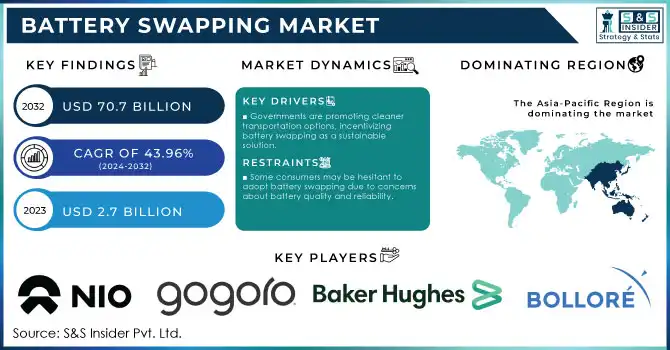

Battery Swapping Market Key Insights:

To Get More Information on Battery Swapping Market - Request Sample Report

The Battery Swapping Market size was valued at USD 2.7 billion in 2023 and is expected to reach USD 70.7 Billion by 2032, growing at a CAGR of 43.96% from 2024-2032.

Battery swapping has emerged as one of the quicker-to-scale solutions to the barriers faced by EVs, like lengthy charging times and range anxiety. Under this model, EV users can swap their depleted batteries with fully-charged ones at designated swapping stations within minutes, offering a faster and more convenient alternative to traditional charging. The growing electric vehicle ownership along with the increased, neat refuelling ammonia stride expanding the battery swapping infrastructure worldwide. New Battery Swapping stations are being gritted to serve the oceans of electric vehicles that will soon circulate in the EV hotbed nations, like China and India. Battery swapping stations in China exceeded 1000 units in 2023 alone, with the greatest companies in the driving force for better deployment Also, the large automotive players and the energy companies are now working together integrate battery swapping. In India, battery swapping station is one of the subset market which is also getting incentive from government to take it on fast pace.

Drivers for the battery swapping market include increasing emphasis on sustainability and transition towards greener mobility solutions. With nations aspiring for carbon neutrality and tightening up on emission guidelines, the rise of EVs with supporting infrastructure such as battery swapping are going to play an even more crucial role in the future. In addition to a much lower downtime for battery swapping EV users, it provides a decoupling of battery charging from the times that drivers need to charge their EV, even eliminating or minimizing the need for large-scale charging infrastructure. The expansion of battery swapping stations, especially for fleet operators who benefit from the convenience of battery swapping in industries like logistics and public transport is another market growth factor. Improvements in battery management and standardization of battery packs through technological progress are likely to enhance the efficiency and cost-effectiveness of battery swapping systems. The increasing collaboration between EV makers and service providers may further accelerate the installation of battery swapping stations, making it an integral part of the future electric vehicle industry.

Market Dynamics

Drivers

-

Governments are promoting cleaner transportation options, incentivizing battery swapping as a sustainable solution.

-

Battery swapping offers faster refuelling compared to traditional charging, reducing downtime for EV users.

-

The rising demand for electric vehicles (EVs) is driving the need for efficient battery swapping infrastructure.

Efficient battery swapping infrastructure is highly driven by the increasing adoption of electric vehicles (EVs). With growing adoption of EV around the world, driven mainly by climate change concerns, government incentives, and technology advancements, the need of fast and convenient refuelling is growing too. Charging stations today often take a long time to charge EV batteries, which can make them unusable for many users who want to continue their journeys quickly. To resolve this issue, there has been an increasing focus on battery swapping as an effective and a relatively quick solution, giving users an opportunity to quickly swap out depleted batteries with newly charged ones, minimizing the time users have to wait. In addition, subsequently, the awareness and providing knowledge regarding the environmental effects of electric mobility such as less emission, lower operational costs than conventional vehicles, further boost the growth of the market. Countries like China and India where EVs adoption is being promoted by governments through subsidies or so have shown huge upsurges in the demand for EVs. This has led to a rapidly developing battery swapping infrastructure to satisfy the increasing demand for fast and swift battery exchange.

Moreover, batter swapping provides a new economy, which allows consumers to avoid paying the hefty initial cost of buying a battery, and pay for their battery usage instead. By minimizing downtime and ensuring vehicles are ready to go when needed, it allows fleet operators, including those in the logistics and public transport sectors, to operate at maximum efficiency. The battery swapping market is set for significant growth as more companies and governments invest in developing this infrastructure, catering to the changing needs of the ever-growing EV market. As the adoption of electric vehicles continues to grow and the demand for green, sustainable solutions increase, this will likely become a trend.

Restraints

-

Establishing battery swapping stations requires significant investment in infrastructure, which can deter adoption in some regions.

-

Some consumers may be hesitant to adopt battery swapping due to concerns about battery quality and reliability.

-

Different EV manufacturers use different battery technologies and sizes, making it challenging to create universal battery swapping stations.

One major barrier for creating universal battery swapping stations is the fact that different EV manufacturers are using different battery technologies and sizes. Typically, EV automakers develop their own unique battery systems with different shapes, capacities, and interfaces for their vehicles. The variation in battery types means that while building a battery swapping system is feasible, creating a universal solution that accommodates all EVs is unachievable due to the significant differences in design. This issue restricts the scalability and efficiency of battery swapping infrastructure, as stations would need to stock multiple battery variants, each of which must be compatible with a wide range of EV models.

So a battery swapping station needs to be tailored to one brand, or develop complicated systems that can adapt to the specifications of multiple batteries, given that, say, a Tesla batteries is designed to differ from those of another automaker, such as a Nissan or a BYD. This complexity raises operational and technical expenditures because the infrastructure would have to be adaptable to various voltages, connectors, and BMS systems. Moreover, this diversified nature of battery technologies makes it difficult to store, service and replace batteries, and could pose a hindrance to the mass deployment of battery swapping as a practical refuelling method.

In addition, Automakers and industry insiders in the EV sector have been slow to adopt common standards for battery swapping. This reluctance to align on a universal framework has hindered the development of a standardized and scalable infrastructure for battery swapping. The lack of agreement stalls the maturation of the market and makes it less appealing for companies to build extensive battery swapping infrastructure. Although several pioneering countries and firms are taking actions to drive standardization, the absence of global specifications remains a crucial restraint. Battery swapping faces significant challenges ahead, particularly in terms of its integration into the broader ecosystem. The success of this approach largely hinges on technological advancements, collaboration across industries, and the development of regulatory frameworks that can foster a more unified and efficient battery swapping infrastructure. Whether manufacturers, tech platforms, and governments can overcome these hurdles will determine the future viability of battery swapping.

Key Segmentation Analysis

By station Type

Automated Battery Swapping Station segment dominated the market and represented revenue share more than of in 2023. owing to benefits offered such as less human intervention in the process and scalable design to reduce overhead and labour cost in large throughput environments. Station automation enables quicker and smoother battery swapping, making it especially appealing for commercial EVs and public transport networks. Growth drivers for this segment include technological advancements in robotics, AI, and Machine Learning, and the rising trend of urbanization, which demands quicker turnaround of vehicles. The rapid growth of the automated station segment is largely driven by continuous technological advancements and government initiatives promoting automation.

The manual station segment is expected to grow at the highest CAGR owing to its cost-efficient and easy accessibility in developing regions with low initial investments. Manual stations facilitate battery swapping with very little technological back-up, thus providing a low cost solution for battery swapping in resource-constrained regions. This segment is anticipated to grow in the future through the rising demand for EVs in price-sensitive regions, where manual stations — with minimal technological requirements — can form a gateway to the battery swapping business.

By Service Type

In 2023, The subscription based service segment held the largest revenue share of , as it provides a flexible, predictable cost model that is attractive to users who avail of such services frequently. This service lets EV owners pay a flat price for unlimited access to battery swaps, a concept that grows more appealing as EV shipments grow. More than ever we continue to see consumer demand for EVs and the adoption of shared mobility models, and so its no surprise that subscription-based is only expected to grow. Fleet operators and EV sharing services are especially interested in subscription services as it helps them save on paying upfront. As we move toward electrification, this segment will maintain a firm hold on the market, just as it continues to benefit from lower prices and ease of transactions.

The pay-per-use model, on the other hand, is experiencing the highest CAGR, as it caters to consumers who want to pay only when they require a battery swap, especially since this turns out to be more cost-effective for infrequent users. This is a pay-per-use model that is likely to develop rapidly on the back of the growing demand for an affordable solution among infrequent EV users. Consumers like option: With the infrastructure for battery swapping in the area developing, this effortlessly will draw in a growing number of consumers who desire and like the leave and accessibility of terminals regardless of a long-term dedication here to remain. This characteristic of the model will drive its adoption in markets where EVs are still in the early stages of acceptance or where customers are hesitant about making long-term commitments.

By Application

Passenger application segment dominated the market and accounting for revnue share in 2023. Its popularity curb among individual consumers who searched for the convenience of battery swapping to face long charging times was mostly responsible for this. There is an exponential increase in demand for electric cars, especially in urban areas, where battery swapping stations provide the opportunity to swap dead batteries with fully charged ones and decrease the time it takes to charge a vehicle compared to traditional charging stations. Also, EV makers are working on embedding swappable battery systems which will help in maximizing vehicle uptime and minimizing waiting time for customers. Government incentives encouraging clean energy adoption are also responsible for this trend, leading to growth of passenger EV segment.

The Commercial application segment is projected to occupy the fastest growing CAGR over the next few years. It is fueled by the demand for high-utilisation vehicles like delivery trucks and buses, and their need to minimise downtime. This enables commercial fleet operators to optimize their vehicle usage, leading to lower operational costs caused by prolonged charging times. This makes battery swapping a lucrative proposition especially for the businesses which are on the lookout for scalable and faster EV solutions. Additionally, commercial vehicle fleets are taking on a more sustainable approach by joining the planet's fight against carbon emissions. An even stronger future potential for this segment is seen in automated battery swapping stations and the continuously increasing availability of commercial electric vehicles.

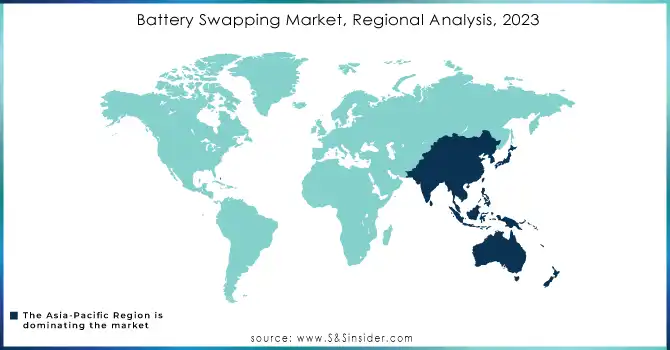

Regional Analysis

The battery swapping market is currently dominated by Asia-Pacific region, led by countries such as China and India, which are among the fastest adopters of electric vehicles (EVs). High population density, favorable government policies, as well as improvements in EV infrastructure are the major growth drivers for this region. The scale of EV adoption from China, its burgeoning EV infrastructure with battery swapping stations, etc. will push the region to take centre stage in the next few years. In this evolving landscape, the forecast calls for Asia-Pacific to remain at the helm, with technologies such as these reducing the TCO around battery swapping systems to help make EVs easier to adopt.

Europe is expected to register highest CAGR during the forecast period, with the goal of establishing electric vehicles in Europe which does includes the UK. NIO will also sell its ET5, ET7, and EL8 models in the UK at the end of next year, following a rollout in Germany, the Netherlands, Denmark, and Sweden, a co-founder of the electric vehicle maker, Lihong Qin, revealed on Wednesday. The Europe market is also gaining from EU initiatives for greener transportation as well as high funding achieved by local players including Swobbee and others.

Do You Need any Customization Research on Battery Swapping Market - Inquire Now

Key Players

The major key players are

-

NIO Inc. – NIO Power Swap

-

Gogoro – Smartscooter

-

Tesla – Supercharger Network

-

Aulton – Aulton Energy

-

Baker Hughes – EV Battery Charging Stations

-

Sun Mobility – Swap Stations

-

Cenntro Electric Group – Cenntro EV400

-

Bolloré Group – BlueSolutions Battery Swap

-

Kia Motors – EV6

-

Honda Motor Co., Ltd. – Honda Mobile Power Pack

-

BYD – Blade Battery

-

China National Petroleum Corporation (CNPC) – Oil and Gas Charging Stations for EVs

-

Yadea Technology Group Co. – Yadea Smart Electric Scooters

-

Porsche – Porsche Charging Solutions

-

Shell – Shell Recharge (EV charging solutions)

-

BP – BP Pulse

-

ABB – ABB EV Charging Stations

-

Enel X – JuicePump

-

EVgo – EVgo Charging Network

-

Tata Power – Tata Power EV Charging Solutions

Recent Developments

-

In January 2024, NIO made significant progress by expanding its Battery as a Service (BaaS) offering, completing over 20 million battery swaps. This expansion included the installation of over 1,400 swapping stations across China. NIO's stations allow for a rapid battery change in less than 3 minutes, setting a high standard for convenience and efficiency in the market.

-

In March 2024, Gogoro raised $68 million in funding to boost its modular battery swapping technology. This funding aims to further expand their network, offering a flexible solution for both public and private electric vehicle (EV) owners. Gogoro’s innovation helps reduce the high upfront costs for EV customers and is particularly valuable in urban areas with limited space for charging.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.7 Billion |

| Market Size by 2032 | USD 70.7 Billion |

| CAGR | CAGR of 43.96% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Station Type (Automated, Manual) • By Service Type (Subscription, Pay Per Use) • By Application (Passenger, Commercial) • By Battery Capacity (>30 kWh, <30 kWh) • By Vehicle Type (2-wheeler, 3-wheeler, 4-wheeler) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | NIO Inc., Gogoro, Tesla, Aulton, Baker Hughes, Sun Mobility, Cenntro Electric Group, Bolloré Group, Kia Motors, Honda Motor Co., Ltd., BYD, China National Petroleum Corporation (CNPC), Yadea Technology Group Co., Porsche, Shell, BP |

| Key Drivers | • Governments are promoting cleaner transportation options, incentivizing battery swapping as a sustainable solution. • Battery swapping offers faster refuelling compared to traditional charging, reducing downtime for EV users. |

| Restraints | • Establishing battery swapping stations requires significant investment in infrastructure, which can deter adoption in some regions. • Some consumers may be hesitant to adopt battery swapping due to concerns about battery quality and reliability. |