cars with better steering systems is driving the market. Stricter fuel efficiency rules and a desire for comfortable driving are also fueling growth. This trend is strong in developing countries like India and China, which are seeing a rise in demand for high-tech automotive steering systems.

-

Advancements in Auto Tech Drive Demand for Steering Systems Market Growth

RESTRAINTS:

-

Construction & Mining Equipment Lack Electric Power Steering

Construction equipment like loaders and graders mostly use articulated steering or hydraulics for steering. Electric power steering is absent because the high force (50kN-100kN) needed is difficult for electric motors. This lack of electric options in construction equipment hinders the automotive steering system market growth, as electrifying these vehicles would create a big demand for electric steering systems.

OPPORTUNITIES:

-

Electric Power Steering Enables Advanced Driver Assistance Systems for Improved Safety and Efficiency

-

Emerging markets with growing vehicle ownership present a vast opportunity for cost-effective power steering solutions.

CHALLENGES:

-

High R&D Costs Impede Innovation in Automotive Steering Systems

IMPACT OF RUSSIA-UKRAINE WAR

The Russia-Ukraine war has disrupted the automotive steering system market in several ways. Sanctions and logistical challenges have hampered the flow of crucial components from the region. Ukraine, for instance, was a significant supplier of wire harnesses, vital for a vehicle's electrical system. This shortage has led to production slowdowns and stoppages at car manufacturers, particularly in Europe. The war has exacerbated the ongoing semiconductor chip shortage. Both Russia and Ukraine play a role in the supply chain for materials needed for chip production. This further restricts car production and limits the availability of new vehicles equipped with advanced steering systems. The war has driven up the prices of raw materials like steel and aluminium, used extensively in steering system components. This inflation increases production costs and potentially leads to higher car prices, affecting consumer demand for new vehicles with advanced steering features. Overall, the Russia-Ukraine war has created a ripple effect that disrupts the automotive steering system market. It remains to be seen how long these disruptions will last and how the industry will adapt to this evolving situation.

IMPACT OF ECONOMIC SLOWDOWN

An economic slowdown can impact the automotive steering system market by reducing the consumer demand. During financial downturns, buyers tend to spend less cash which is driving to a decay in new car purchases. This directly translates to a decrease in demand for vehicles with the latest steering technologies like Electric Power Steering and Steer-by-Wire. Industry estimates suggest a potential 10-15% drop in car sales during a severe slowdown. Economic uncertainty can lead automotive manufacturers to delay or reduce investments in research and development for next-generation steering systems. This can delay innovation and slow down the adoption of features like driver assistance functionalities integrated with EPS, potentially causing a 5-7% decrease in market growth for advanced steering systems.

KEY MARKET SEGMENTS:

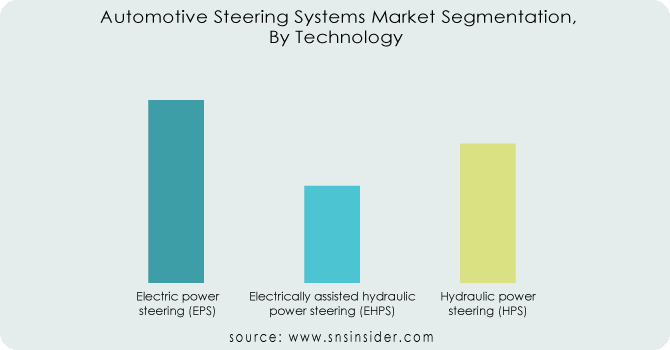

By Technology:

-

Electric power steering (EPS)

-

Electrically assisted hydraulic power steering (EHPS)

-

Hydraulic power steering (HPS)

Electric Power Steering (EPS) is the sub-segment which dominates the automotive steering system market by technology holding about 60-70% of market share. EPS systems offer several advantages over hydraulic and hybrid systems. They are lighter, more fuel-efficient, and provide better flexibility due to precise control. Additionally, EPS integrates seamlessly with Advanced Driver-Assistance Systems (ADAS) features like lane departure warning and parking assist, making them increasingly popular in modern vehicles.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Component:

-

Hydraulic Pump

-

Electric Motor

-

Steering Column

-

Steering Wheel Speed Sensor

Electric Motor is the sub-segment which dominates the automotive steering system market by component holding about 55-60% of market share. With the growing adoption of EPS, the demand for electric motors specifically designed for steering systems has surged. These motors offer precise control and are more efficient than hydraulic pumps used in older systems.

By Type:

-

Column-EPS (C-EPS)

-

Rack-EPS (R-EPS)

-

Pinion-EPS (P-EPS)

Column-EPS (C-EPS) is the sub-segment which dominates the automotive steering system market by type holding about 50-55% of market share. C-EPS systems offer several advantages, including compact size, simpler design, and lower cost compared to other EPS types.

By Off Highway:

-

Agricultural Tractors

-

Construction Equipment

Agricultural Tractors is the dominating sub-segment in the automotive steering system market by off highway holding around 55% of market share. Growing demand for high-tech farming equipment with improved flexibility and driver comfort is propelling the agricultural tractor segment. Technologies like electric power steering (EPS) enhance handling in tight spaces and reduce driver fatigue during long hours of operation.

By Electric Motor Type:

-

Brushless

-

Brushed

Brushless DC motors is the dominating sub-segment in the automotive steering system market by electric motor type holding around 70% of market share. Brushless DC motors offer superior efficiency (>90% compared to brushed motors at ~75%), reliability, and longer lifespan. These advantages are crucial in modern vehicles, particularly electric and hybrid ones, where maximizing battery life and minimizing energy losses are key concerns.

By Application:

-

PCs

-

LCVs

-

HCVs

PCs is the dominating sub-segment in the automotive steering system market by application holding around 60% of market share. Passenger cars constitute the largest volume segment in the automotive industry. Growing disposable income and increasing urbanization are leading to a rise in car ownership, driving demand for PC-specific steering systems. Additionally, features like lane departure warning and automated parking require more sophisticated steering systems, further propelling the PC segment.

By Electric Vehicle Type:

-

BEV

-

PHEV

-

FCEV

Battery Electric Vehicles is the dominating sub-segment in the automotive steering system market by electric vehicle type holding around 40% of market share. Stringent emission regulations and growing consumer preference for eco-friendly transportation are accelerating the adoption of BEVs. BEVs inherently require electric power steering (EPS) systems for efficient operation and regenerative braking capabilities.

By EPS Mechanism:

-

Collapsible

-

Rigid

Collapsible Steering Columns is the dominating sub-segment in the automotive steering system market by EPS mechanism holding around 65% of market share. Collapsible steering columns enhance passenger safety by absorbing impact energy during a collision. With increasingly stringent safety regulations, collapsible columns are becoming the preferred choice for manufacturers.

By Pinion:

-

Single

-

Dual

Single Pinion is the dominating sub-segment in the automotive steering system market by pinion holding around 80% of market share. Single pinion steering systems are simpler, lighter, and more cost-effective compared to dual pinion designs. These advantages are particularly important for mass-produced passenger cars where affordability and weight reduction are key considerations. However, for high-performance vehicles heavy-duty trucks dual pinion systems might be preferred.

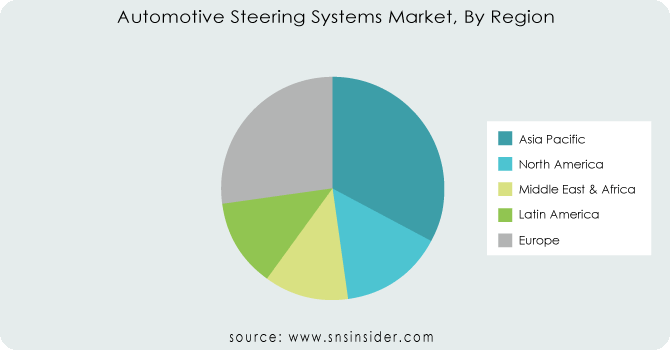

REGIONAL ANALYSES

The Asia Pacific region is dominating in the Automotive Steering Systems Market, holding a dominant market share of around 60-65%. This dominance is fueled by the surging demand for SUVs and luxury cars, along with a growing focus on fuel efficiency and government regulations pushing for adoption of EPS technology.

Europe is the second highest region in this market, capturing approximately 20-25% of the share. Here, a strong emphasis on safety and driver assistance features is driving the market.

The Asia Pacific region itself experiences the fastest growth with the projected CAGR of 8-10%. This fast development is credited to the developing automotive industry in nations like China and India, coupled with expanding disposable income and developing urbanization

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS:

Major players such as Nexteer Automobile Group Limited (US), JTEKT Corporation (Japan), NSK Ltd. (Japan), Hyundai Mobis Co., Ltd. (South Korea), Showa Corporation (Japan), Mitsubishi Electric Corporation (Japan), Sona Koyo Steering System Ltd. (India), TRW Automotive Holdings (US), Thyssenkrupp Presta (US), China Automotive System Inc. (China) and Robert Bosch GmbH dominate the global automotive steering system industry. To acquire momentum in the growing market, these companies used a variety of techniques.

Hyundai Mobis Co Ltd.(South Korea)-Company Financial Analysis

RECENT DEVELOPMENTS:

-

In Oct. 2022 - Nexteer's innovative mCEPS steering system boasts a modular platform and adaptable electronics. This customizable solution caters to diverse customer needs, offering advanced features, cost-efficiency, and flexibility to fit various packaging requirements.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 36.65 Billion |

| Market Size by 2031 | US$ 43.61 Billion |

| CAGR | CAGR of 2.2% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | by Technology (Electric power steering (EPS), Electrically assisted hydraulic power steering (EHPS), Hydraulic power steering (HPS)), by Component (Hydraulic Pump, Electric Motor, Steering Column, Steering Wheel Speed Sensor), by Type (Column-EPS (C-EPS), Rack-EPS (R-EPS), Pinion-EPS (P-EPS), by Vehicle Type (Passenger car (PC), Heavy commercial vehicle (HCV), Light commercial vehicle (LCV)) |

| Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America |

| Company Profiles | Major players such as Nexteer Automobile Group Limited (US), JTEKT Corporation (Japan), NSK Ltd. (Japan), Hyundai Mobis Co., Ltd. (South Korea), Showa Corporation (Japan), Mitsubishi Electric Corporation (Japan), Sona Koyo Steering System Ltd. (India), TRW Automotive Holdings (US), Thyssenkrupp Presta (US), China Automotive System Inc. (China) and Robert Bosch GmbH dominate the global automotive steering system industry. To acquire momentum in the growing market, these companies used a variety of techniques. |

| Key Drivers | The desire of the middle class to own an automobile, as well as successful corporate marketing, contribute to the market's growth. The industry is expanding due to an increase in automobile loans due to low borrowing prices, which results in increased vehicle sales. |

| RESTRAINTS | The initial expense as well as the launch of fully autonomous vehicles are significant market barriers for the business. EPS systems have a limited load-bearing capacity. |