Motor Grader Market Report Scope & Overview:

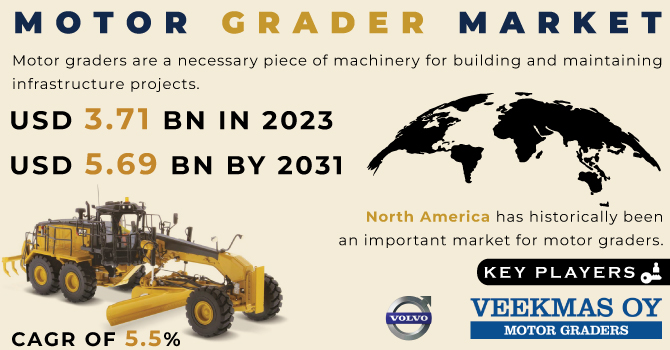

The Motor Grader Market size was valued at USD 3.71 Bn in 2023 and is expected to reach USD 5.69 Bn by 2031, with a CAGR of 5.5% over the forecast period of 2024-2031.

Motor graders are a necessary piece of machinery for building and maintaining infrastructure projects. Here are some essential characteristics and applications for motor graders, The most noticeable aspect of a motor grader is often found between the front and rear axles. To shape and spread materials like soil, gravel, or asphalt, the blade can be raised, lowered, tilted, and rotated. Depending on the model and use, motor graders may have wheels or tracks. For road construction and maintenance, wheeled graders are increasingly prevalent. The operator has a good view of the blade and the surrounding work area while seated in a climate-controlled cab. Many motor graders may bend or pivot in the middle, which increases agility and allows for smaller turning radiuses.

Get More Information on Motor Grader Market - Request Sample Report

Before grading, hard or compacted soil or rock is broken up using a ripper attachment, which some graders have as standard equipment. The grader can carve a crown (a slight slope) into the road surface to aid in water drainage by angling the blade to the left or right. Motor graders are made specifically for precision grading duties, providing level and smooth road surfaces. The longevity of the road and the safety of the roads depend on this.

Market Dynamics

Driver

The rise in demand for motor grader.

Many regions of the world are experiencing rapid urbanization as people move from rural areas to cities in quest of better prospects. New urban services, housing, and infrastructure are required as a result of this trend. Growing economies frequently result in a rise in construction activity. To enable trade and commerce, developing economies make investments in infrastructure projects like building public buildings, bridges, and highways. Governments and commercial organizations invest in infrastructure projects to enhance public services, utilities, and transportation. Highways, railroads, airports, and ports are just a few examples of large-scale projects that significantly contribute to the construction industry. Real estate development is a key factor in driving the construction industry. This sector includes residential, commercial, and industrial development. New homes are built by real estate developers in response to market demand.

Restrain

The government regulatory norms.

Opportunity

The rise in technological advancement.

The Global Navigation Satellite System (GNSS) and Global Positioning System (GPS) are both technologies that are included into many contemporary motor graders. These systems give users access to high-precision location data in real time, enabling precise slope control and grading. Automated grading is made possible using GPS and GNSS, which eliminates the need for manual adjustments. Motor graders have cutting-edge machine control systems that automatically adjust the blade's position and angle using GPS data and sensors. This improves grading accuracy and lessens operator fatigue. Software solutions for grade control enable operators to create and preserve grading profiles, which can then be put onto the control system of the grader. This ensures consistency between passes, which speeds the grading process.

Challenge

The high cost of the motor grader and the high maintenance cost associated with it.

Impact of Recession

As construction activity slows, equipment rental companies may see a drop in demand for motor graders. This may result in rental firms charging lower rents and making less money. As sales of motor graders drop, manufacturers and dealerships may experience financial stress. This may result in job losses, decreased output, or possibly the liquidation of some businesses in the sector. With less demand for new equipment, manufacturers can decrease their prices to attract customers, which could affect their profit margins. During a recession, suppliers of parts and components for motor graders may experience reduced business and financial difficulty.

Impact of Russia Ukraine War:

During geopolitical crises, currency rates can be very erratic. The competitiveness of motor grader producers in international markets may be impacted by fluctuations in exchange rates. Political disputes may engender economic ambiguity, which may result in a decline in investments in building and infrastructure initiatives. This could lead to a decline in the need for motor graders. Regional variations in the effects on the motor grader market are possible. For instance, the building industry and equipment sales may see a more severe and quick decline in the areas directly affected by the conflict.

The capacity of the motor grader business to operate in specific markets may be impacted by changes in government policies and regulations, including export controls and penalties.

Market Segmentation

By Product Type

-

Rigid frame

-

Articulated Frame

By Capacity

-

Small Motor Graders

-

Medium Motor Graders

-

High Motor Graders

By Application

-

Infrastructure

-

Construction

-

Minning

-

Oil

-

Others

Regional Coverage

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

- Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

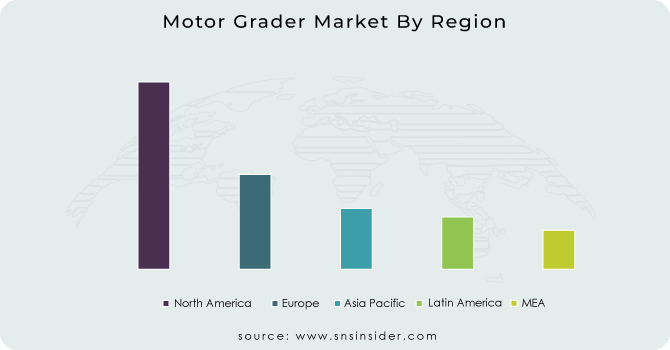

Regional Analysis:

North America is the region which will be having the highest share in terms of revenue because due to its enormous infrastructure development projects and road maintenance activities, North America has historically been an important market for motor graders. Depending on governmental spending and prevailing economic conditions, market size can change from year to year. The annual production of several thousand motor graders is usual for the North American market. Investment in infrastructure projects, such as the building and upkeep of roads, is a significant driver. Large budgets are frequently allotted for these initiatives by the federal and state governments. The need for better transportation infrastructure in cities and suburbs is increasing as North America's population continues to move into urban areas. The necessity to replace outdated motor graders in public and private fleets helps keep sales stable. GPS and automation advancements in motor grader technology.

APAC is the region which will be having the highest CAGR growth rate because of increased use of automation, GPS, and telematics for accurate and effective grading processes. The development of electric or hybrid motor graders may be influenced by growing interest in ecologically friendly construction. Motor grader equipment rental is growing in APAC as construction firms look for flexibility and cost-cutting measures. In order to better serve individual consumer needs and take into account various geographical requirements, manufacturers are providing more customisation possibilities. Large-scale infrastructure projects in the APAC region, such as those involving airports, cities, and roads, are well-known. The need for motor graders is fuelled by this. Increasing investments in transportation infrastructure as a result of the swift urbanization of nations like China and India have boosted the motor grader market. The need for motor graders for haul road maintenance within mining operations is influenced by the mining industry in nations like Australia.

Land preparation and levelling with motor graders are common practices in various APAC nations. Similar to other regions, the motor grader market is growing as a result of technological advancements including automation and GPS.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key players

The major key players are Veekmas Oy, AB Volvo, Leeboy, Caterpillar Inc, Calder brothers Corporation, John Deere, CNH Industrial, Sany Group, Guangxi Liugong machinery, Komatsu and others.

Caterpillar Inc-Company Financial Analysis

Recent Developments

Veekmas: The company has new dealer for RG Motor graders in Norway.

Komatsu: The company has officially introduced a new product @ GD655-7 motor grader.

| Report Attributes | Details |

| Market Size in 2023 | US$ 3.71 Bn |

| Market Size by 2031 | US$ 5.69 Bn |

| CAGR | CAGR of 5.5% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Product Type (Rigid frame, Articulated Frame), • by Capacity (Small Motor Graders, Medium Motor Graders, High Motor Graders), • by Application (Infrastructure, Construction, Minning, Oil, Others), |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Veekmas Oy, AB Volvo, Leeboy, Caterpillar Inc, Calder brothers Corporation, John Deere, CNH Industrial, Sany Group, Guangxi Liugong machinery, Komatsu |

| Key Drivers | The rise in demand for motor grader. |

| Market Restraints | The rise in technological advancement. |