Hybrid Train Market Size & Overview

Get More Information on Hybrid Train Market - Request Sample Report

The Hybrid Train Market Size was valued at USD 21.9 billion in 2023 and is expected to reach USD 41.28 billion by 2032 and grow at a CAGR of 7.3% by 2024-2032

The ever-increasing need to curb greenhouse gas emissions and reduce dependence on fossil fuels is a major driver. Hybrid trains offer an ingenious solution by combining electric and diesel power sources. This translates to significantly lower emissions and improved fuel efficiency compared to traditional diesel trains. This eco-friendly approach aligns perfectly with global efforts to combat climate change and achieve sustainable transportation goals. The rising concerns about air pollution, particularly in urban areas, are driving the adoption of hybrid trains. by minimizing emissions, hybrid trains contribute to cleaner air, especially in densely populated regions where air quality is a major concern.

As battery capacities increase and charging times decrease, hybrid trains become even more efficient and capable of operating on longer stretches of non-electrified tracks. For instance, Stadler, a leading manufacturer, introduced the world's first battery-powered regional train, the Flirt Akku, in 2022. This train can operate up to 100 kilo-meters solely on battery power, showcasing the potential of this technology.

The higher initial investment costs associated with hybrid train technology compared to conventional diesel trains can be a hurdle for some operators. Additionally, the availability of charging infrastructure for battery-powered trains is still evolving in some regions, which can limit their deployment.

MARKET DYNAMICS:

KEY DRIVERS:

-

Hybrid technology offers quieter operation, leading to a more pleasant travel experience for passengers.

-

Lower fuel consumption compared to traditional trains leads to operational cost reductions.

-

Improved battery capacity and faster charging times enable longer operation on battery power.

Environmental concerns are a key driver, as hybrid trains offer a significant reduction in greenhouse gas emissions compared to traditional diesel trains. This aligns perfectly with global climate change goals and the push for sustainable transportation. The rising fuel costs and the desire for operational efficiency are fueling the market's growth. Hybrid technology delivers substantial fuel savings compared to conventional diesel options, leading to long-term cost reductions for operators. The hybrid trains contribute to improved air quality, especially in urban areas, addressing public health concerns and enhancing passenger comfort with quieter operation. The advancements in battery technology that is increased battery capacity and faster charging times, hybrid trains can operate on longer stretches of non-electrified tracks, offering greater flexibility and expanding potential routes. This combination of environmental benefits, operational efficiency, and technological progress is propelling the Hybrid Train Market forward.

RESTRAINTS:

-

Hybrid trains require significant initial investment compared to conventional diesel options.

-

The availability of charging stations for battery-powered trains is still uneven across regions.

The uneven distribution of charging infrastructure for battery-powered trains is a challenge. Some regions are actively building out charging networks, others are lagging behind. This limited infrastructure can restrict the operational range of these trains. The established programs for refurbishing existing diesel trains can act as a detour, diverting resources away from new hybrid models. The increased complexity of hybrid technology also presents a challenge. Integrating electric and diesel power sources introduces new maintenance considerations for operators, requiring additional training and potentially impacting operational efficiency. The evolving landscape of alternative fuels like hydrogen fuel cells adds a layer of uncertainty. These emerging technologies may pose long-term competition, potentially impacting the long-term dominance of hybrid trains.

OPPORTUNITIES:

-

Collaboration between governments and private companies can accelerate the development and deployment of hybrid train infrastructure.

-

Developments in areas like energy storage and power management can further improve performance and cost-effectiveness.

CHALLENGES:

-

Maintaining and servicing hybrid trains can be more complex due to the combination of diesel and electric systems.

-

The expansion of electrified rail networks could limit the need for hybrid trains on certain routes.

KEY MARKET SEGMENTS:

by Propulsion Type

-

Electro Diesel

-

Battery Operated

-

Hydrogen Powered

-

Gas Powered

-

Solar Powered

Electro-Diesel is the dominating sub-segment in the Hybrid Train Market by propulsion type holding around 75-80% of market share due to its versatility and ability to leverage existing infrastructure. These trains seamlessly combine electric and diesel power sources. They can run on electric power on electrified tracks, reducing emissions and noise pollution in urban areas. When on non-electrified routes, the diesel engines kicks in, ensuring uninterrupted operation. This flexibility makes them ideal for regions with a mix of electrified and non-electrified tracks, which is the current reality in most parts of the world. The technology is well-established, with proven reliability and a mature supply chain, making it a more readily available and cost-effective option compared to some newer technologies like hydrogen fuel cells.

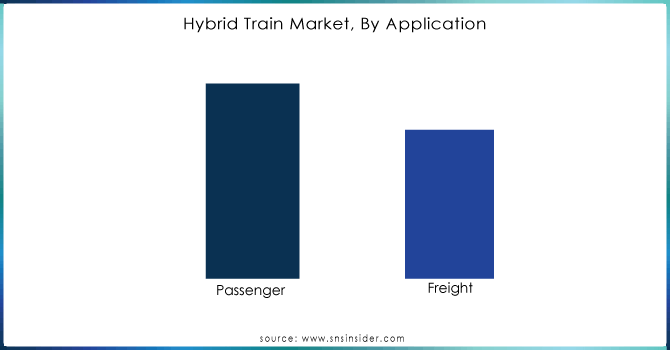

by Application

-

Passenger

-

Freight

Passenger Trains is the dominating sub-segment in the Hybrid Train Market by application holding around 60-65% of market share. This can be attributed to several factors. There's a growing focus on reducing emissions in urban areas, where passenger trains operate frequently. Hybrid technology offers a significant advantage here, leading to cleaner air and a more pleasant travel experience. The passenger train networks are generally more densely populated than freight networks, making it easier to justify the upfront investment in hybrid technology due to the higher frequency of use. The government regulations and public pressure for sustainable transportation solutions are often more pronounced in the passenger rail sector, further driving the adoption of hybrid technologies.

Get Customized Report as per your Business Requirement - Request For Customized Report

by Operating Speed

-

Less than 100 km/hr

-

100-200 km/hr

-

More than 200 km/hr

100-200 km/hr is the dominating sub-segment in the Hybrid Train Market by operating speed. This speed range encompasses a large portion of both intercity and regional passenger rail services. Hybrid trains excel in this range, offering a good balance between performance and efficiency. At these speeds, battery technology can be effectively utilized for shorter electrified sections, while the diesel engine provides sufficient power for maintaining speed on non-electrified tracks. The infrastructure for these speeds is already well-developed in many regions, making it easier to integrate hybrid trains without significant modifications.

by Technology

-

Valve regulated lead-acid

-

Lithium-ion

-

Nickel-Metal Hydride (NiMH)

-

Others

Lithium-Ion Batteries is the dominating sub-segment in the Hybrid Train Market by technology. This is due to their superior energy density compared to other options like lead-acid or nickel-metal hydride batteries. This translates to longer ranges on battery power, a crucial factor for the efficiency and operational flexibility of hybrid trains. The lithium-ion batteries offer a good cycle life, meaning they can withstand numerous charge and discharge cycles before needing replacement. While the initial cost of lithium-ion batteries can be higher, their longer lifespan and improved performance make them a more cost-effective choice in the long run.

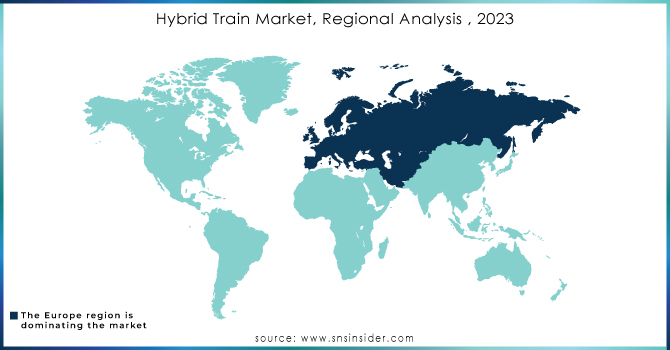

REGIONAL ANALYSES

The Europe is the dominating region in the Hybrid Train Market holding around 40-45% of market share fueled by a potent combination of factors. Strong government support for sustainable solutions translates to subsidies and incentives for adopting hybrid trains. Stricter environmental regulations further push the adoption of cleaner technologies.

The Asia Pacific is the second highest region in this market. Massive investments in rail network expansion create fertile ground for hybrid trains. Growing concerns about air pollution, especially in megacities, are driving the adoption of cleaner technologies like hybrid trains. The governments in Asia are promoting sustainable transportation solutions through funding and policy measures.

North America emerges as the fastest growing region. Aging rail infrastructure necessitates modernization, opening doors for new technologies like hybrid trains. Growing environmental awareness among stakeholders fuels the demand for cleaner transportation options.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are Kawasaki Heavy Industries, CRRC, Alstom, General Electric, Hyundai Rotem, Bombardier, Construcciones Y Auxiliar De Ferrocarriles (CAF), Wabtec Corporation, Siemens, Hitachi, Toshiba and other key players.

RECENT DEVELOPMENT

-

In April 2023: Wales ‘Transport for Wales (TFW)’ introduced the nation's first battery-hybrid passenger trains on the Borderlands Line. These modern Class 230 trains, with five three-carriage units, offer increased capacity and a more comfortable journey for over 120 passengers.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 21.9 Billion |

| Market Size by 2032 | US$ 41.28 Billion |

| CAGR | CAGR of 7.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• by Propulsion Type (Electro Diesel, Battery Operated, Hydrogen Powered, Gas Powered, Solar Powered) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Kawasaki Heavy Industries, CRRC, Alstom, General Electric, Hyundai Rotem, Bombardier, Construcciones Y Auxiliar De Ferrocarriles (CAF), Wabtec Corporation, Siemens, Hitachi, and Toshiba |

| Key Drivers | • Hybrid trains are more cost-effective and reliable modes of transportation. • Demand for more energy-efficient and eco-friendly railway operations is increasing. |

| RESTRAINTS | • A hybrid rail system has a higher infrastructure cost than a diesel-powered rail system. • Hybrid railway technologies have high development costs and difficulties. |