Automotive Flywheel Market Report Scope & Overview:

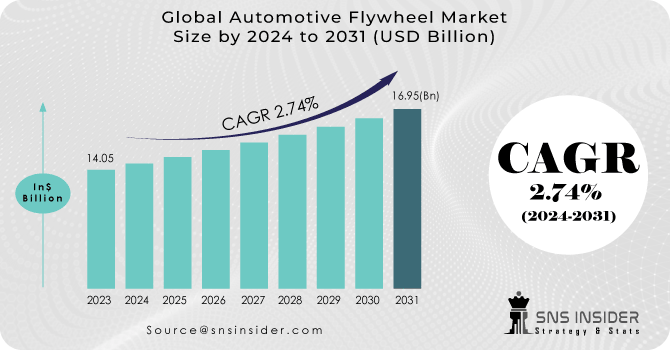

The Automotive Flywheel Market size was valued at USD 14.05 Bn in 2023 and is expected to reach by USD 17.39 Bn by 2031 and grow at a CAGR of 2.74% over the forecast period 2024-2031.

The future landscape of the automotive flywheel market presents a fascinating contrast. The dominance of electric vehicles (EVs) inherently diminishes the necessity for conventional flywheels in their power systems. Yet, this is countered by increasingly stringent government regulations concerning fuel efficiency and emissions for internal combustion engine (ICE) vehicles. For instance, the US Environmental Protection Agency (EPA) is proposing a significant leap in fuel efficiency standards to 54.5 miles per gallon by 2026, up from the current 37 mpg requirement. Such mandates drive the need for advancements in ICE technology, potentially fostering a surge in lightweight, high-performance flywheels aimed at optimizing engine power delivery and reducing emissions.

Get More Information on Automotive Flywheel Market - Request Sample Report

Moreover, the expanding hybrid electric vehicle (HEV) sector presents an avenue for integrating flywheel technology into regenerative braking systems. These systems capture kinetic energy during deceleration and subsequently utilize it for acceleration, offering an efficient means of energy management. Investments in research and development for these advanced flywheels are on the ascent, with SNS Insider research forecasting a growth in investment exceeding $1 billion by 2032. While the overall market size may see moderate growth, the future of flywheels hinges on innovation and adaptability, catering to the evolving requirements of an automotive industry increasingly focused on sustainability.

MARKET DYNAMICS:

KEY DRIVERS:

-

Automated manual transmissions are becoming more popular.

-

Automotive flywheels are being driven by the increasing use of DCTs and CVTs.

-

Increases in vehicle production & sales are driving up the need for flywheels across a wide range of industries.

-

OEMs are expected to use dual mass flywheels to lighten their engines by manufacturing lightweight components.

The automotive sector is accelerating its transition towards lighter engines, with Original Equipment Manufacturers (OEMs) anticipated to progressively embrace dual mass flywheels (DMFs). This trend is propelled by a twofold objective: improving fuel efficiency and adhering to more stringent emission standards. DMFs, renowned for damping torsional vibrations, facilitate the integration of lightweight engine parts while maintaining optimal drivability.

RESTRAINTS:

-

The global market for electric vehicles is being stifled by an increase in the use of electric automobiles.

-

The market's growth is anticipated to be curtailed if conventional transmissions are removed from electric vehicles.

OPPORTUNITIES:

-

Innovations in kinetic energy recovery systems technology.

-

A surge in demand for various factors, including comfort, attractiveness, and safety.

-

The worldwide automotive flywheel market is expanding at a rapid pace due to technological advances.

The surge in growth is being propelled by cutting-edge technologies such as dual-clutch transmissions (DCT) and advancements in material science aimed at creating lighter, more efficient flywheels. Furthermore, governmental involvement is notable, particularly in China, where a substantial $7 billion investment has been allocated for research and development in next-generation electric vehicles (EVs). These EVs often incorporate regenerative braking systems, which heavily rely on flywheel technology for energy storage. This synergy between technological advancements and government support is decisively shaping the trajectory of the automotive flywheel market, paving the way for a more sustainable and efficient automotive landscape.

CHALLENGES:

-

The automotive flywheel market is facing headwinds from issues with vehicle use and maintenance.

-

A big problem for the aftermarket is the growing trend of fixing things instead of replacing them.

IMPACT OF RUSSIA-UKRAINE WAR:

The conflict in Ukraine has disrupted the automotive flywheel market, a vital component in modern vehicles. The disruptions originated with Ukraine, a significant supplier of wire harnesses essential for flywheel functionality, suspending production. Additionally, sanctions on Russia, a major source of steel and nickel used in flywheel manufacturing, have exacerbated the global shortage.

As a result, demand for flywheels is projected to decrease by 5% in 2023 compared to pre-war estimates, with some forecasts done by SNS Insider which indicates a potential price surge of up to 10% due to scarcity. To address this challenge, governments in key car-producing nations are exploring strategies. Germany, for example, is engaging in discussions with domestic steel producers to increase production and secure alternative suppliers. Although the long-term consequences remain uncertain, the immediate future of the automotive flywheel market is expected to be characterized by constrained supplies and potentially elevated costs.

IMPACT OF ECONOMIC SLOWDOWN:

The automotive flywheel market experienced a downturn in 2023, largely influenced by the global economic slowdown. As consumer spending tightened, the demand for new vehicles dropped by approximately 8% compared to the previous year, directly impacting flywheel production as car manufacturers adjusted their output accordingly. However, there were mitigating factors, such as government initiatives like China's stimulus package, which included tax breaks on car purchases, helping to alleviate some of the decline in demand. Despite these measures, flywheel prices saw a slight increase due to rising material costs, particularly steel, a crucial component, which surged by 12% in 2023, adding pressure to overall production costs. The recovery path for the automotive flywheel market relies on various factors, including a resurgence in consumer confidence, sustained government support for the auto industry, and effectively managing the volatility of raw material prices.

Market, By Flywheel Type:

In the automotive flywheel market, there are two primary variants: single mass and dual mass. Dual mass flywheels dominate the market, claiming a majority share of approx. 60% owing to their superior vibration dampening capabilities. This results in a more comfortable and quieter driving experience for motorists. Conversely, single mass flywheels, though simpler and lighter, convey more engine tremors, making them preferable for performance-focused vehicles that prioritize responsiveness. A smaller "Others" category likely encompasses specialized applications, such as lightweight composite flywheels tailored for niche uses.

Market, By Material:

The automotive flywheel market is currently witnessing a significant competitive landscape. Cast iron, long-standing as the dominant material, commands approximately 60% market share owing to its cost-effectiveness and robustness, particularly suited for heavy-duty vehicles. However, its substantial weight poses a challenge. Maraging steel, offering a lightweight alternative, secures around 20% market share due to its exceptional strength, appealing notably to high-performance car segments despite its relatively higher price point. On the horizon is aluminum alloy, a burgeoning contender with a modest 20% market share but rapidly gaining momentum. Its remarkable lightweight properties contribute to enhanced fuel efficiency, a pivotal consideration for environmentally-conscious automakers and forthcoming regulatory standards. This ongoing material competition is poised to intensify as automotive manufacturers seek to strike an optimal balance between cost, weight, and performance.

Market, By Transmission:

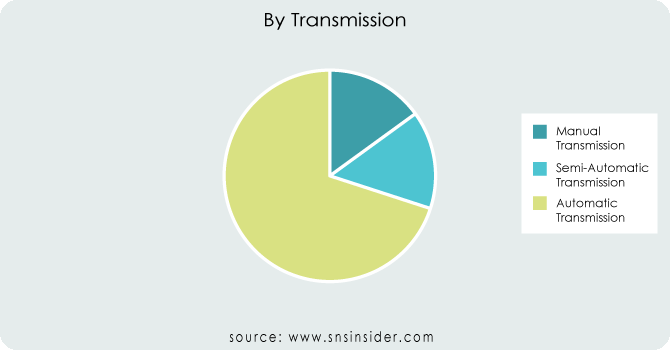

The automotive flywheel market demonstrates a clear preference for automatic transmissions, which command approximately 70% of the market share. Meanwhile, manual transmissions, favored for their engagement and cost-effectiveness, maintain a modest share of around 15%. Semi-automatic options such as dual-clutch transmissions are also on the rise, constituting the remaining 15% and appealing to drivers seeking a blend of convenience and performance. However, with the emergence of electric vehicles that do not require flywheels, this landscape is expected to evolve. Yet, for gasoline-powered vehicles, flywheel designs are tailored to the specific demands of each transmission type, thereby influencing market segmentation.

MARKET SEGMENTATION:

By Flywheel Type:

-

Single Mass

-

Dual Mass

-

Others

By Material:

-

Cast Iron

-

Maraging Steel

-

Aluminum Alloy

By Transmission:

-

Manual Transmission

-

Semi-Automatic Transmission

-

Automatic Transmission

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL ANALYSIS:

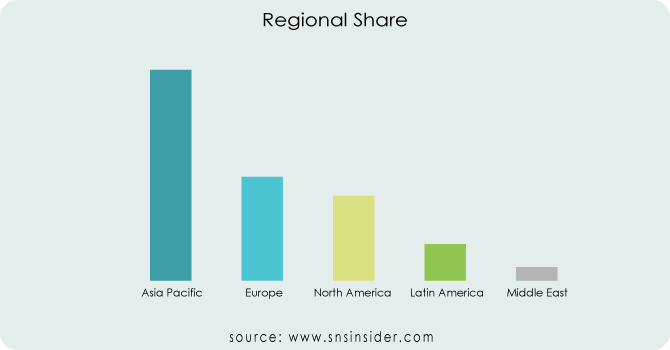

The global automotive flywheel market witnesses significant dominance from the Asia Pacific region, commanding an impressive 49.6% share in 2023, as per SNS Insider research. This supremacy is underpinned by the thriving automotive sectors in countries such as China and India. Here, the rapid pace of urbanization alongside the burgeoning middle class is instrumental in elevating car ownership rates. Moreover, these nations serve as pivotal auto manufacturing hubs with well-established supply chains, thereby emerging as cost-effective producers of flywheels.

Following closely behind, Europe and North America collectively account for approximately 33.2% of the market share in 2022. These regions showcase a robust presence of leading automotive manufacturers and a keen emphasis on technological advancements. This impels the demand for flywheels tailored for hybrid and electric vehicles, as these markets continue to evolve. Despite experiencing a comparatively slower growth trajectory than the Asia Pacific region, Europe and North America remain committed to innovation, particularly in lightweight materials and regenerative braking systems. Such innovations hold significant promise for the future trajectory of the flywheel market.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS:

Schaeffler AG (Germany), ZF Friedrichshafen AG (Germany), Valeo SA (France), American Axle & Manufacturing, Inc. (the US), Ford Motor Company (US), AISIN SEIKI Co., Ltd (Japan), Linamar Corporation (Canada), LUTHRA INDUSTRIAL CORP (India), Skyway Precision, Inc. (the US), and Iljin (Korea) are some of the affluent competitors with significant market share in the Automotive Flywheel Market.

Schaeffler AG (Germany)-Company Financial Analysis

RECENT DEVELOPMENTS

-

BorgWarner, a pioneering force in automotive technology, has introduced advanced lightweight flywheel solutions, optimizing engine performance while enhancing fuel efficiency. Concurrently, Valeo has revolutionized the market with its innovative electric flywheel technology, catering to the growing demand for hybrid and electric vehicles.

-

Schaeffler AG has made significant strides by integrating smart materials and precision engineering into their flywheel designs, resulting in unparalleled reliability and durability.

-

ZF Friedrichshafen AG has focused on enhancing integration capabilities, seamlessly incorporating flywheel systems into next-generation drivetrains for improved vehicle dynamics. Collaborative efforts between these key players have also fostered the emergence of novel dual-mass flywheel designs, striking a delicate balance between comfort and performance in modern automobiles.

| Report Attributes | Details |

|---|---|

| CAGR | CAGR of 2.74% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Flywheel Type (Single Mass, Dual Mass, Others) • by Material (Cast Iron, Maraging Steel, Aluminum Alloy) • by Transmission (Manual Transmission, Semi-Automatic Transmission, Automatic Transmission) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Schaeffler AG (Germany), ZF Friedrichshafen AG (Germany), Valeo SA (France), American Axle & Manufacturing, Inc. (the US), Ford Motor Company (US), AISIN SEIKI Co., Ltd (Japan), Linamar Corporation (Canada), LUTHRA INDUSTRIAL CORP (India), Skyway Precision, Inc. (the US), and Iljin (Korea) |

| Key Drivers | •Automated manual transmissions are becoming more popular. •Automotive flywheels are being driven by the increasing use of DCTs and CVTs. |

| RESTRAINTS | •The global market for electric vehicles is being stifled by an increase in the use of electric automobiles. •The market's growth is anticipated to be curtailed if conventional transmissions are removed from electric vehicles. |