AUTOMOTIVE VIRTUAL REALITY MARKET KEY INSIGHTS:

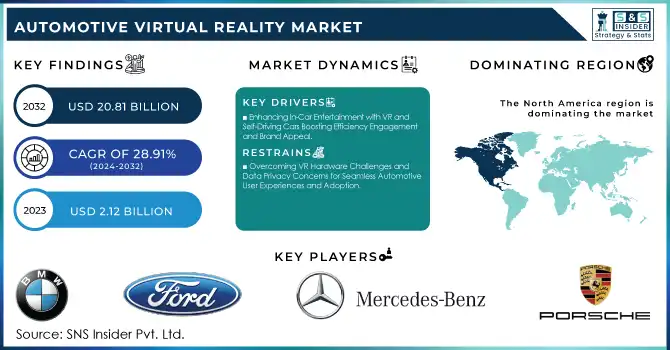

The Automotive Virtual Reality Market Size was valued at USD 2.12 Billion in 2023 and is expected to reach USD 20.81 Billion by 2032 and grow at a CAGR of 28.91% over the forecast period 2024-2032.

To Get More Information on Automotive Virtual Reality Market - Request Free Sample Report

Automotive Virtual Reality is immensely influencing different aspects of the automotive industry making the automotive VR market advance with a greater growth rate. The company is reimagining how vehicle design, construction, and customer interaction will look like through the use of VR technology. VR simulations allow automakers to speed up design and test stages and allow engineers to test parts of vehicles virtually before making a physical prototype. It helps you minimize the costs, decrease the time-to-market phase, and reduce the risk of a design error. Moreover, VR is used in assembling lines by simulating a practical scenario to train the employees which, in return enhances the skillsets along with safety. The landscape of automotive virtual reality (VR) is robustly impacted in 2023-2024 as BMW, Ford, and Tesla save 20-30% of the product development time and maximize 50% of cost savings with the usage of VR tools. Technician VR training has become broad, with Ford using VR to train more than 3,000 engineers for testing and assembly line scenarios. Further, there has been a 30% reduction in design mistakes and a 40% quicker time-to-market for new vehicle functionalities aided by VR.

VR is transforming the vehicle buying experience in the consumer space. Virtual parameters such as here now enable VR-based test drives so you can take a stroll down whatever automotive street of your dreams too, which any automotive showroom could now embed for users to be able to explore various models and configure many features of their potential new cars without the need for inventory. In Advanced Driver Assistance Systems (ADAS), virtual reality is used to create driving environments for the testing and development of autonomous functions. So, this helps in the design and buying experience, and it also drives creativity in things such as vehicle safety and driver assistance, which is why VR is so widely adopted in the automotive industry. 10 out of 14 ADAS features in the U.S. surpassed 50% market penetration, with 5 features (including forward collision warning, automatic emergency braking, and pedestrian detection) reaching 91%-94% adoption. Additionally, technologies like lane keeping assistance, adaptive cruise control, and blind-spot warning also gained significant traction, each surpassing 50% penetration in new vehicles.

MARKET DYNAMICS

KEY DRIVERS:

-

Enhancing In-Car Entertainment with VR and Self-Driving Cars Boosting Efficiency Engagement and Brand Appeal

Growing emphasis on improving in-vehicle entertainment systems is one of the major factors boosting the growth of the automotive virtual reality market. Since today's consumers expect more, automakers are using VR to reshape in-car entertainment, especially in passenger, self-driving cars where people can enjoy media in transit. Self-driving cars are predicted to reduce traffic congestion by up to 11%, improve fuel efficiency by as much as 20%, and lower insurance premiums by up to 40% due to their enhanced safety features. Their ability to communicate with each other and their 360-degree sensor systems also minimize blind spots and enable quicker reaction times compared to human drivers. With VR, unique entertainment experiences such as 360-degree virtual tours, interactive games, and simulations can provide passengers with a fully immersive environment. This is very appealing with its tech-savvy users and families and helps brands stand out. Higher speed 5G connectivity makes VR in-car entertainment even more interesting by enabling high-quality streaming and real-time interaction in vehicles, increasing VR integration demand.

-

Revolutionizing Car Shopping with VR Showrooms Enhancing Customer Engagement and Boosting Conversion Rates by 40%

The growing demand for VR in automotive showrooms and dealerships for marketing and branding is another major driver for the market. Virtual reality technology provides potential buyers the ability to get a feel for varying car models, colors, and configurations in a virtual space, creating an engaging and unforgettable shopping experience. VR reduces the burden of carrying cars in a showroom or dealership as it allows the customer to see a larger variety of options without the need to have these physical models at hand. VR can also improve brand engagement by allowing a user to “test drive” and/or inspect the features of a particular car in a virtual environment. This is particularly well suited for luxury and electric vehicles, where VR can deliver the sophisticated technology and special characteristics of the vehicle excitingly. As consumers increasingly demand personalized and digitally oriented experiences, the auto industry is adapting to these expectations, and the market to support VR-accessible showrooms has increased. VR technology allows customers to explore different car models, colors, and features in a virtual environment, eliminating the need for physical models on-site. This immersive experience has been shown to boost conversion rates by 40%, as it encourages deeper engagement through personalized and interactive elements.

RESTRAIN:

-

Overcoming VR Hardware Challenges and Data Privacy Concerns for Seamless Automotive User Experiences and Adoption

The automotive VR market is still constrained because of the requirement for advanced technologies in the associated hardware to develop seamless high-definition user experiences. Effective use of VR in automotive applications invariably necessitates high-resolution displays, low latency, and realistic graphics from these devices. That would make sense, considering several VR headsets and components available today continue struggling in areas like consistent performance, motion tracking, and field-of-view. This motion sickness and discomfort can deter users from adopting these technologies that are necessary to get the ball rolling. Data privacy and security concerns around VR technology in vehicles are another challenge. With the potential of gathering user information and integrating with various systems already present in the car, VR may create a vast chasm of data vulnerability and privacy concerns. Automakers are faced with the challenge of addressing these risks by implementing thorough data protection measures, which can be fairly time-consuming and complex. But for the industry as a whole, this balance between an immersive VR experience and user privacy is still tricky.

KEY SEGMENTATION ANALYSIS

BY TECHNOLOGY

Advanced driver assistance systems (ADAS) segment accounted for 35% of the automotive virtual reality market in 2023 and are estimated to show the fastest CAGR between 2024 and 2032. The presence of AR and VR technologies across the ADAS technology segment is based on the importance of ADAS in offering enhanced vehicle safety, performance, and driving experience through VR-enabled simulations and testing environments. VR aids the development and refinement of advanced driver assistance systems features such as collision avoidance, lane-keeping assistance, and adaptive cruise control, allowing manufacturers to test these features in highly controlled settings As automotive manufacturers work to construct more intelligent and safer vehicles, VR can play a pivotal factor in growing and refining ADAS functions. With these VR simulations, a single ADAS component can be tested thousands of times in extensive sessions because there is no risk to driver safety and no liability to be dealt with resulting from a malfunction. The benefits of VR on ADAS development also fundamentally help systems related to autonomous driving as well. By allowing algorithms to practice in thousands of different potential driving scenarios, many of which may never be encountered in the real world but are critical for a safe driving AI, such as difficult weather or rare occurrences, these artificial, VR simulations are key aspects of the training process that do not require physical test vehicles.

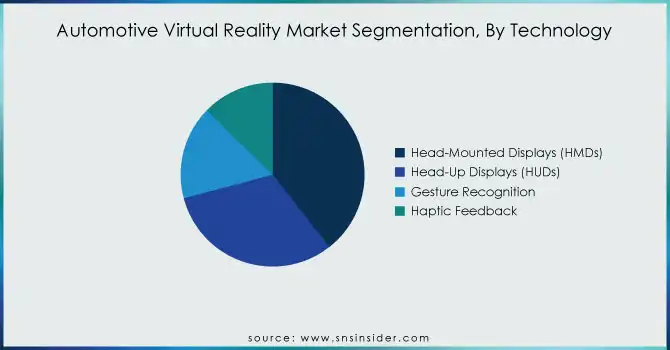

BY COMPONENT

Head-Mounted Displays (HMDs), held a 39% market share in 2023. HMDs also leverage the depth of immersion for more complex simulations in the automotive sector along with the more traditional in-vehicle experiences that benefit from the in-vehicle spatial awareness that HMDs provide. HMDs are used by engineers, designers, and even consumers to interact with virtual models, hold design review sessions, and conduct immersive training sessions. This versatility translates to HMDs being a near-market leading value proposition due to the wide range of applications they support, from vehicle prototyping to immersive driver training.

The Head-Up Displays (HUDs) are anticipated to exhibit the fastest compound annual growth rate throughout the forecast period from 2024 to 2032. As vehicles increasingly employ various advanced safety and navigation technologies, HUDs provide an effective method to convey critical data, such as speed, navigation prompts, and ADAS alerts, directly in the driver’s line of site. This helps minimize driver distraction and makes it safer, which is why HUDs are increasingly found in passenger and commercial vehicles. The increasing emphasis on improving the user experience within the vehicle with advanced features and the evolving augmented reality technology is stimulating the demand for HUDs and is expected to grow at a very high rate during the forecast timeframe in the automobile VR market.

BY APPLICATION

In 2023, hardware led the automotive virtual reality market with a market share of 52%. Hardware will dominate the market due to the necessity of delivering VR automotive experiences through VR devices (headsets, sensors, and display systems). Such hardware is pivotal in facilitating applications such as vehicle design, in-vehicle infotainment, ADAS testing, and customer engagement, making it a foundation of the automotive VR ecosystem. This segment still drives the adoption of virtual reality technologies in the automotive industry, as car makers and suppliers spend big bucks on VR hardware.

The content segment is likely to have the fastest CAGR during the forecast period from 2024 to 2032. As VR hardware grows more approachable and omnipresent, the need for complementary interactive content that enriches the VR experience is exploding. VR content creation simulates immersive placements, builds 3D models for vehicle design, and lays out virtual environments for customer engagements and training. The significant and increasing demand for immersive, personalized content to supplement virtual reality hardware and software solutions is driving the content segment in automotive VR.

BY VEHICLE TYPE

In 2023, the Passenger Cars segment held the largest share of the automotive virtual reality market with a revenue share of 55.2% and is also anticipated to expand at the highest CAGR from 2024 to 2032. Passenger cars have a dominant presence in the VR market primarily owing to the rising penetration of VR applications to improve the driving experience, safety features, and in-car entertainment. VR is being used by Automakers for designing, testing, and running simulations to create consumer-friendly models of passenger vehicles, making them capable of offering advanced features. VR also plays an important part in the development of ADAS and autonomous driving technologies, both of which are increasing demand for passenger cars. With the consumer desire for not only personalization but also immersive experiences associated with VR technology, we can unlock strong growth from the passenger car segment. This demand will also translate to VR-enabled features supporting virtual test drives, personalized vehicle configurations, and Digital Showroom experiences, which makes VR an ideal of way for car buyers’ retention and engagement. As a result, VR use in the automotive sector is predominantly related to passenger cars, driving the growth of the segment at a fast pace.

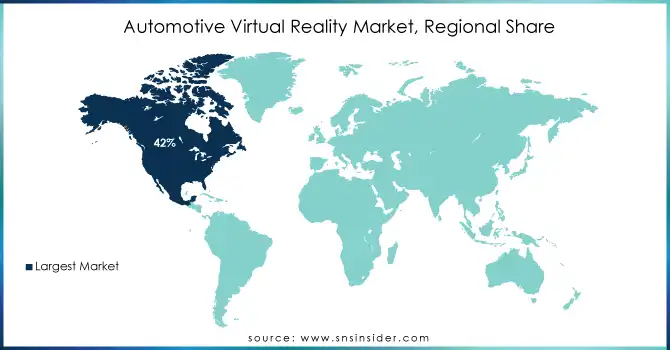

REGIONAL ANALYSIS

In 2023, North America dominated the market with a share of 42%. The region is home to an advanced automotive industry with major investments in VR technologies from General Motors, Ford, and Tesla. Ford illustrates how VR is applied to vehicle design and prototype testing, which creates opportunities for engineers to roam around vehicle concepts virtually and optimize vehicle prototypes before building actual models. On a related note, Tesla has also utilized VR in developing its Autopilot and Full Self-Driving systems, using it to simulate complex driving scenarios for the system to learn from. Moreover, a growing preference for enhanced and immersive experiences for in-car entertainment and safety features like ADAS is propelling North American automakers towards widespread adoption of VR.

Asia Pacific is expected to register the fastest CAGR over the forecast period 2024 to 2032, particularly due to the rapid expansion of the automotive sector in nations such as China, Japan, and South Korea. China, in particular, is influential regarding the car industry's embrace of VR, as BYD and NIO are using VR for their EV design and AV driving test (by NIO). For example, NIO is using the use of VR in its customer service experience enabling potential buyers to explore and configure their cars in virtual showrooms. Also, VR is being used by Japanese automakers such as Toyota and Honda during both design and safety testing, while South Korea's Hyundai has integrated it into the development of its driver-assist systems. This rapid adoption of VR technology is being fueled by the region's growing focus on electric vehicles, autonomous driving, and new mobility solutions.

Get Customized Report as per Your Business Requirement - Inquire Now

Key Players

Some of the major players in the Automotive Virtual Reality Market are:

-

BMW Group [BMW Virtual Prototype, BMW ConnectedDrive]

-

Ford Motor Company [Ford VR Prototyping, Ford Immersive Vehicle Experience]

-

Porsche [Porsche VR Training, Porsche AR Car Configurator]

-

Mercedes-Benz [Mercedes-Benz Virtual Showroom, AR Terrain Mapping]

-

Volkswagen Group [Volkswagen Virtual Reality Training, Volkswagen VR Configurator]

-

Audi [Audi VR Experience, Audi VR Test Drive]

-

Honda [Honda Virtual Reality Car Configurator, Honda Augmented Reality Training]

-

Toyota [Toyota Virtual Prototyping, Toyota VR for Design and Simulation]

-

Jaguar Land Rover [Jaguar Land Rover Virtual Test Drive, AR Configurator]

-

Volvo [Volvo VR Configurator, Volvo Immersive Car Design]

-

General Motors [Chevrolet VR, GM Virtual Reality Prototyping]

-

Hyundai [Hyundai VR Test Drive, Hyundai Virtual Training]

-

Nissan [Nissan VR Experience, Nissan Virtual Prototyping]

-

Tesla [Tesla VR Training, Tesla AR Experience]

-

Rimac Automobili [Rimac Virtual Test Drive, Rimac Digital Twin Prototyping]

-

Aston Martin [Aston Martin Virtual Experience, Aston Martin AR Configurator]

-

Fisker Automotive [Fisker VR Vehicle Design, Fisker Virtual Showroom]

-

Lucid Motors [Lucid VR Car Configuration, Lucid Virtual Prototyping]

-

Rivian [Rivian Virtual Reality Test Drive, Rivian AR Training]

-

BMW i Ventures [BMW i VR Prototype, BMW i Digital Car Configurator]

Some of the Raw Material Suppliers for Automotive Virtual Reality Companies:

-

Qualcomm Technologies

-

NVIDIA

-

Samsung Electronics

-

Intel Corporation

-

ARM Holdings

-

Texas Instruments

-

Micron Technology

-

Advanced Micro Devices (AMD)

-

Sony Corporation

-

LG Display

RECENT TRENDS

-

In November 2024, I-CAR showcased its innovative Virtual Reality (VR) training at the 2024 SEMA Show, focusing on high-voltage EV repair simulations. This immersive technology allows collision repair professionals to develop skills in a risk-free environment.

-

In December 2023, BMW is using virtual reality (VR) and mixed reality technology from the gaming industry to revolutionize vehicle development, starting with the BMW iX. This collaboration with Epic Games enhances design processes, enabling more interactive and efficient simulations.

-

In February 2024, Honda will debut its XR Mobility Experience at SXSW 2024, combining virtual reality with the UNI-ONE mobility device for an immersive entertainment experience. The technology aims to redefine mobility in theme parks and entertainment venues.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 2.12 Billion |

|

Market Size by 2032 |

USD 20.81 Billion |

|

CAGR |

CAGR of 28.91% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• by Application (In-Vehicle Entertainment, Advanced Driver Assistance Systems (ADAS), Simulation and Training, Showroom Display) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

BMW Group, Ford Motor Company, Porsche, Mercedes-Benz, Volkswagen Group, Audi, Honda, Toyota, Jaguar Land Rover, Volvo, General Motors, Hyundai, Nissan, Tesla, Rimac Automobili, Aston Martin, Fisker Automotive, Lucid Motors, Rivian, BMW i Ventures. |

|

Key Drivers |

• Enhancing In-Car Entertainment with VR and Self-Driving Cars Boosting Efficiency Engagement and Brand Appeal |

|

Restraints |

• Overcoming VR Hardware Challenges and Data Privacy Concerns for Seamless Automotive User Experiences and Adoption |