Flex Fuel Engine Market Size & Overview

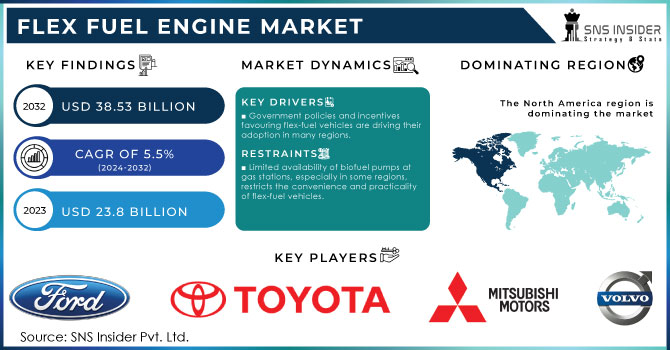

The Flex Fuel Engine Market Size was valued at USD 23.8 billion in 2023 and will reach USD 38.53 billion by 2032 and grow at a CAGR of 5.5% by 2024-2032.

Get More Information on Flex Fuel Engine Market - Request Sample Report

A combination of environmental concerns, fluctuating oil prices, and increasing engine technology advancements places the flex fuel engine market in a position for growth. The thematic focus on ecological sustainability is driving the adoption of alternative fuel technologies. Flex-fuel engines running on gasoline blended with ethanol, generally from E10 to E85, offer a highly suitable solution. Ethanol-derive from renewable crops like corn or sugarcane-has been advanced as a potentially cleaner alternative that could disentangle human civilization from dependence upon fossil fuels and, in the process, reduce levels of greenhouse gas emissions. Not to be outdone, governments around the world also continue to step up, offering incentives such as tax breaks and subsidies to promote the purchase of flex-fuel vehicles and further fuel market growth. The modern flex-fuel engines are designed to run seamlessly on various blends of petrol and ethanol for giving full performance and optimal fuel efficiency.

The new changes in the production processes of ethanol are in the way of emerging cellulosic ethanol, which is produced from non-food material such as wood chips or agricultural waste. Flex-fuel infrastructure, especially refuelling points with high ethanol blend supply, remains scanty in some places. This in itself may discourage buyers from purchasing a vehicle with such fuel type due to uncertainty over ease in finding appropriate fuels for it.

MARKET DYNAMICS:

KEY DRIVERS:

-

Government policies and incentives also support flex-fuel vehicles and are hence favorable in many regions.

-

The increasing importance being attached to environmental sustainability makes the flex-fuel engines very attractive due to their capability to run on biofuels and decrease emissions.

Flex-fuel engines, on the other hand, provide a very attractive solution whereby vehicles can run with gasoline blended with biofuels such as ethanol derived from corn or sugarcane. These biofuels are renewable resources and usually emit less greenhouse gas than regular gasoline. Because they require less fossil fuel, a flex-fuel engine decreases overall carbon emissions. Biofuels are also often produced locally, decreasing a reliance on foreign oil supplies. Production in biofuels can therefore have many beneficial consequences on farming, opening up new avenues of opportunity for farmers. This has helped it to gain greater acceptance among consumers and governments alike, on account of the attendant environmental benefits. The rising consciousness as also the increasing stringency in emission legislations in several countries is creating a strong market pull for flex-fuel technology.

RESTRAINTS:

-

Biofuel pumps are still unavailable for most gas stations, except in some select regional areas, which makes it less convenient and less practical to operate flex-fuel vehicles.

-

Food security and land use-related apprehensions linked with increasing biofuel production may act as a hindrance to the widespread growth seen.

Most of the biofuels are manufactured from crops like corn and sugarcane, and increasing the amount of biofuel production may further compete with food crops for land and inputs. This may serve to raise food prices and drop the level of food security, especially for developing countries. Expanding land area for biofuel crops may create environmental concerns. Large conversions, involving forests or natural habitats, for production of biofuels contribute to deforestation and loss of biodiversity. Intensive farming practices to maximize yields in biofuel crops may hence lead to soil erosion and water pollution. Put together, these diverse issues related to environmental and social impacts of the production of biofuels have the potential to cause consumer and policy unease.

OPPORTUNITIES:

-

Collaboration between automakers and producers of biofuel serves to accelerate innovation in both engine technology and sustainable biofuel production.

-

The development of the next generation of biofuels, with superior energy density, might make flex-fuel cars more attractive.

CHALLENGES:

-

Biofuel feedstock could compete with food crops for agricultural land and resources, which may affect the world's food security.

KEY MARKET SEGMENTS:

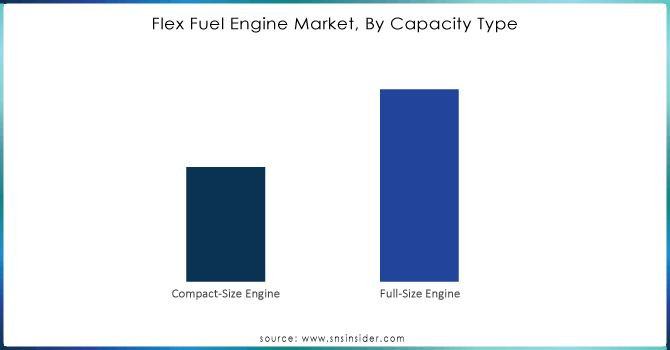

By Capacity Type

By capacity type, the full-size engine segment is the dominant sub-segment of the Flex Fuel Engine Market, holding approximately 60-65% of the market share. Larger-sized vehicles-SUVs and pickup trucks-are more inclined toward the adaptation of flex-fuel since these vehicle types are directly correlated with utility and higher fuel consumption; therefore, they require engines that can provide substantial power and torque. Full-size engines give it this muscle, enabling the flex-fuel vehicle to get performance without giving up the environmental advantages of biofuels. While development is continuing, higher ethanol blends, such as E85, are not as available as the lower blends. The full-size engine can run on a wider range of ethanol blends, normally from E10 to E85, whereas most compact engines cannot. This flexibility gives the owners of flex-fuel vehicles more latitude to use whatever biofuel options may be available.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Fuel Type

By fuel type, the dominating sub-segment is gasoline, holding around 70-75% share in the Flex Fuel Engine Market. The flex-fuel engines allow switching between the gasoline and ethanol blend. This will make sure the car keeps up its run and doesn't face the inconvenience of limited pumps for bio-fuel, especially in certain areas. Seamless switching to gasoline assures comfort and convenience to flex-fuel vehicle owners.

By Vehicle Type

By vehicle type, the passenger vehicle segment holds a dominant share in the Flex Fuel Engine Market. The passenger cars represent a much greater share of the whole vehicle category compared to commercial vehicles. This, in turn, directly implies that a greater number and variability of flex-fuel passenger car options available is continuing to facilitate the broader consumer purchase and market activity. Another major driver influencing flex-fuel technology is environmental awareness among consumers. As the owners of passenger cars are trying increasingly to reduce their carbon footprint, a flex-fuel vehicle provides an excellent alternative for drivers who wish to go green. In some regions, policies and incentives related to government target passenger vehicles so that the adaptation of flex-fuel technology can be promoted. This makes them more attractive in the market compared to commercial vehicles with flex-fuel.

By Blend Type

The dominating sub-segment by blend type is the E10 to E25 in the Flex Fuel Engine Market. E10 and E15 blends are easily available at most fueling stations around the world. Due to this easy availability, flex-fuel automobiles running on these blends are more viable and appropriate for regular applications than those dependent on higher ethanol blends like E85. However, in higher ethanol blends such as E85, it lags behind in infrastructural setup. Availability of E85 pumps remains so restricted that practical utilization of flex-fuel vehicles-whose engineering has been done mainly for those blends-remains limited. While things are getting better, there are still some question marks about higher ethanol blends on power output and fuel efficiency.

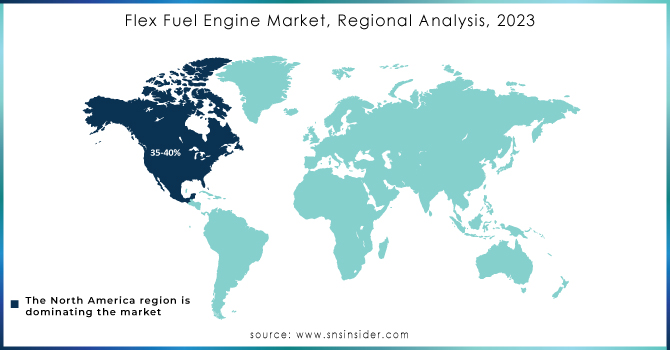

REGIONAL ANALYSIS

North America leads in the Flex-Fuel Engine Market, holding a share of about 35-40%. The reason North America has emerged as the hub for flex-fuel technology is that it holds an oiled network for biofuel production facilities, with easily available ethanol blends at gas stations. This lead is further helped through government support in the form of subsidies and incentives, while growing environmental awareness among people sees consumers demanding greener flex-fuel vehicles.

This, therefore, will ensure rapid growth in the Asia-Pacific region, as growing economies drive vehicle ownership coupled with strong focus on energy security. Governments here actively promote the production and usage of biofuels and flex-fuel vehicles, while the presence of cost-competitive Chinese manufacturers makes this technology more accessible.

KEY PLAYERS

The major key players are Volvo Cars (Sweden), Mitsubishi Motors Corporation (Japan), Fiat Chrysler Automobiles (UK), Toyota Motor Corporation (Japan), AUDI (Germany), Nissan Motor Co. Ltd. (Japan), General Motors Company (US), Honda Motor Co. Ltd. (Japan), Volkswagen (Germany), Ford Motor Company (US) and other key players.

RECENT DEVELOPMENT

-

In June 2024: The Ministry of Heavy Industries in India is considering requests to reduce the Goods and Services Tax (GST) on flex-fuel vehicles. This move aims to make flex-fuel technology more affordable for consumers and incentivize wider adoption.

-

In Aug. 2023: Royal Enfield, a renowned motorcycle manufacturer, unveiled its Classic 350 "Flex Fuel" variant in India. This marks a significant development, bringing flex-fuel technology to the two-wheeler segment and potentially expanding the market reach.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 23.8 Billion |

| Market Size by 2032 | USD 38.53 Billion |

| CAGR | CAGR of 5.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Capacity Type (Compact-Size Engine, Full-Size Engine) • By Fuel Type (Gasoline, Diesel) • By Vehicle Type (Passenger Vehicles, Commercial Vehicle) • By Blend Type (E10 to E25, E25 to E85, Above E85, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Volvo Cars (Sweden), Mitsubishi Motors Corporation (Japan), Fiat Chrysler Automobiles (UK), Toyota Motor Corporation (Japan), AUDI (Germany), Nissan Motor Co. Ltd. (Japan), General Motors Company (US), Honda Motor Co. Ltd. (Japan), Volkswagen (Germany), Ford Motor Company (US). |

| Key Drivers | • The reliance on foreign oil has been greatly decreased. • Demand for carbon-neutral vehicles is increasing. |

| RESTRAINTS | • The enormous expense connected with the production, persistence, and use of ethanol has seen a significant increase. • Concerns about engine damage |