Automotive Horn Systems Market Size & Overview:

Get More Information on Automotive Horn Systems Market - Request Sample Report

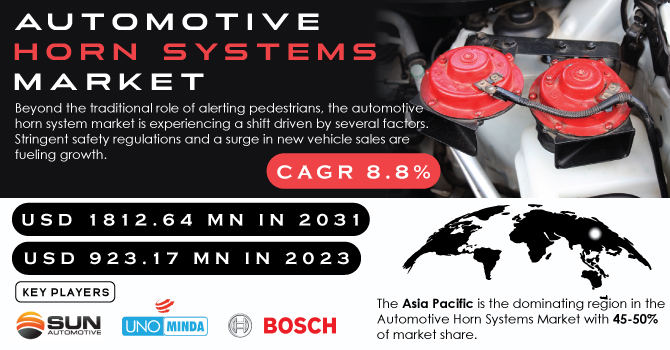

The Automotive Horn Systems Market Size was valued at USD 923.17 million in 2023 and is expected to reach USD 1812.64 million by 2031 and grow at a CAGR of 8.8% over the forecast period 2024-2031.

Beyond the traditional role of alerting pedestrians, the automotive horn system market is experiencing a shift driven by several factors. Stringent safety regulations and a surge in new vehicle sales are fueling growth. The classic loud honk is being replaced by more subtle tones. This change is due to both noise pollution concerns and a desire for a more pleasant driving experience. Manufacturers are innovating with customizable sounds and quieter horns that still effectively communicate a vehicle's presence. Advancements in technology are also influencing horn systems. The rise of connected vehicles and autonomous driving is leading to a focus on efficiency and streamlined components. As horns have a limited lifespan, typically lasting 2-4 years, there's a steady demand for replacements.

MARKET DYNAMICS:

KEY DRIVERS:

-

Connected cars, self-driving vehicles, and the Internet of Things are driving innovation in automotive horn systems to improve overall vehicle efficiency.

The automotive horn system market is stimulating the advancements in connected cars, self-driving vehicles, and the Internet of Things. These technologies are streamlining designs and eliminating unnecessary components, making vehicles more efficient overall. This trend is expected to be a major driver of growth in the horn system market, as new horn designs integrate seamlessly with these technological advancements.

-

Stricter Safety Regulations Drive Growth in Automotive Horn Systems Market

RESTRAINTS:

-

Frequent replacements due to accidents increase overall system costs for vehicle owners.

-

Advancements in connected vehicles and autonomous driving may reduce reliance on traditional horns.

OPPORTUNITIES:

-

Rising electric vehicle demand creates opportunities for quieter, more customizable electric horns.

-

Focus on pedestrian safety approves the horn systems with improved sound directionality.

CHALLENGES:

-

High Upfront Costs for Development and Installation Hinder Automotive Horn Systems Market Growth

High upfront costs for development and installation hinder the wider adoption of automotive horn systems market. This is particularly true for large-scale projects, where the development and installation of new horn systems can be expensive. These costs can encompass research and development for innovative horn technology, purchasing specialized equipment for installation, and potentially even infrastructure upgrades to accommodate the new system.

-

Evolving Customer Demands Challenge Automotive Horn Manufacturers

IMPACT OF RUSSIA-UKRAINE WAR

The ongoing war between Russia and Ukraine has emerged as a disruptive force in the automotive horn system market. The conflict's impact is potentially hindering market expansion by 5% to 15%. This decline is primarily driven by several factors. The supply chain disruptions are causing significant issues. The war has made it difficult to obtain raw materials and crucial components needed for horn system manufacturing. This can lead to production slowdowns and price increases for horns, potentially discouraging potential buyers. The war has triggered economic instability and rising inflation. Consumers limiting their budgets, might prioritize essential car repairs over horn replacements, especially in the aftermarket segment. This shift in priorities could lead to a further decline in demand, impacting market growth by an estimated 3% to 5%.

IMPACT OF ECONOMIC SLOWDOWN

An economic slowdown can disrupt the automotive horn system market's growth potentially leading to a contraction of 5% to 11%. This is due to several factors. The economic downturns typically see a decrease in consumer spending, impacting new vehicle sales. Since new vehicles come equipped with horns, fewer vehicle sales translate to lower demand for horn systems, hindering market growth by an estimated 3% to 7%. During economic hardship, consumers might prioritize essential car maintenance over non-critical repairs like horn replacements. This shift in spending could lead to a decline in the aftermarket segment, impacting market growth by an additional 2% to 4%. Price sensitivity will also play a role, as consumers might opt for cheaper horn replacements or delay replacements altogether. However, there could be some mitigating factors. An economic slowdown could lead people to hold onto their vehicles for longer, potentially creating a future increase in horn replacements. The trade restrictions during an economic downturn might encourage horn manufacturers to source materials domestically, benefiting domestic horn system suppliers.

KEY MARKET SEGMENTS:

By Product Type:

-

Electric Horn

-

Air Horn

Electric Horns is the dominating sub-segment in the Automotive Horn Systems Market by product type holding around 60-70% of market share. They are quieter than traditional air horns, complying with noise regulations in many regions. Additionally, electric horns offer greater design flexibility and are generally more compact, making them suitable for modern vehicles with limited space. Their ease of installation and lower maintenance requirements further solidify their dominance.

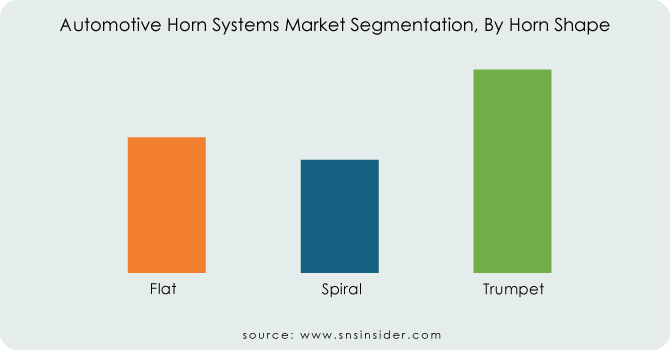

By Horn Shape:

-

Flat

-

Spiral

-

Trumpet

Trumpet Horns is the dominating sub-segment in the Automotive Horn Systems Market by horn shape holding around 40-45% of market share. Trumpet horns are the most popular choice, particularly for passenger cars. Their classic design offers a good balance between sound volume and sound directionality, effectively alerting other drivers and pedestrians. Trumpet horns also come in various sizes and tones, allowing for some level of customization.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Vehicle Type:

-

Passenger cars

-

Commercial vehicles

Passenger Cars is the dominating sub-segment in the Automotive Horn Systems Market by vehicle type holding around 70-75% of market share. This is primarily due to the sheer volume of passenger cars produced and sold globally compared to commercial vehicles. Additionally, regulations mandating horns on all passenger cars contribute to their dominance in the market.

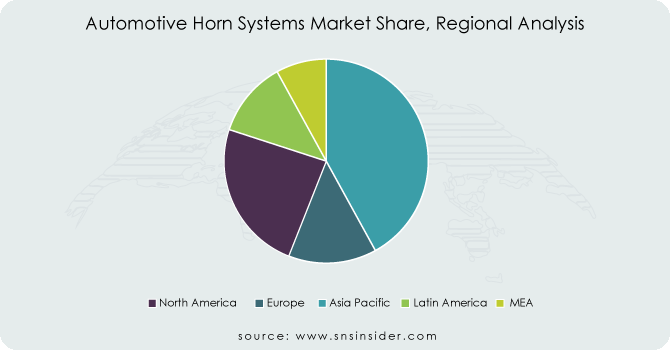

REGIONAL ANALYSES

The Asia Pacific is the dominating region in the Automotive Horn Systems Market with 45-50% of market share. This dominance stems from a rising car manufacturing industry in countries like China, Japan, and India, creating a high demand for horns. The growing middle class across the region is fueling car ownership, further boosting the market.

Europe is the second highest region in this market with 25-30% of market share due to its established automotive companies like Volkswagen and BMW, who require a steady supply of high-quality horns. Stringent noise regulations in the region have also driven innovation, leading to the development of quieter electric horns.

North America is experiencing the fastest growth with 15-20% of market share. The region's focus on technological advancements further strengthens its position, as horn manufacturers actively develop features like integrated safety functionalities.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are Uno Minda (India), Sun AutomobileCo., Ltd. (US), Robert Bosch (Germany), Fiamm (Italy), Maruko Keihoki (Japan), HELLA (Germany), Imasen Electric Industrial (Japan), Mitsuba Corporation (Japan), Roots Group of Companies, Denso Corporation, Kleinn Automotive (US), SORL Auto Parts (China), Wolo Manufacturing (US) and other key players

Uno Minda (India)-Company Financial Analysis

RECENT DEVELOPMENT

-

In April 2024: Uno Minda launches the Ultimo C80, a premium trumpet horn for the Indian aftermarket. This powerful 80mm horn boasts over 105 decibels while requiring low power, bringing global technology at Rs 1,080 with a one-year warranty.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 923.17 Million |

| Market Size by 2031 | US$ 1812.64 Million |

| CAGR | CAGR of 8.8% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Air Horn, Electric Horn) • By Horn Shape (Flat, Spiral, Trumpet) • By Vehicle Type (Passenger Cars, Commercial Vehicles) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Uno Minda (India), Sun AutomobileCo., Ltd. (US), Robert Bosch (Germany), Fiamm (Italy), Maruko Keihoki (Japan), HELLA (Germany), Imasen Electric Industrial (Japan), Mitsuba Corporation (Japan), Roots Group of Companies, Denso Corporation, Kleinn Automotive (US), SORL Auto Parts (China), Wolo Manufacturing |

| Key Drivers | • Connected cars, self-driving vehicles, and the Internet of Things are driving innovation in automotive horn systems to improve overall vehicle efficiency. • Stricter Safety Regulations Drive Growth in Automotive Horn Systems Market |

| RESTRAINTS | • Frequent replacements due to accidents increase overall system costs for vehicle owners. • Advancements in connected vehicles and autonomous driving may reduce reliance on traditional horns. |