Electric Scooter Battery Market Report Scope & Overview:

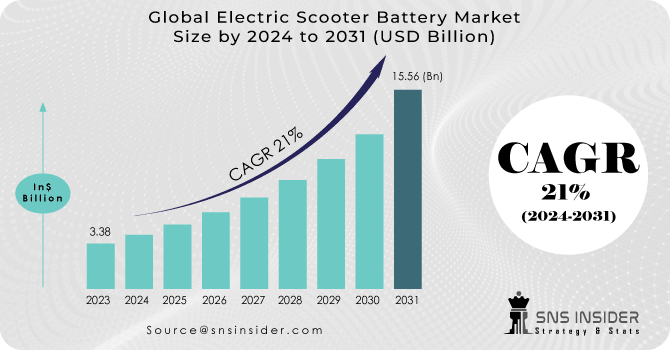

The Electric Scooter Battery Market Size was valued at USD 3.38 billion in 2023 and is expected to reach USD 15.56 billion by 2031 and grow at a CAGR of 21% over the forecast period 2024-2031.

Get More Information on Electric Scooter Battery Market - Request Sample Report

An electric scooter battery is a power storage unit that provides a voltage (power) to the scooter's DC motor, controller, lights, and other accessories. It is managed by a system of electronics known as a battery management system, which ensures that it continues to function without risk while maintaining a high energy density and a long lifespan. Electric car batteries are the gasoline tank. It saves DC motor, light, controller, and accessory power. Because of its energy density and lifespan, most electric scooters use lithium-ion batteries. The battery management system in a scooter consists of individual cells and electronic components to ensure safe functioning.

Larger batteries, measured in watt-hours, allow electric scooters to travel further. Manufacturers make scooters less manoeuvrable by increasing their size and weight. The battery is one of the most expensive parts of a scooter, increasing the cost. Scooter batteries have several cells.

In 2021, the R30 electric scooter was Okinawa Autotech's newest product, and it was released to the public. The scooter is considered to be in the low-speed range, with a top speed of 25 km per hour.

MARKET DYNAMICS:

KEY DRIVERS:

-

The increased use of electric batteries in the scooters boosts the market, resulting in a greater demand for the product

-

The adoption of electric vehicles is also being aided by rising gasoline prices and growing global consciousness

-

Governments are offering a variety of incentives and tax benefits to both producers and consumers

-

Consumers' rising standard of living and rising standard of living per capita

-

Improvements in high-capacity battery packs to extend vehicle range and improve performance

RESTRAINTS:

-

Due to supply chain and transportation channel disruptions, the sector encountered a lack of raw materials

-

Because of its extreme corrosiveness, sulfuric acid affects the chemistry of soil and may be hazardous to subterranean life

OPPORTUNITIES:

-

Several nations' recovery strategies should re-initiate research, and production, fueling the market

-

Electric scooter makers are employing lighter lithium-ion batteries to provide affordable last-mile transportation

CHALLENGES:

-

Electric scooter battery range is a big commercial obstacle

-

Damaged electric batteries can catch fire if the temperature increases too high, posing safety concerns for passengers

IMPACT OF COVID-19:

The new coronavirus has spread & caused massive losses of lives and economies. Due to its reliance on mobility, the COVID-19 pandemic hurt the electronic scooter battery market. According to a report by the International Energy Agency, global road transport activity was over 50% below normal by March 2020. Several enterprises have closed or shrunk due to the risk of diseases among the staff, slowing electric scooter battery production during COVID-19. Falling incomes of customers and travel limits imposed by local and government agencies have reduced sales of electric scooters, leading to a drop in demand for electric scooter batteries.

Market, By Product Type:

Based on the product type segment, the global market has been divided into Lithium-ion (Li-ion), Lithium iron phosphate battery (LFP), Lithium Polymer (LiPo), and Sealed Lead Acid Battery (SLA), and Nickel Metal Hydride Battery (NiMH). Lithium-ion (Li-Ion) batteries dominated the global electric scooter battery market in 2023. The prediction calls for considerable growth. Lithium-ion batteries are rechargeable batteries with low self-discharge, high energy density, and no memory effects. Li-Ion batteries are light and widely used in present and future EVs.

Market, By Capacity:

The global market has been divided into 100 – 500 W, 500 – 1000 W, 1000 – 1500 W, 1500 – 2000 W, 2000 W & Above based on the capacity segment. In 2023, the 1000-1500 W sector is expected to lead the global market in terms of capacity, with a CAGR of 21.3 %. For medium-distance travel, electric scooters with 1000-1500 watt-hour (W) batteries are becoming increasingly popular, which could lead to further market growth.

MARKET SEGMENTATION:

By Battery Type:

-

Lithium-ion (Li-ion)

-

Lead Acid

-

Nickel Metal Hydride Battery (NiMH)

By Capacity:

-

100 – 500 W

-

500 – 1000 W

-

1000 – 1500 W

-

1500 – 2000 W

-

2000 W & Above

By Application:

-

Personal Use

-

Scooter Sharing

-

Commercial Use

REGIONAL ANALYSIS:

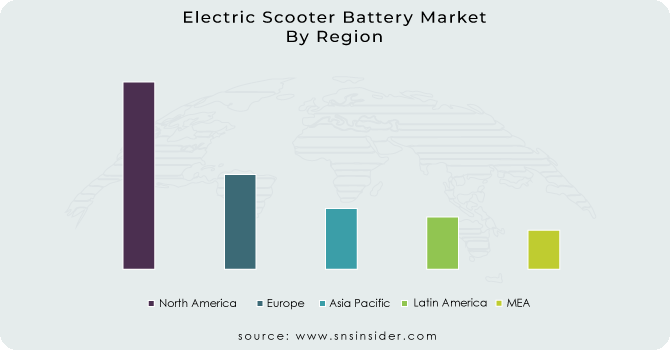

The size of the electric scooter battery market in Asia-Pacific is predicted to increase at the highest CAGR of 22.7% during the forecast period. In 2023, the Asia-Pacific region accounted for 99.2% of the total market share of electric scooter batteries. It is anticipated that the rising number of young people and the rising purchasing power of middle-class communities in countries such as China, India, and others will lead to an increase in the sales of electric scooters. This surge in sales may, in turn, cause the market for electric scooter batteries to experience a significant increase in demand. In addition, the growing environmental consciousness among consumers in the Asia-Pacific area may give an additional impetus for the expansion of the market for electric scooter batteries in that region.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS:

LG Chem, Guoxuan Hi-Tech, Samsung SDI, BYD Co. Ltd., Panasonic Corporation, ENVISION AESC GROUP LTD., Okinawa Autotech, China Aviation Lithium Battery Co., Ltd., Contemporary Amperex Technology Co. Limited (CATL), CBAK Energy Technology, Inc.,are some of the affluent competitors with significant market share in the Electric Scooter Battery Market.

LG Chem-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.38 Billion |

| Market Size by 2031 | US$ 15.56 Billion |

| CAGR | CAGR of 21% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• by Product Type (Lithium-ion (Li-ion), Lithium iron phosphate battery (LFP), Lithium Polymer (LiPo), Sealed Lead Acid Battery (SLA), Nickel Metal Hydride Battery (NiMH)) • by Application (Personal Use, Scooter Sharing, Commercial Use) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | LG Chem, Guoxuan Hi-Tech, Samsung SDI, BYD Co. Ltd., Panasonic Corporation, ENVISION AESC GROUP LTD., Okinawa Autotech, China Aviation Lithium Battery Co., Ltd., Contemporary Amperex Technology Co. Limited (CATL), CBAK Energy Technology, Inc. |

| Key Drivers | •The increased use of electric batteries in the scooters boosts the market, resulting in a greater demand for the product. •The adoption of electric vehicles is also being aided by rising gasoline prices and growing global consciousness. |

| RESTRAINTS | •Due to supply chain and transportation channel disruptions, the sector encountered a lack of raw materials. •Because of its extreme corrosiveness, sulfuric acid affects the chemistry of soil and may be hazardous to subterranean life. |