Automotive Crash Sensor Market Report Scope & Overview:

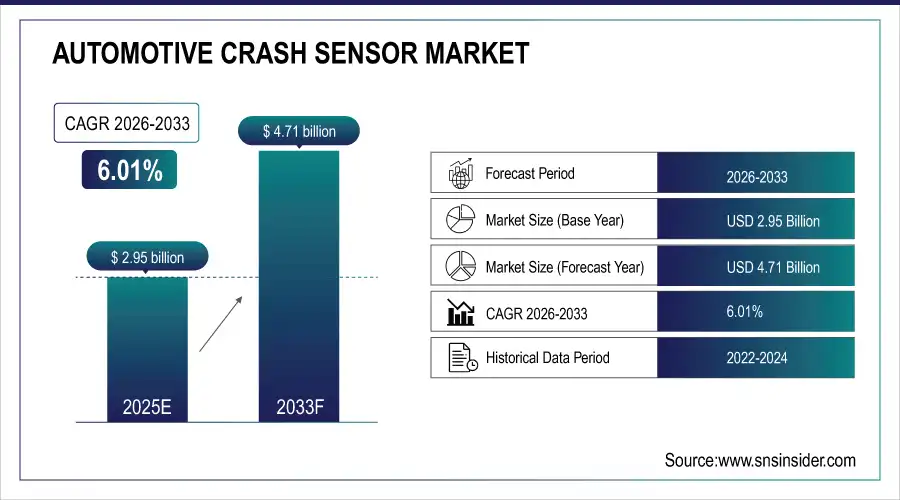

The Automotive Crash Sensor Market Size was valued at USD 2.95 billion in 2025E and is expected to reach USD 4.71 billion by 2033, growing at a CAGR of 6.01% over the forecast period of 2026-2033.

The Automotive Crash Sensor Market is experiencing robust growth, driven by stringent vehicle safety regulations and the increasing integration of advanced driver-assistance systems (ADAS) in modern vehicles. These sensors play a critical role in detecting collisions and initiating timely responses such as airbag deployment, autonomous emergency braking (AEB), and pre-collision safety mechanisms. Technological advancements in radar, LiDAR, ultrasonic, and camera-based sensors are enhancing the accuracy, reliability, and speed of crash detection, significantly improving occupant safety.

NHTSA has established regulations mandating the inclusion of advanced safety features in vehicles, such as crash sensors and advanced driver-assistance systems (ADAS), to improve occupant protection and reduce traffic fatalities.

Market Size and Forecast:

-

Automotive Crash Sensor Market Size in 2025E: USD 2.95 Billion

-

Automotive Crash Sensor Market Size by 2033: USD 4.71 Billion

-

CAGR: 6.01% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Automotive Crash Sensor Market - Request Free Sample Report

Key Automotive Crash Sensor Market Trends

-

Increasing Adoption of Advanced Driver-Assistance Systems (ADAS): Growing integration of AEB, lane departure warning, and pre-collision systems drives sensor demand.

-

Technological Advancements in Sensors: Enhanced radar, LiDAR, ultrasonic, and camera-based sensors improve detection accuracy and vehicle safety.

-

Stringent Safety Regulations: Governments worldwide, including the U.S. and EU, mandate advanced safety systems in new vehicles.

-

Rise of Electric and Hybrid Vehicles: EVs require specialized crash sensors for battery protection and occupant safety.

-

Miniaturization & Cost Reduction: Smaller, more efficient sensors enable wider adoption without increasing vehicle costs.

-

Integration with Autonomous Vehicles: Crash sensors are crucial for Level 2+ and fully autonomous driving systems.

-

Increased Consumer Awareness: Rising awareness of vehicle safety features boosts demand for advanced crash sensors.

U.S. Automotive Crash Sensor Market Insights

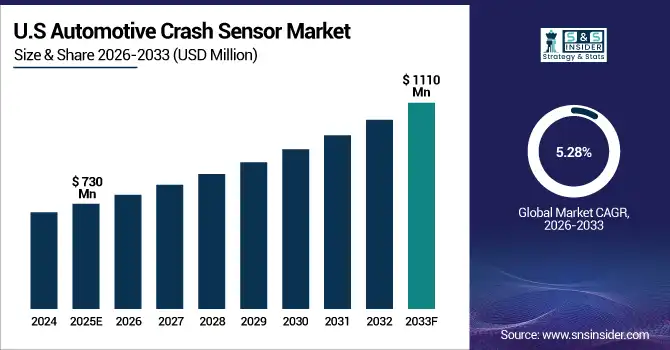

The U.S. Automotive Crash Sensor Market size was USD 730 million in 2025 and is expected to reach USD 1110 million by 2033 growing at a CAGR of 5.28% over the forecast period of 2026-2033. The growth is fueled by increasing vehicle safety regulations, which drive automakers to integrate advanced sensors. Rising consumer demand for safer vehicles leads to wider adoption of radar, LiDAR, ultrasonic, and camera-based systems. Additionally, the expansion of electric and hybrid vehicle production has prompted investment in specialized crash sensors to protect occupants and battery systems.

Automotive Crash Sensor Market Growth Driver

-

Increasing Adoption of Advanced Driver-Assistance Systems (ADAS) Enhances Vehicle Safety and Fuels Demand for Crash Sensors

The growing integration of ADAS technologies, such as automatic emergency braking (AEB) and lane-keeping assistance, is significantly enhancing vehicle safety. These systems rely heavily on crash sensors to detect potential collisions and initiate timely responses. As automakers increasingly adopt ADAS to meet stringent safety regulations and consumer demand for safer vehicles, the need for advanced crash sensors has risen correspondingly. This trend is expected to continue driving the growth of the automotive crash sensor market, as these sensors are integral to the functionality of ADAS.

In April 2025, the U.S. Department of Transportation announced a new initiative to incentivize automakers to integrate ADAS technologies, including crash sensors, into their vehicles. This move aims to accelerate the adoption of safety features and reduce traffic-related fatalities.

Automotive Crash Sensor Market Restraint

-

High Cost and Complex Integration of Advanced Crash Sensor Technologies Limit Widespread Adoption

The high cost and complexity associated with integrating advanced crash sensor technologies pose significant challenges to their widespread adoption. Premium sensors, such as LiDAR and high-resolution cameras, can increase vehicle production costs, making them less accessible for budget-conscious consumers and manufacturers. Additionally, integrating these sophisticated systems into existing vehicle architectures requires substantial investment in research and development, as well as potential redesigns of vehicle platforms. These factors can delay the implementation of advanced crash sensors, particularly in lower-priced vehicle segments.

In March 2025, a leading automotive manufacturer announced a delay in the rollout of its new model equipped with advanced crash sensors due to unforeseen integration challenges and cost overruns. This decision underscores the complexities involved in adopting cutting-edge safety technologies.

Automotive Crash Sensor Market Opportunity

-

Regulatory Mandates for Enhanced Vehicle Safety Features Drive Demand for Advanced Crash Sensors

Government regulations mandating the inclusion of advanced safety features in vehicles present a significant opportunity for the automotive crash sensor market. For instance, the European Union's General Safety Regulation requires new vehicles to be equipped with several safety features, including collision detection systems. Such regulations compel automakers to incorporate advanced crash sensors into their vehicles to comply with legal requirements, thereby expanding the market for these technologies. As regulatory bodies worldwide continue to enforce stricter safety standards, the demand for advanced crash sensors is expected to grow correspondingly.

In January 2025, the European Commission announced the enforcement of stricter safety regulations, including mandatory installation of advanced crash sensors in all new vehicles by 2027. This policy aims to enhance road safety and reduce traffic-related injuries and fatalities.

Automotive Crash Sensor Market Segment Highlights:

-

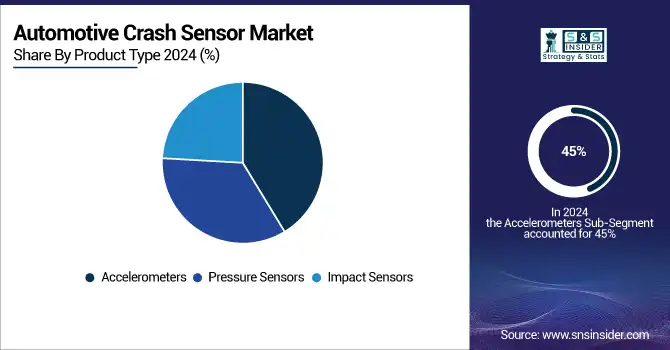

By Product Type: Accelerometers – 45% share (largest); Pressure Sensors fastest-growing; Impact Sensors showing moderate growth.

-

By Technology: Radar Sensors – 40% share (largest); Camera-Based Systems fastest-growing; LiDAR and Ultrasonic Sensors growing steadily.

-

By Function: Airbag Deployment – 50% share (largest); Autonomous Emergency Braking (AEB) fastest-growing; Pre-Collision Systems showing moderate growth.

-

By Vehicle Type: Passenger Cars – 55% share (largest); Electric Vehicles (EVs) fastest-growing; Commercial Vehicles growing steadily.

-

By Propulsion Type: Internal Combustion Engine (ICE) Vehicles – 60% share (largest); Electric Vehicles (EVs) fastest-growing; Hybrid Vehicles showing moderate growth.

-

By Placement: Front-End – 42% share (largest); Side-Impact fastest-growing; Rear-End and Interior showing moderate growth.

Automotive Crash Sensor Market Segment Analysis

By Product Type

The Accelerometers segment holds the largest market share at 45%, driven by their accuracy in detecting vehicle acceleration and deceleration, which is critical for collision detection and airbag deployment. Pressure Sensors are the fastest-growing type, due to rising demand in EVs and hybrid vehicles for battery and occupant protection. Impact Sensors maintain moderate growth, as they complement other sensor types to enhance overall crash detection, though higher costs and integration complexity limit adoption in lower-priced vehicle segments.

By Technology

Radar Sensors dominate with 40% market share, as they provide reliable object detection in various weather conditions, supporting ADAS functionalities like AEB. Camera-Based Systems are the fastest-growing, driven by advances in computer vision and AI, enabling lane detection and pedestrian recognition. LiDAR and Ultrasonic Sensors show steady growth, primarily in premium and autonomous vehicles, as their high cost restricts mass adoption.

By Function

Airbag Deployment leads with 50% market share, reflecting regulatory mandates and the critical role of sensors in occupant safety. Autonomous Emergency Braking (AEB) is the fastest-growing function, fueled by increasing adoption of ADAS in passenger and commercial vehicles. Pre-Collision Systems show moderate growth, as automakers integrate them selectively in mid-to-high-end vehicle models to enhance safety features.

By Vehicle Type

Passenger Cars hold 55% market share, driven by consumer demand for safer, feature-rich vehicles. Electric Vehicles (EVs) are the fastest-growing segment, due to specialized crash sensors protecting high-voltage battery packs. Commercial Vehicles exhibit moderate growth, mainly from fleet safety upgrades and regulatory compliance in logistics and transportation sectors.

By Propulsion Type

Internal Combustion Engine (ICE) Vehicles dominate with 60% market share, as they represent the largest portion of the vehicle fleet. Electric Vehicles (EVs) are the fastest-growing sub-segment, supported by government incentives and technological innovation. Hybrid Vehicles maintain moderate growth, combining benefits from ICE and EV sensor requirements, but limited adoption slows their share.

By Placement

Front-End sensors lead with 42% market share, as they are essential for frontal crash detection and collision avoidance. Side-Impact sensors are the fastest-growing placement, reflecting increased safety focus for lateral collisions in urban environments. Rear-End and Interior sensors show moderate growth, enhancing occupant safety and airbag optimization but with slower adoption rates.

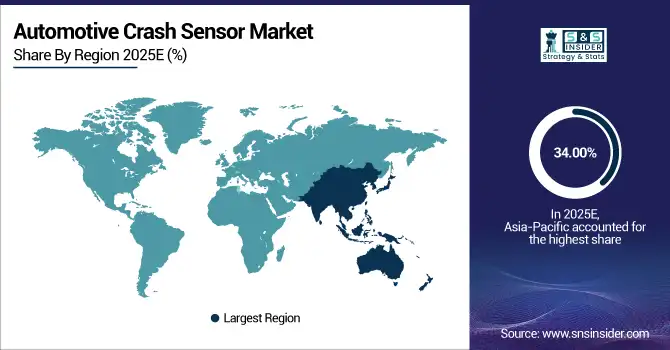

Automotive Crash Sensor Market Regional Analysis

Asia-Pacific Automotive Crash Sensor Market Insights

Asia-Pacific leads with a 34.00% share in 2025 and is the fastest-growing region, driven by rapid industrialization, urbanization, and expanding warehouse and logistics networks. China, India, Japan, and South Korea are major contributors, supported by government policies promoting industrial infrastructure upgrades and e-commerce logistics expansion. Adoption of modular and automated sensor systems is increasing, fueled by rising demand in passenger cars, commercial vehicles, and EVs. Flexible financing, private-sector investments, and technological innovation further accelerate regional growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Automotive Crash Sensor Market Insights

North America accounts for 33.00% of the market in 2025, led by strong infrastructure development, advanced logistics systems, and technological adoption. The U.S. dominates regional growth through investments in passenger vehicles, EVs, and industrial fleets. Integration of smart sensor technologies, modular designs, and ADAS enhances vehicle safety. Availability of financing, private-sector investments, and supportive industrial policies supports adoption across manufacturing, automotive, and logistics sectors.

Europe Automotive Crash Sensor Market Insights

Europe holds 24.00% of the market in 2025, supported by established automotive manufacturing infrastructure, government-backed modernization programs, and strong financing frameworks. Germany, France, and the U.K. are key contributors, investing in advanced crash sensor integration for passenger and commercial vehicles. Safety regulations, environmental compliance, and urban transport modernization drive demand for radar, LiDAR, and camera-based sensors, with banks and NBFCs collaborating to facilitate adoption.

Latin America and Middle East & Africa (MEA) Automotive Crash Sensor Market Insights

Latin America accounts for 4.00% and MEA 5.00% of the market in 2025, emerging as high-potential regions. Brazil and Mexico lead LATAM, investing in fleet safety, logistics, and automotive technology. In MEA, UAE, Saudi Arabia, and Egypt focus on industrial expansion and EV adoption. Government incentives, foreign investments, and strategic infrastructure projects drive adoption of automotive crash sensors, supported by leasing, financing programs, and technology partnerships.

Competitive Landscape for Automotive Crash Sensor Market:

Bosch GmbH

Bosch GmbH is a global leader in automotive safety, crash sensor solutions, and advanced driver-assistance systems (ADAS).

-

In September 2025, Bosch presented new ADAS hardware and software at IAA Mobility 2025, including radar, camera, and inertial sensors, improving collision detection, airbag deployment accuracy, and overall vehicle safety for passenger and commercial vehicles.

Denso Corporation

Denso Corporation specializes in automotive safety, V2X communication, and crash sensor integration for advanced vehicles.

-

In August 2025, Denso showcased Vehicle-to-Everything (V2X) and smart mobility solutions at ITS World Congress 2025, emphasizing enhanced collision detection, accident prevention, and improved occupant protection through integrated crash sensors.

Continental AG

Continental AG develops crash sensors, airbag systems, and vehicle safety solutions for global automakers.

-

In April 2025 Continental introduced two new airbag crash sensors at the AAPEX Show, designed to improve airbag deployment precision and enhance passenger safety in all vehicle segments.

Automotive Crash Sensor Market Key Players

Some of the Automotive Crash Sensor Companies

-

Bosch GmbH

-

Denso Corporation

-

Continental AG

-

Autoliv Inc.

-

ZF Friedrichshafen AG

-

Aptiv PLC

-

Delphi Technologies

-

Veoneer Inc.

-

Hyundai Mobis Co., Ltd.

-

Magna International Inc.

-

Texas Instruments Inc.

-

Infineon Technologies AG

-

NXP Semiconductors N.V.

-

Analog Devices, Inc.

-

STMicroelectronics N.V.

-

Hitachi Automotive Systems, Ltd.

-

Panasonic Corporation

-

Lear Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 2.95 Billion |

| Market Size by 2033 | USD 4.71 Billion |

| CAGR | CAGR of6.01% from 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type: (Pressure Sensors, Accelerometers, Impact Sensors) • By Technology: (Radar Sensors, LiDAR Sensors, Ultrasonic Sensors, Camera-Based Systems) • By Function: (Airbag Deployment, Autonomous Emergency Braking (AEB), Pre-Collision Systems) • By Vehicle Type: (Passenger Cars, Commercial Vehicles, Electric Vehicles (EVs)) • By Propulsion Type: (Internal Combustion Engine (ICE) Vehicles, Hybrid Vehicles, Electric Vehicles (EVs)) • By Placement: (Front-End, Side-Impact, Rear-End, Interior) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Bosch GmbH, Denso Corporation, Continental AG, Autoliv Inc., ZF Friedrichshafen AG, Aptiv PLC, Delphi Technologies, Veoneer Inc., Hyundai Mobis Co., Ltd., Magna International Inc., Texas Instruments Inc., Infineon Technologies AG, NXP Semiconductors N.V., Analog Devices, Inc., STMicroelectronics N.V., Hitachi Automotive Systems, Ltd., Panasonic Corporation, Lear Corporation |