Luxury SUV Market Report Scope & Overview:

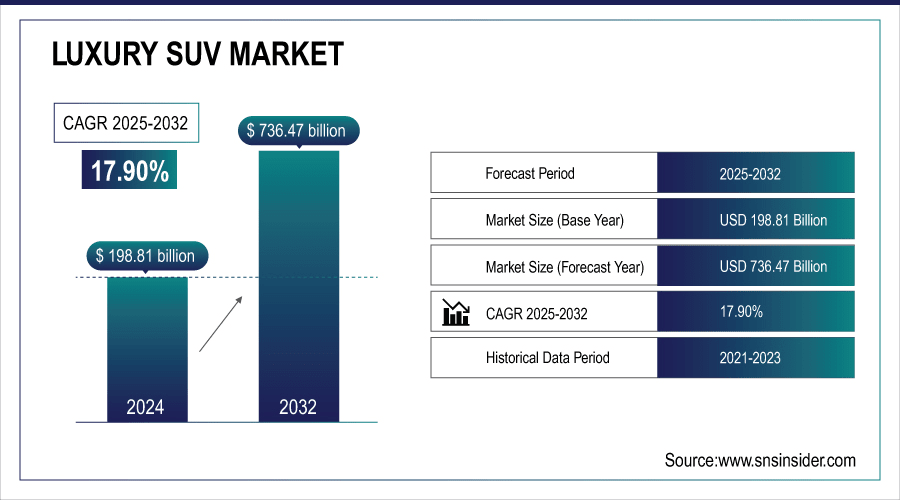

Luxury SUV Market was valued at USD 198.81 billion in 2024 and is expected to reach USD 736.47 billion by 2032, growing at a CAGR of 17.90% from 2025-2032.

The Luxury SUV Market is experiencing strong growth driven by rising consumer demand for premium vehicles with advanced comfort, safety, and technology features. Increasing disposable incomes, urbanization, and lifestyle changes are boosting preference for luxury SUVs over sedans. Additionally, the introduction of hybrid and electric models, along with innovations in connectivity and autonomous driving, enhances market appeal. Expanding dealership networks and strong brand positioning further contribute to sustained market expansion globally.

In 2023, Mercedes-Benz sold 2,493,000 vehicles, with a significant portion attributed to top-end models like the G-Class and Mercedes-Maybach. The G-Class alone saw an 11% increase in sales, reflecting strong consumer demand for luxury SUVs.

Moreover, in the second quarter of 2024, luxury electric vehicles accounted for 32.8% of total luxury vehicle sales in the U.S., highlighting a significant shift towards electrification in the luxury SUV segment.

To Get More Information On Luxury SUV Market - Request Free Sample Report

Luxury SUV Market Trends

-

Rising consumer preference for premium vehicles with comfort, safety, and advanced features is driving luxury SUV demand.

-

Integration of cutting-edge technologies, including AI, connectivity, and autonomous features, is enhancing user experience.

-

Growing popularity of hybrid and electric luxury SUVs is shaping sustainability-focused market growth.

-

Expansion of high-net-worth individuals and urban elite populations is fueling adoption globally.

-

Emphasis on superior interiors, customization, and performance is boosting brand competitiveness.

-

Strong demand in both established and emerging markets is encouraging OEMs to expand product portfolios.

-

Collaborations between automakers and tech companies are accelerating innovation in design and infotainment systems.

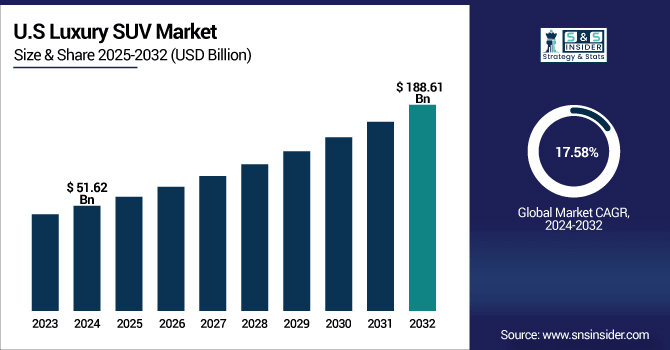

U.S. Luxury SUV Market was valued at USD 51.62 billion in 2024 and is expected to reach USD 188.61 billion by 2032, growing at a CAGR of 17.58% from 2025-2032.

The U.S. Luxury SUV Market growth is fueled by rising consumer preference for spacious, technology-rich vehicles, increasing adoption of hybrid and electric SUVs, higher disposable incomes, and strong brand-driven demand supported by advanced safety, connectivity, and autonomous driving innovations.

Luxury SUV Market Growth Drivers:

-

Growing demand for premium comfort, advanced features, and high-performance vehicles boosts adoption of luxury SUVs across global markets

Rising consumer preference for vehicles that combine premium comfort, innovative safety technologies, and powerful performance engines is fueling luxury SUV demand worldwide. High-net-worth individuals and upper-middle-class buyers are increasingly drawn to vehicles offering advanced infotainment, superior cabin quality, and customizable luxury features. Global brands are expanding product portfolios with hybrid and electric luxury SUVs to meet evolving preferences. The combination of aspirational lifestyles, rising disposable income, and urbanization enhances the appeal of luxury SUVs. Strong marketing, brand positioning, and technological differentiation further accelerate consumer willingness to invest in premium mobility solutions, making luxury SUVs a global growth driver.

-

In June 2025, Toyota Motor North America reported sales of 193,248 vehicles, with 46.8% of total sales volume being electrified vehicles, including hybrids, plug-in hybrids, and pure electrics.

-

In 2024, the BMW Group delivered 426,594 fully-electric vehicles, achieving a BEV sales growth of +13.5%, driven by strong demand for models like the BMW iX and iX3.

-

Porsche Cars North America also recorded a milestone, delivering 76,167 vehicles in 2024, setting a new retail sales record fueled by models such as the Porsche 911, Panamera, Taycan, and Macan.

-

Meanwhile, Audi is rejuvenating its portfolio with more than 20 new electric and combustion models planned for 2024 and 2025, including the upcoming Audi Q6 e-tron, reflecting the brand’s commitment to innovation and sustainability.

Luxury SUV Market Restraints:

-

Environmental concerns and stricter emission regulations challenge growth of fuel-intensive luxury SUV models globally

Growing awareness of climate change and government emphasis on reducing emissions pose challenges for traditional fuel-powered luxury SUVs. Many luxury SUV models rely on large engines with high fuel consumption, conflicting with environmental sustainability goals. Regulatory authorities in key markets such as Europe, North America, and China are imposing stricter emission norms, increasing compliance costs for automakers. Consumer preference is gradually shifting toward greener alternatives, pressuring manufacturers to accelerate electric and hybrid luxury SUV offerings. While sustainability trends foster innovation, reliance on conventional combustion-engine SUVs creates reputational and regulatory risks, restraining long-term growth of the segment.

Luxury SUV Market Opportunities:

-

Rising demand for electric and hybrid luxury SUVs creates expansion opportunities for eco-friendly premium mobility solutions

Global environmental consciousness and stricter regulations are driving demand for electric and hybrid alternatives in the luxury SUV market. Consumers with high purchasing power are increasingly seeking eco-friendly mobility options that do not compromise on luxury, comfort, or performance. Automakers are investing heavily in electrification, battery technology, and charging infrastructure to capture this shift. Luxury electric SUVs combine sustainable engineering with premium features, appealing to a growing base of environmentally aware buyers. Strategic partnerships with energy firms and governments further strengthen ecosystem development, unlocking growth potential for brands that innovate in luxury electric mobility solutions.

| Brand/Model | Details |

|---|---|

|

Lexus RX Hybrid (2025) |

Offers an efficient plug-in electric hybrid powertrain, combining thoughtful cabin appointments with advanced technology. |

|

Lincoln Nautilus Hybrid (2025) |

Available with hybrid powertrains on all models, featuring an immersive panoramic display and Lincoln BlueCruise for hands-free highway driving. |

|

Lamborghini Urus SE Plug-in Hybrid |

Priced at $258,000, offers a 37-mile electric range and aims to reduce emissions by 80% compared to standard models. |

|

Volvo EX90 Production |

Started production of the fully electric EX90 SUV in Charleston, SC, with a capacity to build up to 150,000 cars per year, reflecting commitment to sustainable mobility. |

|

Jaguar's Electric Future |

Transitioning to an all-electric luxury brand, ceasing production of petrol models like E-Pace and I-Pace by Dec 2024, focusing on new all-electric models starting in 2025. |

Luxury SUV Market Segment Highlights

-

By Vehicle Size, Full-size dominated with ~42% share in 2024; Gravel Compact fastest growing (CAGR).

-

By Fuel Type, Gasoline dominated with ~55% share in 2024; Hybrid/Electric fastest growing (CAGR).

-

By Price Range, USD 60K–90K dominated with ~35% share in 2024; Over USD 120K fastest growing (CAGR).

-

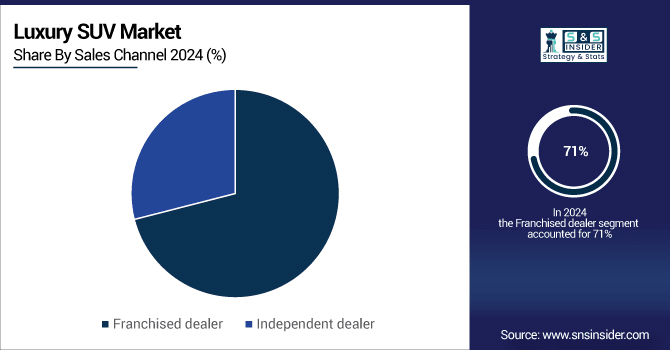

By Sales Channel, Franchised Dealer dominated with ~71% share in 2024; Independent Dealer fastest growing (CAGR).

Luxury SUV Market Segment Analysis

By Sales Channel, Franchised Dealers led in 2024, while Independent Dealers are expected to grow fastest from 2025–2032.

Franchised Dealer segment dominated the Luxury SUV Market in 2024 due to the trust, after-sales service, financing options, and strong brand-backed infrastructure they provide. Customers purchasing high-value vehicles prefer reliable, authorized dealerships that ensure warranty support, certified technicians, and an overall premium buying experience aligned with luxury brand standards.

Independent Dealer segment is expected to grow at the fastest CAGR from 2025–2032 as buyers seek cost advantages, wider availability of pre-owned luxury SUVs, and flexible negotiation options. Expanding networks of independent dealers offering attractive financing and diversified inventory are drawing more customers, particularly in secondary and emerging urban markets.

By Type, Full-size SUVs dominated in 2024, while Compact SUVs are expected to grow fastest from 2025–2032.

Full-size segment dominated the Luxury SUV Market in 2024 due to strong consumer preference for spacious interiors, advanced features, and enhanced driving comfort. These vehicles cater to families and premium buyers seeking luxury combined with utility, towing capacity, and superior road presence, making them the most sought-after choice.

Compact segment is expected to grow at the fastest CAGR from 2025–2032, driven by increasing urbanization, demand for affordable luxury, and the need for maneuverability in crowded cities. Automakers are offering compact SUVs with advanced technology, premium interiors, and efficient powertrains, appealing to younger demographics and first-time luxury vehicle buyers.

By Fuel, Gasoline-powered SUVs led in 2024, whereas Hybrid/Electric SUVs are projected to grow fastest due to sustainability and regulatory support.

Gasoline segment dominated the Luxury SUV Market in 2024 due to widespread infrastructure availability, lower initial costs compared to hybrids or electrics, and established consumer familiarity. Many luxury automakers still prioritize gasoline-powered models with high-performance engines, ensuring strong demand among traditional buyers seeking reliability and long-range convenience.

Hybrid/Electric segment is expected to grow at the fastest CAGR from 2025–2032, fueled by rising environmental awareness, stricter emission regulations, and government incentives. Luxury brands are launching electric SUVs with advanced range, fast-charging technology, and cutting-edge features, attracting eco-conscious customers seeking sustainable mobility without compromising on performance or comfort.

By Car Price, USD 60K–90K range dominated in 2024, while Over USD 120K segment is expected to grow fastest driven by ultra-luxury demand.

USD 60K–90K segment dominated the Luxury SUV Market in 2024 as it balances affordability with premium features. Consumers in this range gain access to advanced technology, safety, and comfort without entering ultra-luxury pricing, making it the most attractive option for upper-middle-class buyers seeking both status and practicality.

Over USD 120K segment is expected to grow at the fastest CAGR from 2025–2032, supported by increasing demand for ultra-luxury vehicles offering exclusivity, bespoke designs, and advanced technology. Rising high-net-worth individuals and strong brand loyalty drive sales in this price range, where consumers prioritize prestige, innovation, and superior craftsmanship.

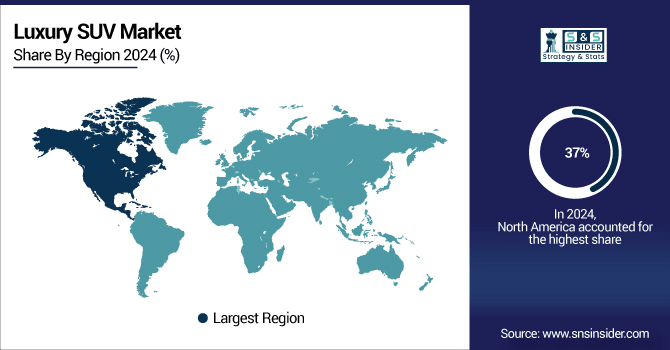

Luxury SUV Market Regional Analysis

North America Luxury SUV Market Insights

North America dominated the Luxury SUV Market in 2024, holding a revenue share of 37%, due to high consumer purchasing power, well-established automotive infrastructure, and strong brand presence of premium automakers. The region’s preference for spacious, technologically advanced, and high-performance SUVs, coupled with widespread dealership networks and financing options, contributed to sustained demand. Consumer inclination toward luxury, safety, and comfort features further reinforced North America’s dominance.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific Luxury SUV Market Insights

Asia Pacific is expected to grow at the fastest CAGR from 2025–2032, driven by rising disposable incomes, urbanization, and increasing adoption of premium vehicles. Growing awareness of luxury lifestyles, expanding dealership networks, and government incentives for vehicle ownership support market expansion. Additionally, rising interest in hybrid and electric luxury SUVs among younger, tech-savvy consumers is boosting demand, making Asia Pacific the fastest-growing region.

Europe Luxury SUV Market Insights

Europe accounted for a significant share in the Luxury SUV Market in 2024, supported by strong demand for premium vehicles with advanced safety, performance, and emission-compliant technologies. High consumer preference for luxury brands, growing adoption of hybrid and electric SUVs, and well-established automotive infrastructure contribute to market strength. Additionally, government incentives for low-emission vehicles and increasing urban affluence are driving sustained growth in the European luxury SUV segment.

Middle East & Africa and Latin America Luxury SUV Market Insights

The Middle East & Africa region contributed to the Luxury SUV Market in 2024 due to high demand for premium, high-performance SUVs, rising disposable incomes, and preference for luxury lifestyles. Similarly, Latin America witnessed steady growth driven by increasing urbanization, improving economic conditions, and growing interest in technologically advanced and comfortable vehicles. Expanding dealership networks and brand presence further support market adoption in both regions, enhancing overall luxury SUV sales.

Luxury SUV Market Competitive Landscape:

Bentley Motors

Bentley Motors holds a prominent position in the Luxury SUV Market, offering high-end, performance-focused SUVs that combine luxury, craftsmanship, and advanced technology. Its models, such as the Bentayga, attract affluent buyers seeking exclusivity, powerful engines, and bespoke customization options. Strong brand reputation, limited production, and a focus on premium features and comfort drive Bentley’s demand and revenue within the luxury SUV segment globally.

2025

-

Bentley unveiled the Bentayga Speed, their most powerful and dynamic SUV to date, powered by a twin-turbo V8 delivering 650 PS and featuring a performance-tuned chassis with on-throttle slip angle capability.

-

The Bentayga Atelier Edition launched with exclusive Mulliner legacy colors and refined interior details. Available on V8, Hybrid, and Extended Wheelbase variants, it combines traditional elegance with modern luxury.

Genesis

Genesis holds a growing presence in the Luxury SUV Market, focusing on combining advanced technology, modern design, and premium comfort at competitive pricing. Its SUVs cater to affluent buyers seeking high-quality interiors, innovative features, and performance-driven vehicles. Genesis’s emphasis on electric mobility and luxury-oriented experiences positions the brand as a strong contender in the expanding luxury SUV segment globally.

2025

-

The upcoming all-electric GV90 EV was spotted testing with rolling (coach) doors and a grand scale an ultra-luxury SUV aimed at competing with Rolls-Royce-level exclusivity.

-

The GV70 EV introduced a spa-like cabin for recharge sessions featuring massaging seats, ambient lights, fragrances, a 27-inch OLED screen, and a "mood curator" mode offering refined luxury comfort.

Key Players

Some of the Luxury SUV Market Companies

-

Acura (Honda Motor Co.)

-

Alfa Romeo Automobiles S.p.A.

-

Audi AG

-

Bentley Motors Limited

-

BMW Group

-

Cadillac (General Motors)

-

Ferrari N.V.

-

Genesis Motor (Hyundai Motor Company)

-

Infiniti (Nissan Motor Co.)

-

Jaguar Land Rover Automotive PLC

-

Lamborghini S.p.A.

-

Land Rover (Jaguar Land Rover)

-

Lexus (Toyota Motor Corporation)

-

Lincoln (Ford Motor Company)

-

Maserati S.p.A.

-

Mercedes-Benz Group AG

-

Porsche AG

-

Rolls-Royce Motor Cars

-

Tesla, Inc.

-

Volvo Cars

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 198.81 Billion |

| Market Size by 2032 | USD 73.47 Billion |

| CAGR | CAGR of 17.90% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type(Full-size, Compact, Mid-size) • By Fuel(Gasoline, Diesel, Hybrid/Electric) • By Car Price(USD 30K-60K, USD 60K-90K, USD 90K-120K, Over USD 120K) • By Sales Channel(Franchised Dealer, Independent Dealer) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Acura (Honda Motor Co.), Alfa Romeo Automobiles S.p.A., Audi AG, Bentley Motors Limited, BMW Group, Cadillac (General Motors), Ferrari N.V., Genesis Motor (Hyundai Motor Company), Infiniti (Nissan Motor Co.), Jaguar Land Rover Automotive PLC, Lamborghini S.p.A., Land Rover (Jaguar Land Rover), Lexus (Toyota Motor Corporation), Lincoln (Ford Motor Company), Maserati S.p.A., Mercedes-Benz Group AG, Porsche AG, Rolls-Royce Motor Cars, Tesla, Inc., Volvo Cars |