Automotive Insurance Market Report Scope & Overview:

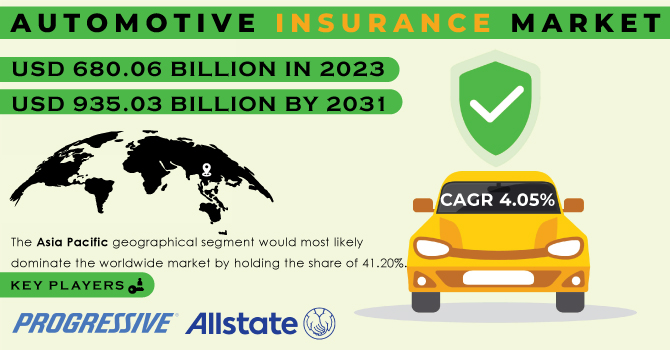

The Automotive Insurance Market size was valued at USD 680.06 billion in 2023 and is expected to reach USD 935.03 billion by 2031 and grow at a CAGR of 4.05% over the forecast period 2024-2031.

The automotive insurance sector is poised to undergo a data-centric revolution, with a shift towards personalized pricing models expected to drive demand. Telematics, utilizing in-vehicle sensors to monitor driving behavior, will be instrumental in this transformation. SNS Insider research indicates that by 2026, more than one-third of global insurers will have invested in telematics. This enables insurers to introduce Pay-How-You-Drive (PHYD) options, incentivizing safe driving habits with reduced premiums.

Get More Information on Automotive Insurance Market - Request Sample Report

Governments are also stepping in; for instance, China initiated a PHYD insurance pilot program in 2020, hinting at potential future regulations that could boost demand for usage-based policies. Nonetheless, challenges persist, particularly regarding privacy concerns regarding data collection and the possibility of discriminating against high-risk drivers. In sum, the automotive insurance market is poised for significant transformation, driven by innovative technologies, evolving regulations, and a heightened emphasis on pricing that accurately reflects risk.

MARKET DYNAMICS:

KEY DRIVERS:

-

An increase in the general public's understanding of the importance of automobile insurance

-

The use of innovative technology in automobile insurance goods

-

The presence of insurance solution suppliers other than the company itself.

Insurance solution suppliers beyond the company itself refer to third-party providers offering various insurance-related products or services. These may include brokers, reinsurers, technology platforms, and consultants. They contribute to diversifying options, enhancing competitiveness, and providing specialized expertise in the insurance industry ecosystem.

RESTRAINTS:

-

Financial constraints are one of the most significant impediments to using cutting-edge technology

-

The incapacity of market participants to adjust to the changing market environment

OPPORTUNITIES:

-

Possibilities presented by the rapid growth of on-demand transportation

-

The transfer of responsibility to manufacturers

-

The introduction and integration of self-driving technology have improved automotive safety

-

There has been an increase in asset utilization and a shift in the ownership patterns of automobiles.

In recent years, there has been a notable rise in asset utilization in the automotive sector, driven by the growing popularity of car-sharing services and ride-hailing platforms. This trend signifies a significant shift in ownership patterns, with more individuals opting for access over ownership, contributing to a more sustainable and efficient transportation model.

CHALLENGES:

-

The changing nature of the sector is one of the biggest challenges

-

Autonomous technologies and changing regulations are transforming the market. Unpredictability rises

IMPACT OF RUSSIA-UKRAINE WAR:

The Russia-Ukraine crisis has intricately influenced the automotive insurance market, particularly within specialized sectors such as aviation, marine, and political risk insurance. In the general insurance market, while some insurers have reported claims related to the conflict, they do not foresee a surge akin to the Covid pandemic. Typically, war-related damages are excluded from policies, mitigating exposure. Aviation insurance faces potential hardening, exacerbating the industry's struggle to rebound from the pandemic. International coverage for satellite launches, particularly for Russian-built satellites and launch sites, has been impacted by sanctions. Marine insurance has seen damage to hulls, ports, and cargo, particularly in Ukrainian ports, affecting insurance claims.

Disruptions to global supply chains, both from hostilities and sanctions, could further strain the industry, leading to increases in hull and cargo war rates by 21%. Energy insurance has experienced immediate impacts due to sanctions on Russian oil and efforts to reduce reliance on Russian energy, potentially leading to higher energy prices and an accelerated shift to renewable energy sources. Claims for Russian and Ukrainian trade credit and political risk insurance have emerged, underscoring the increased volatility in geopolitics and driving demand for such insurance policies. Sanctions and trade controls have led companies to reassess supply chains, shifting from "just in time" to "just in case" risk management, thereby influencing insurance needs and considerations.

IMPACT OF ECONOMIC SLOWDOWN:

Inflation, a consequence of economic downturns, significantly impacts claims costs, particularly post-pandemic. Rising inflation, especially in construction materials, auto parts, rental cars, and medical and legal services, escalates claim prices faster than overall inflation. This strains both insurance carriers and customers. Despite economic challenges, the insurance industry is expected to grow, albeit at a slower pace. Property and auto insurance sectors may experience initial impacts due to sluggish economic growth and high inflation. It's vital to distinguish between nominal and real growth, as commercial insurance hardening rates might yield nominally positive growth rates that mask slower real growth rates affected by inflation.

Increasing interest rates may promise better investment returns for insurers, offering a buffer against economic uncertainties, particularly during high inflation and slower growth periods. During recessions, maintaining or enhancing marketing efforts is advisable for insurance carriers and agencies, as cutting back may exacerbate recessionary impacts. Being responsive to client needs, especially in less resilient industries, and understanding how recessionary conditions intersect with other challenges they face, are critical strategies for navigating economic slowdowns. Overall, while the global economic slowdown presents challenges to the automotive insurance market, strategic planning, market dynamics comprehension, and customer relationship maintenance can help steer through uncertain times.

Market, By Insurance Type:

An examination of the automotive insurance market through segmentation by insurance type highlights a constantly evolving landscape. In many regions, Third-party liability insurance, often mandatory, commands the largest market share, surpassing 50% in certain areas. Following closely is Comprehensive coverage, which provides protection for both the insured vehicle and third-party damages. Third-party theft and fire insurance cater to distinct needs and capture a smaller yet notable portion of the market. Lastly, the category labeled as "Others" encompasses specialized offerings such as personal accident cover or roadside assistance, which hold varying but increasingly significant market shares. This segmented analysis equips insurers with valuable insights to customize products and target specific demographics.

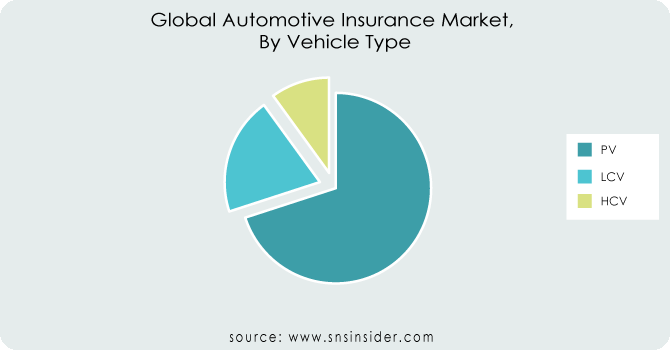

Market, By Vehicle Type:

Segmenting the automotive insurance market based on vehicle type reveals distinct categories with differing risk profiles and premium contributions. Passenger cars, which constitute the majority in terms of quantity, typically dominate with a market share of 60-70%, primarily due to their prevalence. Light Commercial Vehicles (LCVs), such as vans and pickups, may contribute around 15-20% due to their commercial usage and potentially elevated repair expenses.

Heavy Commercial Vehicles (HCVs), including trucks and buses, likely occupy the smallest portion, around 10-15%, despite the potential for larger claims owing to their size and operational purposes. This segmentation enables insurers to customize policies and pricing to suit the specific risks associated with each vehicle type.

MARKET SEGMENTATION:

By Insurance Type:

-

Third-party

-

Comprehensive

-

Third-party theft and Fire

-

Others

By Vehicle Type:

-

Passenger cars

-

LCV

-

HCV

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL ANALYSIS:

The worldwide market is divisible into a variety of geographical submarkets, including the Americas, Europe, the Asia Pacific, the Middle East, and Africa, as well as the rest of the world. The Asia Pacific geographical segment would most likely dominate the worldwide market by holding the share of 41.20% and have a significant influence on the growth of the automobile insurance market over the time that is anticipated. There are a large number of insurance providers and third-party insurance providers in the region, as well as numerous insurance providers in the region, which are some of the primary reasons for the solid performance of the particular regional segment. The sales of automobiles in Asian countries like India and China have increased substantially in recent years. During the time period that is being prophesied, it is also anticipated that both the Middle East and Africa, as well as South America, would display excellent performance. The rise in the number of automobiles on the road has the potential to be a significant element that might bolster the contribution of this market segment at the international level.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS:

Allstate Insurance Company, RAC Motoring Services, Progressive Casualty Insurance Company, Zhongshan Insurance, CPIC, ABIC Inc., Zurich Insurance Group, RSA Insurance Group, and Clements Worldwide are some of the major players in the Automotive Insurance Market.

RECENT DEVELOPMENTS:

-

Usage-Based Insurance (UBI) was pioneered by companies such as Progressive Corporation, Allstate, and State Farm, which introduced programs assessing premiums based on driving behavior and vehicle usage, monitored through telematics devices installed in vehicles.

-

Online insurance platforms saw significant expansion with companies like GEICO (owned by Berkshire Hathaway), Esurance (acquired by Allstate), and Liberty Mutual, offering customers easy access to purchase policies, file claims, and manage accounts digitally.

-

Partnerships between insurers like MetLife and Farmers Insurance with ride-sharing companies such as Uber and Lyft resulted in specialized insurance products tailored for drivers in the gig economy. Integration of Artificial Intelligence (AI) and data analytics became increasingly prevalent among insurers like AXA, Zurich Insurance Group, and Generali, enhancing underwriting processes, risk assessment accuracy, and personalization of insurance offerings.

Allstate Insurance Company-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 680.06 Billion |

| Market Size by 2031 | US$ 935.03 Billion |

| CAGR | CAGR of 4.05% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Insurance Type (Third-party, Comprehensive, Third-party theft and Fire, Others) • by Vehicle Type (Passenger cars, LCV, HCV) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Allstate Insurance Company, RAC Motoring Services, Progressive Casualty Insurance Company, Zhongshan Insurance, CPIC, ABIC Inc., Zurich Insurance Group, RSA Insurance Group, and Clements Worldwide |

| Key Drivers | •An increase in the general public's understanding of the importance of automobile insurance. •The use of innovative technology in automobile insurance goods. |

| RESTRAINTS | •An increase in the general public's understanding of the importance of automobile insurance. •The use of innovative technology in automobile insurance goods. |