Automotive Metal Stamping Market Size & Overview:

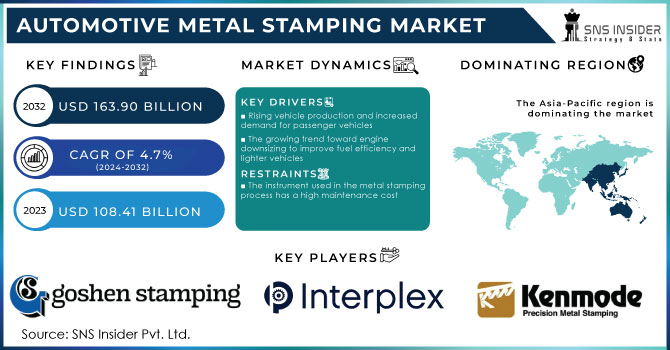

The Automotive Metal Stamping Market Size was valued at USD 108.41 Bn in 2023 and will reach USD 163.90 Bn by 2032 and grow at a CAGR of 4.7% by 2024-2032

Metal stamping for automobiles is a method of processing sheet metals and transforming them into various shapes and sizes according to individual requirements and use. Blanking, embossing, bending, coining, and flanging are among the five basic techniques used in sheet metal stamping. A piece of sheet metal is sliced into a blank or a number of blanks during the blanking process. Embossing is the process of stretching materials into shallow depressions to add different decorative patterns. Metal stamping is used in different stages of manufacturing in the automotive industry, including panels, brackets, bonnets, roofs, hangers, and other components, resulting in steady demand in the automotive metal stamping market.

Get More Information on Automotive Metal Stamping Market - Request Sample Report

Alloys like titanium, cast aluminum, cast iron, and forged steel are still used extensively in vehicle engines. Furthermore, technological improvements such as the usage of hybrid electromagnetically assisted sheet metal stamping machines, which reduce failures by managing strain distribution during stamping, are likely to boost industry growth.

MARKET DYNAMICS:

KEY DRIVERS:

-

Rising vehicle production and increased demand for passenger vehicles

-

The growing trend toward engine downsizing to improve fuel efficiency and lighter vehicles

-

The automotive metal stamping market is expected to be fueled by technological advancements.

The automotive metal stamping industry is poised for a surge driven by innovations that enhance efficiency and precision. Advancements in automation like robotic feeding systems and sensor-controlled presses will streamline production and reduce waste. Additionally, the integration of 3D printing for tooling will allow for faster prototyping and customization of stamped parts. These technological leaps, coupled with the development of powerful simulation software to optimize stamping processes, will translate to significant cost reductions and lighter vehicle components. This confluence of factors will propel the automotive metal stamping market forward, solidifying its role in the future of car manufacturing.

-

The fast expansion of manufacturing industries

RESTRAINTS:

-

The instrument used in the metal stamping process has a high maintenance cost

-

Stamping's growth is anticipated to be hampered by limited pricing flexibility

OPPORTUNITIES:

-

The rapidly expanding automobile industry

-

Demand for smart cars is rapidly increasing.

The desire for automobiles that think for themselves is surging. Consumers are increasingly drawn to "smart cars" loaded with technology that enhances every aspect of driving. This fascination stems from a confluence of factors. Safety features like automatic emergency braking and lane departure warnings provide peace of mind, while built-in navigation and internet connectivity transform commutes into connected experiences. For many, the future of driving is no longer just about getting from point A to B, but about a personalized and intelligent transportation pod. This growing demand is pushing automakers to constantly innovate, making the roads of tomorrow look a whole lot smarter.

-

Technological advancements and investments in R&D

CHALLENGES:

-

The increasing usage of plastics/composites as metal substitutes is posing a new challenge

-

The complexity of operations of newly imported equipment is a major challenge

IMPACT OF RUSSIA-UKRAINE WAR:

The war in Ukraine has sent shockwaves through the automotive metal stamping market. Disruptions began with critical parts shortages. Ukraine was a major supplier of wire harnesses, essential for a car's electrical system. This stalled production lines, especially in Europe. Beyond immediate parts, Russia's role as a key metal exporter is causing tremors. Sanctions and rising energy costs are pushing up prices of steel, aluminum, and nickel, all crucial for stamped auto parts. This cost inflation squeezes margins for metal stampers and car manufacturers alike. The long-term impact remains unclear, but the industry is scrambling to find alternative suppliers and cope with a new era of higher material costs.

IMPACT OF ECONOMIC SLOWDOWN:

An economic slowdown can trigger a domino effect within the automotive industry, negatively impacting the automotive metal stamping market. Reduced consumer spending power leads to declining car sales, forcing manufacturers to scale back production. This translates to a lower demand for metal stamped components like body panels, chassis parts, and brackets. Furthermore, economic uncertainty can cause automotive companies to delay investments in new vehicle models, further dampening demand for metal stamping services. Metal stamping companies may resort to layoffs or production cuts to manage costs during an economic downturn.

MARKET SEGMENTATION:

Market, By Technology:

The automotive metal stamping market can be dissected based on the specific technologies used to manipulate the sheet metal. Blanking, the process of cutting out precise shapes, and bending, which forms angles and curves, are anticipated to remain dominant due to their prevalence in creating body panels and structural components. Embossing creates raised designs, while coining refines details and imparts higher strength. Flanging forms folded edges for rigidity and attachment points. Finally, "Other" technologies encompass niche processes like shearing and perforating used for specialized applications. Understanding the role of each technology within the market allows for informed decisions about production techniques, material selection, and overall cost optimization.

Market, By Application:

The automotive metal stamping market is driven by its application in various vehicle types. Passenger cars hold the largest share due to high production volumes and consistent demand for components like doors, hoods, and trunks. Commercial vehicles, including trucks and buses, are experiencing significant growth due to rising infrastructure projects and increasing freight movement. Recreational vehicles, popular in North America, utilize metal stamping for their robust chassis and body parts, but their market share is concentrated geographically. As the global automotive industry expands and diversifies, all three segments are expected to witness a rise in demand for metal stamped parts, influencing the overall market growth.

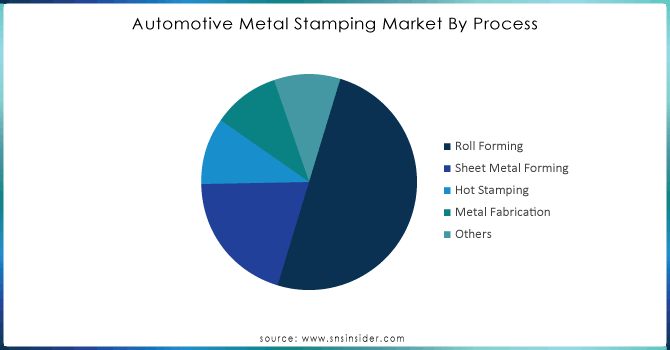

Market, By Process:

By process, the automotive metal stamping market can be segmented into distinct categories. Roll forming excels in creating long, continuous pieces like roof rails and door beams. Sheet metal forming, a broader category, encompasses various techniques like bending and flanging to create complex shapes for hoods and fenders. Hot stamping utilizes heat to shape high-strength steel for crucial safety components like pillars. Metal fabrication involves a wider range of techniques like welding and cutting, often used alongside other processes for intricate parts. Finally, the "Others" segment includes specialized techniques like hydroforming for complex, hollow structures. Understanding the strengths and applications of each process is crucial for optimizing production efficiency and component quality in the automotive metal stamping industry.

By Technology:

-

Blanking

-

Coining

-

Bending

-

Embossing

-

Flanging

-

Others

By Application:

-

Passenger cars

-

Commercial vehicles

-

Recreational vehicles

By Process:

-

Roll Forming

-

Sheet Metal Forming

-

Hot Stamping

-

Metal Fabrication

-

Others

Get Customized Report as per your Business Requirement - Request For Customized Report

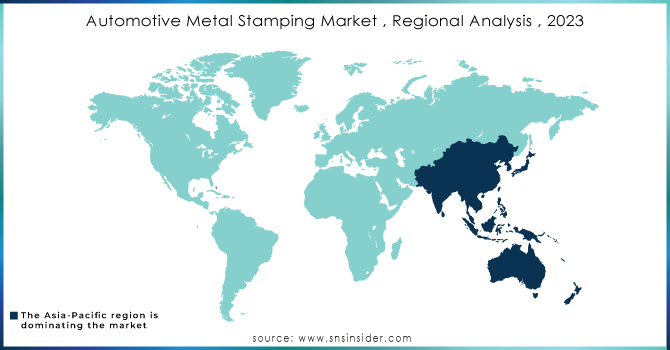

REGIONAL ANALYSIS:

In terms of revenue, Asia Pacific leads the way, followed by Europe, North America, Latin America, and the Middle East and Africa (MEA). China is the world's largest automobile metal stamping market, and the Asia Pacific region is the world's dominating automotive metal stamping market. This is because China is the world's greatest supplier of metals including aluminum, steel, and iron, which are utilized extensively in the car industry for metal stamping. Because of the presence of major vehicle manufacturers in Germany, it is the most important market and the largest contributor to the automotive metal stamping industry in Europe.

Because of the low consumption and manufacturing of automobiles in Latin America, the Middle East, and Africa, the growth rate of the automotive metal stamping industry is modest. The market for automotive metal stamping is predicted to expand in the future years, thanks to expansion in the automotive sector and investments in Latin American and Middle Eastern, and African vehicle businesses.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY MARKET PLAYERS:

Aro Metal Stamping, Alcoa Inc., Kenmode Precision Metal Stamping, Interplex Industries, Martinrea International, Goshen Stamping Company, Shiloh Industries, Inc., Acro Metal Stamping, Lindy Manufacturing, Manor Tool & Manufacturing Company, Tempco Manufacturing, American Industrial Company, Wisconsin Metal Parts, Inc., and Clow Stamping Co. are some of the major players in the industry.

Recent Developments:

Aro Metal Stamping, known for its focus on diverse industries, has hinted at expanding its production capacity to cater to the growing demand for lightweight, high-strength metal components in electric vehicles.

Alcoa, a leader in aluminum production, is likely leveraging its material expertise to develop lighter yet robust aluminum alloys specifically for automotive stamping.

Kenmode Precision Metal Stamping, a strong contender in the custom metal stamping segment, might be looking to solidify its position by investing in advanced automation technologies. This could involve implementing robotic feeding systems and intelligent press controls to optimize production speed and precision for complex automotive parts. Interplex Industries, on the other hand, could be exploring strategic acquisitions or partnerships to broaden its automotive stamping portfolio.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 108.41 Billion |

| Market Size by 2032 | US$ 163.90 Billion |

| CAGR | CAGR of 4.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Technology (Blanking, Coining, Bending, Embossing, Flanging, Others) • by Application (Passenger cars, Commercial vehicles, Recreational vehicles) • by Process (Roll Forming, Sheet Metal Forming, Hot Stamping, Metal Fabrication, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Aro Metal Stamping, Alcoa Inc., Kenmode Precision Metal Stamping, Interplex Industries, Martinrea International, Goshen Stamping Company, Shiloh Industries, Inc., Acro Metal Stamping, Lindy Manufacturing, Manor Tool & Manufacturing Company, Tempco Manufacturing, American Industrial Company, Wisconsin Metal Parts, Inc., and Clow Stamping Co. |

| Key Drivers | •Rising vehicle production and increased demand for passenger vehicles. •The growing trend toward engine downsizing to improve fuel efficiency and lighter vehicles. |

| RESTRAINTS | •The instrument used in the metal stamping process has a high maintenance cost. •Stamping's growth is anticipated to be hampered by limited pricing flexibility. |