Automotive Predictive Analytics Market Analysis & Overview:

The Automotive Predictive Analytics Market was valued at USD 2.10 billion in 2025 and is expected to reach USD 26.18 billion by 2035, growing at a CAGR of 28.7% from 2026-2035.

Automotive Predictive Analytics Market growth is due to increased utilization of connected vehicles and rising demand for Advanced Driver Assistance Systems (ADAS) and which is persuasive the Automotive Predictive Analytics Market growth. Through the use of big data, AI technology allows manufacturers and fleet operators to predict what maintenance a vehicle may require, and optimize performance and enhance safety. The expansion of the market is further boosted by the increasing vehicle electrification and the development of autonomous driving.

Automotive Predictive Analytics Market Size and Forecast

-

Market Size in 2025: USD 2.10 Billion

-

Market Size by 2035: USD 26.18 Billion

-

CAGR: 28.7% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

To Get more information On Automotive Predictive Analytics Market - Request Free Sample Report

Automotive Predictive Analytics Market Trends

-

Rising demand for connected vehicles and intelligent transportation systems is driving the automotive predictive analytics market.

-

Growing adoption across fleet management, OEMs, and after-sales services is boosting market growth.

-

Expansion of real-time vehicle data collection and IoT integration is fueling deployment.

-

Increasing focus on predictive maintenance, fuel efficiency, and driver behavior analysis is shaping adoption trends.

-

Advancements in AI, machine learning, and big data analytics are enhancing accuracy and decision-making.

-

Rising investments in smart mobility, autonomous vehicles, and telematics are supporting market expansion.

-

Collaborations between automotive manufacturers, analytics providers, and technology integrators are accelerating innovation and global adoption.

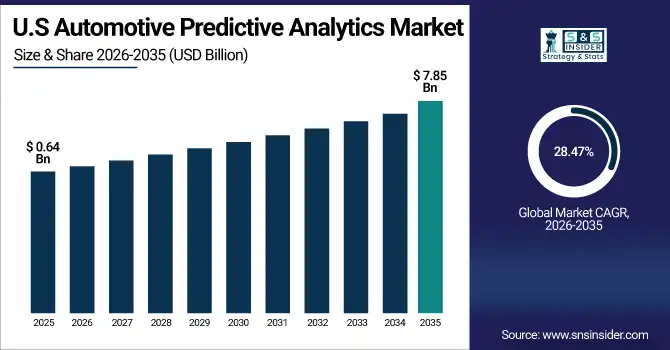

U.S. Automotive Predictive Analytics Market was valued at USD 0.64 billion in 2025 and is expected to reach USD 7.85 billion by 2035, growing at a CAGR of 28.47% from 2026-2035. The U.S. Automotive Predictive Analytics Market is driven by connected vehicles, AI advancements, and demand for improved safety and maintenance.

Automotive Predictive Analytics Market Drivers:

-

Increasing Connected and Autonomous Vehicles Cause Higher Demand for Predictive Analytics to Enhance Vehicle Safety and Maintenance.

One of the significant factors to be attributed for the growth of automotive predictive analytics market is the advent of connected & autonomous vehicles. These vehicles produce massive quantities of real-time sensor, telematics, and vehicle data. Using this data, predictive analytics anticipates when maintenance is needed, ensures optimal vehicle performance, and enhances safety through functionalities such as collision avoidance and driver assistance. Automakers and fleet operators are more often utilizing these analytics to minimize downtime, cut repair costs, and improve the user experience. In addition to this, the slew of government regulations that incentivize autonomous vehicle testing and deployment also hasten the incorporation of predictive analytics solutions in a new-age vehicle.

The number of autonomous vehicles worldwide is expected to increase from 21,150 units in 2023 to 26,560 units in 2024, with further growth anticipated in the coming years.

Automotive Predictive Analytics Market Restraints:

-

High Implementation Costs and Integration Complexity Cause Slower Adoption of Predictive Analytics in Smaller Automotive Players.

While this is beneficial, the automotive predictive analytics market is challenged by high upfront implementation costs and the complexity of integrating analytics with existing vehicle systems. Building and operationalizing predictive models requires a massive investment in data infrastructure, human resources, and software platforms. Its decomposability can be both a strength and a challenge since it usually means more than one vehicle system needs to be able to verify the data is accurate and secure before it can deploy. However, these costs may be prohibitive for smaller manufacturers and fleet operators, which would slow adoption. This restraint restricts larger market adoption, particularly in developing economies where monetary restrictions are huge.

A study indicates that over 60% of UK manufacturers have not adopted AI, primarily due to poor data readiness and the substantial investment required for AI infrastructure.

Automotive Predictive Analytics Market Opportunities:

-

Advancements in AI-Powered Predictive Maintenance Cause Improved Vehicle Uptime and Customer Engagement Through Proactive Servicing.

The rise of AI-based predictive maintenance is bringing a tremendous opportunity in the automotive predictive analytics market. Using machine learning techniques, harvested historical as well as live vehicle data can be modeled to help predict component failure prior to occurrence and to aid in pre-emptive maintenance scheduling. This minimizes the downtime of vehicles, increases the life of components, and enhances the efficiency of the fleet operations. Furthermore, AI content generation tools also enable manufacturers to customize maintenance alerts and customer communication to increase user engagement. The growing popularity of electric and hybrid vehicles also creates new opportunities for AI analytics related to battery health and energy management.

Automotive Predictive Analytics Market Challenges:

-

Data Privacy and Security Concerns Cause Regulatory Compliance Burdens and Hinder Full-Scale Adoption of Predictive Analytics Solutions.

Data privacy and security concerns are a key challenge for the automotive predictive analytics market. Metadata: Vehicles accumulate metadata surrounding their driver behaviour, whereabouts, and operational parameters. That this data is transmitted, stored, and analyzed in such a way to avoid breaches and misuse is of utmost importance. Manufacturers and service providers must comply with strict regulatory frameworks such as GDPR, meaning more complexity and cost. Moreover, there are also risks of cybercrime against connected vehicles that can jeopardize the passenger safety level and vehicle control level. These reasons make the stakeholders more cautious to utilize a predictive analytics solution, unless the solution has very strong security principles.

Automotive Predictive Analytics Market Segmentation Analysis:

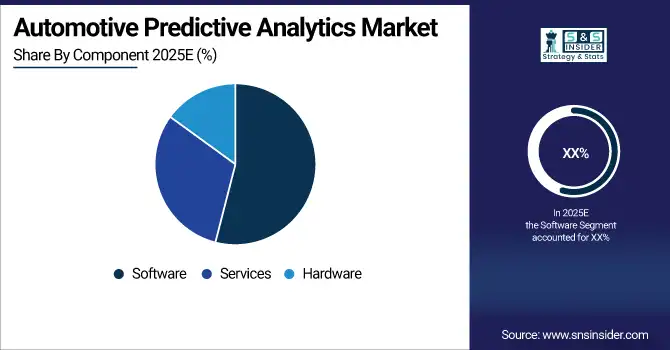

By Component:

In 2025, the Software segment dominated the Automotive Predictive Analytics Market and accounted for a significant revenue share. These factors include the growing requirement of advanced analytics platforms, increasing penetration of AI and machine learning, and rising investments in vehicle data management systems based on the cloud. Software solutions allow real-time data processing, predictive maintenance, and improved safety features.

The Services segment is expected to register the fastest CAGR in the automotive predictive analytics market. Driving demand for consulting, implementation, and managed analytics services that aid automakers and fleet operators in optimizing predictive models and minimizing expenses is expected to drive market growth. Complexity in the deployment of analytics, combined with the need for customized solutions, is driving the service market growth.

By Application:

In 2025, the Predictive Maintenance segment dominated the automotive predictive analytics market and accounted for a significant revenue share. The growth can be attributed to the increasing need to minimize vehicle downtime, maximize maintenance and planning as well as lower costs of repair. Predictive maintenance analytics offer early detection of faults providing added reliability and operational efficiency for vehicles, mainly for commercial fleets and electric vehicles.

The Vehicle Telematics segment is expected to register the fastest CAGR in the automotive predictive analytics market. Development factors consist of the expanding embrace of telematics because of real-time vehicle monitoring, driver safety enhancements, and regulation compliance. The growth of telematics in fleet management and insurance applications as a result of enhanced connectivity and the increasing penetration of the IoT gives a drive to the market as it takes an important turn towards the data-driven approach.

By Vehicle Type:

In 2025, the Passenger Cars segment dominated the automotive predictive analytics market and accounted for a significant revenue share. The high number of passenger vehicles across the globe and demand for safety, predictive maintenance, and driver behavior analytics are on the rise. The incorporation of telematics and connectivity features in passenger cars is further bolstering the market growth.

The Electric Vehicles (EVs) segment is expected to register the fastest CAGR in the automotive predictive analytics market. Factors such as increasing adoption of EVs, need for battery health monitoring, energy management, and predictive maintenance associated with EV components are contributing to growth. So many potential consumers are going directly to demanding that increased government incentives and investments can in pace with the EV infrastructure, which accelerates the demand for advanced analytics solutions.

By End-User:

In 2025, the OEMs segment dominated the automotive predictive analytics market and accounted for a significant revenue share. OEMs are using predictive analytics for vehicle design, warranty management, and even advanced driver assistance systems. Strong adoption by vehicle manufacturers, as it is mostly geared towards minimizing recalls and streamlining manufacturing processes.

The Fleet Operators segment is expected to register the fastest CAGR in the automotive predictive analytics market. The growth is driven by real-time analytics that help in improving fleet maintenance, operational costs, and ensuring driver safety. Fleet management applications see a rapid growth with increasing adoption of connected vehicle technologies and telematics platforms by manufacturers.

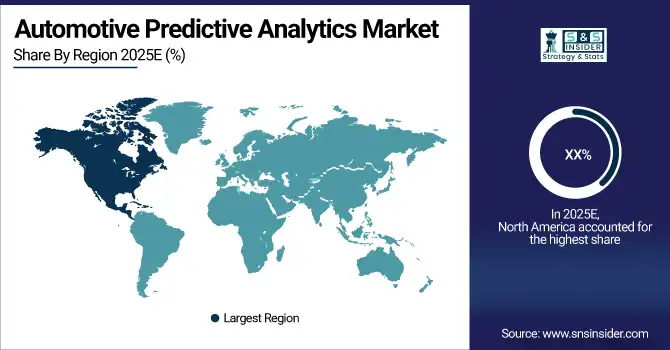

Automotive Predictive Analytics Market Regional Outlook:

North America Automotive Predictive Analytics Market Insights

In 2025, North America dominated the automotive predictive analytics market and accounted for a significant revenue share. The concrete adoption of advanced automotive technology, the long-established connected vehicle infrastructure and stringent safety regulations drive this. Additionally, high investment in AI & telematics and maximum presence of major automotive players is driving market growth in this region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Automotive Predictive Analytics Market Insights

According to the automotive predictive analytics market analysis, the Asia Pacific region is expected to register the fastest CAGR in the automotive predictive analytics market. quick vehicle electrification, development of automotive manufacturing hotspots, and increasing demand for connected & autonomous cars. Emphasis on smart transportation through government initiatives, coupled with growing consumer awareness, drives the market growth of predictive analytics solutions.

Europe Automotive Predictive Analytics Market Insights

Europe’s automotive predictive analytics market growth is driven by Stringent emission regulations, increasing adoption of connected vehicles, and investments in smart mobility are some of the factors supporting the growth. The rise in need for predictive maintenance and safety solutions enables persistent growth with steady growth for 2035 ahead of the market.

Germany dominates Europe’s market due to its automotive strength, early industry 4.0 technology adoption, and government support for electric and autonomous vehicles. Predictive analytics adoption is likely to witness strong growth owing to constant innovation and ongoing digitalization efforts.

Middle East & Africa and Latin America Automotive Predictive Analytics Market Insights

The Automotive Predictive Analytics Market in Middle East & Africa and Latin America is growing as manufacturers adopt AI and IoT to enhance vehicle performance, predictive maintenance, and operational efficiency. Rising demand for connected cars, smart fleet management, and data-driven insights is driving market expansion, helping automotive stakeholders reduce downtime, optimize costs, and improve safety across the region.

Automotive Predictive Analytics Market Competitive Landscape:

IBM Corporation

IBM is a global technology and consulting company specializing in hybrid cloud, AI, software, and enterprise solutions. Its automotive initiatives focus on leveraging AI, data analytics, and connected systems to transform mobility, vehicle diagnostics, and predictive maintenance. IBM works with OEMs, suppliers, and mobility platforms to integrate intelligent technologies, enhance vehicle safety, optimize operations, and develop future mobility solutions, including software-defined and AI-powered automotive systems that align with industry 4.0 and connected-car trends.

-

In December 2024, IBM Corporation released a study predicting that by 2035, 80% of new vehicles will be software-defined and AI-powered, highlighting the growing role of predictive analytics in automotive innovation.

Microsoft Corporation

Microsoft is a leading global technology company providing software, cloud services, AI, and enterprise solutions. In automotive, Microsoft focuses on software-defined vehicles, predictive analytics, and cloud-connected ecosystems, helping OEMs and suppliers innovate vehicle development, optimize operations, and enhance mobility services. Its platforms enable real-time data integration, vehicle monitoring, and AI-driven diagnostics, facilitating connected, intelligent, and autonomous mobility solutions for global automotive markets. Microsoft’s automotive tools support R&D, predictive maintenance, and efficient development workflows.

-

2024: Microsoft unveiled automotive mobility reference architectures with software-defined vehicle toolchains supporting cloud-based analytics and predictive processing for vehicle data and development workflows.

Continental AG

Continental AG is a global automotive supplier specializing in vehicle electronics, mobility solutions, and intelligent systems. The company develops advanced driver-assistance systems (ADAS), connectivity technologies, and predictive analytics tools to enhance vehicle safety, performance, and user interaction. Continental integrates AI, IoT, and vehicle data analytics to improve predictive maintenance, system efficiency, and driver experience. Its innovations support intelligent mobility, connected-car solutions, and the evolution toward autonomous and software-defined vehicles.

-

December 2024: Continental showcased an intelligent demo car at CES 2025, demonstrating advanced vehicle-driver interaction technologies with predictive analytics for enhanced vehicle systems and operational efficiency.

Key Players

Some of the Automotive Predictive Analytics Market Companies

-

IBM Corporation

-

SAP SE

-

Oracle Corporation

-

SAS Institute Inc.

-

Continental AG

-

NXP Semiconductors

-

PTC Inc.

-

Robert Bosch GmbH

-

ZF Friedrichshafen AG

-

Cloud Software Group, Inc. (formerly Citrix)

-

Cognizant Technology Solutions

-

Tata Consultancy Services (TCS)

-

Hewlett Packard Enterprise (HPE)

-

NVIDIA Corporation

-

Capgemini SE

-

Accenture plc

-

Siemens AG

-

Google LLC

|

Report Attributes |

Details |

|---|---|

|

Market Size in 2025 |

US$ 2.10 Billion |

|

Market Size by 2035 |

US$ 26.18 Billion |

|

CAGR |

CAGR of 28.7% From 2026 to 2035 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

Historical Data |

2022-2024 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Component (Software, Services, Hardware) |

|

Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, ASEAN Countries, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar,Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America) |

|

Company Profiles |

IBM Corporation, SAP SE, Microsoft Corporation, Oracle Corporation, SAS Institute Inc., Continental AG, NXP Semiconductors, PTC Inc., Robert Bosch GmbH, ZF Friedrichshafen AG, Cloud Software Group, Inc. (formerly Citrix), Cognizant Technology Solutions, Infosys Limited, Tata Consultancy Services (TCS), Hewlett Packard Enterprise (HPE), NVIDIA Corporation, Capgemini SE, Accenture plc, Siemens AG, Google LLC and others in the report |