Car Manufacturing Market Key Insights:

To get more information on Car Manufacturing Market - Request Sample Report

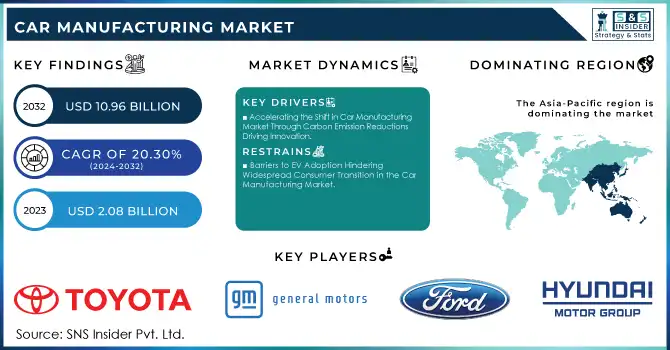

The Car Manufacturing Market Size was valued at USD 2.08 Billion in 2023 and is expected to reach USD 10.96 Billion by 2032 and grow at a CAGR of 20.30 % over the forecast period 2024-2032.

The rise in electric vehicle (EV) adoption is significantly transforming the car manufacturing market. Governments worldwide are enacting policies to reduce emissions, offering incentives, and providing funding to enhance EV infrastructure, which is accelerating the shift from traditional combustion engine vehicles. Technological advancements in battery efficiency and the expansion of charging networks have made EVs more accessible, further driving consumer interest. Major automakers are increasing investments in EV production, creating joint ventures to expand manufacturing capacities. This shift is supported by growing demand for fuel-efficient, environmentally friendly cars. By 2032, EVs are expected to dominate global car production, outpacing traditional vehicles.

The car manufacturing market's growth is fueled by manufacturers’ focus on EV production, battery manufacturing, and infrastructure development. As consumers increasingly prioritize environmentally friendly options, the market for EVs is expanding, with companies like Rivian and Volkswagen leading the way with new models and innovations. Additionally, improved vehicle range, lower long-term maintenance costs, and falling battery prices are encouraging more drivers to make the transition. Government programs, such as tax incentives and zero-emission vehicle mandates, are also bolstering the demand for EVs. Over the next decade, the employment demand in sectors related to EV design, development, and battery manufacturing is projected to grow significantly, supporting the overall market expansion. By 2032, the electric vehicle market is set to overtake traditional vehicle production, with continued growth driven by advances in technology and supportive government policies. Driven by technological advances and government incentives. Policies like the Inflation Reduction Act, which extends USD 7,500 tax credits for new EVs, and the Infrastructure Investment and Jobs Act, which allocates USD 7.5 billion for charging infrastructure, are accelerating EV adoption. Battery improvements, such as a 234-mile average range in 2021 (up from 68 miles in 2011), and lower maintenance costs, are also attracting consumers. As EV production grows, sectors like software development, expected to see 26% employment growth by 2032, are crucial to supporting this transformation.

Market Dynamics

Drivers

-

Accelerating the Shift in Car Manufacturing Market Through Carbon Emission Reductions Driving Innovation

The automotive industry is experiencing a significant transformation as the drive for reduced carbon emissions becomes a dominant force in shaping the future of car manufacturing. With the U.S. EPA reporting that transportation accounts for 27% of greenhouse gas emissions—57% of which come from passenger cars—automakers are focusing heavily on electric and hybrid vehicles (EVs) to meet net-zero targets. Key players like Ford and Toyota are leading the charge, setting aggressive decarbonization goals and adopting sustainable manufacturing practices such as renewable energy-powered production lines. Governments are backing these efforts with supportive regulations; for example, the Biden Administration aims for half of all new U.S. vehicle sales to be zero-emissions vehicles by 2030, and California has mandated that all new vehicles sold in the state must be ZEVs by 2035. As automakers invest in cleaner technologies, including battery innovations and sustainable materials, the market is witnessing accelerated growth in EV production. By focusing on reducing material emissions, especially through increased recycling and the use of green electricity, automakers can cut emissions from production by up to 66% by 2030, while also driving the shift toward electric vehicles. This push toward a cleaner, greener automotive industry is reshaping the market, creating new opportunities in sustainable mobility, and leading the way to a net-zero future.

Restraints

-

Barriers to EV Adoption Hindering Widespread Consumer Transition in the Car Manufacturing Market

A key restraint in the car manufacturing market is consumer adoption of electric vehicles (EVs). Despite growing interest in EVs, barriers like range anxiety and insufficient charging infrastructure continue to hinder widespread adoption. A significant challenge is the higher initial cost of EVs compared to traditional vehicles, which deters many potential buyers. In the U.S., 67% of consumers still prefer gasoline or diesel engines for their next vehicle, with only 21% considering a hybrid electric engine and less than 10% opting for full battery-electric models. In China, consumer preferences show a similar trend, with 33% favoring gasoline or diesel engines, while another 33% opt for battery electric vehicles. While 1.4 million EVs were registered in the U.S. in 2023, a 40% increase from 2022, this represents only a small portion of the overall automotive market. The global EV adoption rate remains well below expectations, with the market still struggling to meet targets due to affordability issues and the slow build-up of charging infrastructure. Although government incentives help ease the transition, the persistent gap in affordability and infrastructure limits the pace at which EVs can become mainstream. Until these issues are addressed, consumer adoption will remain a significant restraint, limiting the full potential of the electric vehicle market.

Segment Analysis

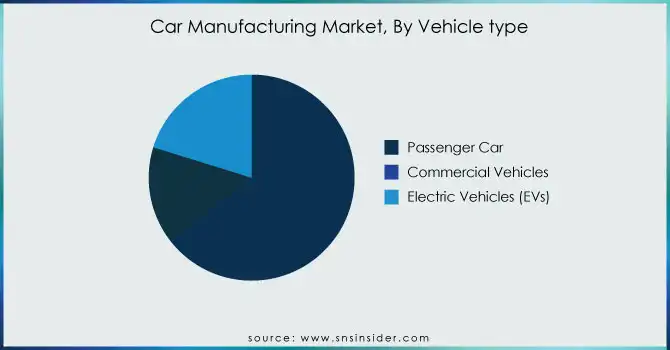

By Vehicle Type

In 2023, the passenger car segment dominated the car manufacturing market, capturing approximately 65% of the total revenue. This can be attributed to the high consumer demand for personal mobility, fuel efficiency, and the growing adoption of advanced technologies in these vehicles. Passenger cars continue to be the primary mode of transportation worldwide due to their versatility, affordability, and comfort. The increasing interest in electric vehicles (EVs) also plays a significant role, with more automakers focusing on electric and hybrid passenger cars to cater to the demand for environmentally friendly transportation. Additionally, the rise of connected and autonomous car technologies is further propelling the growth of this segment, making it a crucial driver in the car manufacturing industry.

By Mode of Operation

In 2023, automatic transmission vehicles accounted for the largest revenue share of approximately 56% in the car manufacturing market. This dominance reflects the growing consumer preference for convenience, ease of use, and improved driving comfort that automatic transmissions offer. Automatic cars are increasingly popular in urban environments where stop-and-go traffic makes manual gear shifting cumbersome. Additionally, advancements in transmission technology, such as continuously variable transmissions (CVTs) and dual-clutch systems, have enhanced fuel efficiency and driving performance, further contributing to the popularity of automatic vehicles. The rising demand for automatic cars aligns with global automotive trends, emphasizing comfort and efficiency.

Regional Analysis

In 2023, the Asia-Pacific region dominated the global car manufacturing market, capturing around 45% of total revenue. This dominance is largely attributed to key automotive players like China, Japan, and India. China stands as the largest producer and consumer of cars, driven by its rapid industrialization and rising middle class. Japan continues to lead in automotive technology, producing innovative and high-quality vehicles. India, with its growing urban population and increasing vehicle demand, plays an essential role in the region’s growth. The region benefits from cost-effective manufacturing, a competitive export market, and substantial government support for the automotive industry. These factors collectively reinforce Asia-Pacific's position as the global leader in car production.

In 2023, North America emerged as the fastest-growing region in the car manufacturing market, driven by a combination of technological advancements, strong consumer demand, and strategic investments in electric vehicle (EV) production. The U.S., as a major automotive hub, is seeing a surge in EV adoption, fueled by government incentives, expanding infrastructure, and increasing consumer interest in sustainable vehicles. The region also benefits from a robust supply chain, innovation in manufacturing processes, and a shift towards automation in production. This acceleration in manufacturing and growing market demand positions North America as the fastest-growing region in the car manufacturing market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Car Manufacturing Market with their products:

-

Toyota Motor Corporation (Toyota Corolla, Prius, RAV4)

-

Volkswagen Group (Volkswagen Golf, Audi A4, Porsche Cayenne)

-

General Motors (Chevrolet Silverado, Cadillac Escalade, GMC Sierra)

-

Ford Motor Company (Ford F-150, Mustang, Explorer)

-

Tesla Inc. (Model 3, Model Y, Cybertruck)

-

Hyundai Motor Group (Hyundai Tucson, Kia Seltos, Genesis G70)

-

BMW Group (BMW 3 Series, X5, Mini Cooper)

-

Daimler AG (Mercedes-Benz C-Class, GLE, Smart Fortwo)

-

Honda Motor Company (Honda Civic, CR-V, Accord)

-

Stellantis N.V. (Jeep Wrangler, Ram 1500, Peugeot 208)

-

Nissan Motor Corporation (Nissan Rogue, Leaf, Altima)

-

Renault Group (Renault Clio, Captur, Dacia Duster)

-

Suzuki Motor Corporation (Suzuki Swift, Vitara, Jimny)

-

Subaru Corporation (Subaru Outback, Forester, Impreza)

-

Tata Motors (Tata Nexon, Safari, Jaguar F-Type)

-

Geely Holding Group (Volvo XC90, Polestar 2, Lynk & Co 01)

-

BYD Auto (BYD Han EV, Tang EV, Dolphin)

-

Mazda Motor Corporation (Mazda CX-5, Mazda3, MX-5 Miata)

-

Mitsubishi Motors (Mitsubishi Outlander, Pajero Sport, Eclipse Cross)

-

Ferrari N.V. (Ferrari 488, SF90 Stradale, Purosangue)

List of key raw material and component suppliers for the car manufacturing industry:

Raw Material Suppliers:

-

ArcelorMittal (Steel, Aluminum)

-

Nippon Steel Corporation (Steel, Automotive Steel Sheets)

-

China Steel Corporation (Steel, Steel Plates)

-

Alcoa Corporation (Aluminum, Aluminum Products)

-

Rio Tinto Group (Iron Ore, Aluminum, Copper)

-

BASF SE (Chemicals, Plastics, Coatings)

-

Covestro AG (Plastics, Polyurethanes)

-

Sumitomo Chemical Co., Ltd. (Plastics, Chemicals)

-

Saint-Gobain (Glass, Plastics)

-

The Dow Chemical Company (Polymer Materials, Adhesives)

Component Suppliers:

-

Bosch Group (Automotive Components, Sensors, Electrical Systems)

-

Denso Corporation (Automotive Components, Electrical and Thermal Systems)

-

Magna International Inc. (Chassis, Body, Mirrors, Lighting Systems)

-

ZF Friedrichshafen AG (Transmission Systems, Steering, Safety Systems)

-

Continental AG (Tires, Brakes, Sensors, Electronic Components)

-

Aptiv PLC (Automotive Electronics, Wiring Systems)

-

Valeo S.A. (Lighting Systems, Wiper Systems, Thermal Systems)

-

Lear Corporation (Seating, Electrical Components, Interior Systems)

-

Faurecia (Exhaust Systems, Interior Components, Emissions Control)

-

Schaeffler Group (Bearings, Transmission Components, Automotive Parts)

Recent Developments

-

November 26, 2024: BMW has advanced its car manufacturing process with the introduction of Automated Driving In-Plant (AFW) technology. Currently implemented at its Dingolfing plant in Germany, the technology allows vehicles like the 5 Series and 7 Series to drive themselves off the assembly line. This innovative development aims to enhance manufacturing efficiency and precision, marking a significant step in the automotive industry's shift toward automation.

-

manufacturing facility in Tamil Nadu. The state-of-the-art, greenfield plant will produce next-generation vehicles using 100% renewable energy. Tata Motors plans to invest approximately INR 9,000 crores, creating over 5,000 jobs. The plant will have an annual production capacity of 250,000 vehicles, with production ramping up over the next 5-7 years to serve both Indian and global

-

November 21, 2024: Mitsubishi Corporation has invested USD 25 million in Ample, a provider of battery swapping solutions for electric vehicles. The investment aims to accelerate the deployment of sustainable energy solutions and enhance Ample’s technology. CEO Khaled Hassounah expressed excitement about the collaboration, noting Mitsubishi’s expertise will play a crucial role in scaling the company’s infrastructure.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.08 Billion |

| Market Size by 2032 | USD 10.96 Billion |

| CAGR | CAGR of 20.30% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vehicle Type (Passenger car, Commercial vehicles, Electric vehicles (EVs)) • By Fuel Type (Petrol, Diesel, electric/hybrid vehicles) • By Mode of Operation( Automatic, Semi-Automatic) • By material (Steel, Aluminium, Composite) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Toyota, Volkswagen, General Motors, Ford, Tesla, Hyundai, BMW, Daimler, Honda, Stellantis, Nissan, Renault, Suzuki, Subaru, Tata Motors, Geely, BYD, Mazda, Mitsubishi, and Ferrari are key automotive manufacturers producing a range of popular models such as the Toyota Corolla, Volkswagen Golf, Chevrolet Silverado, Ford F-150, Tesla Model 3, Hyundai Tucson, BMW 3 Series, Mercedes-Benz C-Class, Honda Civic, Jeep Wrangler, Nissan Rogue, Renault Clio, Suzuki Swift, Tata Nexon, Polestar 2, BYD Han EV, Mazda CX-5, Mitsubishi Outlander, and Ferrari 488. |

| Key Drivers | • Accelerating the Shift in Car Manufacturing Market Through Carbon Emission Reductions Driving Innovation |

| Restraints | • Barriers to EV Adoption Hindering Widespread Consumer Transition in the Car Manufacturing Market |