Automotive Camera Cleaning System Market Size:

Get More Information on Automotive Camera Cleaning System Market - Request Sample Report

The Automotive Camera Cleaning System Market Size was valued at USD 1243.30 Million in 2023 and is expected to reach USD 6861.32 Million by 2032 and grow at a CAGR of 21.01% over the forecast period 2024-2032.

The Automotive Camera Cleaning System Market is showing a swift growth pattern because more and more cameras are becoming part of the newer, modern vehicle safety systems. Cameras are one of the key components in autonomous driving and advanced driver-assistance systems, which enhance safety, navigation, and monitoring capabilities. However, these cameras are often exposed to dirt, debris, rain, and snow, preventing them from functioning properly. In short, making cameras always clear and operational through all sorts of weathers is a vital factor in the automotive camera cleaning systems.

The further impetus for the market will be facilitated by governments around the world, especially in the U.S., through rigorous implementation of regulations regarding vehicle safety. For instance, the National Highway Traffic Safety Administration (NHTSA) of the United States has issued rules requiring camera-based systems in vehicles with ADAS to be serviced on a regular basis and ideally operate under all conditions. One of the major growth drivers for the market is increasing consumer awareness of safety features backed by policies.

Recent innovations in the market include cleaning systems complete with nozzles, sensors, and even heated water that clean cameras. Some systems can automatically detect when a camera is blocked and start cleaning without driver action. For instance, ProViu 360 Surround View System classifies a detected object near the construction machine as a person and warns of possible collisions. Transparent Chassis offers even more visibility and precision for machines with projecting superstructures. Clean Camera Assistant, another new feature is detection of dirty or blocked camera lenses. The integration of such cleaning systems with other safety features like radar and LiDAR has also sparked new market opportunities.

By and large, the future of the Automotive Camera Cleaning System Market appears very promising, which could propel the growth in markets like North America and Asia Pacific. Further, with growing demands for electric and autonomous vehicles in the U.S., and added incentives from governments, the trend is likely to speed up market growth. Besides, increased vehicle manufacturing in countries like China and India will further spur demand for camera cleaning systems in the Asia Pacific region. With automotive technology on the rise, the need for reliable cleaning systems to ensure optimal camera functionality will continue to grow steadily in the market between 2024 and 2032.

MARKET DYNAMICS

KEY DRIVERS:

-

Increasing Deployment of ADAS in New Automobiles across the Globe.

One of the most key drivers of the Automotive Camera Cleaning System Market is increasing adoption of ADAS. Because of increasing emphasis on vehicle safety and regulations, ADAS becomes more of an ordinary feature for luxury as well as mid-range vehicles. These systems depend mostly on cameras for lane-keeping assistance, adaptive cruise control, and automatic parking. However, for their cameras to be reliable enough to capture events in good detail especially in hostile weather, a good cleaning system is highly needed. This is supported by the government's imposition of safety systems in new vehicles. As penetration increases for ADAS across various vehicle segments, there will be an increasing requirement for effective camera cleaning systems, thereby propelling growth in the market.

-

Rising Innovation and Deployment of Autonomous Vehicles around the World.

The main driver in the Automotive Camera Cleaning System Market is the high rate of development and adoption of autonomous vehicles. Autonomous vehicles, especially those at the higher levels of autonomy, are found to heavily rely on the camera systems for navigation, object recognition, and decision-making. Anything that obstructs the view of the camera will compromise the ability of the vehicle to be operated safely; thus, integration of cleaning systems has become an essential component in the overall system of the vehicle. According to a report, Car-borne pedestrian deaths increased 19 percent from 2019 to 2022. And, says American Automobile Association, three-quarters of all pedestrian fatalities happen at night. The Magna International is working hard to change that is a great example of an automotive technology supplier, which has supplied thermal technology installed on 1.2 million vehicles and growing.

There will be tremendous demand for camera cleaning systems with growing countries and regions focusing on achieving an autonomous transportation future. In addition, the companies major in the automotive sector are constantly investing in research and development to improve the reliability and efficiency of such systems so that they can function under varying environmental conditions, which will positively drive the market.

RESTRAINT:

-

The system integration cost of camera cleaning systems is too high.

The Automotive Camera Cleaning System Market has a serious limitation in terms of very high cost to equip the vehicles with these systems, especially in lower-end variants. The camera cleaning systems have to endure modern sensor technology as well as heating elements and designs that are pretty complex. This will naturally increase the cost in the product. Most budgets-friendly or economy variants for car manufacturers won't be able to afford the extra expense. Moreover, in markets where cost sensitivity is high, consumers might regard added features like camera cleaning system as secondary to inclusion, and therefore, the adoption of the system in the larger market will continue to be hindered. Once again, OEMs will have to face the challenge of pricing a vehicle and then recovering extra costs related to the extra expenses brought about by these systems. This is especially vital in areas where regulatory standards for such systems are not fully developed, thereby curtailing the short-term demand for adoption.

KEY MARKET SEGMENTS

BY SALES CHANNEL

The Automotive Camera Cleaning System Market is divided into OEM (Original Equipment Manufacturer) and Aftermarkets. In 2023, the Original Equipment Manufacturer dominated the market with a 64.52% market share. This is due to increased adoption of camera cleaning systems as part of bundled offerings in new-vehicle sales, especially higher-end and electric models. Due to regulatory and consumer demand pressures to improve safety features, OEMs are adding advanced camera cleaning solutions. Beside OEMs, customised solutions best suited for vehicle models mean that the cleaning systems could seamlessly integrate with other camera-based safety technologies.

The Aftermarkets segment is expected to continue growing at the fastest rate with a CAGR of 14.9% during the forecast period, 2024-2032. The demand is increasing with the growing numbers of automobiles that are plying on roads, which need frequent cleaning. As the number of ageing automobiles increases, the greater degree of requirement for solutions in the aftermarket-from retrofitting older vehicles to camera cleaning systems-will be from car owners. The aftermarket channel is also growing as consumers are increasing their knowledge about the necessity of camera system cleanliness in ensuring the best safety features and also the best driving performance.

BY VEHICLE TYPE

The Automotive Camera Cleaning System Market can be divided into different types of vehicles. They are Heavy Commercial Vehicles, Light Commercial Vehicles, and Passenger Cars. As per 2023 data, Passenger cars had the largest share of the entire market, which amounts to 62.99%. The dominance is driven by the volume of passenger vehicles produced globally, primarily in regions such as North America, Europe, and Asia Pacific, where ADAS and camera-based safety systems are becoming increasingly standard. Consumers in the passenger car segment are more likely to add additional safety features, including camera cleaning systems, as a part of a premium or electric vehicle model.

Growth in Light Commercial Vehicles is anticipated to be the fastest CAGR of 22.4% during the forecast period of 2024-2032. The growth will be led by an increased adoption of ADAS in LCVs, particularly in urban delivery vehicles and electric commercial fleets. As more e-commerce and last-mile delivery services come into the picture, the demand for safety and navigation systems in LCVs is on the rise, and as such, efficient camera cleaning systems are in dire need to ensure that cameras keep functioning without interruption. Thereby, regulatory authorities will also look to stringently implement stronger safety standards for commercial vehicles which will add further might to the growth of this market segment.

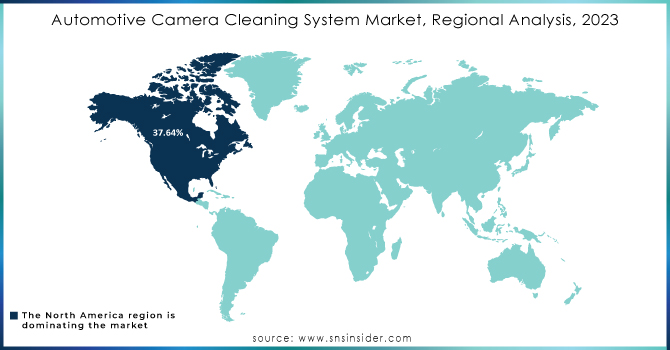

REGIONAL ANALYSIS

In the year 2023, the North America region held the highest market share of Automotive Camera Cleaning System of 37.64%. Advanced safety systems in general, and most notably in the USA, have experienced an increased adoption rate, particularly surrounding ADAS and autonomous vehicle technologies, making the widespread use of camera cleaning systems increasingly popular. Major automotive manufacturers and technology providers in North America contribute to the market's growth and are, as such, continually developing innovative cleaning solutions for camera systems.

Asia Pacific is expected to gain the highest CAGR of 24.0% during the period 2024-2032. The increasing passenger and commercial vehicle production has been a vital factor behind this high growth rate in this region, with China, Japan, and India among the major contributors. In addition, with an increased focus on automobile safety and the increasing trend toward the adoption of electric and autonomous vehicles, the demand for camera cleaning systems in the region is most likely to rise. Government initiatives toward improving automotive safety standards will boost market growth in Asia Pacific even further.

Need Any Customization Research On Automotive Camera Cleaning System Market - Inquiry Now

KEY PLAYERS

Some of the major players in Automotive Camera Cleaning System Market are:

-

Continental AG (Camera cleaning system, ADAS solutions)

-

Valeo (Automated cleaning systems, Vehicle sensors)

-

dlhBOWLES (Fluidic nozzles, Camera cleaning solutions)

-

Kautex Textron GmbH (Camera cleaning nozzles, Headlamp cleaning systems)

-

Ficosa (Vision systems, Camera cleaning modules)

-

Magna International (ADAS technologies, Camera cleaning systems)

-

Bosch Mobility Solutions (Sensor cleaning solutions, Autonomous driving systems)

-

Denso Corporation (Camera washers, ADAS systems)

-

Hella GmbH (Camera-based safety systems, Cleaning solutions)

-

ZF Friedrichshafen AG (Camera sensors, Cleaning systems)

-

Gentex Corporation (Camera monitoring systems, Lens cleaning technologies)

-

MARELLI (ADAS solutions, Cleaning systems for cameras)

-

PPG Industries (Cleaning solutions, Windshield coatings)

-

Waymo (Autonomous vehicle cameras, Camera cleaning technologies)

-

Tesla (Autonomous driving cameras, Vision systems)

-

Hyundai Mobis (ADAS systems, Camera cleaning technologies)

-

Aptiv (Vehicle safety systems, Camera cleaning solutions)

-

Autoliv Inc. (Camera-based safety systems, Cleaning solutions)

-

Omron Corporation (Camera modules, Cleaning technologies)

-

Panasonic Corporation (Vehicle cameras, Cleaning systems)

RECENT TRENDS

January 2024: Valeo partnered with Teledyne FLIR, a business unit of Teledyne Technologies Incorporated, to mark the dawn of thermal imaging technology for automotive. Collaboration aims at enhancing road safety through the next generation of Advanced Driver Assistance Systems equipped with high-performance thermal imaging cameras, ushering in the future of vehicle safety and making better and healthier roads for all.

January 2024: The Gentex Corporation announced its acquisition of Toronto-based eSight. For its part, the $2 billion Zeeland, Michigan-based parent company will bring to bear decades of experience in the manufacture of electro-optical products for the global automotive, aerospace, and fire protection industries with a dedicated focus on connected car technology to improve driver vision.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1243.30 Million |

| Market Size by 2032 | US$ 6861.32 Million |

| CAGR | CAGR of 21.01 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vehicle Type(Heavy Commercial Vehicles,Light Commercial Vehicles, Passenger Cars) • By Application (Parking Camera, Front Camera, Night Vision Camera, Interjection Camera, CMS Camera, Mirror Camera) • By Nozzle Type (Fixed Nozzle, Telescoping Nozzle, Nano Nozzle) • By Sales Channel (OEM, Aftermarkets) |

| Regional Analysis/Coverage | • Increasing Deployment of ADAS in New Automobiles across the Globe. • Rising Innovation and Deployment of Autonomous Vehicles around the World. |

| Company Profiles | Continental AG, Valeo, dlhBOWLES, Kautex Textron GmbH, Ficosa, Magna International, Bosch Mobility Solutions, Denso Corporation, Hella GmbH, ZF Friedrichshafen AG, Gentex Corporation, MARELLI, PPG Industries, Waymo, Tesla, Hyundai Mobis, Aptiv, Autoliv Inc., Omron Corporation, Panasonic Corporation. |

| Key Drivers | • Increasing Deployment of ADAS in New Automobiles across the Globe. • Rising Innovation and Deployment of Autonomous Vehicles around the World. |

| Restraints | • The system integration cost of camera cleaning systems is too high. |