AUTOMOTIVE ENGINE MARKET KEY INSIGHTS:

To Get More Information on Automotive Engine Market - Request Sample Report

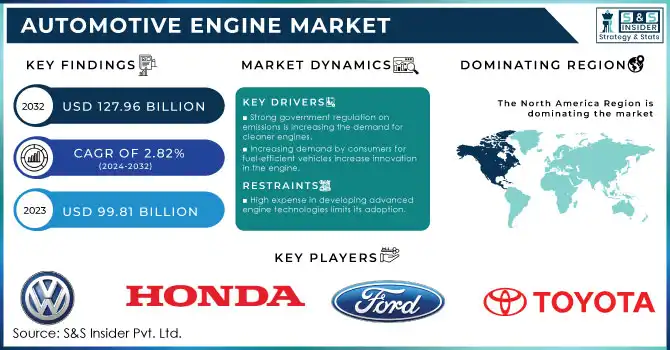

The Automotive Engine Market Size was valued at USD 99.81 Billion in 2023 and is expected to reach USD 127.96 Billion by 2032 and grow at a CAGR of 2.82% over the forecast period 2024-2032.

The automotive engine market is presently undergoing change with the impetus being advanced technologies, government regulations, and changing consumer preferences toward fuel-efficient as well as environmentally friendly automobiles. The rising popularity of electric vehicles (EVs), hybrid engines, and alternative fuel technologies result in a historical transition of the old internal combustion engine (ICE) towards more environmentally sustainable alternatives.

Among the recent government policies that are critically influencing future automotive engine prospects is the reduction of carbon emissions. Recently, in the United States, a focal point has been raised with the Inflation Reduction Act of 2022, which promotes a shift to electric vehicles while providing the tax incentives to encourage manufacturers into cleaner engine technologies. It also places significant investment in charging infrastructure for electric vehicles, thus supporting this transition from ICE vehicles. Similarly, the European Union implemented new standards for CO2 emissions, phasing out ICE vehicles to end before 2035.

For example, in China and Japan, on top of electric engines, hydrogen-powered engines also play a significant role. China is the world's biggest EV market and is presently focusing on augmenting domestic production capacity. Meanwhile, Japan is forging ahead with research in hydrogen fuel cell engines. Efforts by governments are thus pushing the automotive market forward into a low-emission future, prompting demand upward for innovative engine technologies.

Major developments are on the agenda in terms of engine technology for the automotive industry that will control the future of the market. Electric engines and hybrid powertrains, together with progressions in battery ability and charging speed, will enjoy high efficiency with systems that recover energy. Hydrogen fuel cells are also coming forward as an alternative clean source of energy, particularly in markets such as Japan and Germany, which are intensifying their focus on zero-emission vehicles. Advances in turbocharging technology are enhancing fuel economy for the conventional ICE, so that this mode of power generation also stays competitive despite very high regulation.

MARKET DYNAMICS

KEY DRIVERS:

-

Strong government regulation on emissions is increasing the demand for cleaner engines.

Some of the key impulses for a more modern engine in the global automobile industry are strong government regulations on emissions. For example, the U.S-imposed Corporate Average Fuel Economy or CAFE standards mandate automakers to improve fuel efficiency and curtail GHG emissions from vehicles. Euro 6d NOx emissions standards will cap the European Union's NOx emissions, forcing manufacturers to adapt to cleaner, more efficient engines. These regulations make manufacturers design hybrid or electric engines or better ICEs by adopting technologies such as turbocharging, downsizing, and direct injection. Such regulations do not only increase R&D investments but also allow consumers to buy vehicles according to the regulations they wish.

-

Increasing demand by consumers for fuel-efficient vehicles increase innovation in the engine.

Increasing fuel prices along with increasing awareness about the responsible usage of fuel to the environment is raising the level of demand among consumers to seek more fuel-efficient vehicles. It is making the car makers invest in advanced engine technologies. According to a US Department of Energy report, more than 60% of the new-car buyers all around the US considered fuel efficiency as an essential buying criterion for them during 2023. Hybrid engines, which both deliver performance and fuel efficiency, are proving to be very popular among the customers. The stop-start technology and lightweight materials in the engines have been gaining popularity as of late due to fuel consumption and emission cuts. With the desire for mileage and relatively low running cost, advancements in engine solutions keep on growing, especially in regions of Europe as the rates for fuel are very high.

RESTRAINTS

-

High expense in developing advanced engine technologies limits its adoption.

Developing high-tech engine technologies, especially for reduced emissions and increased efficiency, involves significant R&D costs. Considerable investment has to be made by the automobile companies on new technologies such as turbocharging, direct injection, and hybrid-electric systems, which are considered a must for meeting the strict regulations and requirements. For example, aligning U.S. Emission Standards with CAFE requirements might require automakers to retool production lines and thoroughly test new powertrains at an expense running into billions of dollars.

Center for Automotive Research (CAR) estimates that the next round of regulations in the United States could add about USD 1,000 to the manufacturing cost of each vehicle. Hybrid and electric engines also require significant investments in battery technology and charging infrastructure, which consequently increases the cost. Such high expenses discourage small auto manufacturers from implementing such sophisticated technology. Permeation of electric and hybrid engines may thus be restricted, especially in developing markets with higher sensitivity of price. Therefore, where the large automobile companies may afford to bear such costs, the market will not easily embrace the technological advancements of new engine technologies because it is expensive.

KEY SEGMENTATION ANALYSIS

BY VEHICLE TYPE

Passenger Cars were the market leaders in 2023, making up 64% of the total market share. This is mainly because of the increasing demand for personal mobility solutions worldwide, but more importantly in the developing economies of Asia Pacific and Latin America, where there is an increasing tendency towards middle-class buying. These factors have boosted the high demand for passenger car engines, innovations in passenger car technology, which include fuel-efficient turbocharged ICEs and hybrid-electric systems. Moreover, consumer preference towards low emitting with better fuel economy has further consolidated passenger cars in the market.

Commercial Vehicles is expected to remain the growth leader during the forecast period 2024-2032, with a compound annual growth rate (CAGR) of 3.50%. This is because efficient transport solutions for goods and services, more specifically at an urban level, is gaining importance. High investment in infrastructure and transportation services by governments increases the demand for commercial vehicles in which advanced engines provide better fuel efficiency and zero emission capabilities. Additionally, electrical commercial fleet mainly logistics sector is another promising opportunity in this market.

BY PLACEMENT TYPE

The In-line Engine segment dominated the market in 2023 by taking 45%. Since in-line engines are more simple, cost-effective, and efficient to run, these engines are obviously very popular. A compact design helps in achieving a better fuel efficiency, proves relatively easier to maintain, and proves especially advantageous for manufacturers interested in large-scale production of small to middle-sized passenger vehicles. Moreover, in-line engines are cheaper to manufacture and hence are loved by all those manufacturers who intend to produce the best product at a price as low as possible yet would cover a wide range of consumers.

However, the W Engine segment is expected to grow at the fastest CAGR of 3.20% during the forecast period from 2024 to 2032. W engines, with their distinctive layout that allows for more cylinders and higher power output in a compact design, are increasingly being found in luxury and high-performance vehicles. Other brands like Volkswagen and Bugatti have exemplified the use of W engines in all the top-tier products. This is factored into play because consumer demand is seeking high-performance automobiles, particularly luxury and sports cars, and the W engine is expected to continue at an exponential scale.

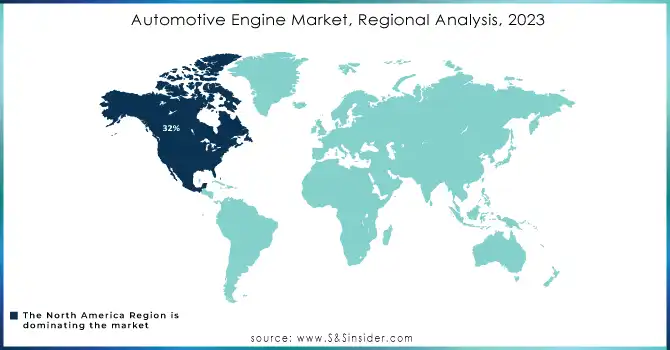

REGIONAL ANALYSIS

In the year 2023, North America was the largest automotive engine market, accounting for 32%. This is primarily due to higher demand for advanced technologies in vehicles and other hybrid or electric engines, along with robust governmental support to reduce pollution. The U.S. Department of Energy, along with its counterparts, has been aggressively promoting the adoption of cleaner vehicle technologies in the region. This has led to an increased market for traditional and alternative powertrains. Consumer preference toward larger, high-performance vehicles in North America has also led to increased demand for advanced ICEs and hybrid-electric engines.

Asia Pacific is also expected to emerge as the greatest growth market in the near term with an estimated CAGR of 4.19% during the period 2024 to 2032. Rapid urbanization and growing middle-class populations in China, India, and Japan are driving demands for passenger and commercial vehicles. Government incentives for the purchase of electric vehicles, especially in China and Japan, are going to take this region's automotive engine market forward further in the near term.

Do You Need any Customization Research on Automotive Engine Market - Inquire Now

KEY PLAYERS

Some of the major players in the Automotive Engine Market are

-

Toyota Motor Corporation (Hybrid engines, Hydrogen fuel cell engines)

-

Ford Motor Company (EcoBoost engines, Hybrid-electric engines)

-

General Motors (Electric motors, V8 engines)

-

Honda Motor Co., Ltd. (Hybrid engines, VTEC engines)

-

Volkswagen AG (W engines, TSI engines)

-

BMW AG (TwinPower Turbo engines, M Hybrid engines)

-

Daimler AG (BlueEfficiency engines, Electric motors)

-

Hyundai Motor Company (Smartstream engines, Hydrogen fuel cell engines)

-

Nissan Motor Co., Ltd. (e-POWER engines, V6 engines)

-

Fiat Chrysler Automobiles (Pentastar V6 engines, HEMI engines)

-

Volvo Group (Hybrid-electric engines, D13 Turbo Compound engines)

-

Mitsubishi Motors Corporation (MIVEC engines, Hybrid powertrains)

-

Mazda Motor Corporation (SKYACTIV engines, Rotary engines)

-

Tata Motors (Revotron engines, Electric powertrains)

-

Renault Group (E-Tech Hybrid engines, Turbocharged engines)

-

Peugeot S.A. (PureTech engines, Hybrid powertrains)

-

Suzuki Motor Corporation (Hybrid engines, K-Series engines)

-

Subaru Corporation (BOXER engines, Hybrid powertrains)

-

Ferrari N.V. (V12 engines, Hybrid-electric engines)

-

Tesla, Inc. (Electric powertrains, Plaid powertrain)

RECENT TRENDS

-

May 2024: Each of the three companies - Subaru Corporation (Subaru), Toyota Motor Corporation (Toyota), and Mazda Motor Corporation (Mazda) - aimed at developing new engines tailored to their own strategy on electrification and carbon-neutral targets. The new engines developed by each of the three companies will be optimized for excellent integration with motors, batteries, and other electric drive units while changing the packaging of vehicles through compact engines and decarbonizing internal combustion engines by equipping them with different types of CN fuels.

-

August 2024: Daimler India Commercial Vehicles today announced the launch of new products in the BharatBenz range of heavy-duty trucks into the Indian market. The new range of trucks comes with new payload applications like bitumen, bulker, Petroleum, Oil and Lubricants (POL) in addition to various existing payload applications. The heavy-duty Rigid range will be available in 2826R (6x2), 3526R (8x2), 3832R (8x2), 4232R (10x2) and 4832R (10x2) configurations.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 99.81 Billion |

| Market Size by 2032 | US$ 127.96 Billion |

| CAGR | CAGR of 2.82% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Placement Type (In-line Engine, V-type Engine, W Engine) •By Fuel Type (Gasoline, Diesel, Electric, Others) •By Vehicle Type (Passengers Car, Commercial Vehicle) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Toyota Motor Corporation, Ford Motor Company, General Motors, Honda Motor Co., Ltd., Volkswagen AG, BMW AG, Daimler AG, Hyundai Motor Company, Nissan Motor Co., Ltd., Fiat Chrysler Automobiles, Volvo Group, Mitsubishi Motors Corporation, Mazda Motor Corporation, Tata Motors, Renault Group, Peugeot S.A., Suzuki Motor Corporation, Subaru Corporation, Ferrari N.V., Tesla, Inc. |

| Key Drivers | • Strong government regulation on emissions is increasing the demand for cleaner engines. • Increasing demand by consumers for fuel-efficient vehicles increase innovation in the engine. |

| Restraints | • High expense in developing advanced engine technologies limits its adoption. |