Automotive NVH Materials Market Size

Get More Information on Automotive NVH Materials Market - Request Sample Report

The Automotive NVH Materials Market Size was valued at USD 10.3 billion in 2023 and is expected to reach USD 16.76 billion by 2032 and grow at a CAGR of 5.5 % over the forecast period 2024-2032.

The automotive NVH materials market is experiencing steady growth, driven by the increasing demand for quieter, more comfortable vehicles. NVH materials – noise, vibration, and harshness – play a crucial role in achieving this by dampening engine noise, road vibrations, and unwanted sounds within the cabin.

Rising consumer preference for electric and hybrid vehicles, which are inherently quieter, is also creating opportunities for specialized NVH materials. The market is dominated by rubber due to its affordability, effectiveness, and temperature resistance. However, advancements in film laminates and lightweight materials are gaining traction as automakers strive for fuel efficiency and performance. All the regions are expected to see growth as NVH becomes a bigger priority for car manufacturers globally.

| Report Attributes | Details |

|---|---|

| Market Segmentation | • by Product: (Molded Rubber, Metal Laminates, Foam Laminates, Film Laminates, Molded Foam, Engineering resins) • by Application: (Absorption, Damping) • by End-use: (Cars, LCVs, HCVs) |

| Regional Analysis | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, The Dow Chemical Company, 3M Company, ElringKlinger AG, Huntsman Corporation, Sumitomo Riko Co. Ltd, Covestro AG, Celanese Corporation, Huntsman Corporation, Lanxess AG, Henkel AG & Co. KGaA, Wolverine Advanced Materials, LLC, Borgers AG, DuPont, Eastman Chemical Company |

MARKET DYNAMICS:

KEY DRIVERS:

-

Rising consumer demand for quieter and more comfortable cars

The automotive NVH (noise, vibration, and harshness) materials market is rising due to a growing focus on superior driving experiences. Consumers are demanding quieter cabins, smoother rides, and enhanced safety features. This translates to a rise in demand for NVH materials that effectively dampen engine noise, road vibrations, and unwanted sounds. The rise of electric vehicle, inherently quieter than combustion engines, also presents an opportunity for specialized NVH materials to optimize acoustics and address potential high-frequency motor noise. This focus on passenger comfort, safety, and a personalized in-car experience is driving the market forward.

-

The growing popularity of electric vehicles

RESTRAINTS:

-

Stricter government rules regarding noise emissions and passenger safety are influencing the automotive industry.

The global NVH materials market faces a barrier in the form of stricter car regulations. Rules on emissions, fuel efficiency, and safety can complicate things for manufacturers. They need to develop NVH materials that meet these standards while remaining affordable and performing well. This balancing act can be a hurdle for the industry's growth.

-

The growing use of active noise cancellation technology in cars.

OPPORTUNITIES:

-

The growing popularity of the electric vehicles

-

The increasing focus on in-cabin passenger comfort

CHALLENGES:

-

The use of NVH materials can contribute to an increase in a vehicle's overall weight.

SEGMENTATION ANALYSIS:

By Product

Foam laminates is the dominating sub-segment in the Automotive NVH Materials Market by product holding around 40-45% of market share. Foam laminates offer a compelling combination of benefits. They are lightweight and flexible, making them ideal for various applications. Additionally, they provide excellent noise absorption and insulation properties at a competitive cost. This versatility and effectiveness have driven them to become the leading product segment.

By Application

Absorption is the dominating sub-segment in the Automotive NVH Materials Market by application holding around 50-55% of market share. Absorption materials, like foams and felts, are crucial for achieving this by converting sound energy into heat, effectively reducing unwanted noise within the vehicle cabin. While damping materials play a role, absorption offers a more direct approach to addressing noise, making it the dominant application segment.

Get Customized Report as per your Business Requirement - Request For Customized Report

By End-use

Passenger Cars is the dominating sub-segment in the Automotive NVH Materials Market by end-use. The consumer demand for more comfortable ride in passenger cars is higher. This combination of factors translates to a higher volume of NVH materials used in passenger car production, solidifying its position as the dominant end-use segment.

REGIONAL ANALYSIS:

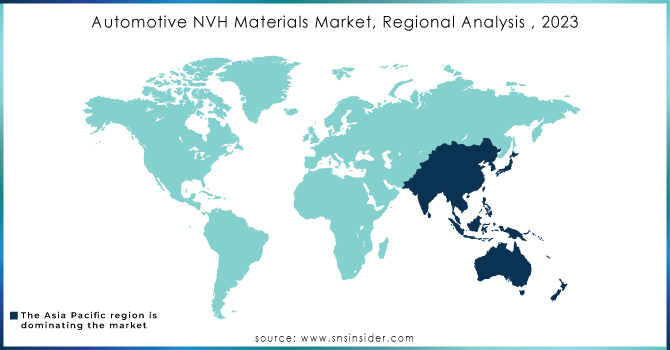

The Asia Pacific is the dominating region in this market, driven by its developing vehicle industry and expanding request for modern cars. This development is fueled by rising disposable incomes and a growing middle class, driving to a surge in car possession.

North America is the second highest region with a strong focus on technological advancements and a well-established automotive sector. Here, the demand for NVH materials is driven by variables like stringent noise regulations and consumer preference for premium car experiences.

The Asia Pacific region is expected to maintain its rapid growth in automotive industry. The future holds guarantee for rising markets like Africa and South America, where the demand for NVH materials is on the rise due to a developing focus on vehicle security and consolation, nearby expanding car possession rates.

KEY PLAYERS:

The Major key players are BASF SE (Germany), The Dow Chemical Company (US), 3M Company (US), ElringKlinger AG (Germany), Huntsman Corporation (US), Sumitomo Riko Co. Ltd (Japan), Covestro AG (Germany), Celanese Corporation US), Huntsman Corporation (US), Lanxess AG (Germany), Henkel AG & Co. KGaA (Germany), Wolverine Advanced Materials, LLC (US), Borgers AG (Germany), DuPont (US), Eastman Chemical Company (US) and other key players.

RECENT DEVELOPMENTS:

-

March 2024: Covestro, a leading materials supplier, announced the launch of a new lightweight polyolefin foam specifically designed for automotive interior applications. This foam offers improved sound absorption and insulation properties while maintaining a lower weight compared to traditional materials.

-

Jan. 2024: BASF, another major player, showcased a new bio-based acoustic insulation material made partially from recycled materials. This development caters to the growing demand for sustainable solutions in the automotive industry.

-

Dec. 2023: A consortium of European research institutions announced a breakthrough in noise-cancelling materials using metamaterials. This technology has the potential to revolutionize NVH control in future vehicles.

Automotive NVH Materials Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | US$ 10.3 Billion |

| Market Size by 2032 | US$ 16.76 Billion |

| CAGR | CAGR of 5.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Drivers | • NVH materials can also aid in vehicle weight loss, stress absorption, and impact resistance. • The Rubber’s characteristics are also used to make cars lighter, faster, and more fuel-efficient, particularly electric cars. |

| Opportunities | • The NVH standards for battery and hybrid vehicles differ from those for traditional IC engines. • NVH control materials will be necessary to create a market for noise and vibration control materials. |