Off-Road Vehicles Market Size & Overview

Get More Information on Off-Road Vehicles Market - Request Sample Report

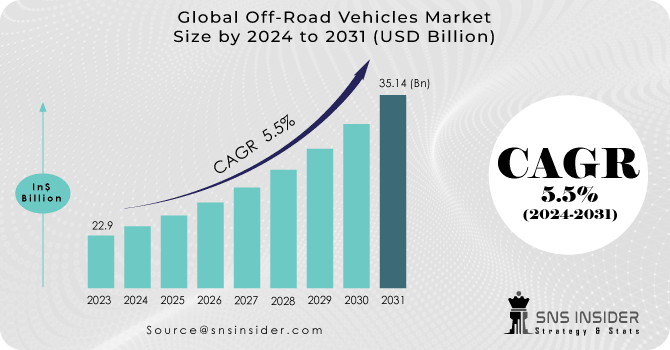

The Off-Road Vehicles Market Size was valued at USD 22.9 billion in 2023 and will reach to USD 37.07 billion by 2032 and grow at a CAGR of 5.5% by 2024-2032 The off-road vehicle market is expected to experience significant growth in the coming years, driven by the rising popularity of recreational off-roading activities like trail riding and off-road racing. This surge in enthusiasm translates to a higher demand for All-Terrain Vehicles (ATVs), Utility Task Vehicles (UTVs), and snowmobiles. These vehicles offer enthusiasts the capability and power to navigate challenging terrains and enjoy the thrill of off-road adventures. With more people having the financial means to pursue hobbies and explore the outdoors, off-road vehicles become a desirable option for adventure seekers.

Manufacturers are developing electric-powered off-road vehicles to cater to the growing demand for eco-friendly transportation. These electric models offer a sustainable alternative to traditional gasoline-powered vehicles, attracting environmentally conscious consumers. For instance, Polaris introduced the RANGER XP Kinetic, an electric UTV, showcasing the industry's commitment to innovation and sustainability. The high upfront cost of off-road vehicles can be a barrier for some potential buyers. The stringent safety regulations and environmental concerns regarding off-roading in certain areas can limit market expansion.

Off-Road Vehicles Market Dynamics:

Key Drivers:

-

Increasing focus on outdoor recreation globally, making off-roading a more attractive leisure activity.

-

Development of electric off-road vehicles caters to the demand for sustainable transportation and stricter emission regulations.

As environmental awareness rises and regulations on emissions limits, the off-road vehicle market is seeing a significant push towards electric models. Traditional gas-powered off-road vehicles contribute to air pollution, especially when used in ecologically sensitive areas. Electric off-road vehicles eliminate tailpipe emissions, offering a cleaner alternative that aligns with growing consumer desire for eco-friendly transportation. The stricter emission regulations are being implemented globally, which could potentially restrict the use of gas-powered vehicles in certain areas. By developing electric models, manufacturers can ensure their products comply with these regulations and avoid limitations on sales or usage. This shift towards electric power ensures the off-road vehicle market can thrive in a future focused on sustainability and cleaner emissions.

Restraints:

-

Environmental concerns regarding off-roading's impact on land and wildlife can restrict usage in certain areas.

-

Maintenance costs of off-road vehicles, especially high-performance models, can be a burden for some owners.

High-performance off-road vehicles are built to conquer tough terrain, but that durability often translates to complex and expensive repairs. Compared to everyday cars, off-roaders experience harsher conditions: mud, rocks, and bumps put a strain on parts like suspension components, tires, and drivetrains. These parts wear down faster and may require specialized mechanics and replacement parts, leading to higher maintenance bills. The high-performance models often boast powerful engines that require specific oil, filters, and other fluids, further adding to the overall maintenance cost. This can be a significant restraint for some potential buyers, especially those who may not anticipate the ongoing expenses associated with keeping an off-road vehicle in top shape.

Opportunities:

-

Development of safety features like advanced driver-assistance systems can attract safety-conscious consumers.

-

Innovation in lightweight materials and efficient electric drivetrains can lead to more affordable and eco-friendly off-road vehicles, expanding the market reach.

Challenges:

-

Educating off-road riders on responsible practices to minimize environmental damage and ensure safe and respectful use of off-road trails.

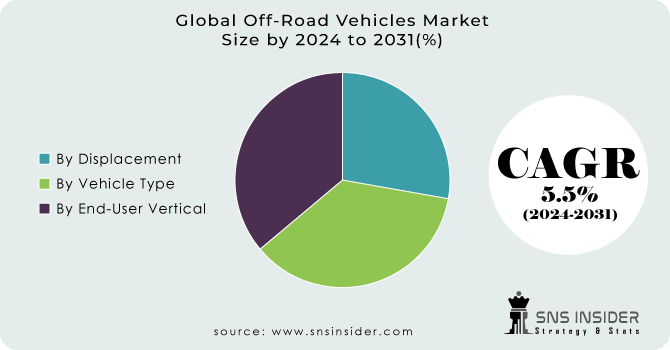

Off-Road Vehicles Market Segments:

By Vehicle

-

ATV

-

UTV/SSV

-

Off-road motorcycle

UTV/SSV is the dominating sub-segment in the Off-Road Vehicles Market by vehicle holding around 45-50% of market share due to its versatility. UTVs offer comfortable seating for multiple passengers, a cargo bed for hauling gear, and impressive off-road capabilities. Their popularity thrives in recreational activities like exploring trails, hunting, and participating in off-road events. The rising popularity of powersports and adventure tourism fuels UTV dominance, with manufacturers constantly innovating features like enhanced suspension, powerful engines, and improved passenger comfort.

By Application

-

Utility

-

Sports

-

Recreation

-

Military

Utility is the dominating sub-segment in the Off-Road Vehicles Market by application holding around 60-65% of market share. Farmers, ranchers, and construction workers rely heavily on these vehicles for tasks like traversing rough terrain, transporting tools and materials, and accessing remote areas. Their movability, durability, and ability to handle heavy loads make them indispensable workhorses. The growing demand for agricultural automation might introduce some competition from specialized utility vehicles, but the overall dominance of utilitarian off-road vehicles is expected to continue.

By Propulsion Type

-

Gasoline

-

Diesel

-

Electric

Gasoline is the dominating sub-segment in the Off-Road Vehicles Market by propulsion type. The established infrastructure for gas stations, the wider range and affordability of gasoline-powered vehicles, and concerns about the limited range and charging times of electric models in remote areas, all contribute to gasoline's dominance. With advancements in battery technology, stricter emission regulations, and a growing focus on environmental sustainability, electric off-road vehicles are expected to gain significant traction in the coming years, especially in regions with strong government support for electric vehicles.

Get Customized Report as per your Business Requirement - Request For Customized Report

Off-Road Vehicles Market Regional Analysis

North America is the dominating region in the Off-Road Vehicles Market holding around 60-65% of market share. A well-established culture of outdoor recreation like off-roading, camping, and hunting fuels strong demand. Diverse terrains, from deserts and mountains to snow-covered landscapes, create a perfect playground for off-road enthusiasts. High disposable income in the region allows for greater investment in powersports vehicles like ATVs and UTVs.

Europe holds the second-largest market share, driven by a strong presence of off-road vehicle manufacturers and a growing interest in adventure sports. The stricter environmental regulations might lead to a shift towards electric off-road vehicles in Europe sooner.

The Asia Pacific region is experiencing the fastest growth in the off-road vehicle market. This surge is fueled by factors like rapid urbanization, leading to the development of new recreational areas and off-road trails. The rise of disposable income and growing interest in leisure activities are propelling market growth.

Regional Coverage:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players in Off-Road Vehicles Market

The major key players are BRP Inc., Deere & Company, CFMOTO, Honda Motor Co., Ltd., Can-am, Kawasaki Heavy Industries, Ltd., KUBOTA Corporation, Polaris Inc., Mahindra & Mahindra Limited, Textron Inc., and Yamaha Motor Co., Ltd. and other key players.

Honda Motor Co .Ltd-Company Financial Analysis

Off-Road Vehicles Market Recent Development

-

In July 2022: American Landmaster brings electric UTVs to the US market. Powered by lithium-ion batteries with various range options, the base model boasts an impressive 45-mile range on a single charge.

-

In July 2022: Volcon's electric UTV, launched in Texas, boasts impressive specs: 143 horsepower, 360 Nm torque, reaching speeds of 130 km/h and traveling over 160 km on a single charge.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 22.9 Billion |

| Market Size by 2032 | US$ 37.07 Billion |

| CAGR | CAGR of 5.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Vehicle (ATV, UTV/SSV, Off-road motorcycle)

• by Application (Utility, Sports, Recreation, Military) • by Propulsion Type (Gasoline, Diesel, Electric) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BRP Inc., Deere & Company, CFMOTO, Honda Motor Co., Ltd., Can-am, Kawasaki Heavy Industries, Ltd., KUBOTA Corporation, Polaris Inc., Mahindra & Mahindra Limited, Textron Inc., and Yamaha Motor Co., Ltd. |

| Key Drivers | • The off-road vehicle market is predicted to develop as the trend of recreational activities and adventure sports grows. • The penetration of AWD and 4WD cars. |

| RESTRAINTS | • The expensive expense of off-road vehicle maintenance, as well as • A ban on ATV and UTV driving due to terrain damage is limiting the market growth. |