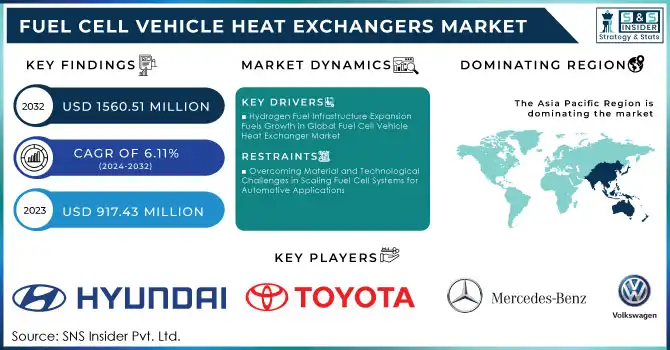

FUEL CELL VEHICLE HEAT EXCHANGERS MARKET KEY INSIGHTS:

The Fuel Cell Vehicle Heat Exchangers Market size was valued at USD 917.43 million in 2023 and is expected to reach USD 1560.51 million by 2032, growing at a CAGR of 6.11% over the forecast period 2024-2032.

Get More Information on Fuel Cell Vehicle Heat Exchangers Market - Request Sample Report

The fuel cell vehicle heat exchangers market is witnessing an increase in revenues owing to the rising demand for clean and efficient energy solutions for automotive applications. Innovative fuel cell vehicles (FCVs) emerged as a promising alternative to the traditional internal combustion engine vehicle as governments across the globe initiated tougher emission regulations and called for carbon-neutral transportation. Heat exchanger integration with fuel cell systems is necessary to achieve efficient temperature regulation, as well as to promote these systems' efficiency and durability. Moreover, the growing investments towards hydrogen infrastructure and rising awareness regarding the adverse environmental effects of fossil fuels are also fuelling the adoption of FCVs, thereby, supporting the need for advanced heat exchangers across various regions.

Japan reported nearly 150 hydrogen refueling stations in 2023, with a plan for 320 by 2030. The U.S. Department of Energy pledged USD 100 million for hydrogen tech, while the EU put aside EURO 1 billion for projects to support hydrogen production. Worldwide 2023 FCV sales passed the mark of 50,000 units, with 10,000 fuel cell trucks and buses in use in China. Meanwhile, the cost of producing green hydrogen will decline to the range of USD 1-USD 2 per kilogram by 2030 across leading markets.

In addition, the continued adoption of sustainable technologies by the automotive industry particularly in markets in North America, Europe, and Asia Pacific is likely to propel the growth of the automotive lithium secondary batteries market. Driven by growing customer demand for zero-emission vehicles and advances in hydrogen production methods, the market for fuel cell vehicle heat exchangers is growing rapidly. These heat exchangers go beyond just passenger cars, as they are also required by heavy-duty vehicles (buses and trucks) that are taking on fuel cells due to their long ranges and reduced refueling time. U.S. will deploy more than 50,000 hydrogen vehicles by 2025, preceded by a USD 100M investment into economical hydrogen infrastructure. Germany is the first in Europe, planning for 1,000 hydrogen buses, to operate in 2023 to seek zero-emission public transport by 2030. By 2023, China had put more than 10,000 fuel cell buses and trucks into operation and had announced plans to expand its fleet of hydrogen-powered trucks to 5,000 by 2025. USD 70,000 South Korea commits USD 1.2 billion to fuel cell vehicle technology, zero-emission, long-range trucks aimed to be available by 2024.

MARKET DYNAMICS

KEY DRIVERS:

-

Hydrogen Fuel Infrastructure Expansion Fuels Growth in Global Fuel Cell Vehicle Heat Exchanger Market

The construction of hydrogen fuel infrastructure will be one of the most important factors boosting the growth of the global fuel cell vehicle heat exchanger market. The prospects for fuel cell vehicles (FCVs) continue to improve as significant funding for hydrogen production, storage, and distribution network projects is coming from governments and private industry alike. Having an ever-growing infrastructure is fundamental to the fuel cell industry development, as it offers real refueling stations and gives a guarantee about the actual use of the FCVs across longer distances. As the refueling infrastructure extends, the market of fuel cell systems and associated systems like heat exchangers will still be on the rise, as these related components maintain operating temperatures in fuel cells effectively. We expect the global shift towards the establishment of a hydrogen economy, most notably in Europe and Asia Pacific, will support robust growth of the market. In 2023, the global network of hydrogen refueling stations (HRS) has exceeded 1,000 units, of which 359 stations are located in China, occupying the first position in the world. This will dramatically increase, with China aiming for 2,879 HRS by 2030. As of the end of 2023, the U.S. had 76 stations operational, but Europe particularly Germany is ramping up its hydrogen infrastructure to accommodate more fuel cell cars.

-

Fuel Cell Technology Drives Fuel Efficiency and Emission Reduction in Heavy Duty Commercial Vehicles

The frequent efforts to improve fuel efficiency, and reduction in operating costs, particularly in commercial vehicles across logistics and transportation industries are a few other contributing factors. Fuel cell technology has high market potential in heavy-duty vehicles like buses, trucks, and trains because they need higher energy demand and operate for long hours. Fuel cell systems consume less fuel overall and therefore produce lower greenhouse gas emissions, thus providing fleet operators with an appealing opportunity to reduce both fuel costs and their carbon footprint. With companies’ increased efforts to bring down operating costs, high-performance heat exchangers are projected to be adopted with advanced designs to improve the efficiency and utility of fuel cells in this region. Innovation and growing market opportunities are largely being driven by the commercial heat exchanger systems required to make fuel cell vehicles more durable, effective, and economical. The Million Mile Fuel Cell Truck Consortium (M2FCT) backed by the U.S. Department of Energy – is targeting 1 million miles (25,000 hours) of a lifetime for long-haul trucks by 2030. Heavy-duty vehicles make up just 10% of vehicle miles but generate 23% of transportation emissions in the U.S. Set to give style to the road in public transport, Foothill Transit in California used 33 fuel cell buses from its zero-emission fleet, funded with government money to offset initial high costs.

RESTRAIN:

-

Overcoming Material and Technological Challenges in Scaling Fuel Cell Systems for Automotive Applications

High-Performance Material Availability One major hurdle is the insufficient accessibility of high-performing materials for fuel cell systems. Their development is difficult and expensive because they must be able to endure extreme temperatures and pressures while remaining efficient and durable. Besides that, the implementation of heat exchangers directly in the fuel cell systems needs to solve the problem of compact design (heat transfer vs. vehicle performance). The other challenge is the technological cost of scale to produce these fuel cell systems at a larger scale. Confidence in Fuel Cell Technology Progress, but the Scale and Quality Squeeze is On While strides in fuel cell technology are encouraging, scaling up and producing uniform quality within large volumes is still a challenge. Furthermore, the industry must solve the technical challenges associated with optimizing thermal management in different climates, as fuel cell systems can be performance-hungry and very dependent on significant temperature variations.

KEY MARKET SEGMENTATION

BY TYPE

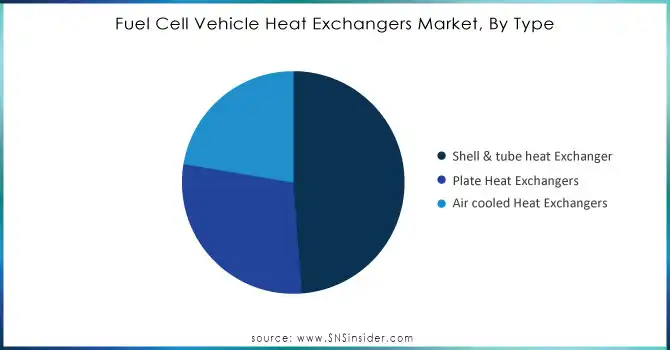

In 2023, Shell & Tube heat exchangers segment accounted for 48% of the total market. Such widespread dominance is a testament to the technology's track record of reliability in demanding applications in oil & gas, power generation, and chemical processing industries. Shell & Tube heat exchangers are preferable due to their high thermal efficiency, high-pressure operating capabilities, and ruggedness, which allows them to be used for large-scale industrial processes. This versatility, aided by the power to handle numerous fluid types and temperatures, is part of the explanation for why they continue to dominate in many heavy-duty applications as well.

Plate Heat Exchanger segment is projected to witness the highest compound annual growth rate (CAGR) from 2024 to 2032. This growth is primarily due to their high heat transfer efficiency, compact size, and flexibility in customization. Plate heat exchangers are also more space efficient, which can be very important for systems with spatial restrictions like HVAC, refrigeration, and miniaturized industrial applications. These offer higher thermal performance for a given volume while maintaining the advantage of flexibly additionally removable plates, allowing them to cater more to different thermal needs, making them ideal for modern energy-efficient systems. The simplicity of plate heat exchangers will create significant demand across several industries to achieve energy efficiency and compact design as industries are driving towards such features.

Need Any Customization Research On Fuel Cell Vehicle Heat Exchangers Market - Inquiry Now

BY APPLICATION

The Heavy Commercial vehicle (HCV) segment held the largest market share at 46% in 2023. Such dominance is mainly attributable to the rising requirements for fuel-efficient and low-emission solutions in freight transport, public transport (buses), and long-haul logistics. Fuel cell technology could be highly beneficial for heavy commercial vehicles, providing longer range, faster refueling, and lower emissions than diesel-powered equivalents. Such benefits make HCVs a potential market driver as governments of several countries look to promote cleaner transportation and impose stringent emission regulations.

Light Commercial Vehicles (LCVs) segment set to register the fastest CAGR throughout the forecast period from 2024 to 2032. This means that the option of LCVs with fuel cells responds to the demand for efficient, zero-emissions solutions among urban logistics, last-mile delivery, and service fleets. They provide an economic, eco-friendly option, especially with the e-commerce sector continuing to grow. With rising regulatory pressure and growing consumer inclination towards greener technologies, the adoption of LCVs will escalate, thus driving high growth in the coming few years.

REGIONAL ANALYSIS

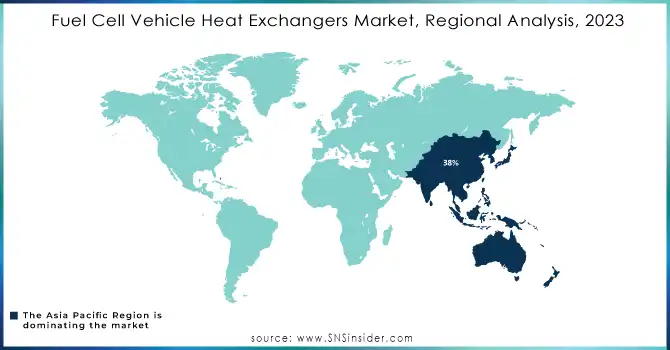

Asia Pacific led the fuel cell vehicle heat exchangers market with a 38% share in 2023 and is expected to be the fastest-growing region to register the highest CAGR during 2024 - 2032 to fuel cell vehicle heat exchangers market growth, Outstripping North America, aplenty of factors influence the growth of the market in this region. Such growth is fuelled by massive investments in hydrogen infrastructure and aggressive recently adopted government policies facilitating zero-emission technologies. China, Japan, and South Korea are at the forefront with China aiming its efforts at hydrogen-fueled public transport and logistics fleets, with hydrogen buses already operating in cities such as Shanghai.

Likewise, market growth is stimulated by the Japanese "Hydrogen Society" vision that features the mass-market Toyota Mirai fuel cell vehicle and the refueling stations to service them. In addition, hydrogen is a very important energy source for South Korea, and Hyundai has the NEXO fuel cell SUV and plans to expand the hydrogen ecosystem. The economic other driving factors such as that the region has a strong base for automotive component manufacturing and it also having economical production capabilities are the close driving factors for growth. With governments incentivizing this arena and companies boosting their R&D expenditure, Asia Pacific is likely to retain its comparatively beneficial position and spearhead the global fuel cell uptake.

Key Players

Some of the major players in the Fuel Cell Vehicle Heat Exchangers Market are:

-

Volkswagen AG (Vehicle Radiators, Hydrogen Cooling Systems)

-

Mercedes-Benz Group (Battery Coolers, High-Efficiency Heat Exchangers)

-

Toyota Motor Corporation (Stack Heat Exchangers, Fuel Cell Radiators)

-

Hyundai Motor Company (Integrated Thermal Modules, Hydrogen Heat Exchangers)

-

Honda Motor Co., Ltd. (Compact Radiators, Cooling Plates)

-

General Motors (Thermal Control Systems, Aluminum Plate Heat Exchangers)

-

MAN SE (Commercial Vehicle Heat Exchangers, Hydrogen Cooling Modules)

-

Volvo Group (Energy Recovery Systems, Industrial Radiators)

-

BMW Group (Advanced Radiator Modules, Gas-to-Liquid Heat Exchangers)

-

Ballard Power Systems (Fuel Cell Stack Cooling Systems, Auxiliary Heat Exchangers)

-

Cummins Inc. (Cooling Subsystems, Fuel Cell Radiators)

-

Plug Power Inc. (Proton Exchange Membrane Cooling Systems, Auxiliary Thermal Management)

-

Bosal (Integrated Plate Heat Exchangers, Custom Thermal Solutions)

-

Valeo (Aluminum Brazed Heat Exchangers, Fuel Cell Thermal Modules)

-

Alfa Laval (Asymmetric Gas-to-Liquid Heat Exchangers, Compact Heat Exchangers)

-

Denso Corporation (Microchannel Radiators, High-Performance Thermal Systems)

-

Hanon Systems (High-Efficiency Radiators, Liquid Cooling Systems)

-

API Heat Transfer (Spiral Plate Heat Exchangers, Modular Cooling Systems)

-

Fischer US LLC (Plate and Frame Heat Exchangers, Compact Hydrogen Coolers)

-

Thermal Transfer Systems (Custom Thermal Control Products, Heat Recovery Systems)

Some of the Raw Material Suppliers for Fuel Cell Vehicle Heat exchanger companies:

-

Linde plc

-

Air Liquide S.A.

-

BASF SE

-

Dow Inc.

-

Henkel AG & Co. KGaA

-

Alcoa Corporation

-

Outokumpu Oyj

-

Nippon Steel Corporation

-

ArcelorMittal

-

Saint-Gobain S.A.

RECENT TRENDS

-

In May 2024, Ballard Power Systems launched its 9th-gen fuel cell engine, FCmove-XD, at the ACT Expo in Las Vegas, showcasing advancements in hydrogen technology.

-

In April 2024, UK-based Intelligent Energy launched a new hydrogen fuel cell system tailored for passenger vehicles, marking a significant step in clean energy innovation.

-

In March 2024, Cranfield Aerospace Solutions successfully installed a hydrogen fuel cell system in the nacelle of a Britten-Norman BN-2 Islander aircraft, advancing clean aviation technology and certification efforts.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 917.43 Million |

| Market Size by 2032 | USD 1560.51 Million |

| CAGR | CAGR of 6.11% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Shell & tube heat Exchanger, Plate Heat Exchangers, Air-cooled Heat Exchangers) • By Application (Passenger Vehicle, Heavy Commercial Vehicle, Light Commercial Vehicle) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Volkswagen AG, Mercedes-Benz Group, Toyota Motor Corporation, Hyundai Motor Company, Honda Motor Co., Ltd., General Motors, MAN SE, Volvo Group, BMW Group, Ballard Power Systems, Cummins Inc., Plug Power Inc., Bosal, Valeo, Alfa Laval, Denso Corporation, Hanon Systems, API Heat Transfer, Fischer US LLC, Thermal Transfer Systems. |

| Key Drivers | • Hydrogen Fuel Infrastructure Expansion Fuels Growth in Global Fuel Cell Vehicle Heat Exchanger Market • Fuel Cell Technology Drives Fuel Efficiency and Emission Reduction in Heavy Duty Commercial Vehicles |

| Restraints | • Overcoming Material and Technological Challenges in Scaling Fuel Cell Systems for Automotive Applications |