Automotive Stainless Steel Tube Market Report Scope & Overview:

To get more information on Automotive Stainless Steel Tube Market - Request Free Sample Report

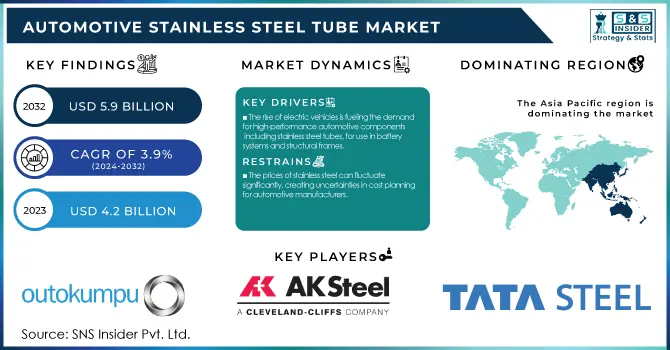

The Automotive Stainless Steel Tube Market Size was valued at USD 4.2 Billion in 2023 and is expected to reach USD 5.9 Billion by 2032, growing at a CAGR of 3.9% over the forecast period 2024-2032.

The automotive stainless steel tube market is driven by increasing demand for lightweight, durable, and corrosion-resistant materials in automotive manufacturing. With governmental regulations across the world becoming stricter in emission norms and demand for fuel-efficient vehicles soaring globally, automotive manufacturers are forced to adopt lighter and performance-improvement materials. The EU CO2 emissions standards, which come into effect this year, require that fleet-wide CO2 emissions from new cars are reduced to 95g/km from the previous target of 130g/km, according to the European Commission. The demand for stainless steel tubes in the automotive sector has received an additional boost from this focus on fuel-efficient vehicles, especially for exhaust systems, fuel lines, and structural applications.

In the U.S., CAFE (Corporate Average Fuel Economy) standards require manufacturers to average 54.5 mpg across their vehicle lineup by 2025, as enforced by the National Highway Traffic Safety Administration (NHTSA). The regulations are encouraging the adoption of lightweight and high-strength materials such as stainless steel tubes, which are ideal for auto parts that need to be both strong and low-weight. Similarly, the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme of the Indian government is expected to trigger the growth of electric vehicles, thereby creating further demand for stainless steel tubes. That is, electric vehicles (EVs) and hybrid vehicles use more parts that need corrosion resistance than any conventional vehicle when compared to weight, volume, or use. With automotive companies facing rigorous laws across the globe and consumers wanting tougher, durable, lightweight designs, the demand for stainless steel tubes is only going to increase, experts say. The automotive sector is expected to witness the demand for stainless steel tubes during the forecast period owing to the growing adoption of electric and hybrid vehicles, as well as tightening regulatory measures.

Automotive Stainless Steel Tube Market Dynamics

Drivers

-

Stainless steel tubes are gaining popularity in the automotive industry due to their lightweight and corrosion-resistant properties, helping to reduce vehicle weight and improve fuel efficiency.

-

The rise of electric vehicles is fueling the demand for high-performance automotive components, including stainless steel tubes, for use in battery systems and structural frames.

Increasing demand for lightweight materials, owing to the rise in the automotive industry's focus on fuel efficiency and sustainability, is one of the key factors boosting this market growth. The preferred models are stainless steel tubes that not only merely reduce the weight of the vehicle but also resist corrosive damage. This further enhances fuel economy by reducing carbon emissions and addressing some of the strictest environmental regulations within many territories. The European Union, for example, has established very high CO2 emissions reduction targets for vehicles manufactured in the region, and the automakers are responding by relying increasingly on lightweight materials such as tubes of stainless steel for exhaust systems and chassis and the like. The two organizations note from an International Energy Agency (IEA) report that lightweight material adoption can cut vehicle weight by up to 15%, which directly enhances fuel economy.

As such the lightweight characteristics of stainless-steel tubes are becoming more valuable in the EV sector as they aid in boosting efficiency and range of the battery. Thermal management is essential for battery systems in EVs, and stainless-steel tubes are used in the cooling circuits, delivering high performance, while remaining lightweight. The drive for lightweight components that enable the adoption of environmentally friendly technologies in the automotive sector will further boost the demand for stainless steel tubes over the forecast period.

Restraints:

-

The manufacturing process for stainless steel tubes can be expensive, particularly due to the high raw material costs, which may deter some automotive manufacturers from adopting this material.

-

The prices of stainless steel can fluctuate significantly, creating uncertainties in cost planning for automotive manufacturers

The high cost of production for the manufacturing of stainless-steel tubes is among the key restraints for the automotive stainless steel tube market. Making these tubes can be costly in terms of materials, energy, and advanced manufacturing methods. The base alloy stainless steel is expensive & production involves custom equipment & skilled labour thus resulting in a higher price for the entire process. In addition, high-quality stainless-steel tube manufacturing also includes welding, and seamless tube forming, as well as used for precision shaping which also causes a price overhead to automotive manufacturers. Consequently, these high production costs restrict the penetration of stainless-steel tubes heavily in some price-sensitive segments of the automotive market.

Automotive Stainless Steel Tube Market Segmentation Overview

By Product

The welded tube segment dominated the market with a 92% revenue share in 2023, owing to its high application in automotive components, such as exhaust systems, chassis, and fuel lines. Stainless steel tubes have the right tensile strength and corrosion resistance, are cost-effective, and offer versatility making welded stainless-steel tubes often a choice material for automotive manufacturing. This is mainly because they can be made in large numbers at low production costs making them ideal to be used in mass production for the automotive industry.

In addition, the seamless tube segment is anticipated to register a competitive compound annual growth rate (CAGR) throughout the forecast period. The growth is due to rising demand for high-performance and durable automotive components. These have more strength and are suitable for high-temperature applications as compared to seamless stainless-steel tubes, making them an excellent choice for applications such as hydraulic lines, pressure vessels, high-temperature engine components, etc. Additionally, seamless tubes are more reliable than welded tubes in certain high-stress applications, where the integrity of the tube is paramount.

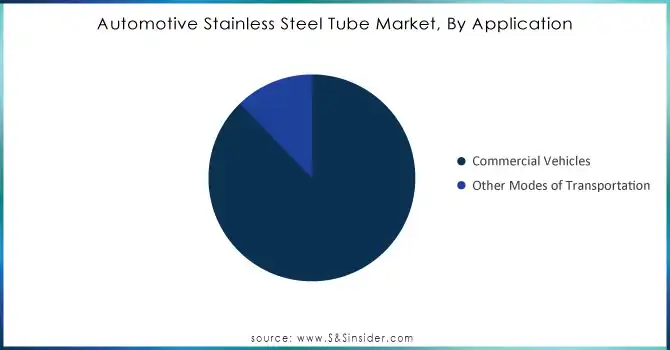

By Application

In 2023, the commercial vehicles segment captured the largest revenue share of 51%, attributed to the demand for durable and corrosion-resistant materials in the production of trucks, buses, and other commercial vehicles. Special commercial vehicles usually run in a more severe environment, heavy loads and long-running lines or other materials which need to be good and sufficient to be able to support. Due to its non-corrosive, high strength, and low weight nature, stainless steel tubes are perfectly fit for these applications.

Furthermore, the increasing demand for durable and low-maintenance vehicles in the logistics and transportation industries is anticipated to boost the demand for automotive stainless-steel tubes in commercial vehicles. The demand for commercial vehicles in North America has been increasing steadily, with the U.S. trucking industry alone accounting for more than $700 billion in revenue for the U.S. economy in 2022, according to the U.S. Department of Transportation. Demand for dependable and efficient components, like stainless-steel tubes that convey the durability and performance of the vehicle, increases as the industry grows. In addition, government initiatives for commercial vehicle solutions, including electric trucks and electric buses, are expected to boost the demand for stainless steel tubes in the segment.

Need any customization research on Aviation Crew Management Systems Market - Enquiry Now

Automotive Stainless Steel Tube Market Regional Insights

In 2023, Asia Pacific held the highest market share of around 51.0% in terms of revenue in the Automotive Stainless Steel Tube Market. This leading position can be attributed to a few essential factors, such as the rapid industrialization of the region, strong automotive manufacturing capabilities, and increasing demand for high-performance automotive components. The automotive vehicle manufacturing industry is being dominated by emerging economies such as Japan, India, South Korea, and China among others, which in turn is fuelling the demand for stainless steel tubes for various automotive critical applications including fuel lines, exhaust systems, and structural components. This boom is mainly due to the massive participation of big players such as Toyota, Hyundai, and Honda in the region. Moreover, government programs such as the 2025 "Made in China 2025" and "FAME" scheme in India to encourage the use of electric vehicles will further propel the demand for high-level materials such as stainless-steel tubes. Further, Asia Pacific has a competitive edge in cost-effective manufacturing and the skilled labour force is steering the automotive stainless steel tube market from the forefront.

North American region is expected to grow at a significant growth rate, due to stringent environmental regulations, efficient fuel vehicles, presence of major automotive manufacturers. In particular, the U.S. has played an important role in the promotion of the market as the CAFE standards of NHTSA have been lobbying for the use of lightweight materials in the form of stainless-steel tubes to prove efficiency in terms of fuel consumption. Additionally, a higher level of electric vehicle (EV) production in the area has fueled the need for long-lasting, corrosion-resistant components driving the market.

Recent Developments

-

Jindal Stainless, in January 2023, also supplied stainless steel for various parts of the Mumbai metro project, including roofs, outer panels, car bodies, and other structural components.

-

MARCEGAGLIA STEEL S.p.A. purchased a stainless-steel electric furnace plant in Sheffield, U.K. in January 2023. This is the first investment they have made in steel production, completing supply chain integration and offering a more sustainable and competitive product portfolio.

Key Players in Automotive Stainless Steel Tube Market

Key Service Providers/Manufacturers:

-

Outokumpu (Outokumpu Stainless Steel Tubes, Duplex Stainless-Steel Tubes)

-

AK Steel (304 Stainless Steel Tubes, 316 Stainless Steel Tubes)

-

MARCEGAGLIA STEEL S.p.A. (Stainless Steel Coils, Stainless Steel Sheets)

-

Tata Steel (Stainless Steel Tubing for Exhaust Systems, High-Temperature Resistant Tubes)

-

Jindal Stainless (Jindal Stainless Steel Tubes, Stainless Steel Welded Tubes)

-

Thyssenkrupp (Stainless Steel Seamless Tubes, Stainless Steel Welded Tubes)

-

SSAB (SSAB Boron Steel Tubes, Advanced High-Strength Steel Tubes)

-

JFE Steel Corporation (JFE Stainless Tubes, JFE Exhaust Tubes)

-

Nippon Steel (Seamless Stainless-Steel Tubes, Welded Stainless Steel Tubes)

-

Sandvik Materials Technology (Sanicro Stainless Steel Tubes, Sanmac Stainless Tubes)

-

Vallourec (Seamless Tubes for Automotive Applications, Stainless Steel Tubes for Chassis)

-

ArcelorMittal (Stainless Steel Tubes for Auto Manufacturing, Automotive Exhaust Tubes)

Key Users of the Services and Products:

-

Ford Motor Company

-

General Motors

-

Toyota Motor Corporation

-

Volkswagen Group

-

BMW AG

-

Mercedes-Benz (Daimler AG)

-

Honda Motor Co., Ltd.

-

Hyundai Motor Company

-

Nissan Motor Co., Ltd.

-

Tesla Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.2 Billion |

| Market Size by 2032 | USD 5.9 Billion |

| CAGR | CAGR of 3.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Welded Tube, Seamless Tube) • By Application (Passenger Cars, Commercial Vehicles, Other Modes of Transportation) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Outokumpu, AK Steel, Tata Steel, ThyssenKrupp, MARCEGAGLIA STEEL S.p.A., SSAB, JFE Steel Corporation, Jindal Stainless, Nippon Steel, Sandvik Materials Technology, Vallourec, ArcelorMittal. |

| Key Drivers | • Stainless steel tubes are gaining popularity in the automotive sector due to their lightweight and corrosion-resistant properties, helping to reduce vehicle weight and improve fuel efficiency. • The rise of electric vehicles is fueling the demand for high-performance automotive components, including stainless steel tubes, for use in battery systems and structural frames. |

| RESTRAINTS | • The manufacturing process for stainless steel tubes can be expensive, particularly due to the high raw material costs, which may deter some automotive manufacturers from adopting this material. |