Fuel Cell Powertrain Market Report Scope & Overview

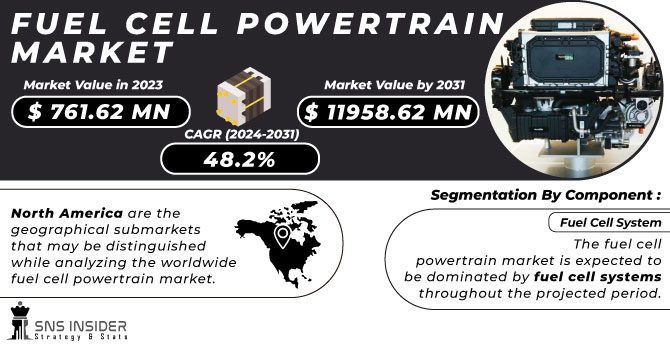

The Fuel Cell Powertrain Market Size was valued at USD 761.62 million in 2023 and is expected to reach USD 11958.62 Million by 2031 and grow at a CAGR of 48.2% over the forecast period 2024-2031.

The growing focus on curbing greenhouse gas emissions is driving a strong push for sustainable transportation solutions. Fuel cell powertrains, unlike traditional gasoline or diesel engines, emit only water vapor, making them a champion for clean air. The powertrain fuel cell is a low-cost mobility solution that produces zero emissions in the immediate area. Governments worldwide are implementing stricter environmental regulations, further propelling the market forward. The advancements in technology are making fuel cell powertrains a more attractive option

Get more information on Fuel Cell Powertrain Market - Request Sample Report

The rising demand for low-emission automobiles is creating a fertile ground for FCEVs. Consumers are increasingly environmentally conscious and seek cleaner transportation options. Thus, the expanding range of FCEVs offered by automakers like Toyota and Hyundai is enticing potential buyers. The high upfront cost of FCEVs compared to conventional vehicles remains a hurdle. The limited hydrogen refuelling infrastructure, especially outside major cities, presents a challenge for widespread adoption.

MARKET DYNAMICS:

KEY DRIVERS:

-

Stricter environmental regulations are pushing for cleaner transportation solutions, making zero-emission fuel cell powertrains a frontrunner.

-

Growing consumer demand for eco-friendly vehicles creates a market for FCEVs as people seek cleaner transportation options.

As environmental consciousness rises, people are actively seeking cleaner transportation options. Fuel Cell Electric Vehicles (FCEVs) address this need perfectly. They generate only water vapor as a byproduct, unlike traditional gasoline or diesel engines which contribute to air pollution. This aligns with the increasing shift towards sustainable transportation solutions, creating a fertile ground for FCEVs to flourish. Furthermore, automakers like Toyota and Hyundai are expanding their FCEV offerings, providing consumers with more choices and enticing them with the prospect of clean and efficient driving. This growing consumer demand, coupled with the environmental benefits of FCEVs, is a powerful force propelling the Fuel Cell Powertrain Market forward.

RESTRAINTS:

-

Limited availability of hydrogen refuelling stations, especially outside major cities, creates a barrier for widespread FCEV adoption.

The limited availability of hydrogen refuelling stations is a barrier for the Fuel Cell Powertrain Market. Unlike gasoline stations readily found across most regions, hydrogen infrastructure is still in its early stages. This lack of readily available fuel, especially outside major cities, creates a significant barrier for widespread adoption of FCEVs. This "range anxiety" discourages many potential buyers. The relatively new fuel cell technology raises concerns about the long-term durability and potential maintenance costs. While advancements are ongoing, some consumers remain hesitant due to the unfamiliar technology. The production volumes of FCEVs are currently lower compared to conventional vehicles. This limited production scale restricts economies of scale, potentially keeping overall costs higher for FCEVs. Thus, the availability of hydrogen itself can be limited in certain regions.

-

The relatively new technology raises concerns about the long-term durability and potential maintenance costs of fuel cells.

OPPORTUNITIES:

-

Collaboration between governments, automakers, and energy companies can accelerate market growth and infrastructure development.

-

Government initiatives promoting hydrogen infrastructure development can significantly expand FCEV adoption.

CHALLENGES:

-

The high initial costs of FCEVs compared to traditional vehicles creates a significant price barrier for consumers.

KEY MARKET SEGMENTS:

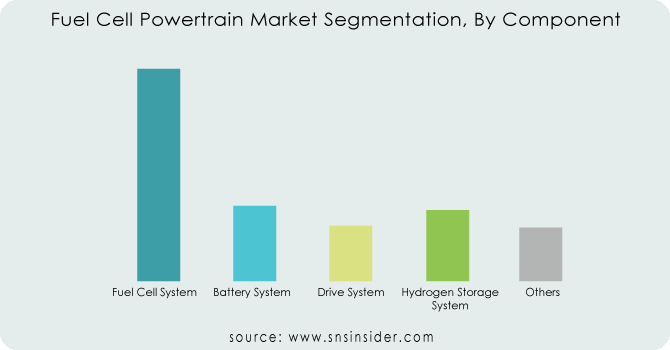

By Component:

-

Fuel Cell System

-

Battery System

-

Drive System

-

Hydrogen Storage System

-

Others

The Fuel Cell System is the dominating sub-segment in the Fuel Cell Powertrain Market by component holding around 60-70% of market share due to its fundamental role in electricity generation. It's essentially the crucial part of the system, converting hydrogen fuel and an oxidant (usually air) into electricity through an electrochemical process. Fuel cell technology is still relatively new, with immense potential for improvement. Advancements in fuel cell design, materials science, and efficiency directly translate to better performance, lower costs, and ultimately, wider adoption of the entire Fuel Cell Powertrain. Fuel cell stacks are intricate and require high-performance materials, making them the most expensive component within the powertrain. This high value translates to a significant share in the overall market. A large portion of research and development efforts in the Fuel Cell Powertrain industry is concentrated on improving fuel cell technology.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Vehicle Type:

-

Passenger Cars

-

Light Commercial Vehicle (LCV)

-

Buses

-

Trucks

Passenger Cars is the dominating sub-segment in the Fuel Cell Powertrain Market by vehicle type. This dominance aligns with the growing popularity of FCEVs as a clean and efficient alternative to gasoline-powered cars for personal transportation. Consumers are increasingly interested in eco-friendly vehicles with long driving ranges and fast refuelling times. FCEVs cater to this demand perfectly, offering a zero-emission alternative with refuelling times comparable to gasoline vehicles. Many governments are offering subsidies and tax breaks for purchasing FCEVs. The stricter regulations on emissions are pushing car manufacturers towards cleaner technologies, further propelling the adoption of FCEVs in the passenger car segment. Consumers and governments alike are prioritizing sustainability, leading to a rise in demand for electric vehicles of all kinds.

By Power Output:

-

<150 kW

-

150-250 kW

-

>250kW

Less Than 150 kW is the dominating sub-segment in the Fuel Cell Powertrain Market by power output. The transportation sector is witnessing a growing demand for heavier duty vehicles with longer ranges, such as buses and trucks. Fuel cells have the potential to meet these requirements, leading to a potential rise in the 150-250 kW segment. Research and development efforts are focused on creating more powerful fuel cells suitable for commercial applications. These advancements could accelerate the adoption of FCEVs in the higher power output segments.

By Drive Type:

-

Rear-Wheel Drive (RWD)

-

Front-Wheel Drive (FWD)

-

All-Wheel Drive (AWD)

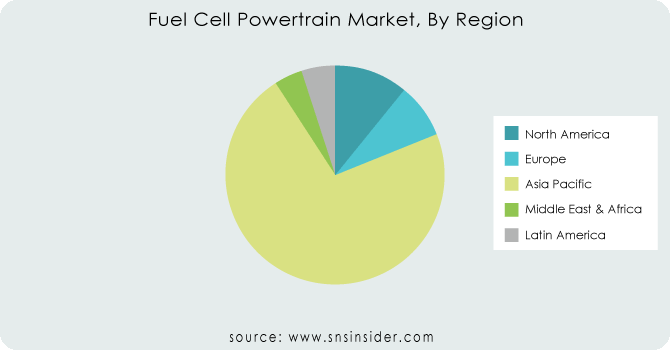

REGIONAL ANALYSES

The Asia Pacific is the dominating region in the Fuel Cell Powertrain Market, holding around 70-75% of market share. The government incentives like subsidies and infrastructure investments in China, Japan, and South Korea create a supportive environment for FCEVs. The region boasts a powerful automotive industry with key players like Toyota and Hyundai actively developing and deploying these vehicles. The growing focus on environmental sustainability fuels the adoption of clean transportation solutions like FCEVs.

North America holds the second-highest share, driven by early adoption in the US and continued technological advancements. This is due to anticipated infrastructure expansion and rising consumer awareness, making FCEVs a more attractive option in the future.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are Robert Bosch (Germany), AVID Technology Ltd (UK), Delphi Technologies (UK), Ballard Power Systems (Canada), BMW, Brown Machine Group (US), Ceres Power (UK), ITM Power Manufacturers (UK), Cummins (US), Denso Corporation (Japan), Bloom Energy (US), SFC Energy (Germany) and other key players.

Delphi Technologies (UK)-Company Financial Analysis

RECENT DEVELOPMENT

-

In Feb. 2024: Extreme E teams up with Symbio to swap batteries for a 75kW hydrogen fuel cell in their off-road racing cars. This green hydrogen, made from solar and water, will power the vehicles in the upcoming Extreme H series, marking a shift to hydrogen-fueled racing.

-

In Feb. 2024: Honda unveils America's first mass-produced hydrogen fuel cell car, the 2025 CR-V e:FCEV. This collaboration with GM leverages combined expertise to create a cost-effective powertrain, slashing costs by two-thirds compared to previous models.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 761.62 Million |

| Market Size by 2031 | US$ 11958.62 Million |

| CAGR | CAGR of 48.2% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Fuel Cell System, Battery System, Drive System, Hydrogen Storage System, Others) • By Vehicle Type (Passenger Cars, Light Commercial Vehicle (LCV), Buses, Trucks) • By Power Output (<150 kW, 150-250 kW, >250kW) • By Drive Type (Rear-Wheel Drive (RWD), Front-Wheel Drive (FWD), All-Wheel Drive (AWD)) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Robert Bosch (Germany), AVID Technology Ltd (UK), Delphi Technologies (UK), Ballard Power Systems (Canada), BMW, Brown Machine Group (US), Ceres Power (UK), ITM Power Manufacturers (UK), Cummins (US), Denso Corporation (Japan), Bloom Energy (US), and SFC Energy (Germany) |

| Key Drivers | • Better fuel efficiency and range will raise FCEV demand, driving the fuel cell powertrain market. • The environmental concerns about GHG emissions may be the primary reason for the rise of the market. |

| RESTRAINTS | • There are further obstacles to the expansion of the FEV market because of the high cost of FEVs. • Since hydrogen gas is so light, it cannot be scented to detect leaks immediately. |