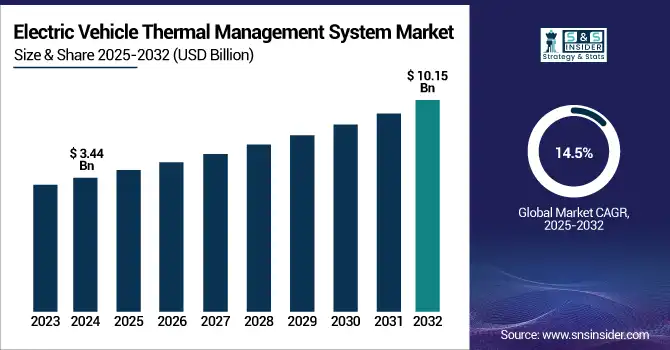

Electric Vehicle Thermal Management System Market Size:

The Electric Vehicle Thermal Management System Market was valued at USD 3.44 billion in 2024 and is expected to reach USD 10.15 billion by 2032, growing at a CAGR of 14.5% from 2025-2032.

During the electrochemical activities that are taking place in the cells of an electric vehicle's battery pack, a battery thermal management system, abbreviated as BTMS, is utilized to keep the battery pack at the ideal average temperature. A decrease in performance, a reduction in the battery's life span, and an increased risk of explosion can all result from an overheated battery. As a result, a thermal management system for batteries is required for each and every module that contains batteries. The primary objective of a thermal management system for a battery is to extend the useful life of the battery by controlling the temperature of the individual battery cells. It is anticipated that the battery heat management system will make it possible for the pack to function properly in a wide variety of climatic conditions and with a supply of ventilation.

Get More Information on Electric Vehicle Thermal Management System Market - Request Sample Report

In addition, the management of thermal energy in electric vehicles makes it possible to not only increase the power of the batteries and their lifespan but also to decrease the dimensions of the electric engines. Therefore, the temperature is the most important characteristic that must be maintained at a consistent level in a battery. Therefore, it is essential for electric vehicles to make use of a system that can manage the temperature of the battery.

MARKET DYNAMICS:

Drivers

-

Rising demand for enhanced battery efficiency and range optimization is boosting the need for robust EV thermal management solutions globally.

Thermal management systems are essential to maintaining ideal battery temperatures, directly influencing electric vehicle performance, safety, and battery lifespan. As EV adoption increases, the need to prevent overheating or undercooling of battery packs has intensified, especially in extreme climates. Improved battery efficiency translates to better range and energy utilization, aligning with consumer expectations. Automakers are increasingly investing in advanced thermal technologies—like liquid cooling and phase change materials—to address these requirements. These innovations ensure vehicle longevity, charging speed, and occupant comfort, driving strong market demand across passenger and commercial electric vehicle segments.

-

Increasing government regulations and incentives toward electric mobility are accelerating the integration of efficient thermal management systems in EVs.

Governments worldwide are introducing stringent emission norms and offering financial incentives to promote electric vehicle adoption. Regulatory bodies mandate performance and safety standards, including temperature thresholds for batteries and power electronics, making thermal management systems indispensable. Subsidies on EVs and infrastructure development are pushing automakers to scale up production, indirectly driving thermal system demand. In parallel, public-private collaborations are fueling R&D in lightweight, compact, and energy-efficient thermal technologies. This policy-driven momentum ensures consistent investment in the EV ecosystem, making effective thermal management a strategic imperative to comply with regulations and improve vehicle acceptance globally.

Restraints

-

Limited availability of advanced thermal materials and supply chain constraints can delay system manufacturing and affect deployment timelines in key regions.

Sourcing high-performance materials like graphite, phase change materials, or specialized polymers remains a challenge due to limited suppliers and geopolitical disruptions. These materials are crucial for designing components that handle rapid heat flux and long-term thermal stability. Supply shortages or price fluctuations can disrupt manufacturing schedules and escalate costs. Moreover, dependency on specific regions for rare materials, such as China for graphite, introduces risks of bottlenecks or export restrictions. OEMs may face delays in vehicle rollout due to thermal subsystem unavailability, ultimately affecting EV adoption. Resilient and diversified supply chains are currently lacking, restraining overall market growth.

Opportunities

-

Integration of AI and IoT in EV thermal systems is unlocking new possibilities for real-time monitoring, efficiency, and predictive maintenance.

Advanced technologies like artificial intelligence and Internet of Things (IoT) are transforming traditional thermal management systems into intelligent, adaptive ecosystems. AI-driven analytics can monitor temperature fluctuations in real time, optimize energy flow, and predict thermal failures before they occur. IoT sensors provide continuous data on vehicle performance, enhancing diagnostics and ensuring proactive system adjustments. Automakers are leveraging these tools to offer smarter, connected EVs that improve user experience and battery life. As digitization gains ground in the automotive industry, these innovations create a high-growth opportunity for thermal management providers to offer premium, differentiated solutions.

Challenges

-

Designing compact, lightweight thermal systems without compromising performance remains a core engineering challenge for electric vehicle manufacturers.

Electric vehicles have limited space due to battery placement, demanding thermal systems that are both compact and high-performing. Reducing weight is equally important to preserve range and energy efficiency. Engineers must balance these constraints while ensuring consistent heat dissipation across powertrain components. Traditional thermal designs often require bulky radiators or cooling loops that do not align with EV architecture. This necessitates the development of innovative, space-saving materials and system layouts. Achieving thermal uniformity across various modules without increasing system complexity is a persistent design challenge that slows product development and requires significant cross-disciplinary expertise.

Segment Analysis

By System Type

Battery Thermal Management System segment dominated the Electric Vehicle Thermal Management System Market in 2024. The growing need to maintain optimal battery temperature for enhanced safety, extended lifespan, and improved charging performance has made this system critical. As batteries are the most sensitive and high-value components in EVs, automakers are prioritizing efficient thermal management solutions, particularly liquid cooling systems, to prevent overheating and ensure consistent performance across varying driving and climate conditions.

By Technology

This Active Thermal Management segment dominated the market due to its superior efficiency in dissipating heat, especially in high-performance EVs. Liquid cooling is more effective than air cooling in managing the thermal load of batteries, power electronics, and motors, ensuring optimal functioning under various driving conditions. As EV power densities increase, liquid-based systems offer better control, compact design integration, and improved safety, making them the preferred choice among OEMs and tier-1 suppliers.

By Component

Among components, heat exchangers held the largest market share in 2024. They are integral to the thermal circuits of EVs, facilitating efficient heat transfer between subsystems such as batteries, motors, and power electronics. With increasing adoption of integrated thermal management systems and compact vehicle designs, demand for high-performance, compact, and lightweight heat exchangers continues to rise, making them indispensable for optimizing energy usage and ensuring thermal stability.

By Vehicle Type

BEVs dominated the market by vehicle type, driven by global electrification trends and regulatory push toward zero-emission vehicles. BEVs require dedicated thermal management for batteries, motors, and inverters, as they rely entirely on electric propulsion. Unlike hybrids, BEVs operate longer under electric load, generating more heat, which necessitates robust and efficient thermal systems. This makes BEVs the largest consumer of thermal management technologies across all electric vehicle types.

By End User

OEMs were the dominant end users in 2024, as most thermal systems are designed and integrated during the vehicle manufacturing process. With increasing emphasis on energy efficiency, safety, and warranty coverage, OEMs are investing in sophisticated thermal management systems to enhance vehicle performance and customer satisfaction. Collaborations with suppliers and R&D initiatives to develop compact, modular systems further reinforce OEM dominance in the thermal management value chain.

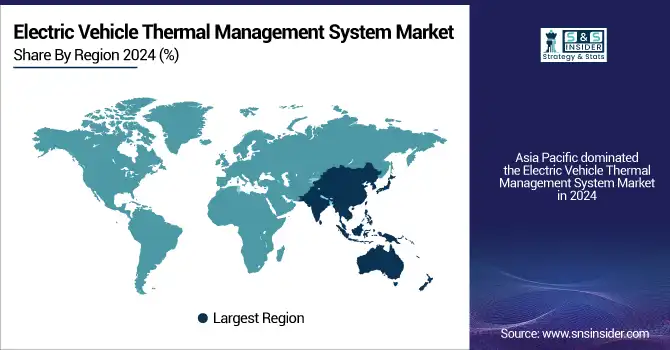

Regional Analysis

Asia Pacific dominated the Electric Vehicle Thermal Management System Market in 2024, primarily due to rapid EV adoption and strong manufacturing capabilities in countries like China, Japan, South Korea, and India. China led the region with its vast EV fleet, robust battery production, and aggressive government policies supporting electrification. Additionally, local OEMs and suppliers have heavily invested in advanced thermal management technologies, including liquid cooling and integrated systems. The presence of a strong EV supply chain, growing consumer demand, and technological advancements have positioned Asia Pacific as the leading region, accounting for the highest market share in thermal management systems.

Europe holds a significant position in the Electric Vehicle Thermal Management System Market in 2024, driven by strong environmental regulations, EV subsidies, and the continent’s commitment to carbon neutrality. Countries like Germany, France, the UK, and the Netherlands are at the forefront of EV adoption and production. European automakers are investing heavily in advanced thermal management solutions to meet stringent efficiency and safety standards. The region’s focus on battery safety, energy efficiency in extreme climates, and technological innovation supports growing demand. Expansion of charging infrastructure and electrification targets across the EU further contribute to Europe's strong presence in this market.

Get Customized Report as per Your Business Requirement - Enquiry Now

KEY PLAYERS:

BorgWarner Inc. (US), Dana Limited (US), Robert Bosch GmbH (Germany), VOSS Automotive GmbH (Germany), Ford Motors, BMW AG, Denso Corporation (Japan), MAHLE GmbH (Germany), Valeo (France), Gentherm (US), LORD Corporation, Modine Manufacturing Company (US), and Hanon Systems (South Korea) are some of the affluent competitors with significant market share in the Electric Vehicle Thermal Management System Market.

Recent Developments:

-

2024: BorgWarner Inc. Showcased high‑voltage coolant & air heaters plus eFans for traction motor and battery cooling at EV JAPAN/SIAT, marking advanced EV thermal portfolio in 2024

-

2024: Dana Limited Delivered lightweight aluminum battery-cooling products with proprietary brazing tech and multiple patents, now available for light/heavy EV applications

-

2023: Dana Limited Invested in R&D and secured CAD 2.112 M ecoENERGY grant for developing flux‑less aluminum brazed battery-cooler heat exchangers and thick-film electric heaters for EV thermal systems

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 3.44 Billion |

| Market Size by 2032 | US$ 9.15 Billion |

| CAGR | CAGR of 14.5% From 2024 to 2031 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By System Type (Battery Thermal Management System, Motor Thermal Management System, Cabin Thermal Management System, Power Electronics Thermal Management System, Transmission System Cooling, Integrated Thermal Management System)

|

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles |

BorgWarner Inc. (US), Dana Limited (US), Robert Bosch GmbH (Germany), VOSS Automotive GmbH (Germany), Ford Motors, BMW AG, Denso Corporation (Japan), MAHLE GmbH (Germany), Valeo (France), Gentherm (US), LORD Corporation, Modine Manufacturing Company (US), and Hanon Systems (South Korea) |