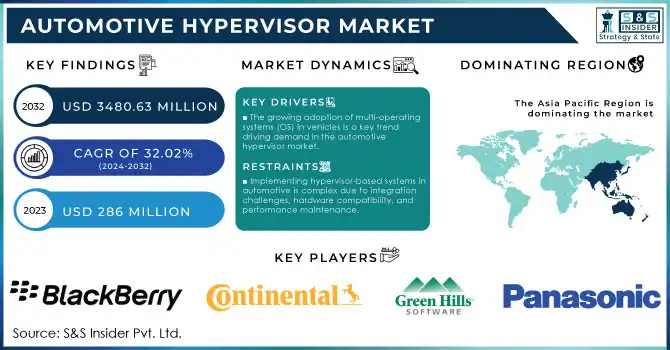

Automotive Hypervisor Market Key Insights:

To Get More Information on Automotive Hypervisor Market - Request Sample Report

The Automotive Hypervisor Market size was valued at USD 286 Million in 2023 and is now anticipated to grow USD 3480.63 Million by 2032, displaying a compound annual growth rate (CAGR) of 32.02% during the forecast Period 2024-2032.

The automotive hypervisor market is experiencing significant growth, driven by the evolution of vehicles into highly connected, autonomous systems with sophisticated in-vehicle technology. In the automotive industry, a hypervisor functions as a software layer that enables multiple operating systems (OS) to operate concurrently on a single hardware platform. This technology is instrumental in improving resource allocation, ensuring system safety, and providing necessary isolation between critical and non-critical vehicle functions. As a result, automotive hypervisors are becoming essential for applications such as advanced driver-assistance systems (ADAS), infotainment, and autonomous driving technologies.

With the increasing complexity of in-car electronics, Original Equipment Manufacturers (OEMs) and Tier 1 suppliers are increasingly integrating hypervisors into vehicle architectures to manage various software applications efficiently. Hypervisors allow these manufacturers to isolate critical and non-critical functions, ensuring optimal performance, stability, and security across the vehicle’s systems. This isolation is particularly crucial for real-time critical systems, such as safety features, which require separation from infotainment or navigation systems to maintain reliability and system integrity.

| Feature | Description | Commercial Products |

|---|---|---|

| Multi-OS Virtualization | Enables the simultaneous running of multiple operating systems on a single hardware platform, essential for automotive systems requiring diverse functionalities. | BlackBerry QNX Hypervisor, Wind River Hypervisor for Automotive |

| Real-Time Performance | Provides low-latency, real-time performance for critical automotive functions such as safety and driving assistance systems. | AGL (Automotive Grade Linux) Hypervisor, Mentor Graphics Hypervisor |

| Isolation of Safety Functions | Ensures separation of safety-critical and non-critical applications for better security and performance. | Green Hills INTEGRITY MultiView, Virtual Open Systems Hypervisor |

| Scalability | Offers scalability to support a wide range of automotive applications, from infotainment to ADAS (Advanced Driver Assistance Systems). | Renesas R-Car Hypervisor, AOSP-based Hypervisors |

| Security and Safety Compliance | Adheres to functional safety standards like ISO 26262 for automotive applications, ensuring secure and safe virtualization. | Harman Automotive Hypervisor, NXP i.MX Hypervisor |

| High Availability and Reliability | Ensures continuous operation of critical automotive systems by maintaining high availability and redundancy. | Wind River VxWorks Hypervisor, Linaro Hypervisor |

| Resource Allocation Efficiency | Optimizes the distribution of computing resources between different virtual machines, ensuring optimal performance. | AGL Hypervisor, KUKA Automotive Virtualization Solutions |

| Cost-Effective Solution | Offers cost savings by reducing hardware requirements and enabling the use of a single processor for multiple applications. | Intel Virtualization Technology for Automotive, Xilinx Automotive Hypervisor |

| Integrated Development Tools | Provides easy integration with automotive development tools, simplifying the design and validation of virtualized systems. | Mentor Embedded Hypervisor, Qualcomm Automotive Virtualization Platform |

| Integration with Embedded Systems | Works seamlessly with embedded systems commonly used in automotive electronics, enabling efficient software deployment. | QNX Hypervisor for Safety, Infineon Automotive Hypervisor |

MARKET DYNAMICS

DRIVERS

-

Growing demand for ADAS, infotainment, and autonomous driving technologies fuels the need for automotive hypervisors to support flexible, powerful computing environments.

The increased demand for advanced in-vehicle systems is a significant driver in the growth of the Automotive Hypervisor Market. As automotive technologies evolve, particularly with the rise of Advanced Driver Assistance Systems (ADAS), infotainment, and autonomous driving, there is a growing need for more powerful and flexible computing solutions to manage these complex systems. Vehicles today are becoming increasingly reliant on multiple software applications and systems that work simultaneously, such as real-time safety applications, entertainment systems, navigation, and communication tools. Automotive hypervisors address this need by enabling virtualization. They allow multiple operating systems to run on the same hardware, each in its isolated environment, ensuring that safety-critical systems like ADAS or autonomous driving software do not interfere with non-critical systems like infotainment. This separation is crucial for both security and reliability, as it ensures that failures or vulnerabilities in one system do not compromise others.

-

The growing adoption of multi-operating systems (OS) in vehicles is a key trend driving demand in the automotive hypervisor market.

As modern vehicles incorporate increasingly complex technologies, the need for multiple specialized OSes within a single vehicle has surged. For instance, infotainment systems often run on Linux or Android, while safety-critical systems—such as those supporting advanced driver-assistance systems (ADAS) and autonomous driving—operate on real-time operating systems (RTOS) to deliver high reliability and low latency. Similarly, telematics and in-vehicle communication systems frequently rely on embedded OSes. Automotive hypervisors facilitate the secure and efficient operation of these diverse OSes on a shared hardware platform, ensuring that each system performs independently without interference, which is essential for vehicle stability, security, and performance in complex automotive applications.

RESTRAIN

-

Implementing a hypervisor-based system in automotive applications is complex due to the challenges of integrating multiple operating systems, ensuring hardware compatibility, and maintaining system performance.

Implementing a hypervisor-based system in automotive applications is inherently complex due to several factors. The primary challenge lies in integrating multiple operating systems (OS) onto a single hardware platform. In modern vehicles, various OS platforms are required to run different applications—such as real-time operating systems (RTOS) for safety-critical systems (e.g., ADAS), and general-purpose OS for infotainment and telematics. A hypervisor manages these multiple OSes by creating isolated virtual environments on the same physical hardware, ensuring that each system operates independently. This integration requires significant technical expertise to ensure that the hypervisor supports the full range of applications needed while maintaining robust communication and resource allocation between them. Compatibility with existing hardware also poses a challenge. Automotive systems often use hardware with strict specifications for safety and performance, making it difficult to retrofit new virtualization solutions without extensive re-engineering. Hypervisors must be compatible with automotive-grade processors and meet stringent safety standards, such as ISO 26262 for functional safety.

KEY SEGMENTATION ANALYSIS

By Product

The Type 1 automotive hypervisor segment accounted for the largest revenue share of 57.90% in 2023. Unlike Type 2 hypervisors, which rely on an underlying operating system, Type 1 hypervisors run directly on the vehicle's hardware, making them highly efficient and reliable. This architecture allows Type 1 hypervisors to deliver superior performance and security, making them ideal for safety-critical and mission-critical applications in the automotive industry. They are responsible for managing real-time operations, advanced driver-assistance systems (ADAS), and other essential vehicle functions. By operating at the hardware level, Type 1 hypervisors also ensure enhanced system separation, preventing non-critical software from interfering with safety-critical systems.

By End-User

In 2023, the luxury segment dominated the market share over 58%, as luxury car manufacturers focused on offering an exceptional user experience. Automotive hypervisors play a crucial role in this by seamlessly integrating various infotainment systems, digital displays, navigation tools, and entertainment features within the vehicle. Additionally, safety remains a top priority for high-end vehicles, and hypervisors enhance both active and passive safety measures. By virtualizing critical systems such as collision avoidance, adaptive cruise control, and emergency braking, automotive hypervisors ensure that these safety functions operate efficiently without compromising safety standards. This combination of advanced technology and safety features contributes to the growing dominance of the luxury segment in the automotive industry.

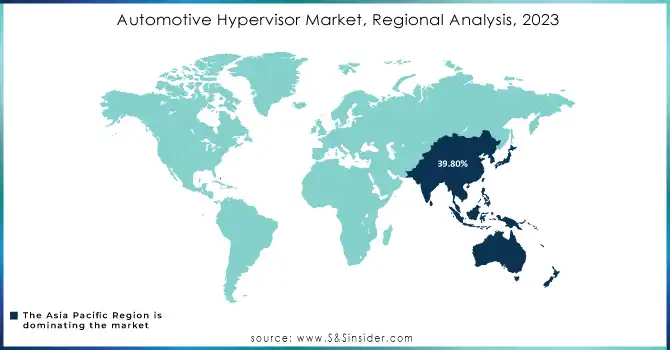

KEY REGIONAL ANALYSIS

In 2023, the Asia Pacific region accounted for the largest market share, capturing 39.80% of the revenue. This growth is primarily driven by increasing consumer awareness and demand for connected vehicle technologies. As consumers show a growing preference for vehicles equipped with advanced features such as enhanced connectivity and autonomous capabilities, automakers are responding by integrating hypervisor technology into their designs. Hypervisors enable the seamless operation of multiple vehicle functions, including infotainment, navigation, and safety features, on a single platform. Additionally, significant investments from automotive manufacturers and tech companies in research and development (R&D) of connected and autonomous driving technologies are further accelerating the adoption of hypervisor solutions in the region.

North America is projected to experience substantial growth at a strong compound annual growth rate (CAGR) throughout the forecast period. A key factor contributing to this expansion is the rising focus on vehicle safety and cybersecurity. Automotive manufacturers are increasingly adopting hypervisor technology to enhance security by isolating critical functions within the vehicle’s systems, thereby preventing unauthorized access to sensitive data. This heightened emphasis on robust security protocols in modern vehicles is driving the demand for automotive hypervisors. Furthermore, the growing popularity of electric vehicles (EVs) in North America plays a significant role in propelling the market. As the automotive industry shifts towards electric mobility, EVs require advanced technology to ensure safety, performance, and data protection, boosting the adoption of hypervisor solutions. This combination of security concerns and the rise of EVs is fueling the demand for automotive hypervisors across the region.

Do You Need any Customization Research on Automotive Hypervisor Market - Inquire Now

Some of the major key players of Automotive Hypervisor Market

-

BlackBerry Limited (QNX Hypervisor)

-

Continental AG (Automotive Hypervisor Solutions)

-

Green Hills Software (INTEGRITY RTOS and Hypervisor)

-

Infineon Technologies AG (AURIX™ Hypervisor)

-

NXP Semiconductor N.V. (NXP Hypervisor Solutions)

-

Panasonic Holdings Corporation (Automotive Infotainment and Hypervisor Solutions)

-

Renesas Electronics Corporation (Automotive Hypervisor Solutions)

-

Sasken Technologies Ltd (Sasken Automotive Hypervisor)

-

Siemens (Automotive Software & Hypervisor Solutions)

-

Visteon Corporation (SmartCore® In-Vehicle Computing Platform with Hypervisor)

-

Aptiv PLC (ADAS and Hypervisor Solutions)

-

Intel Corporation (Intel Hypervisor for Automotive)

-

VMware Inc. (VMware Hypervisor for Automotive Applications)

-

Harman International (Samsung Electronics) (Automotive Infotainment with Hypervisor)

-

Elektrobit (EB) (EB tresos Hypervisor)

-

Xilinx (now part of AMD) (Automotive Hypervisor Solutions with FPGA integration)

-

Littelfuse, Inc. (Automotive Electronics and Hypervisor Solutions)

-

Micron Technology (Memory solutions for Automotive Hypervisors)

-

Qualcomm Technologies, Inc. (Snapdragon Automotive Platforms with Hypervisor)

-

Texas Instruments (TDAx Series Automotive Processors and Hypervisor Solutions)

RECENT DEVELOPMENTS

-

In April 2024: BlackBerry Limited revealed its partnership with ETAS GmbH to promote and market software solutions designed to enhance safety-critical functions in next-generation software-defined vehicles.

-

In January 2024: Panasonic Holdings Corporation introduced a new system that enhances high-performance computing by integrating multiple CUs into a single platform, optimizing the management of features like driving support and entertainment.

-

In January 2024: Panasonic Automotive Systems introduced its High-Performance Compute (HPC) system, called Neuron. This cutting-edge technology is designed to meet the rapidly changing mobility demands of software-defined vehicle development. Panasonic Automotive's Neuron HPC enables both software updates and upgrades, as well as hardware enhancements throughout the platform's lifecycle.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 286 Million |

| Market Size by 2032 | USD 3480.63 Million |

| CAGR | CAGR of 32.02% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Type 1 Automotive Hypervisor, Type 2 Automotive Hypervisor) • By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles) • By End User (Economy, Mid-Priced, Luxury) • By Mode of Operation (Autonomous Vehicle, Semi-autonomous Vehicle) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BlackBerry Limited, Continental AG, Green Hills Software, Infineon Technologies AG, NXP Semiconductor N.V., Panasonic Holdings Corporation, Renesas Electronics Corporation, Sasken Technologies Ltd, Siemens, Visteon Corporation, Aptiv PLC, Intel Corporation, VMware Inc., Harman International (Samsung Electronics), Elektrobit (EB), Xilinx (now part of AMD), Littelfuse, Inc., Micron Technology, Qualcomm Technologies, Inc., Texas Instruments. |

| Key Drivers | • The growing demand for advanced in-vehicle systems like ADAS, infotainment, and autonomous driving technologies is driving the need for powerful and flexible computing, with automotive hypervisors enabling multiple virtualized environments on the same hardware. • Automotive manufacturers are integrating multiple operating systems in vehicles for different domains, and hypervisors enable secure, efficient management of these systems, driving their adoption. |

| Restraints | • Implementing a hypervisor-based system in automotive applications is complex due to the challenges of integrating multiple operating systems, ensuring hardware compatibility, and maintaining system performance. |