Automotive Parking Sensors Market Report Scope & Overview:

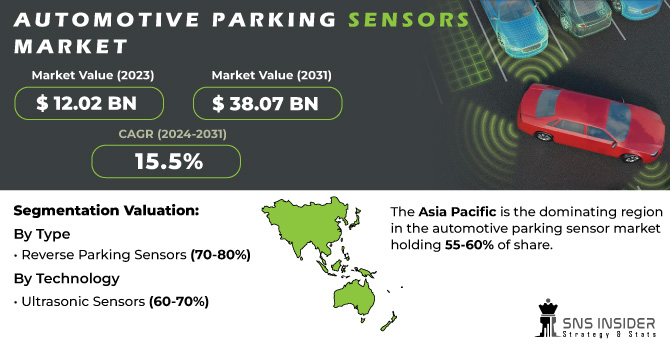

The Automotive Parking Sensors Market Size was valued at USD 12.02 billion in 2023 and is expected to reach USD 38.07 billion by 2031 and grow at a CAGR of 15.5% over the forecast period 2024-2031.

Advancement in automotive technology has led to the development of parking sensors, a valuable addition to the Advanced Driver Assistance System (ADAS). These sensors, placed on vehicles, warn drivers of obstacles while parking and optimize parking space usage, potentially easing parking woes in crowded cities. Parking sensors are considered a major success in automotive technology. Some vehicles even have dashboard screens connected to cameras, providing drivers with a clear view of blind spots, thus enhancing pedestrian safety, especially for children who might be invisible to the driver. Growing safety concerns are prompting regulatory bodies to mandate the pre-installation of parking sensors.

Get More Information on Automotive Parking Sensors Market - Request Sample Report

MARKET DYNAMICS:

KEY DRIVERS:

-

Parking Sensors Market Driven by Widespread Use in Vehicles to Enhance Safety and Parking Efficiency

The developing popularity of parking sensors over different vehicle sorts, including passenger cars, light commercial vehicles, and indeed heavy-duty trucks, is a key figure fueling the market's development. These sensors play a vital part in improving road safety by alerting drivers to nearby obstacles during parking. They help drivers in finding vacant parking spaces more effectively, a major advantage in crowded urban environments.

-

Innovations in sensor technology, like ultrasonic, radar, and camera-based systems, are offering more accurate and feature-rich parking assistance.

RESTRAINTS:

-

The cost of parking sensors can be a deterrent for budget-minded consumers, especially in price-sensitive regions.

-

Parking sensors may not detect all obstacles, especially in poor weather conditions or at blind spots beyond their range.

OPPORTUNITIES:

-

Mandatory Safety Features & AI Integration Drive Growth in Parking Sensor Market

The parking sensor market has seen significant growth due to the automotive industry, as it is constantly evolving, and governments around the world are implementing stricter safety regulations for vehicles. These regulations often require features that help drivers identify vacant parking spaces and avoid accidents. The growing adoption of artificial intelligence and Advanced Driver Assistance Systems creates opportunities for even more sophisticated parking sensors.

CHALLENGES:

-

Located on bumpers, sensors are prone to damage during parking or low-speed collisions.

-

Adding sensors to older vehicles can be expensive and technically challenging.

IMPACT OF RUSSIA-UKRAINE WAR

The Russia-Ukraine war has impacted the automotive parking sensor market, disrupting its growth in many ways. The war has increased the ongoing global chip shortage, a crucial component in parking sensors. This shortage is likely to delay production and inflate sensor prices by an estimated 5-10% due to supply chain disruptions. The sanctions imposed on Russia, a significant producer of raw materials like palladium (used in sensor circuitry), could further restrict production and potentially drive material costs up by 3-7%. These combined factors are expected to lead to a temporary slowdown in market growth, with a potential decline in production volume by 2-4% in the short term. Thus, the long-term impact remains uncertain and will depend on the war's duration and the resilience of the global supply chain.

IMPACT OF ECONOMIC SLOWDOWN

An economic slowdown can pose a significant threat to the automotive parking sensor market, potentially leading to a decline in sales by around 15-20% in the short term. The consumers facing economic hardship tend to delay unnecessary purchases, including new cars which are the primary recipients of pre-installed parking sensors. The slowdown can lead to production slowdowns or stoppages at car manufacturers, directly impacting the demand for sensor components. Additionally, reduced consumer spending power weakens the aftermarket sector, where individuals might opt to forgo adding parking sensors to existing vehicles due to budget constraints. These factors combined can cause bad effect throughout the market, potentially leading to lower revenue for sensor manufacturers and a temporary stall in market growth.

KEY MARKET SEGMENTS:

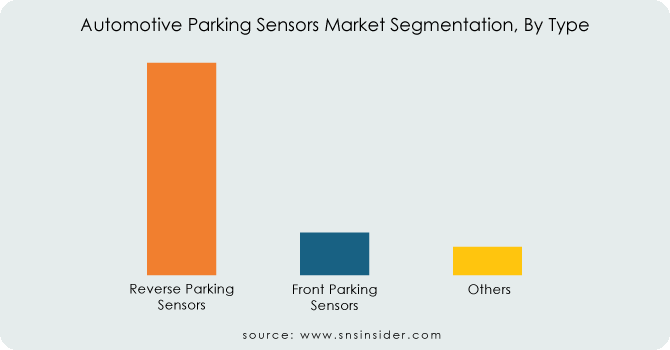

By Type:

-

Reverse Parking Sensors

-

Front Parking Sensors

-

Others

Reverse Parking Sensors is the dominating sub-segment in the automotive parking sensors market by type holding around 70-80% of market share. Reverse parking is generally considered more challenging than forward parking, as drivers have limited visibility behind their vehicles. Reverse parking sensors provide a crucial safety net, preventing collisions with obstacles while backing into parking spaces.

Get Customized Report as per your Business Requirement - Ask For Customized Report

By Technology:

-

Ultrasonic Sensors

-

Electromagnetic Sensors

-

Infrared Sensors

-

Laser

-

Others

The Ultrasonic Sensors is the dominating sub-segment in the automotive parking sensors market by technology holding around 60-70% of market share. Ultrasonic sensors are the most broadly utilized technology due to its affordability, reliability, and effectiveness in most parking scenarios. They transmit high-frequency sound waves to detect the objects and provide audible or visual warnings to the driver.

By Sales Channel:

-

OEM

-

Aftermarket

OEM (Original Equipment Manufacturer is the dominating sub-segment in the automotive parking sensors market by sales channel holding around 65-70% of market share. New cars are increasingly equipped with pre-installed parking sensors as standard features or options. This trend is driven by growing consumer demand for safety features and stricter government regulations in some regions.

By Vehicle Type:

-

Passenger cars

-

LCV

-

HCV

Passenger Cars is the dominating sub-segment in the automotive parking sensors market by vehicle type holding around 75-80% of market share. Passenger cars constitute the largest segment of the overall vehicle market. Additionally, parking challenges are more prevalent in urban areas where passenger cars are the primary mode of transportation. This high demand for parking solutions in conjunction with the larger vehicle base, fuels the dominance of parking sensors in passenger cars.

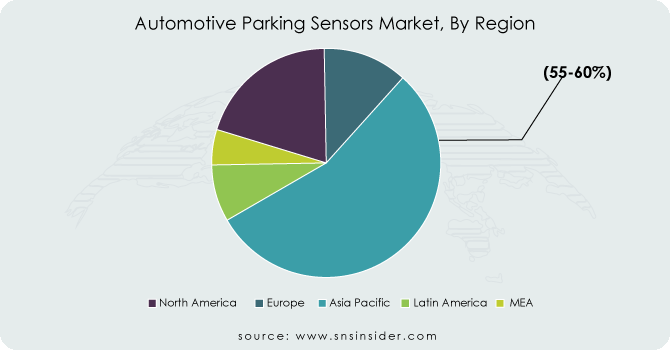

REGIONAL ANALYSES

The Asia Pacific is the dominating region in the automotive parking sensor market holding 55-60% of share. This dominance stems from a thriving auto industry with countries like China, Japan, and South Korea leading production. The rapid urbanization creates a constant struggle for parking spaces, making parking sensors an invaluable tool for drivers.

Europe is the second-largest region in this market with 25-30% of share due to its established car manufacturers and a safety-conscious consumer base receptive to technological advancements. Stringent EU regulations regarding pedestrian safety often mandate parking sensors in new vehicles, solidifying Europe's market presence.

North America is experiencing the fastest growth with 15-20% of share. This surge is fueled by increasing urbanization, rising car ownership, and a growing preference for larger vehicles like SUVs and trucks, all of which benefit from the enhanced safety and convenience offered by parking sensors.

REGIONAL COVERAGE:

North America

- US

- Canada

- Mexico

Europe

- Eastern Europe

- Poland

- Romania

- Hungary

- Turkey

- Rest of Eastern Europe

- Western Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Switzerland

- Austria

- Rest of Western Europe

Asia Pacific

- China

- India

- Japan

- South Korea

- Vietnam

- Singapore

- Australia

- Rest of Asia Pacific

Middle East & Africa

- Middle East

- UAE

- Egypt

- Saudi Arabia

- Qatar

- Rest of the Middle East

- Africa

- Nigeria

- South Africa

- Rest of Africa

Latin America

- Brazil

- Argentina

- Colombia

- Rest of Latin America

KEY PLAYERS

The major key players are Continental AG (Germany), Robert Bosch GmbH (Germany), NXP Semiconductors N.V. (the Netherlands), Valeo (France), Aptiv PLC (Greece), Denso Corporation (Japan), Autoliv Inc. (Sweden), Gentex Corporation (U.S.), TGS Group (UK), Murata Manufacturing Co., Ltd. (Japan) and other key players.

Valeo (France)-Company Financial Analysis

RECENT DEVELOPMENT

In Feb. 2023: BMW and Valeo are teaming up to develop next-generation Level 4 automated parking technology for BMW's upcoming Neue Klasse vehicles. This collaboration involves creating advanced sensors, software, and an ADAS domain controller.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 12.02 Billion |

| Market Size by 2031 | US$ 38.07 Billion |

| CAGR | CAGR of 15.5 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Reverse Parking Sensors, Front Parking Sensors, Others) • By Technology (Ultrasonic Sensors, Electromagnetic Sensors, Infrared Sensors, Laser, Others) • By Sales Channel (OEM, Aftermarket) • By Vehicle Type (Passenger cars, LCV, HCV) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Continental AG (Germany), Robert Bosch GmbH (Germany), NXP Semiconductors N.V. (the Netherlands), Valeo (France), Aptiv PLC (Greece), Denso Corporation (Japan), Autoliv Inc. (Sweden), Gentex Corporation (U.S.), TGS Group (UK), Murata Manufacturing Co., Ltd. (Japan) |

| Key Drivers | • Parking Sensors Market Driven by Widespread Use in Vehicles to Enhance Safety and Parking Efficiency • Innovations in sensor technology, like ultrasonic, radar, and camera-based systems, are offering more accurate and feature-rich parking assistance. |

| Restraints | • The cost of parking sensors can be a deterrent for budget-minded consumers, especially in price-sensitive regions. • Parking sensors may not detect all obstacles, especially in poor weather conditions or at blind spots beyond their range. |