Automotive Wheel Rims Market Report Scope & Overview:

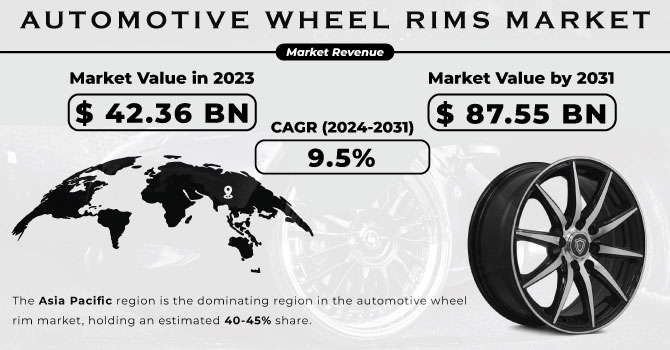

The Automotive Wheel Rims Market Size was valued at USD 42.36 billion in 2023 and is expected to reach USD 87.55 billion by 2031 and grow at a CAGR of 9.5% over the forecast period 2024-2031.

As the demand for high-performance and fuel-efficient vehicles rises, lightweight wheel edges are getting to be dynamically well known. These rims significantly impact driving experience by progressing the power-to-weight proportion, driving to superior ride quality and in general vehicle execution.

Get More Information on Automotive Wheel Rims Market - Request Sample Report

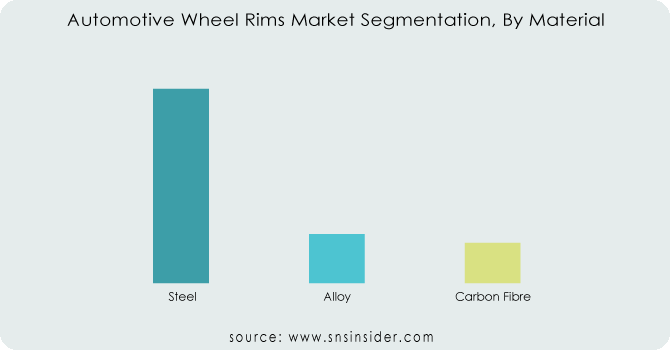

The well-designed rims improve stability and ensure precise rolling, braking, and other basic activities. Beyond performance, wheel rims play a crucial aesthetic role. The different plans and wraps up accessible cater to a wide extend of consumer preferences, further driving market growth. Traditionally, alloys and steel have been the essential materials for rim production. In any case, high-performance vehicles like sports cars are progressively utilizing progressed materials like carbon fibre. Carbon fibre boasts prevalent properties like high tensile strength, thermal and chemical resistance, and remarkable lightweight characteristics, making it a compelling choice for automotive wheel rims.

MARKET DYNAMICS:

KEY DRIVERS:

-

Urbanization and infrastructure development in emerging markets fuel the demand for automobiles and subsequently, automotive wheels.

The rise in urbanization and infrastructure development, especially in developing markets, directly fuels the demand for automobiles and subsequently, automotive wheels. This drift is driven by the extending number of people moving to cities, where car ownership gets to be a more practical and desirable means of personal transportation. Improved infrastructure like roads and highways further encourages car utilization, driving to a rising number of vehicles on the road and a ensuing increase in the demand for automotive wheels.

-

Lightweight materials, advanced production methods, and innovative designs fuel automotive wheel market expansion.

RESTRAINTS:

-

Fluctuations in raw material prices impact automotive wheel manufacturing costs.

The automotive wheel market faces a potential issue in the form of fluctuating raw material prices. Steel, aluminium, and carbon fibre which are the essential materials utilized in wheel generation, are subject to market changes. When the costs of these materials rise, it directly influences the manufacturing cost of car wheels. This can lead to increased costs for the final product, influencing customer affordability and possibly influencing generally market demand. Manufacturers may need to adjust their pricing strategies or seek alternative materials to moderate the effect of such cost swings and maintain affordability for their products.

-

Shifting consumer preferences for EVs, autonomous vehicles, and specific wheel designs necessitate product adaptations by manufacturers.

OPPORTUNITIES:

-

Manufacturers prioritize advanced facilities, new machinery, and FEA analysis to gain global market recognition.

CHALLENGES:

-

Developing nations' low adoption, fluctuating material costs, and the need for lightweight, compliant wheels with rising replacements hinder automotive wheel market growth.

IMPACT OF RUSSIA-UKRAINE WAR

The Russia-Ukraine war has severely disrupted the automotive wheel rim market, creating several crisis. The Ukraine is the key supplier of components like wiring harnesses has seen production halts and delays, impacting European and global production. Additionally, Russia, a major source of vital metals like nickel and palladium crucial for wheel production, faces sanctions and export disruptions, leading to significant price hikes. This combined effect is estimated to cut global car production by millions, directly impacting the demand for new wheels. Long-term consequences are likely to include cost inflation as rising raw material and transportation costs translate to higher wheel rim prices, potentially dampening consumer demand. Manufacturers will likely seek alternative suppliers for critical materials, potentially altering the global market landscape. Furthermore, the need for fuel efficiency and emission reduction will likely push manufacturers towards lightweight materials like carbon fibre, despite potential cost challenges.

IMPACT OF ECONOMIC SLOWDOWN

Economic slowdowns has reduced consumer spending power which leads to a decline in new car purchases, possibly causing a critical drop in demand for new wheel rims, demand for new wheel rims, during such periods. The buyers limit their budgets, driving to postponed non-essential car maintenance like wheel replacements affecting the aftermarket portion and possibly causing a 5-10% decline in sales. Automakers may moreover be constrained to reduce generation or stop operations, specifically affecting the demand for original equipment manufacturer (OEM) wheel rims, possibly leading to a decrease of 15-25% in demand. The long-term impacts incorporate descending weight on costs due to reduced demand, possibly affecting profit margins by 5-10%. Unsold wheel rim inventory can accumulate, driving to potential capacity costs and cash flow issues for producers and wholesalers. Furthermore, weaker players may struggle to survive, possibly driving to market consolidation and reduced competition, possibly resulting in a shift in market share of 5-10% towards larger players.

KEY MARKET SEGMENTS:

By Material:

-

Steel

-

Alloy

-

Carbon Fibre

Steel is the dominating sub-segment in the Automotive Wheel Rims Market by material, estimated at around 60-70% of market share. Steel is significantly cheaper than alloy or carbon fibre, making it the preferred choice for budget-conscious consumers. Steel rims are known for their strength and ability to withstand heavy loads, making them ideal for commercial vehicles.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Vehicle Type:

-

Passenger cars

-

Commercial vehicles

Passenger Cars is the dominating sub-segment in the Automotive Wheel Rims Market by vehicle type, estimated at around 70-80% of market share. Passenger cars significantly outnumber commercial vehicles on the road, leading to higher demand for their wheels. Passenger car owners often prioritize visually appealing and performance-enhancing wheels, driving demand for alloy and carbon fibre options.

By Rim Size:

-

13”-15”

-

16”-18”

-

19”-21”

-

Above 21”

16”-18” is the dominating sub-segment in the Automotive Wheel Rims Market by rim size, estimated at around 40-50% of market share. This size range provides a wide variety of visually appealing designs. Performance: Offers good handling characteristics without significantly impacting fuel efficiency. Strikes a balance between cost and performance compared to larger sizes.

REGIONAL ANALYSES

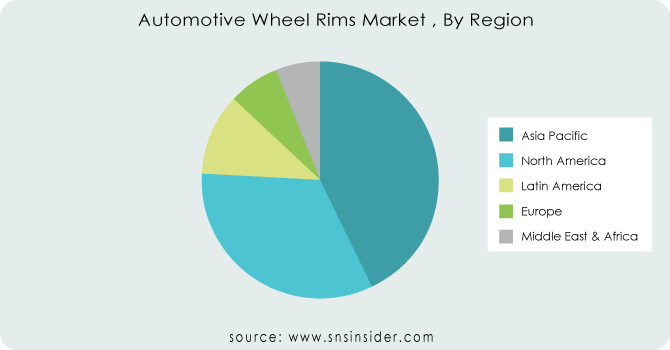

The Asia Pacific region is the dominating region in the automotive wheel rim market, holding an estimated 40-45% share. This dominance stems from a thriving automotive manufacturing hub in countries like China and India, leading to a high demand for wheel rims. The steel wheels dominate due to their affordability and cater to a budget-conscious consumer base, the region is also witnessing a shift towards larger and more visually appealing wheels, potentially leading to increased adoption of alloy and even carbon fibre options in the future. North America is the second highest region in this market holding a share of approximately 30-35%, driven by its well-established automotive industry and a strong aftermarket sector. Consumers here often favour larger wheels, contributing to the demand for alloy and carbon fibre options alongside the prevalent steel rims.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are TSW Alloy Wheels (US), Fuel Offroad Wheels (US), CLN Group, Maxion Wheels Inc. (US), Euromax Wheel (US), VOXX International Corporation (US), Sota Offroad (US), Mobile Hi-Tech Wheels Inc. (US), Status Wheels (TUFF A.T) (US), Wheel Pros Holdings, LLC (US), Topy Industries Limited (Japan) and other key players.

Fuel Offroad Wheels (US)-Company Financial Analysis

RECENT DEVELOPMENTS:

-

In Sept., 2022 - Maxion Wheels, the world's top wheel producer, announced the opening of its newest truck steel wheels plant in Turkey, built in partnership with Inci Holding. This marks a significant expansion for the company.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 42.36 Billion |

| Market Size by 2031 | US$ 87.55 Billion |

| CAGR | CAGR of 9.5% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Material (Steel, Alloy, Carbon Fibre) • by Vehicle Type (Passenger cars, Commercial vehicles) • by Rim Size (13”-15”, 16”-18”, 19”-21”, Above 21”), |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America |

| Company Profiles | TSW Alloy Wheels (US), Fuel Offroad Wheels (US), CLN Group, Maxion Wheels Inc. (US), Euromax Wheel (US), VOXX International Corporation (US), Sota Offroad (US), Mobile Hi-Tech Wheels Inc. (US), Status Wheels (TUFF A.T) (US), Wheel Pros Holdings, LLC (US), and Topy Industries Limited (Japan) |

| Key Drivers | •Due to increased vehicle production and the continued trend of vehicle weight reduction. •The need for lightweight wheels to reduce vehicle weight and improve fuel efficiency. |

| RESTRAINTS | •By fluctuating raw material prices in the EV battery production process. •The market is projected to be constrained by a lack of standardization in automobile wheel production methods. |