Fire Truck Market Report Scope & Overview

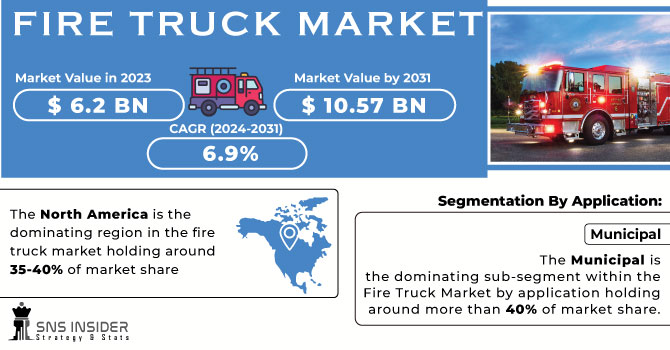

The Fire Truck Market Size was valued at USD 6.2 billion in 2023 and is expected to reach USD 10.57 billion by 2031 and grow at a CAGR of 6.9% over the forecast period 2024-2031.

The fire truck market is poised for growth driven by urbanization, stricter fire safety regulations, and technological advancements. As cities become more crowded, the risk of larger fires increases. This creates a demand for modern fire trucks that can handle these complex situations. Governments around the world are implementing stricter fire codes, mandating features like improved pumping capacities, enhanced ladder capabilities, and advanced firefighting technologies on fire trucks.

Get More Information on Fire Truck Market - Request Sample Report

The integration of aerial ladder platforms with automated deployment systems allows for faster and safer access to higher floors during building fires. The fire trucks are incorporating thermal imaging cameras to help firefighters locate victims and navigate smoke-filled environments. These advancements enhance firefighter safety and firefighting efficiency, leading to increased demand for such equipped trucks.

The high initial cost of fire trucks, particularly those with advanced features, can be a barrier for some fire departments, especially in budget-constrained regions.

MARKET DYNAMICS:

KEY DRIVERS:

-

Stricter fire safety regulations are pushing fire departments to upgrade their trucks with advanced features.

-

The increasing awareness of fire safety is driving demand for better firefighting technology.

-

Advancements in firefighting technology like thermal cameras lead to development of more effective fire trucks.

The fire truck market is undergoing a transformation fueled by advancements in firefighting technology. One key driver is the integration of thermal imaging cameras. These cameras pierce through smoke and darkness, allowing firefighters to see what the human eye cannot. The firefighters can locate victims trapped in smoke-filled buildings more quickly and efficiently. The thermal cameras help pinpoint the hottest areas of the fire, enabling firefighters to target their water streams more precisely. This not only conserves water but also minimizes damage caused by excessive water use. Furthermore, thermal imaging allows firefighters to identify hidden pockets of fire that might otherwise reignite later, preventing flare-ups and ensuring a safer environment for everyone involved. The development and use of these advanced technologies are making fire trucks more effective tools for saving lives and property.

RESTRAINTS:

-

Maintenance costs for complex fire trucks with advanced technology can be a burden for some departments.

Modern fire trucks equipped with complex features like thermal cameras, advanced pumping systems, and computer-aided controls require specialized knowledge and training for technicians to maintain and repair. This can be a burden for smaller departments with limited resources. Not only does it necessitate investment in specialized training programs for their personnel, but it may also require outsourcing maintenance to qualified technicians, adding to the overall operational costs. The sophisticated technology can also lead to the need for more specialized parts and equipment, potentially increasing maintenance costs further.

-

Limited government funding for fire departments in some regions can restrict their ability to invest in the latest fire trucks.

OPPORTUNITIES:

-

Increasing focus on firefighter safety can lead to development of fire trucks with advanced safety features like improved cabin protection and firefighter monitoring systems.

-

Growing demand for specialized fire trucks in areas like electric vehicle fires and natural disasters can open new market segments.

CHALLENGES:

-

The long lifespan of fire trucks due to their durability can slow down adoption of new technologies.

KEY MARKET SEGMENTS:

By Type

-

Rescue Truck

-

Tanker

-

Pumper

-

Multi-Tasking Truck

-

Aerial Ladder

-

ARFF

-

Specialty Vehicles

Pumper is the dominating sub-segment in the Fire Truck Market by type holding around 40-45% of market share. This dominance is driven by their versatility and core firefighting functionality. Pumper trucks carry large water tanks and powerful pumps, allowing them to be the primary fire attack vehicle for most fire departments. Their ability to deliver high volumes of water quickly and efficiently makes them crucial for extinguishing a wide range of fires. While other specialized trucks play important roles, pumper trucks remain the backbone of most firefighting fleets due to their adaptability and essential firefighting capabilities.

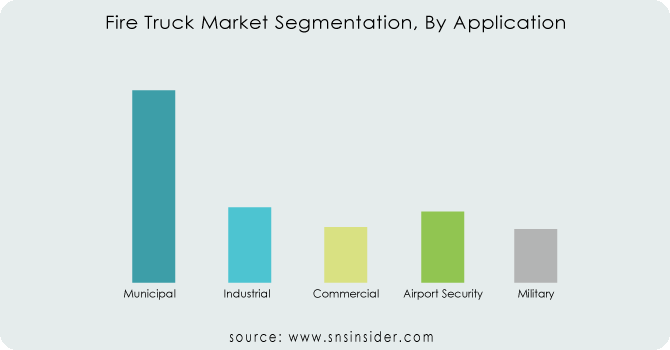

By Application

-

Municipal

-

Industrial

-

Commercial

-

Airport Security

-

Military

The municipal is the dominating sub-segment within the Fire Truck Market by application holding around more than 40% of market share. Municipal fire departments are responsible for protecting the majority of the population and respond to the widest range of fire emergencies. This necessitates a diverse fleet that includes pumper trucks, ladder trucks, rescue vehicles, and other specialized units. The high concentration of people and structures in urban areas creates a constant demand for well-equipped municipal fire departments, driving the dominance of this segment.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL ANALYSES

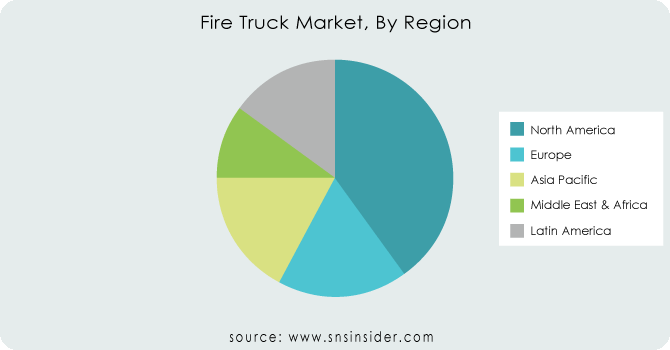

The North America is the dominating region in the fire truck market holding around 35-40% of market share, fueled by the well-funded fire departments and strict fire safety regulations. These regulations mandate advanced features and frequent upgrades, necessitating consistent investment in modern fire trucks.

The Asia-Pacific is the fastest growing region in this market. This surge is driven by rapid urbanization and industrialization, leading to a heightened demand for advanced fire protection. Rising fire safety awareness across Asia is prompting governments to invest in modern fire trucks for improved response times. The presence of cost-competitive Chinese manufacturers makes fire trucks more accessible for regional fire departments, further accelerating market growth in Asia-Pacific.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are Rosenbauer International AG (Austria), Oshkosh Corporation (Japan), Zoomlion Heavy Industry Science & Technology Co., Ltd., (China), Alexis Fire Equipment Company (USA), MORITA Holdings Corporation (Japan), W. S. Darley & Co. (USA), ALBERT ZIEGLER GmbH (Germany), KME Corp. (USA), Spartan Motors (USA), Magirus GmbH (Germany) and other key players.

Oshkosh Corporation (Japan)-Company Financial Analysis

RECENT DEVELOPMENT

In April 2023: E-ONE's new Defender Type III fire truck tackles tough situations. Designed for urban-interface firefighting, it boasts a low battery placement for increased stability during operation, ensuring firefighters can maneuver confidently even in challenging environments.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 6.2 Billion |

| Market Size by 2031 | US$ 10.57 Billion |

| CAGR | CAGR of 6.9% From 2024 to 20231 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Type (Rescue Trucks, Tanker, Pumper, Multi-tasking Trucks) • by Application (Residential & Commercial, Enterprises & Airports, Military) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Rosenbauer International AG (Austria), Oshkosh Corporation (Japan), Zoomlion Heavy Industry Science & Technology Co., Ltd., (China), Alexis Fire Equipment Company (USA), MORITA Holdings Corporation (Japan), W. S. Darley & Co. (USA), ALBERT ZIEGLER GmbH (Germany), KME Corp. (USA), Spartan Motors (USA), and Magirus GmbH (Germany) |

| Key Drivers | • Increased worldwide interest in fire safety. • The market is growing as a result of the. increasing demand for cutting-edge firefighting equipment. |

| RESTRAINTS | • Engine manufacturing's rapid expansion has been slowed by the industry's expensive start-up expenses. • Low replacement rates and a lack of necessary equipment for the development of fire engines. |