Automotive Chassis Market Report Scope & Overview:

Get More Information on Automotive Chassis Market - Request Sample Report

The Automotive Chassis Market size was recorded at USD 149.2 Billion in 2023 and is expected to reach USD 441.1 Billion in 2032, growing at a CAGR of 12.8% over the forecast period of 2024-2032.

The increasing global vehicle demand, especially passenger and commercial vehicles is driving the growth of advanced as well chassis systems in the automotive industry. According to the global report for automotive market sales, shows that the total vehicle unit sales in the U.S. market will be around 27% in 2024. Same with the Indian market, the sales for Passenger vehicles had reached up to 42, 18,746 units in 2023-24, an increase of 8.4% from the previous year.

Beginning with the development of automobile manufacturing to high-performance, safe, and comfortable direction, which requires the new lightweight chassis material with excellent properties, which makes vehicle efficient and more productive. Moreover, the government laws and regulations for vehicle emissions & fuel economy have also impacted driving the automotive chassis market. Automobile producers are developing lightweight chassis structures with composites made of carbon fiber, aluminum, and high-strength steel. The materials provide similar performance as before but better fuel efficiency and lower emissions along with the same structural integrity in terms of safety.

The companies also invested in the development of new vehicles with light chassis material, giving the market key players an opportunity to fight, and customers have better options with the purchase of vehicles. For Instance, Leading global automotive supplier ZF Friedrichshafen AG and the world's largest electronics manufacturer, Hon Hai Technology Group (Foxconn), officially formed a strategic partnership by completing their transaction today to create provisionally named "ZF Foxconn Chassis Modules." The joint venture was officially launched on April 30, with Foxconn purchasing a 50% share in ZF Chassis Modules GmbH. ZF plans to utilize this partnership strategically and in a bid to open up promising growth prospects with a fresh customer base as well as other development opportunities outside its traditional axle system assembly core business. From Foxconn's perspective, the deal represents an entry into auto manufacturing and a way to secure further expertise amid its mass production of electronics.

Market Dynamics:

Driver

- The growing demand for chassis for Electric vehicle manufacturing.

The evolution of the chassis design is required due to the rapid improvements in specialized EV requirements. Regardless of whether you're more concerned with range or power, an EV's ability to handle well and reduce the center of gravity is greatly enhanced by having its battery pack located on the floor of the car. Aluminum Chassis is mostly preferred for vehicles as it has high thermal conductivity and corrosion resistance. It also reduces the overall weight of the vehicle by 50%, as compared to other materials. According to the report, the Aluminum demand for body construction for vehicles is expected to reach from 65kg/BEV in 2023 to 80kg/BEV in 2030.

Restrain

-

The global disruptions are causing backlogs and volatility.

Opportunity

-

Growing demand for Lightweight Aluminum chassis for vehicles.

Challenge

-

The high cost and rising geopolitical pressures.

Market Segmentation

By Chassis Type

-

Non-Conventional

-

Modular

-

Conventional

By Vehicle Type

-

Passenger Car

-

Commercial Car

-

Electric Vehicles

The passenger car segment accounted for over 30% market share in terms of revenue in 2023. This sector is fueled by the rapidly growing consumer demand for safety and advanced connected car applications. The introduction of lightweight materials in passenger cars, and integrated chassis systems to improve fuel efficiency & performance will significantly contribute to increasing automotive market size and reducing environmental Impact.

Rising global demand for an environmentally friendly and efficient mode of public transportation is likely to provide impetus to the bus chassis market from 2023 through 2031. This is likely to have a profound impact on the market, with technological developments various trends among urban communities, and greater emphasis being laid upon environmental sustainability all influencing future CNG demand dynamics.

Regional Analysis:

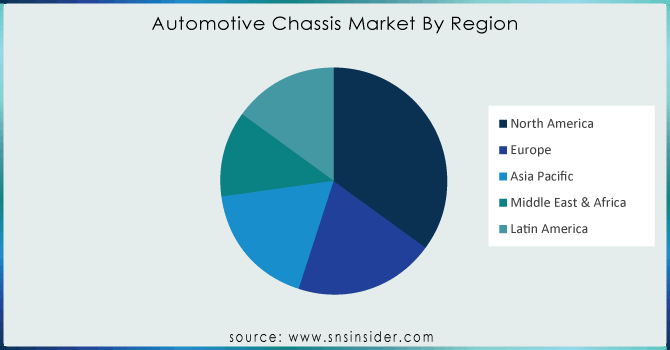

The Asia Pacific leads the automotive chassis market with more than 30% of the global market share in 2023, with its cost-saving nature as a result of the availability of cheap labor and raw materials that tend to entrench growth. This includes China and India which contribute to ~34% of global vehicle production driven by their high populations and growing purchasing power parity. According to data that shows China’s new energy vehicle sales reached around 10 million in 2023, consisting of Battery Electric vehicles and Plug-in Hybrid vehicles.

The US has also shown growth and developments in the automotive chassis market. Research on the US market indicates that sales of electric vehicles (EVs) rose to 53% in 2023 compared to 2022. This increase can be attributed to customers' preference for EVs over other options because charging stations are easily accessible. A total of twenty-one billion dollars has also been announced by the public and private sectors for the development of public charging stations.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Regional Coverage

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

The major key players are Schaeffler Technologies, Hyundai Motor, Aisin Seiki, Mahna International, Continental Ag, Tower International, CIE Automotive, REE Automotive, Benteler International AG, ZF Friedrichshafen AG, CIE Automotive and others players.

Recent Developments:

-

In April 2023, Magna International was awarded a contract to build INEOS Automotive's all-new electric SUV: Starting production in Graz, Austria in 2026. In addition to building it, Magna will also do the full engineering effort on this vehicle.

-

In March 2023: ZF announced software for an "intelligently networked" chassis system that harmonizes the longitudinal, lateral, and vertical dynamics of the vehicle. This system controls all chassis systems and ensures optimal acceleration, braking action, and precise steering response associated with balanced damping.

-

In October 2022: Four Mercedes-Benz E-SUV platforms, Hyundai Mobis chassis module delivery announced Hyundai thus became the first chassis module supplier to a luxury German OEM anywhere outside of Europe.

| Report Attributes | Details |

| Market Size in 2023 | US$ 149.2 Billion |

| Market Size by 2032 | US$ 441.1 Billion |

| CAGR | CAGR of 12.8 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Chassis Type (Non-conventional, Modular, Conventional) • By Vehicle Type (Passenger Car, Commercial Car, Electric Vehicles) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Schaeffler Technologies, Hyundai Motor, Aisin Seiki, Mahna International, Continental Ag, Tower International, CIE Automotive, REE automotive, Benteler International AG, ZF Friedrichshafen AG |

| Key Drivers | • The growth of automotive industry and the rising demand |

| Market Opportunity | • The rising trends in automotive industry and the rising sales percentage post global disruptions. |