Automotive Brake Shoe Market Report Scope & Overview:

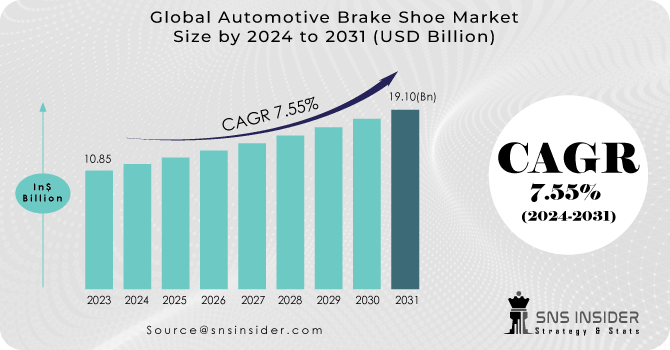

The Automotive Brake Shoe Market Size was valued at USD 10.85 billion in 2023 and is expected to reach USD 19.10 billion by 2031 and grow at a CAGR of 7.55% over the forecast period 2024-2031.

A brake shoe is a curved piece of metal that is used in the braking system of a vehicle. Inside the brake drum systems, it transports the brake lining. This metal has a friction substance integrated into it that is set aside. The automobile brake shoe is put on the inside of the drum during brake operation, forcing the brake shoe to move and pressing the lining that is positioned on the outside against the drum's inside. The braking effort is then provided by friction between the drum and the lining, where the energy is lost as heat. Brake shoes have a significant impact on the vehicle's braking system.

Get More Information on Automotive Brake Shoe Market - Request Sample Report

Despite the fact that they serve the same purpose, brake shoes and brake pads are not the same. In recent years, the brake shoe market has seen a number of advancements.

This automotive brake shoe system requires little effort to monitor vehicle speed and produces very little noise and vibration. Drum brakes generate more heat than brake pads. It causes less harm to the discs and increases their durability due to the low heat.

In 2020, Continental AG has developed a third-generation anti-lock braking system (ABS) that adjusts to vehicle speeds and provides safer, more regulated, and optimal braking performance.

MARKET DYNAMICS:

KEY DRIVERS:

-

Introducing breakthrough technology for the creation of lightweight braking systems

-

Consumers per capita disposable income levels are rising, & electro-mobility developments

-

The market is developing due to improved braking effectiveness & increasing disc brake use

-

Due to increased industrialization & modernization, there is a growing demand for commercialization

RESTRAINTS:

-

The market's growth is being stifled by rising demand for disc brakes in automobiles

-

Market growth is projected to be hampered by rising raw material prices and strict government regulations

OPPORTUNITIES:

-

The development of organic fibers and the regular introduction of innovations in braking systems

-

The market is being boosted by technology that helps the optimization of safety systems

CHALLENGES:

-

Brake shoes overheating

-

One of the biggest hurdles to the market's growth is the rise of severe laws linked to brake system heating

IMPACT OF COVID-19:

The entire world has been adversely impacted by the COVID-19 pandemic. Businesses are lost as a result of the installation of lockdowns and limits on various commercial activities. Similarly, producer constraints and supply chain disruptions are constraining car brake pad manufacturers all around the world. Several vehicle brake pad manufacturers demand and supply cycles have slowed as a result of the recent lockout.

Manufacturing companies confront a slew of issues as a result of the lockdown, including a scarcity of raw materials, a labor shortage, and supply chain interruptions, all of which result in production and installation halts across the impacted countries. As a result of the pandemic, the automobile brake shoe market will be significantly impacted in 2020. Further, the worldwide market is rapidly growing its market value in the post-lockdown phase, recouping the loss caused by the pandemic.

Market, By Type:

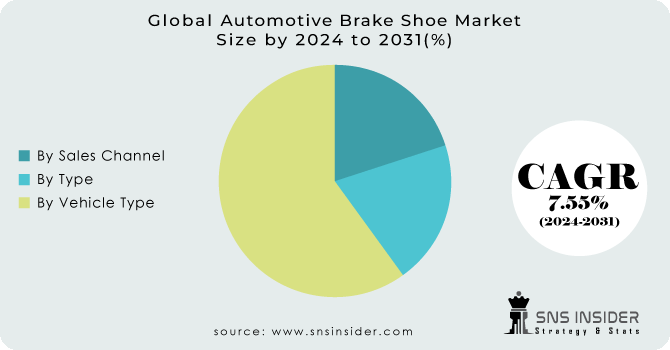

Based on the type segment, the global market has been divided into Leading/trailing, twin leading, and Duo servo. When placed against the drum, the leading shoe rotates in the same direction as the drum. During forward and backward braking, this type of brake shoe is required. It has a consistent braking force. In most passenger automobiles, the leading shoe is used. Due to these factors, the leading/trailing type of shoe segment is expected to dominate the brake shoe market over the forecast period.

Market, By Vehicle Type:

The global market has been divided into Passenger cars, LCV, and HCV based on the vehicle type segment. Due to increased automobile manufacturing, the passenger car segment has the biggest market share among them. Because of the expanding logistics and construction industries, HCVs will see significant expansion. HCVs transport big loads and, in order to meet the increased demand for safety at high speeds, they require effective braking systems.

Market, By Sales Channel:

The global market has been divided into OEM and Aftermarket based on the sales channel segment. Because of the simple accessibility of parts, low cost, professional technical team, and availability of good service facilities and service stations, the aftermarket segment is expected to drive the brake shoe market over the forecast period. To improve braking effectiveness, vehicle manufacturers are adding novel and modern brake shoes into their vehicles.

MARKET SEGMENTATION:

By Type:

-

Leading/Trailing

-

Twin Leading

-

Duo Servo

By Vehicle Type:

-

Passenger cars

-

LCV

-

HCV

By Sales Channel:

-

OEM

-

Aftermarket

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL ANALYSIS:

Europe, Asia-Pacific, North America, the Middle East, and Africa are the four key regions in which the automotive brake shoe market is divided. Because of the high adoption of automotive brake shoes and rising automobile production, Asia-Pacific has the greatest automotive brake shoe market share among these regions. Furthermore, rising demand for both passenger and commercial cars is propelling the industry in this region to new heights. Due to rising demand for passenger automobiles and strict vehicle safety rules, Europe is expected to hold the second-largest market share. Many market participants are seeing profitable potential in growing economies such as China and India, where enormous populations are combined with new developments in a variety of industries.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS:

Continental AG, Bosch Auto Parts (Germany), Woking (Spain), ACDelco (US), BNA Automotive India Pvt Ltd (India), Meritor, Inc. (US), Brake Parts Inc. LLC. (US), Tribo (Ukraine), MAT HOLDINGS INC. (US), ASK Automotive Pvt. Ltd. (India), S.L. (Spain), SBS Friction A/S (Denmark), Kampol company (Poland), and TRW Automotive (US) are some of the affluent competitors with significant market share in the Automotive Brake Shoe Market.

Continental AG-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 10.85 Billion |

| Market Size by 2031 | US$ 19.10 Billion |

| CAGR | CAGR of 7.55% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Type (Leading/Trailing, Twin Leading, Duo Servo) • by Vehicle Type (Passenger cars, LCV, HCV) • by Sales Channel (OEM, Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Continental AG, Bosch Auto Parts (Germany), Woking (Spain), ACDelco (US), BNA Automotive India Pvt Ltd (India), Meritor, Inc. (US), Brake Parts Inc. LLC. (US), Tribo (Ukraine), MAT HOLDINGS INC. (US), ASK Automotive Pvt. Ltd. (India), S.L. (Spain), SBS Friction A/S (Denmark), Kampol company (Poland), and TRW Automotive (US) |

| Key Drivers | •Introducing breakthrough technology for the creation of lightweight braking systems. •Consumers' per capita disposable income levels are rising, & electro-mobility developments. |

| RESTRAINTS | •The market's growth is being stifled by rising demand for disc brakes in automobiles. •Market growth is projected to be hampered by rising raw material prices and strict government regulations. |