Road Safety Market Report Scope & Overview:

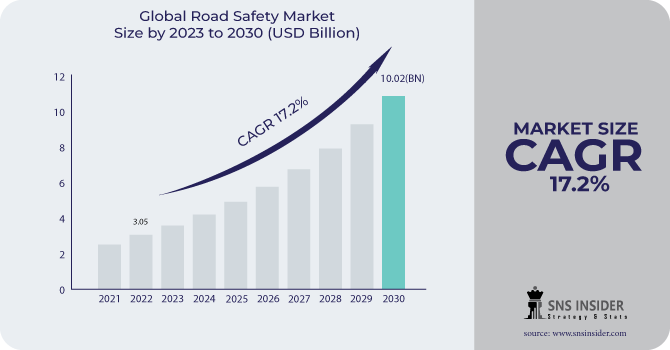

The Road Safety Market was valued at USD 3.20 Billion in 2023 and is expected to reach USD 11.21 Billion by 2032, growing at a CAGR of 14.99% from 2024-2032.

The Road Safety Market is growing rapidly as governments, organizations, and technology providers focus on reducing road accidents, injuries, and fatalities. The rise in urbanization, increased vehicle ownership, and heightened awareness of road safety have made adopting advanced safety solutions essential worldwide. These technologies include traffic management systems, speed enforcement mechanisms, red-light cameras, and incident detection tools. Key factors driving this growth include technological advancements such as AI-driven traffic systems, enhancements in autonomous vehicle safety, and vehicle-to-everything (V2X) communication technologies. For instance, IoT-enabled traffic data collection systems are helping cities alleviate congestion and optimize emergency response. The adoption of smart city initiatives, especially in highly urbanized regions like Asia-Pacific, is further fueling investments in modern road safety infrastructure.

Get PDF Sample Report on Road Safety Market - Request Sample Report

The pressing need for improved infrastructure plays a pivotal role. As per WHO, about 1.3 million people die yearly due to road accidents, with millions suffering injuries. This alarming scenario has led to stricter regulations and the deployment of advanced safety systems. For example, the United States' "Vision Zero" initiative aims to eradicate traffic fatalities, prompting the adoption of innovative safety measures. Recent statistics highlight the market's evolution. In 2024, over 60% of global road safety deployments featured AI and machine learning, underlining a shift toward intelligent systems. Europe also witnessed a 25% annual rise in automated speed enforcement solutions, significantly curbing accidents in high-risk zones.

Emerging economies are contributing to market expansion as governments in regions like the Middle East and Africa invest in state-of-the-art surveillance and enforcement systems to address increasing traffic issues.

Looking ahead, the integration of technologies such as 5G, AI, and connected vehicle systems will continue to revolutionize road safety. As awareness of road safety grows globally and technological innovations advance, the market is set to play a vital role in creating safer road environments across the world.

Market Dynamics:

Drivers

-

Integration of AI, IoT, and V2X communication to enable real-time traffic management and predictive analytics.

-

Growing urban population and investments in smart city projects driving demand for advanced road safety infrastructure.

-

Increased focus on reducing road accidents through policies like Vision Zero and mandatory adoption of safety systems.

The global focus on reducing road accidents has led to the widespread implementation of policies like Vision Zero, which strives to eliminate traffic fatalities and severe injuries through proactive and strategic road safety measures. Originating in Sweden, Vision Zero has gained international recognition, shaping the development of advanced safety frameworks. These policies emphasize prioritizing human life by integrating engineering solutions, stringent enforcement, and educational initiatives to create safer traffic environments. Mandatory regulations requiring the integration of safety technologies like speed enforcement cameras, red-light violation detectors, and advanced driver assistance systems (ADAS) have become a cornerstone of these efforts. Governments globally are mandating vehicles to feature systems such as lane departure warnings, automatic emergency braking, and pedestrian detection to curb accidents and reduce their severity, significantly enhancing roadway safety.

For example, the European Union’s General Safety Regulation introduced in 2024 requires vehicles to include intelligent speed assistance and event data recorders. Such regulatory measures have accelerated the adoption of safety technologies, fueling growth in the road safety market. Complementing these efforts, AI and IoT-enabled real-time traffic management systems are transforming road safety by analyzing traffic patterns, identifying hazardous zones, and enabling prompt incident responses. By integrating these technologies with infrastructure, cities are better equipped to enforce traffic laws and mitigate human error, a leading cause of road mishaps. Public awareness campaigns further bolster these measures by promoting safe driving behaviors. Initiatives advocating for seatbelt use, helmet compliance, and anti-drunk driving practices have significantly reduced fatalities and injuries, showcasing the impact of education alongside enforcement. In essence, the focus on reducing road accidents through comprehensive policies like Vision Zero and mandatory safety systems is driving the adoption of advanced road safety technologies. These efforts reflect a unified global commitment to building safer and more sustainable transportation ecosystems.

Restraints

-

Implementing advanced road safety systems, such as AI-based traffic management and IoT-enabled devices, requires significant financial investment, limiting adoption in cost-sensitive regions.

-

Efficient operation and maintenance of modern road safety technologies demand skilled professionals, which are scarce in developing and rural areas.

-

Inadequate road infrastructure in emerging markets hampers the integration of advanced safety technologies like surveillance cameras and automated traffic systems.

The poor road quality in most emerging markets represents one of the biggest hurdles to the implementation of high-end road safety technologies and consequently improving traffic safety. A lot of developing countries suffer from having badly maintained roads, few road signs, and a lack of dedicated lanes for vehicles and pedestrians. This lack of infrastructure hamper the effective deployment of the latest solutions like AI-based traffic management systems, automated surveillance cameras, and smart sensors that are needed to form a solid base for things to work on. Current technologies including vehicle-to-everything (V2X) communication and AI-enabled traffic systems rely on an integrated network of sensors, cameras, and data-processing units. Due to inconsistent road conditions, limited power availability, and inadequate communication infrastructure, these systems often fall short of their intended effectiveness in regions where they are most needed. Lacking lighting and uniform lanes, those major arteries also reduce the effectiveness of such advanced safety features as speed enforcement cameras and incident-detection systems.

Due to limited finances, many developing nations opt for basic infrastructure rather than high-tech alternatives. Often overhead costs are restricted to very basic functions, such as building roads and simple traffic management, thus advanced technology goes underfunded. So, while developed worlds are spending on smart transportation ecosystems, the bulk of investments in developing countries are still geared towards basic needs. Moreover, this absence of infrastructure holds back the adoption of connected and autonomous vehicles (CAVs), which rely on smart roads to share safety and traffic information. These vehicle technologies cannot be integrated without such infrastructure.

Some programs are attempting to remedy that, though. With the support of international organizations like the World Bank and collaborative global partnerships, road modernization projects in the global south are booming. These efforts aim to bridge the gap between emerging and developed markets by modernizing infrastructure and utilizing standards to promote the broad deployment of advanced safety technologies. By focusing on smart investments and a long-term vision, emerging economies would be able to leverage weaknesses in their infrastructure and capitalize on the opportunity of the global road safety market.

Segment Analysis:

By Solution

The red light & speed enforcement segment held a market share of 57.20% in 2023. Furthermore, these services were placed at road junctions or on the roads so that traffic discipline could be maintained. Since the technology has advanced to that degree, the competition among the death penalty providers has now become to service providing a speedy and red-light monitoring feature in a signal device

Automatic Number/License Plate Recognition (ANPR/ALPR) is expected to register the highest CAGR over the forecast period. Some of the factors responsible for the large revenue share of the ANPR/ALPR segment include varied end-use applications such as road interactions & parking lots, private land, schools, etc. Such solutions help in finding a vehicle in case of theft, crime scenarios, or traffic violations. These services also provide monitoring 24 hours a day, even in low light or poor weather, which is another benefit that boosts demand. Based on the solution, the market has been segmented into ANPR/ALPR, speed enforcement, red light, incident detection, and response.

By Service

In 2023, the professional services segment dominated the market and represented a significant revenue share of 79.80%. The professional services segment includes service integration, installation, training, consultancy, support and maintenance. We need to calibrate the equipment to implement it and do regular maintenance, and we also need to monitor it. The international trend of growing need for professional-based services has been the leading force behind industry growth in recent years and will remain in the future.

The managed service segment is expected to expand with the highest CAGR throughout the projection period. Since these services are managed & controlled end-to-end by dedicated vendors, they appear to be an obvious choice for end customers. In the segment, the high growth is due to an increasing trend to outsource services by customers. Furthermore, the ease of business and provision of convenience in outsourcing services is also one of the major driving forces aiding the growth of the global managed services demand.

Regional Analysis:

North America dominated the market and accounted for a revenue share more than of 39.8% in 2023, due to the developed infrastructure, strong investments, and regulatory frameworks. It has led safety programs like Vision Zero and the introduction of ITS in the region. Continued investments in AI-based traffic management, automated enforcement instruments, and connected vehicle technologies continue to provide momentum to the market. In addition, the massive growth is a result of projects funded by the U.S. Department of Transportation for smart city and road safety projects. North America will continue to lead, driven by both assimilating autonomous vehicles and progress with vehicle-to-infrastructure (V2I) technologies.

Asia-Pacific region is expected to observe the highest compound annual growth rate (CAGR) during the forecast periods. Such growth is driven by rapid urbanization, increasing vehicle ownership, and a growing focus of the government towards mitigating traffic casualties. Countries such as China, India, and Japan are investing in smart city projects and solutions such as intelligent transportation systems and automated traffic enforcement technology. The region is also witnessing strong support due to the growing road safety regulations and rising adoption of connected vehicle technologies. Innovation migration demand of the middle class alongside road safety awareness will also contribute to the growth opportunities for new technology. Due to continuing infrastructure development and expanded development of artificial intelligence (AI) and Internet of Things (IoT) technologies in traffic systems, the road safety market in the Asia-Pacific region is anticipated to expand at a considerable rate.

.png)

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players:

The major key players along with their products are

Siemens Mobility - Intelligent Traffic Management Systems

Honeywell International - Road Safety Cameras

Garmin Ltd. - Dash Cameras

Thales Group - Road Traffic Enforcement Solutions

Cubic Corporation - Traffic Management Systems

Kapsch TrafficCom - Automatic Number Plate Recognition (ANPR) Systems

Xerox Corporation - Speed and Red-light Enforcement Cameras

TransCore - Tolling Solutions and Traffic Management Systems

Flir Systems - Thermal Traffic Cameras

Swarco Group - Traffic Control Systems

L3 Technologies - Radar-based Vehicle Detection Systems

Bosch Security Systems - Advanced Driver Assistance Systems (ADAS)

Aptiv PLC - Autonomous Vehicle Safety Systems

Inrix, Inc. - Traffic Flow Analytics

Pelco - Surveillance Cameras for Traffic Monitoring

LeddarTech - LiDAR Sensors for Road Safety

Verra Mobility - Red-light and Speed Enforcement Systems

Snap-on Inc. - Road Safety Diagnostic Tools

Dynniq - Smart Traffic Signal Systems

Evolis - Road Safety Signage Solutions

Cubic Corporation-Company Financial Analysis

Recent Developments:

March 2024: Jenoptik has collaborated with the First Joint Group to implement advanced traffic safety systems in Kuwait. The project involves the installation of 60 TraffiTower 2.0 units and over 100 external flash units designed to enhance traffic monitoring and reduce accidents. The systems integrate advanced measurement technology for precise monitoring and effective enforcement

February 2024: Transoft Solutions has introduced enhanced tools for urban planning and traffic management. These tools, powered by artificial intelligence and sensors, help collect and analyze traffic data, which urban planners use to make informed decisions on improving road safety infrastructure

| Rert Attributes | Details |

|

Market Size in 2023 |

US$ 3.20 Bn |

|

Market Size by 2032 |

US$ 11.21 Bn |

|

CAGR |

CAGR of 14.99% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Solution (Red Light & Speed Enforcement, Incident Detection & Response, Automatic Number/License Plate Recognition, Others) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

|

Company Profiles |

Conduent, Cubic Corporation, Dahua Technology, FLIR Services, IDEMIA, JENOPTIK, KAPSCH TraficCom, Motorola Solutions, Redflex Holdings |

|

Key Drivers |

• The rising cases of road incident |

|

Market Opportunities |

• The rise in advancement technology |