Automotive Garage Equipment Market Report Scope & Overview:

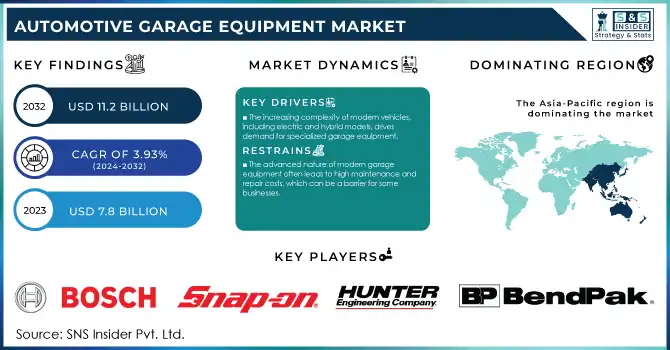

The Automotive Garage Equipment Market was valued at USD 7.8 Billion in 2023 and is expected to reach USD 11.2 Billion by 2032, growing at a CAGR of 3.93% from 2024-2032.

The automobile garage equipment Market is growing significantly, one of the main drivers is the growing complexity of today's vehicles, which means they are much more difficult to maintain and repair without advanced tools to help these tasks. Electric vehicle and hybrid vehicle-specific equipment like battery diagnostic equipment, EV chargers, and smart lifts are becoming necessary to keep pace with the evolution of the automotive sector. This change in automotive technology drives garages to invest in new equipment to stay ahead of the game in a competitive market and meet the demands of the modern vehicle owner.

To get more information on Automotive Garage Equipment Market - Request Free Sample Report

Rising Trend Of DIY Vehicle Maintenance In Developed Markets

With consumers increasingly choosing the DIY route to save on labor charges, there is a growing demand for efficient and easy-to-use automotive repair tools, diagnostic equipment, and lifts. Moreover, the incorporation of automation and smart technologies, such as robotic arms for lifting cars and competent diagnostic software that aids precision, elevates efficiency, and minimizes maintenance time, is also playing an important role in shaping the market. Such innovations are particularly beneficial for high-throughput corporative automotive service centers where timing and precision are of paramount importance.

Growing Emphasis On Sustainability Is Expected To Create New Opportunities For Green Garage Equipment

Along with an increasing number of eco-friendly lifting applications, manufacturers are focusing on energy-efficient lifts, environmentally safe disposal systems, and low-emission diagnostic tools to meet rising consumer demand for green and adhere to stricter regulations. Taking into account the rising knowledge of global safety standards and regulatory compliance, garages are spending on equipment that has measures that satisfy foreign safety and quality standards for quick, stable compliance and a secure working environment.

Market Dynamics

Drivers

-

The increasing complexity of modern vehicles, including electric and hybrid models, drives demand for specialized garage equipment

An automotive garage equipment market evolution has appeared in response to the increasing complexity of automobiles and the emerging electric and hybrid automobiles at this new modern world. With the sophistication of vehicles adapted to great changes and complex technologies, ordinary conventional maintenance tools cannot meet the specific needs of new vehicles. For instance, electric and hybrid vehicles have specialized diagnostic needs to assess battery health, charging systems, and electrical components quite different than traditional internal combustion engine vehicles. This escalated demand in turn has accentuated the market for sophisticated equipment such as battery diagnostic tools, EV chargers, and smart lifts that take into account the weight and frame of the EVs. Also, the demand for EV chargers continues to grow with the rising adoption and ownership of electric vehicles, which in turn require the installation and maintenance of EV chargers. Automotive service providers are also required to spend money on old-fashioned specialized equipment due to the push for EVs by government policies and manufacturers pushing dealers to adapt to this new market. Hybrid cars that combine electric and regular powertrains need tools to service the electric portion and traditional components.

The automotive garage equipment market is moving towards the automotive garage equipment capable of servicing these advanced vehicle variant types. With high-tech information, plug-in vehicles, and diagnostic standards, garages, and service centers are increasingly investing in new diagnostic systems and charging infrastructure to remain relevant in the bought-out market. This trend will only continue as more electric and hybrid vehicles enter the road.

-

The adoption of automated systems like robotic arms and advanced diagnostic software enhances efficiency, and accuracy, and reduces maintenance time in service centers.

-

Rising environmental awareness and regulatory pressures are pushing the development of eco-friendly garage equipment, including energy-efficient lifts and low-emission diagnostic tools.

Restraints

-

The advanced nature of modern garage equipment often leads to high maintenance and repair costs, which can be a barrier for some businesses.

The critical factor that is creating a challenge for businesses involved in the automotive garage equipment market is the highly advanced nature of modern garage equipment, as the growing adoption of electric & hybrid cars and models is fueling the demand for garage equipment, although maintaining & repairing them is a costly affair. With cars getting more and more advanced, so too do the tools needed to repair them, which are ever more complicated, and costly, including everything from diagnostic units to lifts to EV chargers. More complex systems such as electric drivetrains and battery management will need an ongoing level of maintenance to ensure these tools remain accurate and operational. The cost of maintaining such equipment can be substantial for small and medium-sized enterprises. Business not only requires investment in advanced tools but also training for staff management so they properly operate and maintain it. Combined with the potential for needing specialized parts, tools, or technical expertise to complete the repairs, costs can spiral. Such costly services might limit garages from embracing new technologies as seen elsewhere, especially in less developed regions with lower markets for niche services. This financial strain prevents companies from performing essential repairs or upgrading their infrastructure, making it difficult for them to stay competitive as the market expands. This way, though the demand to invest in advanced automotive garage equipment is only increasing day by day, the ongoing repair and maintenance costs continue to act as major deterrents for any business that hopes to remain competitive.

-

The cost of advanced automotive garage equipment, such as specialized diagnostic tools and EV chargers, can be prohibitively high for small garages.

-

The complexity of modern automotive technologies requires highly skilled technicians, which may be in short supply, limiting the adoption of new equipment.

Segmentation Analysis

By Garage Type

OEM Authorized Garages segment dominated the market and represented a significant revenue share of 65% in 2023, with their direct connection with vehicle manufacturers. These garages have special tools and technologies prescribed by different OEMs to ensure perfect diagnostics and repairs. OEM-authorized garages are trusted for vehicle servicing, especially under warranty, as they offer genuine parts with certified expertise. Also, with more electric and hybrid vehicles on the road, that will only increase this segment as OEMs will provide specialized training and tools to high-end technicians for complex systems such as EV batteries and drivetrains.

Independent Garages are projected to grow at the fastest CAGR during the growth of the automotive garage equipment market. Such garages are inexpensive and convenient, serving a wide range of customers, from the owners of older vehicles to those looking for an affordable solution for their repairs. Access to aftermarket tools and diagnostic equipment is increasingly available, making it easier for independent garages to offer services that can rival those of OEM-authorized service centers.

By Vehicle Type

The Passenger Cars segment dominated the automotive garage equipment market and accounted for a revenue share of more than 72% in 2023, which is due to the high global ownership and the increasing production of passenger vehicles. Increasing ownership of private vehicles, especially passenger cars in urban areas boosts the demand for periodic servicing, repairs, and diagnostic services. Modern passenger cars — electric and hybrid included — are more complex, requiring advanced garage equipment such as EV chargers, smart lifts, and battery diagnostic tools. This segment is further propelling by increasing vehicle customization and preventive maintenance. Continuous growth in the passenger car market and the development of professional automotive technologies in the future will lead to constant consumption of equipment for garages.

The Commercial Vehicles segment is projected to grow at the fastest rate in the automotive garage equipment market. The growth of global vehicle fleets to meet the rising demand for freight transportation, logistics, and public transportation services is further boosting the revenue growth of the commercial vehicle sector. Due to their extensive usage, these vehicles require regular maintenance and repair work, in turn increasing the demand for reliable and advanced garage equipment including heavy-duty lifts, wheel alignment, and diagnostic equipment.

By Application

In 2023, the car dealership segment is projected to hold a significant share of 46% of the automotive garage equipment market, and it is expected to dominate the automotive garage equipment market shortly. There are also sets of gadget mechanics and suppliers at their disposal at auto car dealerships garages, and they also consist of diagnostic gadgets, wheel alignment, and shrewd lifts for professionals to achieve high satisfactory vehicle supplier requirements based on OEM well-known confirmation. As the market shifts for electric and hybrid vehicles, more dealerships are incorporating specific equipment — EV chargers, battery analyzers, etc., for the new technology in vehicles. Then, car dealerships usually have solid relationships with automakers that guarantee them access to the latest tools and technologies.

The Tire Shop segment is expected to hold the fastest growth rate in the automotive garage equipment market. The surge in demand for tire replacement and maintenance services, due to growing vehicle usage and awareness about road safety, is one of the major growth factors. For this, tire shops are bringing high-end equipment like tire changers, wheel balancers, and alignment machines to the plate. That demand is further reinforced by the rise in electric and autonomous vehicles, which need specialized tire service. Also, concerns about fuel economy and service life of tires are leading vehicle owners to emphasize routine servicing of their tires.

Regional Landscape

The increase in urbanization, vehicle ownership, and automotive manufacturing hubs, the automotive garage equipment market in the Asia-Pacific region is anticipated to witness the fastest CAGR of 5.14% during the forecast period. The rising adoption of passenger and commercial vehicles in countries such as China, India, and Japan is expected to increase demand for vehicle maintenance and repair services. Government initiatives promoting EV adoption coupled with increasing penetration of electric mobility in the region are fuelling the demand for advanced garage equipment, including EV chargers and battery diagnosis and maintenance tooling. Moreover, market pricing developments are also supporting market growth due to the increase in independent garages and tire shops in emerging economies. In addition, with the technology upgradation and increase in the investment for automotive infrastructure, the growth of the market in Asia-Pacific will be propelled in the upcoming years.

The high adoption of advanced garage equipment, a strong automotive industry, and increasing demand for vehicle maintenance services are the factors driving the regional market in North America. The North America automotive equipment market has remained the same, where the U.S. accounts for a major share of growth owing to the high demand for automotive lifts, diagnostic equipment, and tire service equipment in the country.

KEY PLAYERS:

Robert Bosch GmbH, Snap-on Incorporated, Hunter Engineering Company, BendPak Inc., Rotary Lift (Dover Corporation), MAHA Maschinenbau Haldenwang GmbH & Co. KG, Atlas Automotive Equipment, Autel Intelligent Technology Corp. Ltd., Ravaglioli S.p.A., Beissbarth GmbH, Launch Tech Co., Ltd., Stertil-Koni, Manatec Electronics Pvt Ltd, Istobal S.A., Nussbaum Automotive Solutions, Corghi S.p.A., SEMA Equipment, SAMOA Industrial S.A., Technotools, Forward Lift

RECENT DEVELOPMENTS:

-

November 2024: Istobal S.A Launched the M WASH4, an advanced and eco-friendly rollover car wash system that reduces water and energy consumption.

-

October 2024: Snap-on Incorporated Introduced a new advanced diagnostic tool designed for electric and hybrid vehicles to improve efficiency in fault detection.

|

Report Attributes |

Details |

|---|---|

|

Market Size in 2023 |

US$ 7.8 Billion |

|

Market Size by 2032 |

US$ 11.2 Billion |

|

CAGR |

CAGR of 3.93% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Equipment (Lifting Equipment, Wheel & Tire Service Equipment, Vehicle Diagnostic & Testing Equipment, Body Shop Equipment, Washing Equipment, Others) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Robert Bosch GmbH, Snap-on Incorporated, Hunter Engineering Company, BendPak Inc., Rotary Lift, MAHA Maschinenbau Haldenwang GmbH & Co. KG, Atlas Automotive Equipment, Autel Intelligent Technology Corp. Ltd., Ravaglioli S.p.A., Beissbarth GmbH, Launch Tech Co., Ltd., Stertil-Koni, Manatec Electronics Pvt Ltd, Istobal S.A., Nussbaum Automotive Solutions, Corghi S.p.A., SEMA Equipment, SAMOA Industrial S.A., Technotools, Forward Lift |

|

Key Drivers |

• The adoption of automated systems like robotic arms and advanced diagnostic software enhances efficiency, and accuracy, and reduces maintenance time in service centers. |

|

RESTRAINTS |

• The cost of advanced automotive garage equipment, such as specialized diagnostic tools and EV chargers, can be prohibitively high for small garages. |