Automobile Logistics Market Report Scope & Overview:

Get More Information on Automobile Logistics Market - Request Sample Report

The Automobile Logistics Market Size was valued at USD 298.30 Billion in 2023 and is expected to reach USD 569.53 Billion by 2032 and grow at a CAGR of 7.5% over the forecast period 2024-2032.

The Automobile Logistics Market is part of the broader automobile market and ensures that parts, components, and finished vehicles move effectively along the supply chain. The expansion of this market is owing to speedy growth in automobile production and the complexity of the global supply chain. All over the globe, governments are embracing policies which enhance infrastructure, advocate sustainability, and make operations more efficient in logistics. For instance, new carbon-emission-related regulations have caused automotive manufacturers and logistics operators to modify their fleets to greener transport solutions such as EVs. Emerging new technologies in the market are transforming the market, thanks to automation, real time tracking, and digital platforms on logistics. For example, Acquisitions of SeaRates.com, a digital platform that enables customers to transport cargo across the world at the click of a mouse, and LandRates.com, and AirRates.com; DP World has also created the Digital Freight Alliance which is an online association that brings freight forwarders globally onto one platform, giving them access to new tools, routes, and services, and enabling them to do more business anytime, anywhere.

Automation of warehouse and logistics stations has reduced human error and saved labor costs. Digital tracking tools that track real-time allow stakeholders to track packages shipped and optimize delivery routes where possible to cut down on delays and save cost. For example, AI is being very quickly applied in pretty shallow trucking activity, which will be set up for further adoption in the future. The third-party logistics company RXO uses AI to scan trucks arriving at warehouses of Penske Logistics.

Ahead lies plenty of real opportunities for automotive logistics, as the industry quickly shifts toward electric vehicles. Electric vehicles require special logistics, like transporting batteries and all those other niche parts. Finally, with the growth in e-commerce of the automotive aftermarket, there is a global distribution need for spare parts, requiring efficient logistics solutions. Increasingly important in logistics operations, growth is also prompted by the related focus on sustainability. As consumers and companies show growing interest in green practices, demand for low-emission transportation and alternative sources of energy for logistics operations accelerates. Green logistics-the electric truck as well as renewable energy in warehouses-expects to experience significant growth.

Automobile Logistics Market Drivers

KEY DRIVERS:

-

More extensive production of electric vehicles will require effective logistics systems.

The transition to electric vehicles has created demand for specialized automotive logistics systems. This shift impacts various logistics activities, including the transportation and warehousing of batteries, EV components, and finished vehicles. EV batteries are heavier and more hazardous than traditional components, requiring special handling procedures and regulations. This change in component dynamics made manufacturers revisit their logistics flows to ensure more efficient, safe, and compliant transportation modes. The boom of huge production bases in EV worldwide, especially in Asian and European markets, has been another factor driving a need for smooth automotive logistics. With increased incentive from the governments of various countries to adopt EVs in mass, the demand for customized logistics solutions is sure to rise.

-

Rise of global e-commerce demands efficient automotive spare parts logistics.

Online sales of automotive spare parts are driving the demand in this market for automotive logistics-boosted by the growth in e-commerce. It is to be expected that customers will continue demanding faster and faster delivery, which will further place demand on warehousing and last-mile logistics operations. The complexity of managing a wide range of spare parts, from small components to large engine parts, requires advanced logistics infrastructure that supports order accuracy, rapid dispatching, and tracking. Automotive manufacturers are increasingly collaborating with third-party logistics (3PL) providers to streamline the distribution of parts globally.

With this increased demand for purchasing auto components through the Internet, particularly for aftermarket products, logistics providers need to optimize warehousing operations and develop robust distribution networks that meet these expectations from consumers.

RESTRAIN:

-

High transportation costs impede profitability in the automotive logistics sector.

High transportation cost, especially over long distances, is the major constraint for the automotive logistics market when transporting heavy parts and finished vehicles. Fuel costs, varying tariffs, and vehicle maintenance increase the operational costs of logistics providers significantly. As global trade and automobile production rise, so does transportation cruciality and cost, particularly in the aspect of international shipping that entails road, rail, maritime, and air transportation modes. The high carbon emissions associated with transportation also increase the operational cost as companies incur regulatory costs for failing to meet the established emission standards. This issue is amplified with EV production as lithium-ion batteries are heavier and considered a hazardous material, requiring specific, costlier shipping procedures. Reducing transportation costs while keeping service efficiency will be a particularly difficult task for logistics companies in the future.

Automobile Logistics Market Segmentation

BY ACTIVITY

The segment of transportation was leading market share of a tremendous 78.44% in 2023. Transporting automotive parts and finished vehicles across different regions forms the backbone of the sector, with mode of transportation roadways being the most preferred due to its flexibility and cost-effectiveness. However, other modes of transportation such as airways, maritime, and railways are also very essential for long distance and international shipments.

The warehousing segment will have the highest growth rates during the forecast period of 2024-2032 at a CAGR of 10.1%. The growth results from the increased demand for warehousing solutions that are more sophisticated, such as real-time tracking, inventory management, and automation. Automotive manufacturers increasingly use Third-Party Logistics (3PLs), as the demand for spare parts, vehicle components, and finished vehicles increases, necessitating efficient storage solutions. For instance, the 3PL industry comprises 15.9K+ organizations, employs a workforce of 679.4K people, has experienced an annual growth rate that increases 8.28%, and has seen the emergence of 1.6K+ new 3PL companies within the last five years.

BY TYPE

The market for automotive logistics is mainly segmented into two variants: Finished Vehicles and Automobile Parts. In the year 2023, Automobile Parts possessed a relatively large share of the market, about 72.56%. The burgeoning growth in the automobile components segment because of growth in the e-commerce sector, along with the flourishing aftermarket segment, has presented heightened demands for effective logistics solutions. Streamlining logistics operations further helps manufacturers manage the flow of parts between multiple production facilities and assembly plants.

The Finished Vehicle segment is expected to grow at the highest pace, with a CAGR of 9.3%. Increasing adoption of EVs and growing vehicle demand in emerging economies is making for a need for innovative transportation solutions that ensure the timely delivery of finished vehicles to dealerships around the world.

Automobile Logistics Market Regonal Analysis

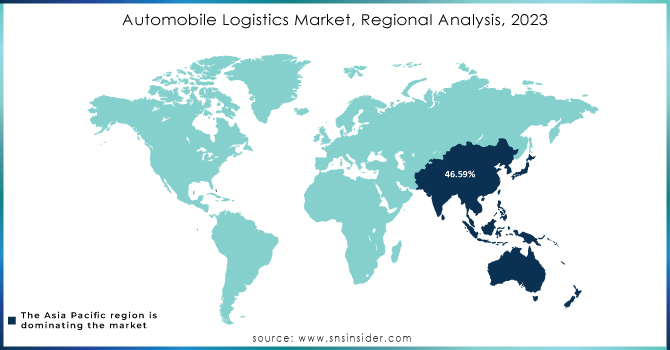

In 2023, Asia Pacific accounts for 46.59% of the automotive logistics market due primarily to a significant automotive manufacturing base in the region, particularly in China, Japan, and South Korea, where demand is high for efficient logistics solutions. The growth in the production and export of EV boosts the logistics market in this region.

North America is expected to register the fastest growth rate, at 9.1% during the forecast period. This would be attributed to this region's increasing car production, adaptation of EVs, and advancement in logistics technologies, with an emphasis on improvements in transportation and warehousing solutions to meet the growing demand of consumers.

Need any customization research on Automobile Logistics Market - Enquiry Now

Key Players

-

DHL Supply Chain (Automotive warehousing, Finished vehicle transportation)

-

XPO Logistics (Aftermarket parts logistics, Inbound transportation)

-

DB Schenker (Automotive parts warehousing, EV battery logistics)

-

Kuehne + Nagel (Parts transportation, Warehousing solutions)

-

Nippon Express (Automobile parts logistics, Air cargo solutions)

-

CEVA Logistics (Automotive contract logistics, Finished vehicle distribution)

-

UPS Supply Chain Solutions (Aftermarket logistics, Freight forwarding)

-

Ryder System, Inc. (Aftermarket parts distribution, Finished vehicle transport)

-

BLG Logistics (Vehicle logistics, Component management)

-

Penske Logistics (Inbound parts logistics, EV supply chain management)

-

GEFCO Group (Automotive parts logistics, Warehousing services)

-

Hitachi Transport System (Automotive spare parts logistics, Warehousing services)

-

FedEx Supply Chain (Aftermarket logistics, Freight services)

-

AIT Worldwide Logistics (Global parts distribution, Warehousing services)

-

Yusen Logistics (Finished vehicle transportation, Automotive component warehousing)

-

Expeditors International (Air cargo logistics, Finished vehicle distribution)

-

Panalpina (Automobile parts logistics, Customs brokerage services)

-

Hellmann Worldwide Logistics (Global spare parts logistics, Warehousing solutions)

-

Kerry Logistics (Automotive parts warehousing, Sea freight services)

-

Agility Logistics (Inbound logistics, Automotive warehousing)

RECENT TRENDS

-

Aug 2024: Wärtsilä Water & Waste, a part of the technology group Wärtsilä, recently declared that it has established a new partnership with DHL Supply Chain, under which DHL will manage its warehouse and logistical operations for spare parts. The new partnership will thus further optimize Wärtsilä Water & Waste's supply chain as well as prepare operational capabilities toward selling the business line of Water & Waste from the corporation.

-

April 2024: Penske Truck Leasing on launched technology to help shippers better benchmark and manage private truck fleets, as more U.S. companies expand in-house transportation operations. The tool is dubbed the "Catalyst AI" platform, allowing shippers to compare their fleet's performance against thousands of other similar operations by using AI to benchmark against data drawn from over 442,000 vehicles that Penske operates and maintains for customers.

-

Feb 2024: Ryder System opened a new warehouse in Laredo, Texas, and expanded its drayage yard in Nuevo Laredo, Mexico, as it continues its push to capture more cross-border freight.

-

Sept 2024: Sumadhura Group receives big logistics contract from NX Logistics India (Nippon Express) leasing 1.8 lakh sq ft of warehousing space at the largest Grade A logistics park at Bengaluru. This forms part of the first phase of the 2.5 million sq ft of Sumadhura Logistics Park and happens to be one of the largest warehousing agreements signed by NX Logistics India in India. The 9-year lease affords NX Logistics India a readymade facility built around advanced infrastructure and amenities specifically designed for storage solutions in FMCG products.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 298.30 Billion |

| Market Size by 2032 | US$ 569.53 Billion |

| CAGR | CAGR of 7.5 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Activity (Warehousing, Transportation(Roadways, Airways, Maritime, Railways)) • By Type (Finished Vehicle, Automobile Parts) • By Distribution (Domestic, International) • By Solution (Inbound, Outbound, Reverse,Aftermarket logistics) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | DHL Supply Chain, XPO Logistics, DB Schenker, Kuehne + Nagel, Nippon Express, CEVA Logistics, Agility Logistics, UPS Supply Chain Solutions, Ryder System, Inc., BLG Logistics, Penske Logistics, GEFCO Group, Hitachi Transport System, FedEx Supply Chain, AIT Worldwide Logistics, Yusen Logistics, Expeditors International, Panalpina, Hellmann Worldwide Logistics, Kerry Logistics. |

| Key Drivers | • More extensive production of electric vehicles will require effective logistics systems.• Rise of global e-commerce demands efficient automotive spare parts logistics. |

| Restraints | • High transportation costs impede profitability in the automotive logistics sector. |