Automotive Heat Shield Market Report Scope & Overview:

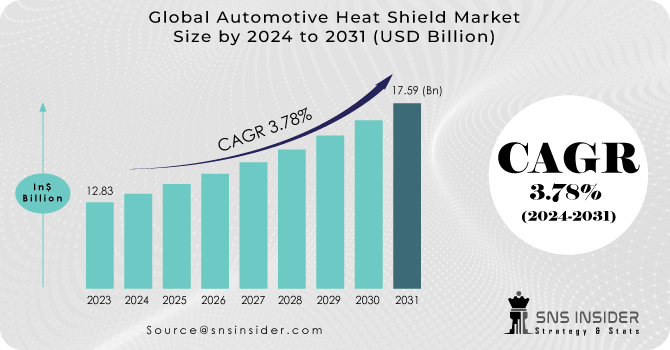

Automotive Heat Shield Market size was valued at USD 12.83 billion in 2023 and is expected to reach USD 17.59 billion by 2031 and grow at a CAGR of 3.78% over the forecast period 2024-2031.

The automotive heat shield market is poised for remarkable growth, driven by a convergence of factors. Heightened governmental regulations pertaining to fuel efficiency and emissions control are compelling automakers to adopt lightweight materials and potent engines, both of which generate substantial heat. This surge in thermal output underscores the critical need for heat shields to safeguard delicate components and uphold optimal cabin temperatures. Notably, the impending implementation of the European Union's stringent Euro 7 emission standards in 2025 necessitates advanced thermal management solutions within vehicles.

Get More Information on Automotive Heat Shield Market - Request Sample Report

Moreover, the rapid expansion of the electric vehicle (EV) sector presents a novel avenue for market growth. Although electric cars produce less engine heat, the high-voltage battery packs they employ demand robust thermal shielding to ensure safety and durability. Investors are taking heed of this expanding market opportunity. This influx of investment capital is set to catalyse extensive research and development efforts aimed at crafting innovative heat shield materials such as composites and volcanic ash, thereby further accelerating market expansion. In essence, the future of automotive heat shields shines brightly, supported by stringent regulations, the growing influence of EVs, and escalating investor confidence.

MARKET DYNAMICS:

KEY DRIVERS:

-

The growing popularity of electric and hybrid vehicles.

Technological advancements have led to a surge in demand for hybrid vehicles within the automotive industry. Consequently, the Automotive Heat Shield Market is experiencing growth driven by the unique thermal management needs of these vehicles.

-

A greater emphasis on light and efficient fuel restrictions.

-

More emphasis on fuel regulations that are light and efficient.

-

The expansion of the market is fueled by an increase in vehicle manufacturing around the world.

RESTRAINTS:

-

The cost of raw materials for the manufacture of vehicle heat shields has risen.

The production of vehicle heat shields is being hampered by rising raw material costs, which may have an influence on overall production costs and industry competitiveness. Finding effective cost-cutting strategies and alternative materials could be critical to resolving this problem.

-

Major countries' restrictions on internal combustion engine automobiles are projected to slow the market's expansion.

OPPORTUNITIES:

-

A rise in technological innovation in the automotive industry.

Automobiles are being revolutionized, innovation is accelerating, electric dreams are being realized, and autonomy is being navigated.Connectivity thrives, AI takes the lead, and the automotive future moves at a breakneck pace.

-

Government authorities have developed standards for components and buildings.

CHALLENGES:

-

The barriers related to added vehicle weight

The weight of an automotive heat shield adds to the overall weight of the vehicle. Ongoing research is expected to aid in the development of lightweight shielding systems in the near future. However, as of today, the excess weight is added to the car in accordance with OEM requirements. As a result, one of the key problems in the vehicle heat shield market is added weight.

-

The production of electric vehicles is a significant issue for the worldwide automotive heat shield market.

IMPACT OF RUSSIA –UKRAINE WAR:

The automotive heat shield market experienced significant repercussions in the wake of the Russia-Ukraine War. While the conflict brought forth challenges such as supply chain disruptions and regional market volatility, it also spurred opportunities for technological innovation and heightened demand in specific industries. The crucial role of heat shields in combating the internal combustion engine's heat cannot be overstated. Typically, these shields envelop the engine body, safeguarding it and its components from heat damage.

The ramifications of the Russia-Ukraine conflict reverberated throughout the automotive industry, leading to disruptions in the supply chain and inadequate provision of raw materials. Consequently, the automotive sector faced prolonged waiting periods for car purchases and witnessed price fluctuations. In the United States, the average cost of new cars surged by 13% over the past 12 months, indicative of the ripple effects of the war on market dynamics. The upheaval caused by the Russia-Ukraine conflict significantly impacted supply chain management, exacerbating challenges within the automotive sector. As disruptions cascaded through the supply chain, industries reliant on automotive components, such as the manufacturing and transportation sectors, felt the strain. This underscored the critical importance of resilient and adaptable supply chain strategies in mitigating the fallout from geopolitical tensions and safeguarding business continuity

IMPACT OF ECONOMIC SLOWDOWN

The Automotive Heat Shield Market has experienced significant disruptions due to shifts in consumer behavior, changes in auto manufacturing, and broader economic downturns. The recession has led to a decline in vehicle production, impacting the demand for heat shield products. Furthermore, escalating raw material costs have exacerbated the situation, with key materials like aluminum witnessing a staggering 70% price surge in 2022, continuing to climb thereafter. Steel products also faced a notable price hike of 30.4%, Although comparatively lower than the 105.6% increase observed in crude oil prices. These soaring costs have contributed to the overall price inflation, making automotive components less affordable for consumers amidst the economic downturn.

Market, By Product:

The global market for heat shields is segmented into Single Shell, Double Shell, and Sandwich products. Single shell heat shields currently dominate the market, capturing a significant 59.0% of sales. These shields are manufactured using 0.3-1.0 mm aluminum foil. Meanwhile, Double Shell heat shields are crafted from 0.3-1.0 mm aluminum sheets, offering robust protection against heat. Sandwich products, on the other hand, provide superior temperature resistance, catering to specific high-temperature applications within the market.

Market, By Application:

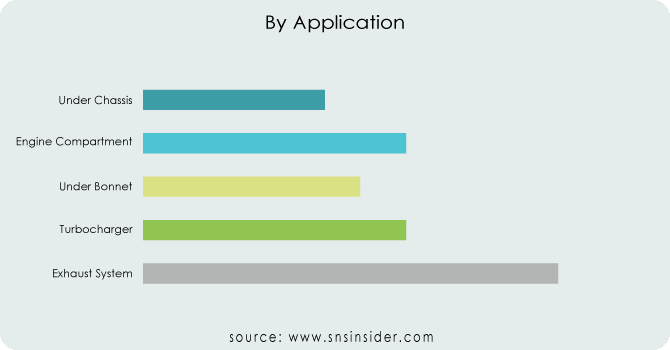

The global market is segmented into Exhaust Systems, Turbochargers, Under Bonnet, Engine Compartment, and Under Chassis based on application. The Engine Compartment segment is projected to hold over 32.0% of the total revenue share. Heat shields often protect engine assemblies from elevated temperatures. The Turbocharger application segment is forecasted to grow at a CAGR of 5.6% during the projection period.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Market, By Material:

The global market is segmented into metallic and non-metallic categories based on materials. The metallic segment currently holds a dominant position, contributing over 87% of the total revenue. Materials like aluminum and stainless steel, renowned for their excellent conductivity, are frequently utilized in crafting metallic heat shields. However, over the forecast period, the non-metallic segment is anticipated to exhibit significant growth, with a projected Compound Annual Growth Rate (CAGR) of 5.2%. This growth is attributed to the increasing adoption of non-metallic heat shields, particularly in under-bonnet applications such as high-temperature hoses, reflecting a shift towards more diverse material choices in the industry.

MARKET SEGMENTATION:

By Product:

-

Single Shell

-

Double Shell

-

Sandwich

By Application:

-

Exhaust System

-

Turbocharger

-

Under Bonnet

-

Engine Compartment

-

Under Chassis

By Material:

-

Metallic

-

Non-Metallic

REGIONAL ANALYSIS:

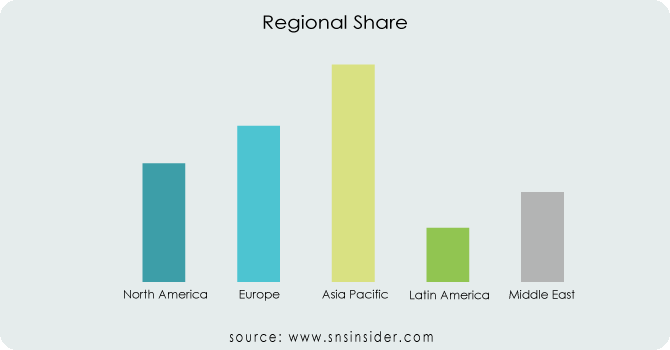

The Asia-Pacific electric vehicle market is poised for significant growth in the coming years, largely propelled by the escalating demand for passenger automobiles in developing nations across the region. China stands out as a major driver holding the share of 70%. Additionally, India's electric vehicle market is anticipated to experience rapid expansion in the near future.

Meanwhile, the European electric vehicle market is forecasted to witness substantial growth during the assessment period, primarily fueled by the regional government's initiatives aimed at curbing carbon emissions. The widespread adoption of fuel-efficient vehicles further contributes to the market's positive outlook. Key players in this growth story include the United Kingdom, France, and Germany, with Germany leading the charge in driving regional growth, while the UK is expected to exhibit the highest growth rate throughout the review period.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS:

Dana Incorporated, Lydall Inc., Tenneco Inc., Morgan Advanced Materials, Autoneum Holding AG, ElringKlinger AG, Carcoustics, UGC Inc., Talbros Automotive Components Ltd, and DuPont are some of the affluent competitors with significant market share in the Automotive Heat Shield Market.

Dana Incorporated-Company Financial Analysis

Recent Development

-

A legally binding contract to buy a section of Modine Manufacturing Company's thermal-management business was signed by Dana Incorporated in November 2020.

-

With its Japanese partner, "Sanwa Packing Industry Co. Ltd," Talbros Automotive Components Limited signed into a Technical Assistance Agreement (TAA) for Light Weight Aluminium Heat Shields in 2020. This cutting-edge solution, which will be utilised for automotive applications, has value-added characteristics including noise reduction, emission control, and heat insulation at extreme temperatures

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 12.83 Billion |

| Market Size by 2031 | US$ 17.59 Billion |

| CAGR | CAGR of 3.78% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Single Shell, Double Shell, Sandwich) • By Application (Exhaust System, Turbocharger, Under Bonnet, Engine Compartment, Under Chassis) • By Material (Metallic, Non-Metallic) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Dana Incorporated, Lydall Inc., Tenneco Inc., Morgan Advanced Materials, Autoneum Holding AG, ElringKlinger AG, Carcoustics, UGC Inc., Talbros Automotive Components Ltd, and DuPont |

| Key Drivers | • The growing popularity of electric and hybrid vehicles. • A greater emphasis on light and efficient fuel restrictions. • More emphasis on fuel regulations that are light and efficient. • The expansion of the market is fueled by an increase in vehicle manufacturing around the world. |

| Restraints | • The cost of raw materials for the manufacture of vehicle heat shields has risen. • Major countries' restrictions on internal combustion engine automobiles are projected to slow the market's expansion. |