Automotive Shielding Market Report Scope & Overview:

Get More Information on Automotive Shielding Market - Request Sample Report

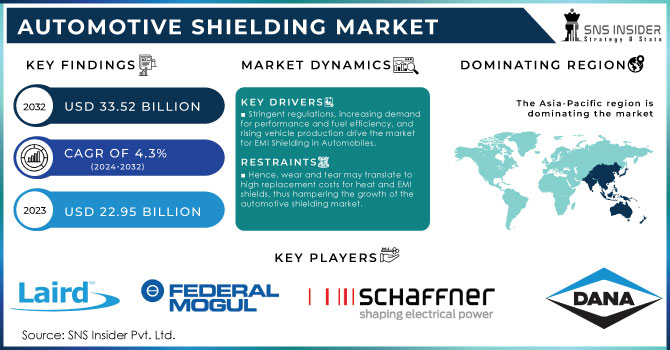

The Automotive Shielding Market Size was valued at USD 22.95 billion in 2023 and is expected to reach USD 33.52 billion by 2032 and grow at a CAGR of 4.3% over the forecast period 2024-2032.

The growth of the automotive shielding market is high, driven primarily by increasing integration of electronics and ADAS. In the US, the rise in demand for EVs has resulted in huge demand for EMI shielding, since such vehicles integrate a number of electronic components that are prone to electromagnetic interference. Strict regulations related to fuel efficiency and emissions force vehicle manufacturers to integrate lightweight, efficient heat shields, hence significantly driving market growth. Further, the passenger car segment adds the largest share in the market over 70% of the total demand. This can be due to the emergence of luxury and premium vehicle variants requiring advanced features, hence better shielding solutions.

The most prominent change would be that EMI shielding has jumped to around 85% in the recent time globally. This could be explained by the rapid growth of ADAS systems and in-vehicle electronics, which generate a strong requirement for protection from electromagnetic interference. At the same time, heat shielding remains an important element, especially with turbocharged engines and hybrid vehicles finding increasing applications. It is expected that only the heat shields used in passenger cars will continue to see a stable growth of 12% over the forecast period. From the point of view of material usage, since vehicles are getting heavier due to safety and other requirements, the trend in the industry is towards the usage of lightweight shielding materials such as aluminum and composites to improve fuel efficiency. This trend is more prevalent in the developed economies, where nearly 60% of new models introduced in 2023 incorporated at least one type of lightweight shielding component.

MARKET DYNAMICS:

Market Drivers:

-

Stringent regulations, increasing demand for performance and fuel efficiency, and rising vehicle production drive the market for EMI Shielding in Automobiles.

-

Growing Electronics and Advanced Features to Drive Demand for EMI Shielding in Automobiles

Today, more so than ever before, cars are equipped with more and more electronic equipment. These include a variety of features driven by the need to bring fuel efficiency and advanced driver assistance systems into vehicles. All these electronics create a mesh of wires and circuits that can cause interference with one another. This interference may cause malfunction and even safety problems; therefore, car manufacturers make use of EMI shielding. These shields block electromagnetic fields, much like a special type of insulation for wires and devices. The rising demand for luxury cars and high-tech features, including internet connectivity, further increases the demand for EMI shielding.

Restrains:

-

Hence, wear and tear may translate to high replacement costs for heat and EMI shields, thus hampering the growth of the automotive shielding market.

-

These shields are designed to last throughout a car's lifetime but degrade due to continuous usage. Extreme heat causes weakening in the shields that protect the engine and other parts from the exhaust, and sparks from inside, moisture, and rust affect the EMI shields that protect the electronics. Since these shields wear out, they may cause failures in the system. While shielding enhances car safety and performance, such replacements are imperative; this overall cost of ownership and maintenance may hamper the market growth.

KEY MARKET SEGMENTS:

By Heat Application:

One of the dominant areas for the application of heat in this sub-segment of the automotive shielding market is the engine compartment shielding, with a 40% market share. This is because engine compartments generate a good amount of heat due to combustion processes. Shielding will protect critical components like wiring and hoses from heat damage, thereby assuring engine performance and life.

By EMI Application:

Infotainment Shielding is the leading sub-segment in the EMI application segment of the automotive shielding market and occupies a market share of approximately 30%. Infotainment systems in use today consist of complex electronics that are prone to electromagnetic interference from other components in the vehicle. Shielding enables the smooth functioning of the system without malfunction or glitch.

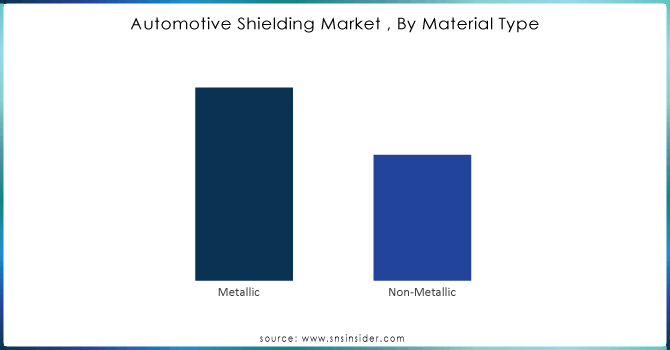

By Material Type:

By material type, metallic shielding dominates an automotive shielding market and holds a close to 60% market share. Metallic materials, such as aluminium, have excellent EMI shielding properties and good heat resistance. However, non-metallic materials like composites are gaining traction due to their light weight property that is an important requirement for fuel efficiency.

By Shielding Type:

Heat Shielding forms the dominating sub-segment in the automotive shielding market, by shielding type, holding about 65% of the market share. Heat management is one of the prime requirements for any vehicle to protect its components and provide comfort to passengers. Heat shields find broad usage in several locations such as the engine compartment and exhaust system.

By Vehicle Type:

By vehicle type, passenger car shielding accounts for approximately 45% of the automotive shielding market and is, therefore, the dominating sub-segment. In terms of vehicle type, the most produced vehicles across the world are passenger cars. The demand for shielding in this segment is driven by the stringent emission regulations and rising demand for features like infotainment systems.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL ANALYSES

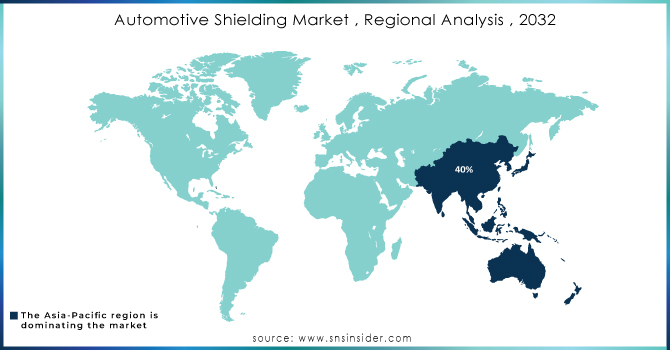

The Asia-Pacific dominates the market for automotive shielding, holding a 40% share, driven mainly by its passenger car and light commercial vehicle production dominance. Government initiatives in China and Japan encourage electric vehicles. Stricter emission regulations provide a natural accelerator of market growth through the adoption of advanced technologies that rely on heavy shielding. It is followed by Europe, which contributes around 30% of the market share, almost commensurate with its established and safety-conscious automotive industry. It is due to the stringent regulations and an expanding luxury car market with feature-rich infotainment systems that drive demand for shielding solutions here.

North America is the fastest-growing market, with a share of 20%, as massive adoption of electric vehicles and advanced driver-assistance systems occurs. Further driving the demand for these advanced shielding solutions in this region is the presence of key automakers and a significant focus on innovation.

KEY PLAYERS

The major key players are Laird PLC (UK), Dana Limited (US), Schaffner Holding (Switzerland), ElringKlinger AG (Germany), Federal-Mogul Corporation (US), Morgan Advanced Materials (UK), Henkel AG & Company, KGaA (Germany), Kitagawa Europe (Japan), Autoneum (Switzerland), Progress-WerkOberkirch AG (Germany) and other key players.

RECENT DEVELOPMENT

-

In July 2023: Morgan Advanced Materials, a leading manufacturer of advanced materials, has significantly expanded its Yixing plant in China. This expansion will increase production capacity of TJM® Insulating Firebricks by over 50%, supporting customers in petrochemicals, iron & steel, and other industries across China and Asia.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 22.95 Billion |

| Market Size by 2032 | US$ 3 3.52 Billion |

| CAGR | CAGR of 4.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Heat Application (Engine Compartment, Exhaust System, Turbocharger, Under Bonnet, Under Chassis, Fuel Tank, Battery Management) • By EMI Application (Adaptive Cruise Control, Electric Motor, Engine Control Module, Forward Collision Warning, Intelligent Park Assist, Lane Departure Warning, Infotainment, Blind Spot Detection, Night Vision System, Driver Monitoring System, Automatic Emergency Braking) • By Material Type (Metallic, Non-Metallic) • By Shielding Type (EMI Shielding, Heat Shielding) • By Vehicle Type (Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicle) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Laird PLC (UK), Dana Limited (US), Schaffner Holding (Switzerland), ElringKlinger AG (Germany), Federal-Mogul Corporation (US), Morgan Advanced Materials (UK), Henkel AG & Company, KGaA (Germany), Kitagawa Europe (Japan), Autoneum (Switzerland), Progress-WerkOberkirch AG (Germany) |

| Key Drivers | • Increased Electronics and Advanced Features Drive Demand for EMI Shielding in Automobiles • Stronger regulations, rising demand for performance and fuel efficiency, and increasing vehicle production drive the market for EMI Shielding in Automobiles |

| RESTRAINTS | • High replacement costs for heat and EMI shields due to wear and tear may hinder automotive shielding market growth. |