Automotive Telematics Market Size:

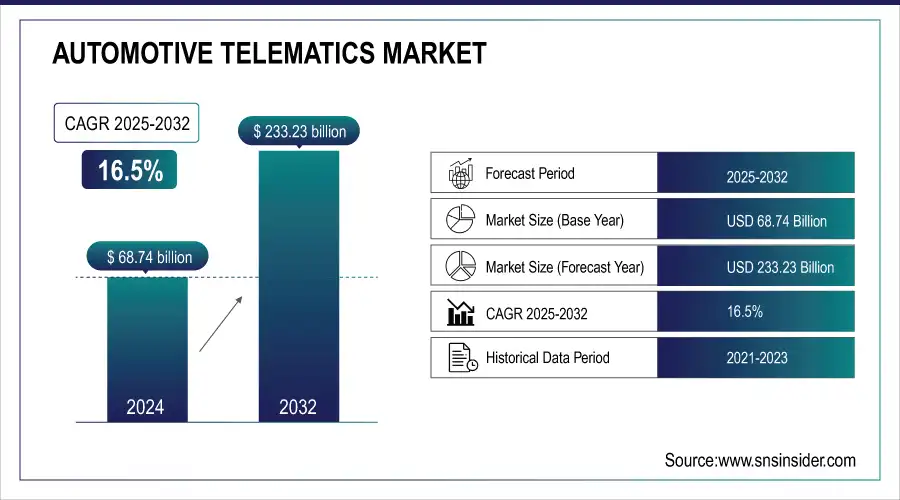

The Automotive Telematics Market size was valued at USD 68.74 billion in 2024 & will reach USD 233.23 billion by 2032 and grow at a CAGR of 16.5% by 2025-2032.

Get More Information on Automotive Telematics Market - Request Sample Report

The automotive telematics market is driven by innovation aimed at enhancing passenger comfort and fostering greater in-car interaction. This technology merges telecommunications and information technology to provide vehicles with a range of features including navigation, safety, and security. Common telematics applications include navigation systems, safety and security features, car sharing, vehicle analytics, container tracking, emergency warning systems, trailer tracking, and more. Stringent safety regulations, heightened public awareness of safety concerns, and the increasing affordability of telematics features are all contributing to its expansion. The future of automotive telematics looks bright, particularly with the rise of electric vehicles (EVs). Leading car manufacturers are enthusiastic about the potential unlocked by EVs, and the integration of telematics technology into these vehicles is expected to be a significant driver of industry growth.

Automotive Telematics Market Size and Forecast:

-

Market Size in 2024: USD 68.74 Billion

-

Market Size by 2032: USD 233.23 Billion

-

CAGR: 16.5% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Automotive Telematics Market Key Trends:

-

Connected vehicle ecosystem – Growing integration of telematics with IoT, V2X (vehicle-to-everything) communication, and 5G is enabling seamless connectivity and real-time data exchange.

-

Regulatory push for safety and compliance – Governments are mandating telematics solutions for emergency call (eCall), vehicle tracking, and electronic logging devices (ELDs), driving adoption.

-

Rise of usage-based insurance (UBI) – Insurance companies are increasingly leveraging telematics data to offer personalized premiums, encouraging wider consumer adoption.

-

Fleet management optimization – Rising demand for efficient route planning, fuel monitoring, and predictive maintenance is boosting telematics use in commercial fleets.

-

Integration of AI and big data analytics – Telematics platforms are using advanced analytics to provide predictive insights, driver behavior analysis, and real-time alerts.

-

Electric and autonomous vehicle adoption – EVs and self-driving cars require advanced telematics for battery management, remote diagnostics, and over-the-air (OTA) updates.

-

Cybersecurity concerns – With vehicles becoming data hubs, safeguarding telematics systems against hacking and data breaches is a growing priority.

Among the main trends that have occurred, one should indicate the increasing application of vehicle-to-everything communication technologies, which enable a vehicle to communicate with another vehicle and with the surrounding infrastructures. Telematics Systems: As of 2024, approximately 36% of new vehicles sold in the U.S. are embedded with telematics systems, which reflects a trend toward integrated solutions, offering real-time data on the performance, safety, and route navigation of a vehicle. Another trend is increasing demand for driver safety and driver assistance features, like ADAS, depending on telematics for sharp and timely monitoring and warnings. "About 29% of US vehicles now incorporate some form of ADAS, enabled by telematics, aimed at increasing road safety. Fletemanagement solutions are also gaining interest: 42% of commercial fleets in the US use telematics for routing optimization, driver behavior monitoring, and operational cost reductions. The rise of connected car services is increasing; consumer demand for telematics-enabled services such as remote diagnostics and predictive maintenance is up 25% year over year.

Automotive Telematics Market Drivers:

-

Rising demand for in-vehicle experiences and interactive features fuels the Automotive Telematics Market.

-

Increasing affordability of telematics features expands the Automotive Telematics Market.

The automotive telematics market is getting a boost due to more affordable features. Telematics systems combine communication and computer technology to offer a variety of in-car services, like navigation and security. Thus, previously these features might have been too expensive for many car buyers. But as the technology becomes more accessible, it's becoming more common to see telematics included in new vehicles. This wider availability is opening up the market to a larger audience, leading to more growth for the industry.

Automotive Telematics Market Restraints:

-

High upfront costs of installing advanced telematics systems can be a barrier for budget-conscious consumers.

-

Concerns about data privacy and security around driver behaviour and vehicle location slow down adoption.

The automotive telematics offers exciting features but some drivers are hesitant to embrace them due to data privacy and security concerns. Telematics systems collect a lot of information, including where you're driving, how you're driving, and even how often you use your car. This raises concerns for some people who worry about this data being misused or falling into the wrong hands. These anxieties can be a significant hurdle for the wider adoption of telematics technology.

Automotive Telematics Market Segmentation Insights:

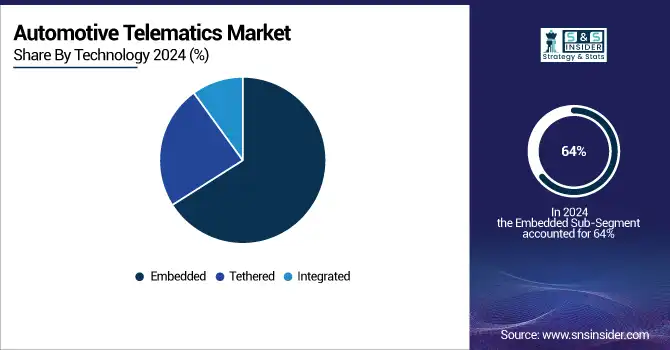

By Technology, Embedded Telematics Leads the Market with 64% Share in 2024

Embedded Telematics is the dominating sub-segment in the Automotive Telematics Market by technology holding around 64% of market share in 2024. Embedded systems are seamlessly integrated into vehicles during manufacturing, offering a more robust and reliable connection. This segment is primarily driven by Original Equipment Manufacturers (OEMs) who are increasingly incorporating telematics features as standard or optional equipment.

By Solution, Component Segment Dominates Automotive Telematics Solutions in 2024

In 2024, Component is the dominating sub-segment in the Automotive Telematics Market by solution holding around 52% of market share. The component segment, which includes hardware like GPS modules and telematics control units, is currently larger due to the ongoing integration of telematics technology into new vehicles. However, the service segment is expected to grow rapidly as the use of telematics data for various purposes expands.

By Vehicle, Passenger Vehicles Hold Largest Market Share in 2024

Passenger Vehicles is the dominating sub-segment in the Automotive Telematics Market by vehicle in 2024. Passenger vehicles currently hold the larger market share due to the rising demand for in-car features and safety concerns. However, the commercial vehicle segment is expected to witness significant growth due to stricter regulations and increasing focus on fleet management efficiency.

By Sales Channel, OEMs Drive Telematics Integration in New Vehicles

In 2024, OEM (Original Equipment Manufacturer) is the dominating sub-segment in the Automotive Telematics Market by sales channel. OEMs are taking the lead in integrating telematics systems into new vehicles due to the aforementioned reasons like regulatory requirements and consumer demand. However, the aftermarket segment is expected to grow as older vehicles are retrofitted with telematics solutions.

By Application, Fleet Management Emerges as Top Application Segment in 2024

In 2024, Fleet Management is the dominating sub-segment in the Automotive Telematics Market by application. Fleet management solutions generate significant cost savings and operational efficiencies for businesses. Features like real-time vehicle tracking, driver behaviour monitoring, and preventative maintenance alerts offer substantial value propositions, driving strong adoption in this segment.

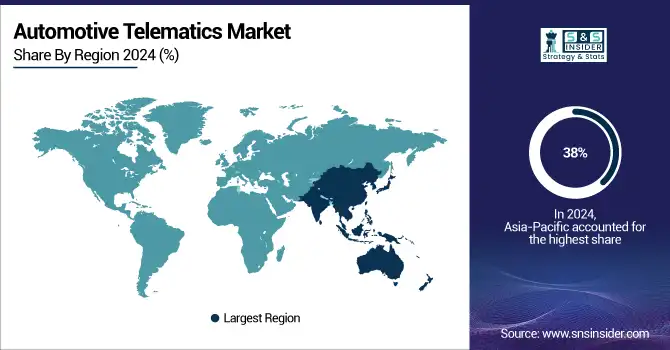

Automotive Telematics Market Regional Analysis

Asia-Pacific dominates the Automotive Telematics market in 2024

In 2024, Asia-Pacific holds an estimated 38% share of the Automotive Telematics market, driven by rapid urbanization, increasing vehicle ownership, and government initiatives promoting connected vehicles. The region benefits from rising demand for fleet management, predictive maintenance, and advanced safety solutions. Strong partnerships between OEMs and telematics providers are expanding embedded and aftermarket telematics adoption. Additionally, advancements in 4G/5G networks and IoT integration enhance vehicle connectivity. These factors collectively maintain Asia-Pacific’s leadership position and support sustained market growth in the region.

Get Customized Report as per your Business Requirement - Request For Customized Report

-

China leads Asia-Pacific’s Automotive Telematics market

China dominates due to its vast automotive industry and proactive government policies supporting smart mobility. The adoption of electric vehicles and connected car technologies, along with safety regulations and fleet management requirements, drives widespread integration of telematics systems. OEMs are incorporating embedded solutions, while aftermarket providers retrofit older vehicles. Growing consumer awareness of safety and convenience features, coupled with rapid urban transport expansion, further accelerates market adoption. Strategic partnerships between automakers and telematics solution providers strengthen system availability, making China the leading contributor to Asia-Pacific’s automotive telematics revenues.

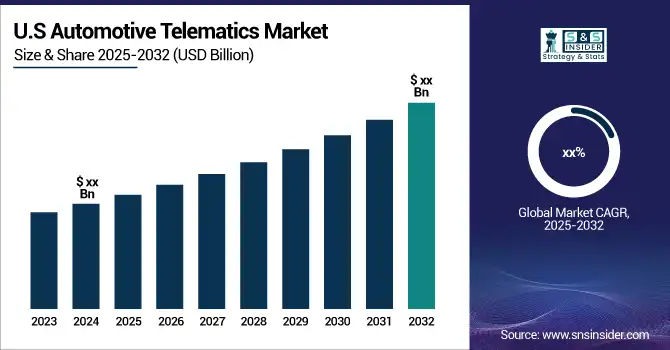

North America is the fastest-growing region in the Automotive Telematics market in 2024

The North American market is projected to expand at an estimated CAGR of 14.2% from 2025 to 2032, fueled by stringent safety regulations, advanced driver-assistance system adoption, and demand for connected car features. Fleet management solutions, usage-based insurance, and predictive maintenance are driving growth, supported by technological advancements in 5G connectivity and AI-enabled analytics. These factors collectively accelerate telematics adoption and position North America as the fastest-growing region in the forecast period.

-

United States leads North America’s Automotive Telematics market

The U.S. dominates due to its mature automotive industry, advanced technology infrastructure, and high consumer awareness of safety and vehicle efficiency. OEMs integrate embedded telematics solutions, including remote diagnostics and fleet management tools, while insurance companies leverage usage-based insurance programs. Early adoption of connected car features, over-the-air updates, and predictive maintenance technologies strengthens market penetration. Additionally, collaborations between automakers, tech providers, and insurance companies expand service offerings. Combined with strong disposable incomes and regulatory support, the United States is the largest contributor to North America’s automotive telematics market.

Europe Automotive Telematics market insights, 2024

Europe shows steady growth in 2024, supported by stringent vehicle safety regulations, emission standards, and increasing adoption of connected car technologies. The region benefits from growing demand for fleet management solutions, predictive maintenance, and advanced driver-assistance systems. Strict safety and emission regulations cause higher telematics adoption, enhancing connected car features and regulatory compliance across German vehicles.

Germany, as the dominating country, drives market expansion due to its robust automotive industry, high OEM integration of telematics, and early adoption of electric and autonomous vehicles. Regulatory focus on road safety and emissions compliance further encourages telematics deployment, while consumer preference for convenience and connectivity sustains market momentum.

Middle East & Africa and Latin America Automotive Telematics market insights, 2024

The Middle East & Africa and Latin America markets show moderate growth in 2024. In the Middle East, countries like the UAE and Saudi Arabia are investing in smart transport and fleet management solutions, driving telematics adoption. Africa’s emerging urban centers are gradually integrating vehicle tracking and connected car services due to rising commercial fleet activity. In Latin America, Brazil and Mexico lead adoption, driven by growing fleet operations, logistics optimization, and safety awareness. Increasing smartphone penetration, affordable internet, and mobile-based telematics platforms support steady expansion across both regions.

Competitive Landscape for the Automotive Telematics Market:

Robert Bosch

Robert Bosch is a Germany-based global leader in automotive technology and electronics, specializing in telematics, connectivity, and sensor solutions. With decades of experience, the company develops embedded telematics systems, vehicle tracking solutions, and predictive maintenance platforms. Bosch collaborates with OEMs to integrate connected car features directly into vehicles, supporting safety, fleet management, and usage-based insurance applications. Its role in the automotive telematics market is significant, providing advanced hardware and software solutions that enhance vehicle performance, connectivity, and driver convenience, while enabling data-driven insights for fleet operators and service providers.

-

In 2024, Bosch unveiled its latest telematics control units and vehicle connectivity platforms, emphasizing real-time diagnostics, remote monitoring, and AI-based predictive maintenance for passenger and commercial vehicles.

Continental AG

Continental AG, headquartered in Germany, is a leading automotive supplier specializing in telematics, vehicle networking, and advanced driver-assistance systems. The company delivers embedded telematics modules, GPS tracking solutions, and integrated fleet management software for both passenger and commercial vehicles. By partnering with OEMs worldwide, Continental ensures seamless integration of connectivity features that enhance safety, operational efficiency, and regulatory compliance. Its role in the market is crucial, offering scalable solutions that support predictive maintenance, vehicle tracking, and data-driven analytics for global automotive and fleet markets.

-

In 2024, Continental AG expanded its connected vehicle portfolio with enhanced telematics control units and predictive fleet analytics software, targeting improved uptime and operational efficiency.

Qualcomm Technologies

Qualcomm Technologies is a U.S.-based technology leader focusing on wireless communication, vehicle-to-everything (V2X) connectivity, and automotive telematics solutions. The company provides telematics platforms, embedded connectivity chips, and software solutions that support remote diagnostics, vehicle tracking, and connected car applications. Qualcomm partners with automakers and tier-one suppliers to deliver scalable, 5G-enabled telematics systems that enhance safety, fleet management, and in-car infotainment. Its role in the automotive telematics market is pivotal, powering high-speed data transfer, advanced analytics, and real-time vehicle monitoring across global passenger and commercial fleets.

-

In 2024, Qualcomm introduced its latest 5G automotive telematics chipsets and integrated V2X communication modules, enabling real-time vehicle monitoring and predictive maintenance capabilities.

Verizon

Verizon, headquartered in the U.S., is a leading provider of connected vehicle and telematics services, offering fleet management, vehicle tracking, and IoT-based automotive solutions. The company provides cloud-based telematics platforms that enable real-time monitoring, predictive maintenance, driver behavior analytics, and route optimization. Verizon collaborates with fleet operators, OEMs, and software providers to enhance operational efficiency, reduce downtime, and improve vehicle safety. Its role in the automotive telematics market is vital, delivering scalable, secure, and reliable solutions for commercial fleets and passenger vehicle connectivity worldwide.

-

In 2024, Verizon launched an upgraded fleet telematics platform integrating AI-driven predictive maintenance, driver safety monitoring, and real-time vehicle diagnostics for North American and global markets.

Automotive Telematics Market Key Players:

-

Robert Bosch

-

Continental AG

-

Qualcomm Technologies

-

Verizon

-

Intel Corporation

-

Delphi Automotive Plc

-

LG Electronics

-

Harman International

-

DENSO Corporation

-

Ficosa International SA

-

Magneti Marelli SpA

-

Trimble Inc. (U.S.)

-

TomTom International B.V. (Netherlands)

-

Telogis (U.S.)

-

Visteon Corporation (U.S.)

-

AT&T Inc. (U.S.)

-

Harman International Industries, Inc. (U.S.)

-

Panasonic Corporation

-

NVIDIA Corporation

-

NXP Semiconductors

| Report Attributes | Details |

| Market Size in 2024 | US$ 68.74 Bn |

| Market Size by 2032 | US$ 233.23 Bn |

| CAGR | CAGR of 16.5 % From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Embedded, Tethered, Integrated) • By Solution (Component, Service) • By Vehicle (Passenger, Commercial) • By Sales Channel (OEM, Aftermarket) • By Application (Information & Navigation, Safety & Security, Fleet Management, Insurance Telematics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Robert Bosch, Continental AG, Qualcomm Technologies, Verizon, Intel Corporation, Delphi Automotive Plc, LG Electronics, Harman International, DENSO Corporation, Ficosa International SA, Magneti Marelli SpA, Trimble Inc., TomTom International B.V., Telogis, Visteon Corporation, AT&T Inc., Harman International Industries, Inc., Panasonic Corporation, NVIDIA Corporation, NXP Semiconductors, and others |