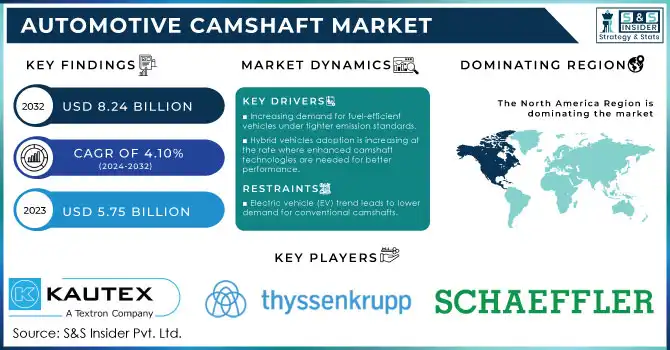

AUTOMOTIVE CAMSHAFT MARKET KEY INSIGHTS:

To Get More Information on Automotive Camshaft Market - Request Sample Report

The Automotive Camshaft Market Size was valued at USD 5.75 Billion in 2023 and is expected to reach USD 8.24 Billion by 2032 and grow at a CAGR of 4.10% over the forecast period 2024-2032.

Automotive Camshaft Market would doubtless be one of the major contributors to the internal combustion engine (ICE) vehicle segment that is growing within a world which is increasingly looking towards electrification yet retaining strong market offerings by its presence. Camshafts are components from which serve as critical actuators for valve control in an engine. It is responsible for controlling the proper opening and closing of valves allowing the efficient running of fuel intake and exhaust systems.

In 2023, the U.S. automotive industry produced approximately 10.6 million motor vehicles. Demand for camshafts in the U.S. is also extremely healthy, given the persistent predominance of ICE and hybrid vehicles. However, it has to contend with the effects of government policies and technological advancements.

Government policies in the U.S. and other key regions are a prime factor bearing down on the camshaft market. The U.S. government, instead, kept demanding more stringent emissions standards from the Environmental Protection Agency (EPA) to decrease the amount of gas effluvia into the atmosphere and also make the fuel consumed to run the vehicle the most efficient. This has forced manufacturers to continue improving camshaft designs in order to increase engine performance and efficiency and reduce fuel consumption and emissions as well. The U.S., at the same time, is also aggressively promoting the transition to EVs, which raises difficulties and opportunities for producers in the camshaft field. As the market for ICE vehicles is gradually shrinking, producers find safe zones in hybrid vehicle technologies that still heavily rely on camshafts.

Recent technology improvements also have molded the automotive camshaft market. However, the development of VVT and VVL has boosted the efficiency and performance aspects of an ICE engine to a greater extent, not to speak of their environmental friendliness. In VVT and VVL systems, valve operation is finely controlled in relation to time and amount, which ensures the possibility of optimal fuel economy along with pollutant reduction. These camshafts are made of light-weight materials like aluminum and composite parts; therefore, this reduces the entire weight of the engine and decreases its fuel consumption.

MARKET DYNAMICS

KEY DRIVERS:

-

Increasing demand for fuel-efficient vehicles under tighter emission standards.

Governments are imposing strict emission standards to check the rate of climate change and resultant pollution. For instance, the United States Environmental Protection Agency stipulates and standardizes an action that leaves a mark on the reduction in greenhouse gases by 2030 from the current level. Strict emission standards require cleaner vehicles that call for the manufacturers of automobiles to produce more efficient engines. However, modern camshafts, especially VVT-based camshafts, allow the engines to optimize fuel combustion and thus have more fuel-efficient engines and better mileage. With countries increasingly focusing on curtailing pollution, the demand for efficient engine components like advanced camshafts is growing, thereby promoting growth in the automotive camshaft market.

-

Hybrid vehicles adoption is increasing at the rate where enhanced camshaft technologies are needed for better performance.

Hybrid cars, that form the major step between full-electric vehicles and the conventional ICE cars, have paved their way in the market. Hybrid cars find the usage of camshafts to boost up the performance of engines in the cars. The demand for camshafts rises accordingly, which can meet the needs of specific hybrid engines. High-performance-level and fuel-efficient camshaft technologies such as camshaft phasing and dual mode camshaft improve hybrid system performance. With the increasing momentum of sustainable transportation across the globe, market demand will increase further for novel camshaft technologies that improve the efficiency of hybrid engines.

RESTRAIN:

-

Electric vehicle (EV) trend leads to lower demand for conventional camshafts.

One of the biggest distresses for the traditional automotive camshaft market is the growing trend toward electric vehicles (EVs). EVs use electric motors instead of an ICE, and therefore, do not require typical components such as camshafts, which are key components to valve timing control in ICE engines. With governments around the globe raising their effort and incentivizing the adoption of EVs through supportive policies, demand for electric motor-driven vehicles is rapidly picking up. For instance, the U.S. government aims to have 50% of all new vehicle sales be electric by 2030, and gasoline and diesel cars are supposed to be phased out by 2030 and 2035 in the UK and Germany, respectively. These trends are consequently lowering the number of conventional ICE vehicles being manufactured, thus reducing demand for automotive camshafts.

KEY SEGMENTATION ANALYSIS

BY PRODUCT TYPE

Cast Camshaft acquired 42% of the overall market share in 2023. Casting camshafts is favoured because manufacturing is relatively cheaper, and the product is pretty robust and durable, thus suitable for high-volume production in passenger vehicles. They are cast directly from molten metal into a mold, after which the final product comes out to be reliable and affordable to the automaker. The cast camshafts also possess good strength and durability in terms of longevity, a quality that makes them particularly attractive for light-duty vehicles.

Compacted by extreme pressures, Forged Camshafts, even at a greater cost, have high strength and resistance and, therefore, are mainly used in automobiles for high-performance motorsports and commercial use. It has produced metal compression that enhances its resistance to wear and tear. Although for a small market share, forged camshafts are very important since they fill applications where engine stress and durability are key.

BY VEHICLE TYPE:

Passenger Cars held the share market of 64% during the year 2023. A huge number of passenger vehicles are produced globally. As a result, it has maintained a constant demand of camshafts in the market for this class of passenger cars from regions such as North America, Europe and Asia. Passenger cars generally require that camshafts be stiffer, as well as more fuel efficient. As such, higher camshaft technology further propelled the development of auto makers to provide better performance and fuel economy in the said passenger cars.

The LCVs segment is expected to have the noteworthy growth in terms of CAGR during the forecast period 2024-2032. LCVs are increasingly used in e-commerce and last-mile deliveries, apart from other commercial activities, mostly in urban areas. The camshafts of LCVs are most vulnerable to stop-and-go driving, which is very stressful for the engine. Future demand for efficient LCVs with advanced camshaft technologies, in a sector of growing logistics and e-commerce, worldwide.

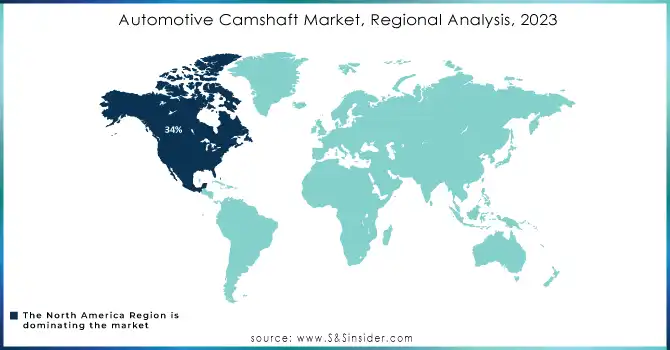

REGIONAL ANALYSIS

North America was the largest shareholder in 2023 with a market share of 34%. Automotive manufacturing hub region, most particularly in the United States, that produced 10.6 million motor vehicles in 2023 is propelling the demand in camshafts. Second, in North America, regulatory requirements have been quite tough on emissions, thereby making automobile sector investment in high camshaft technologies such as fuel efficiency and reduced emissions. Of course, there is the existing major automobile manufacturers and the pre-existing supply chain. Thus, North America should come as the top leader in this market.

The fastest growth will be experienced by the Asia-Pacific region as a part of this market, at a CAGR of 5.37% during the forecast period from 2024 to 2032. Key contributors within China, India, and Japan are noted through their rapidly growing automotive sectors. In China, the world's largest automotive producer increased its production of hybrid vehicles, building a good base for demand on camshafts.

Do You Need any Customization Research on Automotive Camshaft Market - Inquire Now

KEY PLAYERS

Some of the major players in the Automotive Camshaft Market are

-

Schaeffler Group (Camshaft Phasing Systems, Assembled Camshafts)

-

Thyssenkrupp AG (Hollow Camshafts, Forged Camshafts)

-

MAHLE GmbH (Dual-Mode Camshafts, Variable Camshaft Timing Systems)

-

DENSO Corporation (Valve Control Systems, Camshaft Position Sensors)

-

COMP Cams (Performance Camshafts, Racing Camshafts)

-

Kautex Textron (Fuel Systems, Camshaft Components)

-

Crane Cams (Camshaft Kits, Valve Train Components)

-

Melling Engine Parts (Stock Replacement Camshafts, Custom Camshafts)

-

Federal-Mogul (Camshaft Bearings, Valve Train Components)

-

Camshaft Machine Company (OEM Camshafts, High-Performance Camshafts)

-

Eaton Corporation (Engine Valvetrain Solutions, Camshaft Adjusters)

-

Liebherr (Hydraulic Camshaft Systems, Precision Camshafts)

-

Hirschvogel Automotive Group (Forged Camshafts, Powertrain Components)

-

Engine Power Components Inc. (Cast Camshafts, Crankshafts)

-

NSK Ltd. (Camshaft Bearings, Engine Components)

-

Hitachi Metals Ltd. (High-Durability Camshafts, Engine Parts)

-

Metaldyne Performance Group (Precision Camshafts, Forged Engine Parts)

-

Delphi Technologies (Variable Valve Timing, Camshaft Position Sensors)

-

GKN Automotive (Powertrain Systems, Camshaft Modules)

-

Riken Corporation (Piston Rings, Camshaft Parts)

MAJOR SUPPLIERS

-

ArcelorMittal

-

Allegheny Technologies Inc. (ATI)

-

Sandvik Materials Technology

-

Carpenter Technology Corporation

-

TimkenSteel Corporation

-

Nucor Corporation

-

AK Steel Holding

-

Alcoa Corporation

-

Nippon Steel & Sumitomo Metal Corporation

-

Outokumpu Oyj

MAJOR CLIENTS

-

Ford Motor Company

-

General Motors

-

Toyota Motor Corporation

-

Volkswagen Group

-

Hyundai Motor Company

-

BMW AG

-

Daimler

RECENT TRENDS

-

November 2023: Melling offers its latest camshaft lineup for the Gen V LT family of engines, tailored toward various applications. From a mildly upgraded piece over the stock unit to a high-performance camshaft, Melling's got the deal for your LT engine. New camshafts fall within a wide range of use and power bands. The smallest of the LT cam line, having an intake duration of 193 degrees at .050 inches of lift, the largest of the cams has an intake duration of 230 degrees at .050 inches of lift. The lineup is rounded out by cams having intake durations of 218, 224, and 228 degrees.

-

July 2023: one of the leading camshaft manufacturers, Precision Camshaft, announced that it is strategically focusing on the EV segment because it will provide high-margin opportunities. The company has announced plans to establish a manufacturing plant for EVs in Solapur and is developing an electric powertrain that would be designed for sub-4 tons Light Commercial Vehicles.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.75 Billion |

| Market Size by 2032 | US$ 8.24 Billion |

| CAGR | CAGR of 4.10 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Cast Camshaft, Forged Camshaft, and Assembled Camshaft), • By Vehicle Type (Passenger Car, Light Commercial Vehicles, and Heavy Commercial Vehicle), • By Sales Channel (Original Equipment Manufacturer (OEM), and Aftermarket) • By Material (Alloy, Cast Iron, Steel) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Schaeffler AG, Thyssenkrupp AG, Mahle GmbH, Aisin Seiki Co. Ltd., COMP Cams, ElringKlinger AG, Linamar Corporation, Camshaft Machine Company, Federal-Mogul, Precision Camshafts Limited, Kautex Textron GmbH, Honda Foundry Co. Ltd., Melling Engine Parts, INA Schaeffler, Bharat Forge Limited, Nemak, Seojin Cam Co., Ltd., GKN Automotive, Musashi Seimitsu Industry Co. Ltd., Mechadyne International Ltd. |

| Key Drivers | • Increasing demand for fuel-efficient vehicles under tighter emission standards. • Hybrid vehicles adoption is increasing at the rate where enhanced camshaft technologies are needed for better performance. |

| Restraints | • Electric vehicle (EV) trend leads to lower demand for conventional camshafts. |