Automotive Fasteners Market Report Scope & Overview:

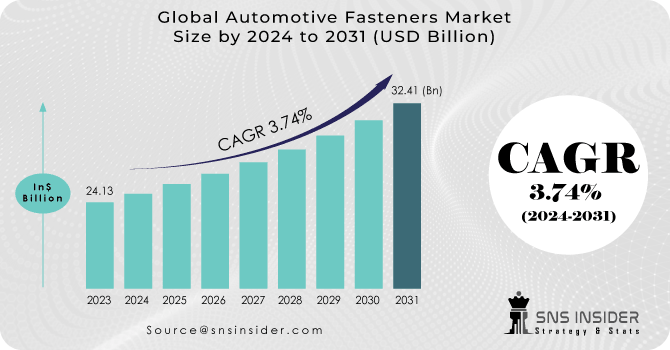

Automotive Fasteners Market size was valued at USD 24.13 billion in 2023 and is expected to reach USD 32.41 billion by 2031 and grow at a CAGR of 3.74% over the forecast period 2024-2031.

The future course of automotive fasteners is eloborately shaped by a convergence of important trends prioritizing lightweight construction, electrification, and the advent of autonomous driving. Propelled by the anticipated surge in global vehicle production, forecasted to escalate to 100 million units by 2030, the demand for conventional fasteners is poised for sustained growth. However, the true upsurge lies within specialized components.

Get More Information on Automotive Fasteners Market - Request Sample Report

Governments such as China, exemplified by their substantial $3.1 billion commitment to EV infrastructure by 2025, are catalyzing the transition towards electric vehicles. This precipitates an escalating requirement for corrosion-resistant and high-strength fasteners capable of withstanding the unique stresses inherent to electric motors and battery packs.

Moreover, the expansion of autonomous vehicles underscores the imperative for advancements in weight reduction to optimize operational range and efficiency. Consequently, this trend paves the way for broader acceptance of materials such as aluminum and composites in fastener construction, alongside the integration of innovative solutions like self-piercing rivets, which streamline assembly processes. The automotive fastener market stands at the cusp of a dynamic transformation, characterized by a mounting demand for high-performance and application-specific solutions.

MARKET DYNAMICS:

KEY DRIVERS:

-

A rise in demand is being fueled by the increasing acceptance of safer and more fuel-efficient vehicles.

A increase in demand is being caused by the increasing use of safer and more fuel-efficient vehicles. This trend is being driven by consumers' increased emphasis on safety and environmental concerns. As a result, there is a growing need in the automobile industry for vehicles that offer both greater safety features and fuel efficiency.

-

The global market has recently benefited from innovations in product development and material composition

-

The production and sales of electric vehicles are increasing as a result of stringent regulations in some nations

RESTRAINTS:

-

The market is anticipated to be constrained due to a lack of consumer knowledge regarding vehicle parts

The potential for market expansion may be constrained by consumers' ignorance of automotive components. A lack of knowledge about different parts could make it difficult to make informed aftermarket and purchase decisions. Closing this knowledge gap is essential for long-term market growth.

-

The high price of vehicle components is anticipated to limit demand

OPPORTUNITIES:

-

Government regulations for light-weight automobiles have helped the area's technology improve

Government mandates for light-weight automobiles have accelerated technological development in the industry. These rules encourage material and manufacturing process innovation, which promotes the creation of lighter and more fuel-efficient cars. As a result, the sector is making significant advancements in technology and productivity.

-

Several design businesses are working to improve the quality and design of fasteners

-

The demand for battery packs and charging infrastructure will rise as the number of battery-powered technologies in trains rises

CHALLENGES:

-

The lack of raw resources on a global scale caused a break in the supply chain

Raw material shortages around the world have caused supply chain snags. Various industries that depend on these resources have been impacted by supply chain cracks caused by this scarcity. Due to the lack of resources, manufacturers are dealing with difficulties in the areas of production, distribution, and procurement.

-

Utilization of fasteners is constrained by increasing clenching and welding in the automotive industry

IMPACT OF ONGOING RECESSION:

The Automotive Fasteners Market experiences decreased car demand during a recession, which results in decreased output and orders. Manufacturers of fasteners are further challenged by supply chain interruptions, cost constraints, and sluggish innovation. Delayed consumer spending affects both OEM and aftermarket divisions, which impedes recovery. A recession brought on by the energy crisis is having a negative impact on several industrial sectors. With steel demand declining more sharply than anticipated (-3.5% for this year and -1.9% for next year), the picture for the steel industry has gotten worse for both the second half of 2022 and 2023. However, import penetration continues to be historically high. the recovery seen throughout 2021 (+16.3%), the apparent steel consumption trend appeared to come to a stop in the second quarter of 2022 with a sharp decline (-4.8%), down to 38.6 million tonnes. The likelihood of a more severe annual contraction in apparent steel consumption this year (-3.5%, previously forecast at -1.7%) and the next year (-1.9%) is increased by the prediction that poor performances will persist through 2022 and at least the first part of 2023.

IMPACT OF RUSSIA-UKRAINE WAR:

The current conflict between Ukraine and Russia has given the Indian auto sector additional reasons for concern. Given that both nations are significant producers of essential components needed in semiconductors, the conflict between Ukraine and Russia is likely to make the worldwide chip situation worseFADA anticipates that fuel prices would increase by at least $10 to $15 per litre. The global EV transition could be hampered by the $114 price of oil.

On a yearly basis, February saw a 9.21% fall in all car sales in India. Sales figures made public by the FADA show a decline of more than 20% from February of the previous year. Sales of two-wheelers, cars, and tractors decreased in February 2022 by 10.67%, 7.84%, and 18.87%, respectively, year over year.

The two-wheeler market segment continues to bear the weight of rural unrest and high ownership costs. While the demand for passenger cars is still strong, the supply is still being affected by the heat of the semiconductor shortage. The government's investment in infrastructure drives up demand for tippers and big commercial trucks.

Market, By Product:

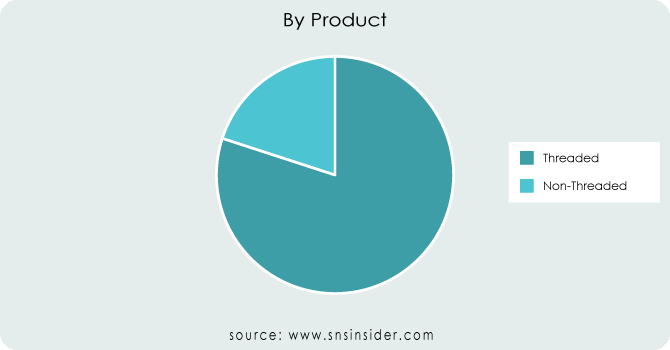

The automotive fastener market is driven by two primary product classifications: threaded and non-threaded fasteners. Threaded fasteners, such as nuts and bolts, notably command the majority market share, likely surpassing 80% as of 2023. This dominance is attributable to their ability to provide a secure hold, making them particularly suitable for vital vehicle components like engines and chassis. Regulatory frameworks, such as those established by entities like the US Department of Transportation, often influence this landscape by setting stringent safety standards for threaded fasteners in critical automotive parts.

Market, By Material Type:

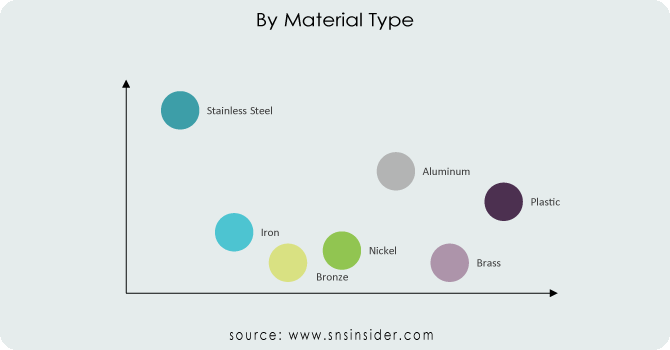

The automotive fastener market thrives on a diverse array of material selections, each serving specific industry needs. Stainless steel leads the market, commanding approximately 30% of market share due to its exceptional durability and corrosion resistance, particularly valued for under-the-hood components and harsh environmental conditions. However, with government initiatives increasingly promoting fuel efficiency, there is a notable shift towards lighter materials within the industry.

This shift has paved the way for aluminum, which now holds a significant 20% market share, leveraging its weight advantage while maintaining strength. Plastic follows closely behind at 15%, prized for its ability to reduce weight and offer cost-effectiveness, particularly in interior parts and applications where weight reduction is critical.

Despite these advancements, traditional materials such as iron continue to hold a 10% market share, valued for their affordability and ease of machinability. Additionally, niche players like brass and bronze maintain a smaller but significant presence, capturing 5% and 3% of the market respectively. Brass caters to specific needs such as corrosion resistance in electrical components, while bronze finds favor in high-wear applications. Government regulations worldwide, such as the stringent emission standards set by the European Union, significantly influence these market trends. In particular, such regulations incentivize the use of lightweight materials like aluminum and plastic in car manufacturing, further driving the evolution of material choices within the automotive fastener industry.

Market, By Application:

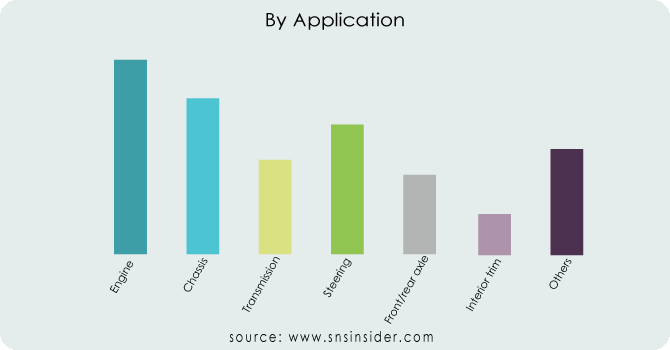

In terms of application, the automotive fasteners market is delineated into various segments including engine, chassis, transmission, steering, front/rear axle, interior trim, and others. Engine compartments, which demand robust strength and heat resistance, command the largest market share, comprising approximately 35%. Following closely behind are chassis components, necessitating durability and vibration resilience, accounting for approximately 30% of the market. Government initiatives such as the CAFE (Corporate Average Fuel Economy) standards in the US are advocating for the adoption of lightweight materials in these domains, thereby influencing the selection of fasteners. Transmission and steering systems, pivotal for safety and performance, represent 15% and 10% of the market respectively. The remaining 10% is attributed to interior trim and other applications, with a discernible shift towards the increased utilization of plastic fasteners owing to their cost-effectiveness and aesthetic appeal.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

MARKET SEGMENTATION:

By Product:

-

Threaded

-

Non-Threaded

By Material Type:

-

Stainless Steel

-

Iron

-

Bronze

-

Nickel

-

Aluminum

-

Brass

-

Plastic

By Application:

-

Engine

-

Chassis

-

Transmission

-

Steering

-

Front/rear axle

-

Interior trim

-

Others

REGIONAL ANALYSIS:

The global market for automotive fasteners has been segmented into the following regions: North America, Europe, Asia-Pacific, and the Rest of the World. Due to the increasing number of automobiles sold in countries across Asia-Pacific, such as New Zealand, Australia, India, China, Japan, South Korea, and Indonesia, the market for fasteners is anticipated to experience growth in this region. In 2023, the automotive fasteners market is been dominated by the Asia Pacific region. Fasteners for automobiles are popular in China, India, and Japan. In 2023, China's share of global automotive fastener production is expected to be over 55%. As a result, India and Japan accounted for more than 28% of the overall production of automotive fasteners in the Asia Pacific area, which is related to a change from standard to customized automobile parts, as well as a rise in the per capita income of Asian consumers. During the projected period, electric vehicle adoption is expected to increase significantly in the Asia Pacific region. Consequently, the Asia Pacific market for automotive fasteners is likely to grow in the near future.

Because of increased investments in the automobile industry, Asia Pacific had the majority of the market share in 2023. In the approaching years, market expansion in this region will be fueled by the presence of top car manufacturers in China and Japan as well as the adoption of encouraging government initiatives in India. The need for lightweight automotive fasteners has increased due to the growing popularity of EVs, which is further fueling the growth of regional markets.

Due to the implementation of strict government rules governing car mileage, there is expected to be a significant increase in the demand for lightweight fasteners in North America over the course of the projection period.

Regional Coverage

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS:

The Philips Screw Company (U.S.), Lisi Group (France), Permanent Technologies Inc. (U.S.), Atotech (Germany), KAMAX (Germany), SFS Group (Switzerland), Fontana Gruppo (Italy), Nifco Inc. (Japan), Kova Fasteners Pvt. Ltd. (India), Shanghai Tianbao Fastener International (U.S.), Bulten AB (Sweden), Westfield Fasteners Limited (U.K.) are some of the affluent competitors with significant market share in the Automotive Fasteners Market.

Lisi Group (France)-Company Financial Analysis

RECENT DEVELOPMENT:

-

BultenAB and Polestar joined together in September 2022 to create a climate-neutral electric vehicle by the year 2030. BultenAB will provide fasteners that are extremely functional and climate neutral for this partnership.

-

One of the top manufacturers of rubber gaskets with headquarters in Magnolia, Texas, Champion Sales and Manufacturing, Inc., was purchased by Birmingham Fastener & Supply Company Inc. in April 2022. Birmingham Fastener & Supply Company Inc. broadens its product line and manufacturing variety across Texas as a result of this transaction.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 24.13 Billion |

| Market Size by 2031 | US$ 32.41 Billion |

| CAGR | CAGR of 3.74% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Product (Threaded, Non-Threaded) • by Material Type (Stainless Steel, Iron, Bronze, Nickel, Aluminum, Brass, Plastic) • by Application (Engine, Chassis, Transmission, Steering, Front/rear axle, Interior trim, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | The Philips Screw Company (U.S.), Lisi Group (France), Permanent Technologies Inc. (U.S.), Atotech (Germany), KAMAX (Germany), SFS Group (Switzerland), Fontana Gruppo (Italy), Nifco Inc. (Japan), Kova Fasteners Pvt. Ltd. (India), Shanghai Tianbao Fastener International (U.S.), Bulten AB (Sweden), Westfield Fasteners Limited (U.K.) |

| Key Drivers | • A rise in demand is being fueled by the increasing acceptance of safer and more fuel-efficient vehicles. • The global market has recently benefited from innovations in product development and material composition. • The production and sales of electric vehicles are increasing as a result of stringent regulations in some nations. |

| RESTRAINTS | • The market is anticipated to be constrained due to a lack of consumer knowledge regarding vehicle parts. • The high price of vehicle components is anticipated to limit demand. |