Automotive Fuel Tank Market Report Scope & Overview:

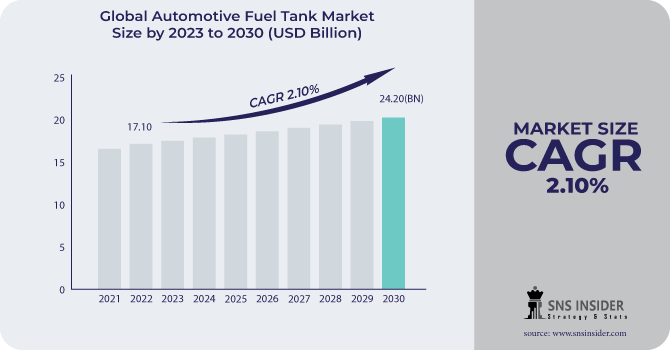

The Automotive Fuel Tank Market size is expected to reach USD 27.08 Bn by 2031, the market was valued at USD 18.33 Bn in 2023 and will grow at a CAGR of 5% over the forecast period of 2024-2031.

The fuel tank serves as a reservoir, storing fuel until the engine needs it. Typically, it is under the trunk or cargo area of a passenger car or, in some trucks and commercial vehicles, underneath the chassis at the back of the automobile. Fuel tanks are often built of plastic, steel, or aluminium. Each material has benefits and drawbacks. Steel tanks can rust over time despite being sturdy. Although it can be more expensive, aluminium is both lightweight and resistant to corrosion. Although plastic tanks are lightweight and resistant to corrosion, in some circumstances they might not last as long. Depending on the type of vehicle and its intended purpose, different gasoline tanks have different capacities. Smaller tanks are more common in passenger cars, while larger vehicles like SUVs, lorries,

The filler neck is the valve used to add fuel to the tank. It attaches to the fuel cap, which closes the tank to stop impurities from entering and fuel from leaking or evaporating. A fuel level sensor, frequently a float coupled to a variable resistor, is typically located inside the tank, and transmits a signal to the fuel gauge of the car. As a result, the driver can keep an eye on the fuel level. Systems for allowing air to enter fuel tanks in automobiles are built into the tanks' construction. This avoids the tank creating a vacuum, which would obstruct the fuel's flow to the engine.

In the event of a collision, gasoline tanks are made to be secure and prevent fuel leaks. They are frequently found in secure parts of the vehicle that are encircled by supporting structures. Some fuel tanks have baffles or other anti-slosh features that lessen the movement of fuel inside the tank during acceleration, braking, and cornering. These characteristics help to increase vehicle stability and handling. To trap and regulate fuel vapours, contemporary fuel tanks are outfitted with emission control equipment including charcoal canisters and evaporative emissions systems. Components like fuel tanks require little upkeep. To guarantee safety and stop gasoline loss, they should be routinely checked for corrosion, leaks, or other damage. Any problems should be fixed right away.

Market Dynamics:

Driver

-

The urge of meeting the regulatory requirement related to safety and emissions

In the design of fuel tanks, safety comes first. Fuel tanks must endure a variety of stressors, such as blows from crashes, scuffs from the road, and the effects of the environment. It is essential to keep the tank intact during an accident to avoid fuel leaks and flames. Fuel tanks for automobiles are made to reduce the amount of fuel vapours released into the atmosphere. To absorb and manage these damaging pollutants, modern fuel tanks have evaporative emissions control systems, including charcoal canisters.

Restrain

-

To manage the overall weight and the safety protocols.

Opportunity

-

The rising technological advancement and the engineering related to the materials and the overall functionality.

Even in harsh circumstances, improved sealing technology like gaskets and welds aid in preventing fuel leakage. To minimize over pressurization or vacuum creation during variations in temperature and altitude, engineers have created sophisticated venting systems that maintain pressure balance within the tank. Engineers have implemented evaporative emissions control mechanisms, such as sealed fuel systems and charcoal canisters, to reduce the escape of fuel vapours into the atmosphere. To monitor the integrity of gasoline tanks and rapidly identify any leaks, sophisticated leak detection devices are used.

Challenges

-

To match up with the drastic changes in automotive industry and keeping up the pace for the compatibility element.

Impact of Recession:

During economic downturns, automakers may cut back on research and development (R&D) spending. For instance, the incumbent OEMs in Germany have decreased the R&D expenditure by aggregate of 11% to prior years, which could have an impact on the creation of cutting-edge fuel tank technologies, materials, and design elements. Economic pressure may cause manufacturers to reevaluate the materials used in gasoline tank construction and investigate cost-cutting options. But it's important to uphold safety and quality requirements. A recession might have an impact on the creation of fuel tanks for alternative fuels like hydrogen or natural gas. In the event of a resource shortage, investments in these technologies might decrease.

Impact of Russia Ukraine War:

Typically, materials like steel, aluminium, and plastic are used to create fuel tanks. The production and cost of gasoline tanks may be impacted if the war raises the price or reduces the availability of these materials. Export and import restrictions on a variety of items, including automobile components, may result from ongoing trade disputes. The movement of fuel tanks and related materials between nations and regions may be hampered by these regulations.

According to IMF there was 30% of fluctuations in exchange rates observed because of the war, Currency exchange rate fluctuations can have an impact on the price of imported materials and components, which influences how competitive the makers of gasoline tanks are on the worldwide market.

Market Segmentation

By Capacity Type

-

Less Than 45L

-

45L-70L

-

Above 70L

By Vehicle Type

-

Passenger Cars

-

Commercial Vehicles

By Material Type

-

Plastic

-

Metal

-

Aluminum

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Regional Analysis

North America region will be having good growth because the US, Canada, and Mexico make up the North American vehicle fuel tank market. It is distinguished by a wide variety of vehicle types, ranging from small automobiles to big trucks and SUVs. The design and materials used in fuel tanks are influenced by stricter pollution and safety standards. Fuel tank technology are impacted by emission control requirements, such as evaporative emissions limits. There is a high demand for pickup trucks and SUVs, which frequently call for larger fuel tanks. Consumer tastes vary. Range and fuel efficiency are crucial factors. The market for alternative fuels, such as natural gas and propane, is expanding in North America, necessitating specific fuel tank solutions.

Europe will be the region which will have second largest share because it comprises nations with a variety of interests, from electric cars to diesel-powered cars. The design of fuel tanks is influenced by strict emissions regulations as well as efforts to reduce carbon emissions, with an emphasis on lightweight materials and emissions management. Demand for conventional fuel tanks is being impacted by the popularity of fuel-efficient automobiles and a movement in consumer preferences toward electrified vehicles. The demand for large, effective fuel tanks for trucks and buses is influenced by Europe's thriving commercial vehicle market.

APAC region will be having the highest CAGR growth rate because the need for automobile gasoline tanks is being driven by two economies that are expanding quickly: China and India, where the rate of vehicle ownership is rising. The region is seeing an increase in the use of electric and hybrid vehicles, which influences the demand for conventional fuel tanks. Consumer desires and regulatory requirements are influencing an increase in the usage of innovative materials and lightweight construction methods. This market is sizable and has a range of preferences for technology and fuel tank capacity.

Key Players

The major key players are Yachiyo, Continental AG, Kautex Textron, TI Automotive, Magna International, YAPP, SMA Serbatoi, The plastic Omnium, Martinrea International, Unipres Corp. and others.

Yachiyo-Company Financial Analysis

Recent Industry Developments:

Transition to Lightweight Materials: To make fuel tanks lighter, automakers are increasingly using lightweight materials like composites and sophisticated polymers. This action was taken to increase fuel economy and lower emissions.

Innovations in Plastic Fuel Tanks: Due to its ability to take on complicated shapes and corrosion resistance, plastic fuel tanks, particularly those made of high-density polyethylene (HDPE), have become more and more popular. To improve durability and fuel vapor containment, some manufacturers were looking into multi-layer plastic tanks.

| Report Attributes | Details |

| Market Size in 2023 | US$ 18.33 Billion |

| Market Size by 2031 | US$ 27.08 Billion |

| CAGR | CAGR of 5% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Capacity Type (Less than 45L, 45L-70L, Above 70L) • By Vehicle Type (Passenger Cars, Commercial Vehicles) • By Material Type (Plastic, Metal, Aluminum) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Yachiyo, Continental AG, Kautex Textron, TI Automotive, Magna International, YAPP, SMA Serbatoi, The plastic Omnium, Martinrea International, Unipres Corp. |

| Key Drivers | • The urge of meeting the regulatory requirement related to safety and emissions |

| Market Opportunity | • The rising technological advancement and the engineering related to the materials and the overall functionality. |