Freight Forwarding Market Report Scope and Overview

Get More Information on Freight Forwarding Market - Request Sample Report

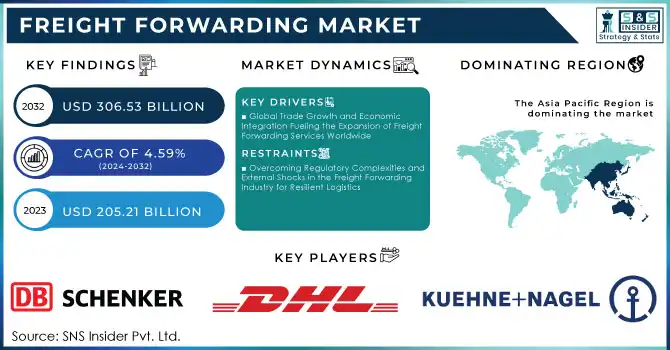

The Freight Forwarding Market Size was valued at USD 205.21 billion in 2023 and is expected to reach USD 306.53 billion by 2032, growing at a CAGR of 4.59% over the forecast period 2024-2032.

The growth of the freight forwarding market is mostly driven by the growing demand for logistics and transportation solutions in a globalized world. With the captivating rise of global trade, organizations are looking for dependable and economical ways to transfer goods between national borders. The growth of e-commerce in North America, Europe, and Asia has increased demand for speed and convenience when it comes to delivery services. Consumer demand for faster deliveries, which requires a more sophisticated logistics infrastructure, is also a potential catalyst for growth in the freight forwarding industry. Also, with the introduction of digital platforms and technologies in freight forwarding, such as automated tracking systems and artificial intelligence, the speed and transparency of operations have increased, which also positively affects the growth of the market. American Airlines Cargo expanded its winter schedule from November 2023 to March 2024 with over About 12,500 round-trip flights.

Starting in June 2023, Cargo-partner introduced weekly air freight options between Chicago and London. C.H. Robinson also opened a new 1.5 million square feet logistics center in Laredo, Texas, in support of north-south cross-border trade, including 400,000 square feet of warehouse space and 154 dock doors. In parallel, Kazakhstan's new terminal project at the China-Kyrgyzstan-Russia border is planned to be able to process 10 million tons/year once ready by 2030

Specialty supply chains are reliant on growth, the other vital aspect affecting growth is the dependency of numerous sectors. As an example, the automotive, healthcare, and food & beverages sectors have distinct shipping requirements and demand custom solutions. Similarly, sourcing from emerging markets and the general proliferation of global manufacturing increases the need for freight forwarding services. In addition, advances in air and sea shipping technologies, and modern and expanded rail and road networks are making international trade smoother. Collectively, these factors are transforming the freight forwarding market into a high-growth industry, which is expected to grow further in the next few years. Digital Transformation is the top priority for logistics companies to maintain competitiveness at 76%. Rising manufacturing activity will also drive logistics demand by up to 8% annually, especially in fast-growing economies, such as India. In addition, 40% of global CEOs in logistics firms are embracing sustainability in their strategy. Although 6% of specialized freight services came from the automotive sector, more demand for temperature-controlled transport is coming from the healthcare industry.

Freight Forwarding Market Dynamics

KEY DRIVERS:

-

Global Trade Growth and Economic Integration Fueling the Expansion of Freight Forwarding Services Worldwide

The growth of the freight forwarding market is mainly driven by the emergence of intricate global supply chains that have been made feasible by trade agreements as well as economic integration among regions. Countries are majorly following free trade policies nowadays and removing trade barriers which made the flow of goods from one country to another country smooth and easy for businesses to reach the international market. This has greatly increased the demand for freight forwarders who can navigate the intricate world of customs laws, import/export regulations, as well as the international shipping processes required. This is illustrated by the establishment of large global trade centers and the unification of regional economies (for example, in the Asia-Pacific and Latin American regions). However, these changes demand logistical solutions that allow the rapid movement of goods, and this is where freight forwarders get to play a central role in one of the most complex transport segments of the software industry, balancing costs and time through the coordination of transport through different modes (air, sea, rail, and road). Global Trade Volume Grew 8.7% In 2023 Major logistics centers including the Port of Singapore recorded container throughput growth of 2.5%. Trade grew 6.2% for Intra-Asia and 4.5% for Latin America. These numbers further emphasize the role of trade agreements and regional economic integration in increasing demand for freight forwarding services

-

Driving Freight Forwarding Growth through Green Logistics and Sustainable Practices in the Global Supply Chain

Sustainability practices in logistics are also another main driver that makes the freight forwarding market forward. With Swedish companies facing increasing pressure from governments, consumers, and regulators to cut carbon emissions, there is a stronger focus on green transportation. As a result, there is a growing need for green logistics, including electric vehicle use, energy-efficient shipping methods, and carbon-neutral activities. From optimizing shipping routes to switching to low-emission vehicles and using greener packaging, freight forwarders are turning to innovative technologies and approaches to minimize the environmental impact of their services. The motivation towards sustainability is two-fold a reaction to environmental concerns and a competitive differentiator more companies strive to be viewed as environmentally responsible and consumers buy from companies that take sustainable practices from the supply chain to the consumer end. It is these market dynamics that are propelling the freight forwarding industry toward growth and the pace at which the sector evolves is consistent with contemporary consumer and corporate values. DHL Express has introduced 80 new electric vehicles into its fleet in Singapore. The company claimed its GoGreen Plus program with Sustainable Aviation Fuel (SAF) resulted in emissions savings of up to 80%. For 2030, the EU is aiming for a 10% reduction in transport-related emissions and will achieve these targets in part by shifting people and goods from road to rail. Brazil's Alcântara Port Terminal incorporates passive energy in its operations; Digitalization efforts like electronic bills of lading can eliminate 99% of emissions from documents and save the sector up to USD 6.5 billion.

RESTRAIN:

-

Overcoming Regulatory Complexities and External Shocks in the Freight Forwarding Industry for Resilient Logistics

Freight forwarding is a competitive market that has several restraints, with the significant being the complexity of regulatory compliance in all continents. The increasing scale of international trade is aggravated by the ever-complicating system of import/export regulations, customs conditions, and tariffs that are intricate from region to region. Such multiparty systems are complicated, and unnecessary layers of bureaucracy can result in delays and compliance failure of contracts that cannot only clog supply chains but also compromise business efficiency. A second major threat is the susceptibility of global supply chains to external shocks. Natural calamities, geopolitical unrest, and pandemics can make the transportation lanes virtually not functional, disrupting shipments, and delivery delays. Freight forwarders must be proactive and always prepared for changing conditions and contingency plan implementation, thereby offering a huge scope for having flexible, resilient logistics systems. Such external factors can result in major operational issues thus making it difficult for companies to ensure on-time and effective delivery of goods.

Freight Forwarding Market Segment Analysis

BY TRANSPORTATION

Road transport accounts for 46% of market share in 2023. The reason for this supremacy is that road transport is flexible profitable and easily accessible for domestic and regional deliveries. Roads are not only last-mile connectivity for short-distance freight but equally important for long-distance freight. Besides, road transport gives better control over delivery timing and is less vulnerable to disruptions as compared to other means of transport, making it the preferred logistic solution in many fields of business. A vast system of road infrastructure and highways, especially in emerging markets, has cemented its role in global freight forwarding.

Air transport is projected to have the fastest CAGR between 2024 and 2032. The ongoing drive for speedier delivery, as witnessed in e-commerce, healthcare, and high-value goods, is fuelling this expansion. Air freight has become an increasingly vital aspect of the supply chain as delivery windows grow tighter and global supply chains become more complex, necessitating expeditious shipping. In addition, the air freight segment is set to continue playing an important role in the transportation provider of the future, as the volume of air cargo capacity, air logistics technology improvements, and the emergence of air freight startups continue to benefit the growth of the air transport segment.

BY CUSTOMER TYPE

B2B (business-to-business) held a major market share of 57% in 2023. This is mainly due to corporations depending on freight forwarding services to run large quantities of raw materials, finished items, and also equipment to markets around the world. Since there are long-standing contracts, consistent and bulk B2B shipments transit across modes (road, air, sea, and rail) and tend to form part of stable supply chain partnerships. Industries such as manufacturing, automotive, and retail that make up the B2B sector need a scalable freight-forwarding solution that is cost-efficient and time-effective to ensure their global operations are running smoothly. Due to the volume of shipments and complexity involved in B2B transactions, this segment continues to hold the largest share of the overall freight forwarding market.

B2C (business-to-consumer) is anticipated to exhibit the fastest CAGR during the forecast period of 2024 to 2032. This is fueled by the rapid growth of e-commerce, the consumer wants faster, more reliable, and transparent delivery of their online purchases. With the rise of online retail, particularly in developing markets, the need for last-mile delivery is booming. Following the boom of eCommerce in recent years, the expectations of consumers are rapidly changing as they want increasingly shorter delivery times, the ability to track shipments sent anywhere in the world, and flexibility in their choice of shipping method; all of which means new areas of B2C logistics for freight forwarders to innovate in. The growth of the B2C sector due to a rise in direct-to-consumer models along with delivery technology innovations (including drones, autonomous vehicles, and smart programs) will spur rapid growth within the next years and be a key factor supporting the growth of the total freight forwarding market.

BY SERVICE

The transportation & Warehousing segment led the freight forwarding market accounting for the largest share of 34% share in 2023. The dominance is due to the significance of transportation and warehousing in the logistics chain. The freight forwarding process is supported by transport transferring goods between regions and countries while warehousing ensures the proper storage, management of inventory, and effective movement of goods both in and out of supply chains. As global trade and supply chains become more complicated, many firms rely on integrated transportation and warehousing services to provide timely deliveries, maintain stock levels, and reduce lead times. Further solidifying the position of this segment in the overall freight forwarding market is the ongoing development of infrastructure on roads railways ports and airports along with logistics technology.

Value-added Services are anticipated to experience the fastest CAGR over the forecast period between 2024 and 2032. The surge in growth is due to increased demand for services beyond transportation and warehousing. As companies continue to prioritize cost-effective and tailored logistics services, value-added services like inventory management, packaging and labeling, customs clearance, and supply chain optimization have become pivotal industry trends. Moreover, e-commerce growth and demand for tailored shipping solutions have played a key role in boosting value-added services. Freight forwarders are using technology to provide real-time tracking, analytics, and other service products that sit on top of the basic logistics services. Value-added services will be an integral part of innovation for growth within the freight forwarding market as businesses will continue to focus on enhancing operational efficiency and reducing costs.

BY APPLICATION

The Industrial & Manufacturing sector was the fastest, accounting for 26% of total market share in 2023. It is indispensable to the global supply chain, with industries like automotive, electronics, machinery, and heavy equipment needing end-to-end logistics services to move raw materials, components, and finished goods. The scale of shipments and the complexity associated with them means the need for efficient, reliable, and cost-effective forwarding services in this space is undeniable. Many industrial and manufacturing businesses need freight forwarding as a key part of their operations as they often need special handling, customized transportation solutions, and time-sensitive deliveries. The heavy dependence on international trade, manufacturing, and supply chain networks has secured the industrial and manufacturing industry the largest market segment in freight forwarding.

Retail & E-commerce is expected to grow fastest CAGR from 2024–2032. The evolution of the freight forwarding sector is largely due to the booming e-commerce industry. With expectations for shorter lead times and flexible shipping from consumers the norm now for retailers and e-commerce companies, freight forwarders are increasingly becoming the providers of choice for fast, reliable, and efficient delivery solutions. Last-mile delivery services, real-time tracking, and customized shipping solutions have innovatively fuelled the forward process in the freight forwarding industry. Also, the expansion of e-commerce business, especially from emerging markets forces acceleration of these structural requirements to scale logistics networks. Thus, the growth of the retail and e-commerce industry is expected to be faster than the growth of other industries, which in turn will be an important driver of the freight forwarding market through 2024.

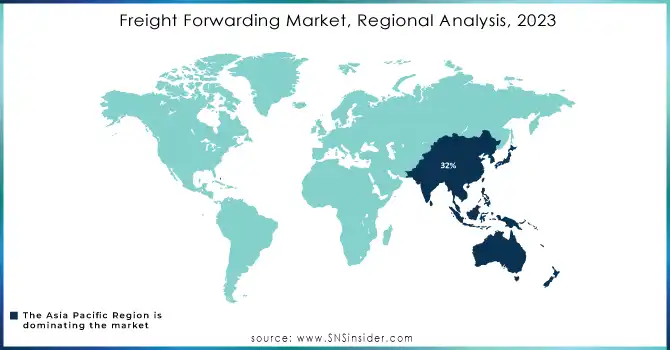

Freight Forwarding Market Regional Overview

In 2023, Asia Pacific accounted for 32% of the total freight forwarding market. The region has largely maintained its dominance in the global supply of textiles and garments due to its global manufacturing-centered nature of the economy and its role as a regional capital of global trade. This market share is mainly attributed to countries such as China, India, and Japan. As an illustration, China is the biggest exporter in the world, and its developed infrastructures (such as Shanghai Port which is the busiest container port in the world) allow all the goods to be delivered to various destinations all over the world. Likewise, the expansion of manufacturing industries in India, particularly textiles, automotive, and electronics, creates substantial demand for freight forwarding services. To deal with the large volume of trade and provide customized logistics solutions to the businesses, main logistics companies such as DHL, Kuehne + Nagel, and DB Schenker have large-scale operations in Asia Pacific.

Europe is anticipated to expand at a rapid CAGR during 2024 - 2032. Growth in the region is supported by the growing eCommerce sector and the need for high-quality logistics solutions utilizing real-time tracking, automation, last-mile delivery services, etc. The EU's largest economy Germany epitomizes this trend. Located in the middle of Europe and provided with one of the most developed transport infrastructures including Frankfurt Airport (one of the world’s biggest air freight centers), Germany is one of the leaders in freight forwarding. Enterprises like Amazon and Zalando also stimulate the demand for rapid delivery and better logistics solutions on European grounds. EU is also expected to witness increased growth in the freight forwarding market, attributed to the rapidly growing e-commerce sector, coupled with investments aimed at technology, automation, and digitalization.

Need Any Customization Freight Forwarding Market - Inquiry Now

Key Players in Freight Forwarding Market

Some of the major players in the Freight Forwarding Market are:

-

Kuehne + Nagel (Sea Freight, Air Freight)

-

DHL Supply Chain & Global Forwarding (Logistics Solutions, Freight Services)

-

DSV (Air Freight, Sea Freight)

-

DB Schenker (Logistics Services, Freight Transport)

-

Sinotrans (Air Freight, Sea Freight)

-

Nippon Express (Air Cargo, Sea Freight)

-

CEVA Logistics (Contract Logistics, Freight Management)

-

C.H. Robinson (Air Freight, Ocean Freight)

-

Expeditors (Logistics Services, Supply Chain Management)

-

GEODIS (Supply Chain, Freight Forwarding)

-

Kerry Logistics (Global Freight, Supply Chain Solutions)

-

UPS Supply Chain Solutions (Air Freight, Ground Transportation)

-

Hellmann Worldwide Logistics (Air Freight, Ocean Freight)

-

Maersk Logistics (Supply Chain, Ocean Freight)

-

Kintetsu World Express (Logistics, Freight Transport)

-

Bolloré Logistics (Logistics Services, Freight Forwarding)

-

LX Pantos (Sea Freight, Air Cargo)

-

CTS International Logistics (Air Freight, Sea Freight)

-

Yusen Logistics (Logistics Solutions, Freight Forwarding)

-

DACHSER (Logistics Services, Freight Management)

Some of the Raw Material Suppliers for Freight Forwarding Companies:

-

ArcelorMittal

-

BASF

-

Dow Chemicals

-

ExxonMobil

-

China National Petroleum Corporation (CNPC)

-

Shell

-

Chevron

-

TotalEnergies

-

Glencore

-

Rio Tinto

RECENT TRENDS

-

In May 2024, Magenta Mobility and Kuehne+Nagel have teamed up to introduce electric vehicles (EVs) in road logistics across India. This partnership aims to reduce carbon emissions and is part of Kuehne+Nagel’s sustainability plan.

-

In January 2024, DHL Global Forwarding partnered with Schneider Electric to pilot a new multimodal transportation solution aimed at enhancing sustainability and efficiency. This collaboration will leverage digital energy management and automation to improve logistics operations.

-

In September 2024, SATS and Sinotrans have partnered to create new airfreight hubs in Singapore, Malaysia, Indonesia, Saudi Arabia, and Belgium. The collaboration will enhance Sinotrans' airfreight network through Sinoair's expanded global reach.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 205.21 Billion |

| Market Size by 2032 | USD 306.53 Billion |

| CAGR | CAGR of 4.59% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Transportation (Road, Maritime, Rail, Air) • By Customer Type (B2B, B2C) • By Service (Transportation & Warehousing, Value-added Services, Packaging, Others) • By Application (Retail & e-commerce, Healthcare, Food & Beverages, Media & Entertainment, Industrial & Manufacturing, Oil & Gas, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Kuehne + Nagel, DHL Supply Chain & Global Forwarding, DSV, DB Schenker, Sinotrans, Nippon Express, CEVA Logistics, C.H. Robinson, Expeditors, GEODIS, Kerry Logistics, UPS Supply Chain Solutions, Hellmann Worldwide Logistics, Maersk Logistics, Kintetsu World Express, Bolloré Logistics, LX Pantos, CTS International Logistics, Yusen Logistics, DACHSER. |

| Key Drivers | • Global Trade Growth and Economic Integration Fueling the Expansion of Freight Forwarding Services Worldwide • Driving Freight Forwarding Growth through Green Logistics and Sustainable Practices in the Global Supply Chain |

| RESTRAINTS | • Overcoming Regulatory Complexities and External Shocks in the Freight Forwarding Industry for Resilient Logistics |