Automotive Hinges Market Report Scope & Overview:

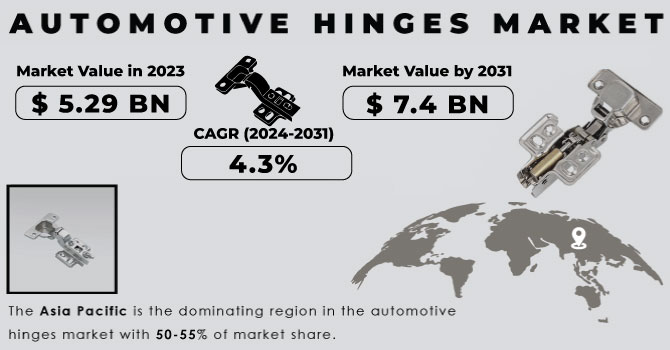

The Automotive Hinges Market Size was valued at USD 5.29 billion in 2023 and is expected to reach USD 7.4 billion by 2031 and grow at a CAGR of 4.3% over the forecast period 2024-2031.

Automotive hinges are the critical joints, connecting crucial parts like doors, hoods, and trunks to the car's body. These hinges allow controlled movement, enabling components to open at specific angles. Just like a door swing the car doors and hoods rotate around a fixed point due to these specialized mechanisms.

Get More Information on Automotive Hinges Market - Request Sample Report

The material used in hinges varies depending on the application. Heavier components like doors and hoods require robust materials like steel, while lighter-duty parts like fuel caps can utilize fewer substantial options. Interestingly, some premium and sports car doors even boast electronically operated hinges for a touch of luxury. Electrically operated hinges are making their way into even compact and mid-size cars, particularly for the rear trunk or tailgate, enhancing convenience. Fuel caps, another vital component, prevent direct access to the car's fuel tank. To improve fuel efficiency by reducing overall vehicle weight, many manufacturers are turning to composite materials for crafting these hinges.

MARKET DYNAMICS:

KEY DRIVERS:

-

Advanced Materials and Manufacturing Drive Innovation in Automotive Hinges

The evolving automotive industry demands hinges that are both strong and lightweight. To meet this need, advancements in material science are introducing lighter options like aluminium alloys and composites, improving fuel efficiency. Additionally, manufacturers are exploring "smart materials" that can respond to external stimuli, creating more dynamic hinges. These advancements extend to manufacturing as well, with techniques like computer-aided design and precision forging optimizing hinge design and production for both strength and intricate features.

-

Rising Vehicle Production and Sales Fuel Demand for Automotive Hinges Globally

RESTRAINTS:

-

High costs of advanced lightweight materials like composites could limit their widespread adoption in automotive hinges.

-

Fluctuations in global oil prices could impact overall car production, indirectly affecting demand for automotive hinges.

OPPORTUNITIES:

-

Lighter hinges made from aluminium alloys and composites can improve fuel efficiency for eco-conscious car buyers.

-

Hinges with shape-memory alloys could offer self-adjusting features or enhanced security.

CHALLENGES:

-

New Vehicle Technologies Challenge Automotive Hinge Design and Manufacturing

The rapid shift towards electric and autonomous vehicles, along with a focus on lighter car designs, is challenging the automotive hinge market. Traditional hinges may not meet the needs of these new technologies. Electric vehicles have different layouts requiring unique hinge designs. Autonomous cars might need hinges that integrate sensors. The emphasis on lightweight cars creates a need for hinges that are strong but also light. To address these challenges, hinge manufacturers must invest in research and development of new materials and processes. They should also collaborate with carmakers to ensure their hinges seamlessly fit the next generation of vehicles.

IMPACT OF RUSSIA-UKRAINE WAR

The war in Russia-Ukraine is expected to disrupt the automotive hinges market, potentially impacting production and raising costs by 5-10% in the short term. This stems from several interconnected factors. The conflict has disrupted global supply chains, particularly those reliant on Eastern Europe. Ukraine was a minor supplier of raw materials for hinge production, but the overall disruption to regional logistics creates uncertainties and delays. The sanctions imposed on Russia limit access to certain metals like nickel, a key component in stainless steel hinges, potentially leading to shortages and price hikes of 7-12%. The war has caused a surge in energy prices, impacting production costs across the board. The cost of operating factories and the price of natural gas used in some manufacturing processes are likely to increase by 3-8%. These combined factors could lead to temporary shortages and price increases for automotive hinges.

IMPACT OF ECONOMIC SLOWDOWN

Economic downturns can significantly impact the automotive hinges market. Consumer spending on new cars plummets, leading to a direct decrease in vehicle production by automakers. As a result, the demand for hinges, a crucial car component, falls proportionally. A 10% decline in vehicle production could translate to an 8-10% drop in hinge demand, impacting manufacturer revenue. The economic slowdowns cause people to delay car repairs and maintenance, including postponing replacements for damaged hinges. The economic uncertainty leads companies to limit their budgets and reduce investment in research & development. This can hold back the innovation in the hinge market, hindering the development of new lightweight materials or advanced hinge designs. Reduced R&D investment can put companies behind competitors in the long run.

KEY MARKET SEGMENTS:

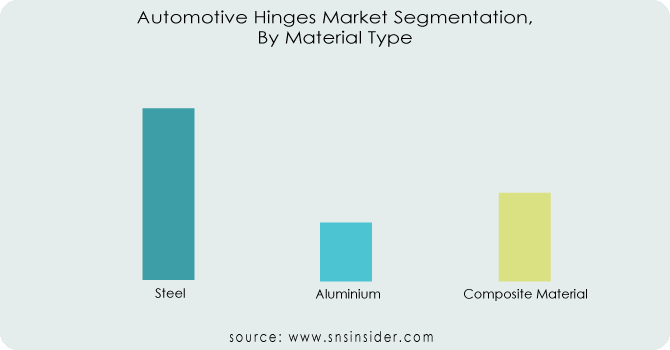

By Material Type

-

Steel

-

Aluminium

-

Composite Material

Steel is the dominating sub-segment in the Automotive Hinges Market by material type holding around 60-65% of market share. Steel remains the dominant material due to its exceptional strength and durability, crucial for supporting heavy components like car doors and hoods. While heavier, it provides the structural integrity needed for safety and longevity in these critical applications.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Sales Channel

- OEM

- Aftermarket

OEM (Original Equipment Manufacturer) is the dominating sub-segment in the Automotive Hinges Market by sales channel holding around 70-75% of market share. The OEM segment accounts for the larger market share due to the high volume of vehicle production. Automakers directly integrate hinges into new vehicles during assembly, driving significant demand for this segment

By Vehicle Type

-

Passenger Cars

-

Commercial Vehicles

Passenger Cars is the dominating sub-segment in the Automotive Hinges Market by vehicle type holding around 55-60% of market share. Passenger cars represent fastest-growing segment in the automotive industry as this naturally translates to a higher demand for hinges used in these vehicles compared to commercial vehicles.

By Product

-

Door

-

Cabinet

-

Hood

-

Others

Door Hinges is the dominating sub-segment in the Automotive Hinges Market by product holding around 65-70% of market share. Door hinges are the most widely used type of hinge in automobiles. Every car has multiple doors, and each door requires a hinge mechanism, making it the most in-demand product category within the automotive hinges market.

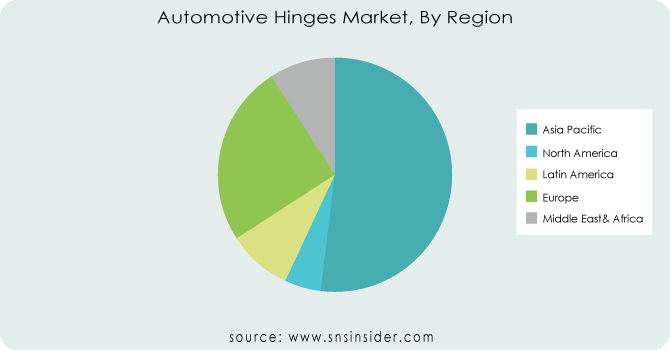

REGIONAL ANALYSES

The Asia Pacific is the dominating region in the automotive hinges market with 50-55% of market share. This dominance stems from China's position as a car manufacturing giant, fueling immense demand for hinges during vehicle assembly. Rising disposable incomes and rapid urbanization across the region further propel the market as car ownership increases. Europe is the second highest region in this market holding around 25-30% of market share due to its well-established automotive industry with renowned manufacturers like Volkswagen. These players require high-quality hinges, and Europe's focus on premium vehicles often translates to a need for more intricate and potentially costlier hinge designs. The North America is experiencing the fastest growth at 4-5% due to the demand for replacement vehicles due to extended car ownership cycles, the popularity of larger vehicles requiring robust hinges, and the emerging electric vehicle trend.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are Orchid International, Dura Automotive System LLC, Brano Group, Tenneco Inc, Magna International Inc., Eberhard Manufacturing Company, Aisin Seiki Co. Ltd, Milan Metal System LLC, Wenzhou Rongan Auto Parts Co., Ltd, Global Rollforming System LLC, Saint Gobain, ER Wagner Manufacturers, Gestamp, Scissor Doors Inc., Midlake Custom Hinges, Orchid International, AISIN SEIKI, Eberhard Manufacturing Company, Multimatic, Gaoming Ligang Precision Casting Co., Ltd., DURA Automotive Systems and other key players.

Orchid International-Company Financial Analysis

RECENT DEVELOPMENTS:

-

In Jan. 2022: Dura Automotive Systems proudly opened its new high-tech factory in Muscle Shoals, Alabama, celebrating a milestone in automotive manufacturing.

-

In Aug. 2021: Dura Automotive Systems partners with ALMAC to create a joint venture focused on manufacturing aluminium extrusions and components specifically designed for lightweight and electric vehicles.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.29 Billion |

| Market Size by 2031 | US$ 7.4 Billion |

| CAGR | CAGR of 4.3% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Material Type (Steel, Aluminum, Composite, Others) • by Product (Door, Cabinet, Hood, Others) • by Vehicle Type (Passenger cars, Commercial vehicles) |

| Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America |

| Company Profiles | Orchid International, Dura Automotive System LLC, Brano Group, Tenneco Inc, Magna International Inc., Eberhard Manufacturing Company, Aisin Seiki Co. Ltd, Milan Metal System LLC, Wenzhou Rongan Auto Parts Co., Ltd, Global Rollforming System LLC, Saint Gobain, ER Wagner Manufacturers, Gestamp, Scissor Doors Inc., Midlake Custom Hinges, Orchid International, AISIN SEIKI, Eberhard Manufacturing Company, Multimatic, Gaoming Ligang Precision Casting Co., Ltd., and DURA Automotive Systems |

| Key Drivers | • Urbanization and industrialization are becoming more prevalent. • The market is expected to grow in response to the rising demand for private commutes due to the growing working population. |

| RESTRAINTS | • The automotive hinges' great dependability and longevity may function as a market limitation. • The demand for automobile hinges may be slowed by increased demand for luxury vehicles. |