INTELLIGENT ALL-WHEEL DRIVE SYSTEM MARKET REPORT SCOPE & OVERVIEW:

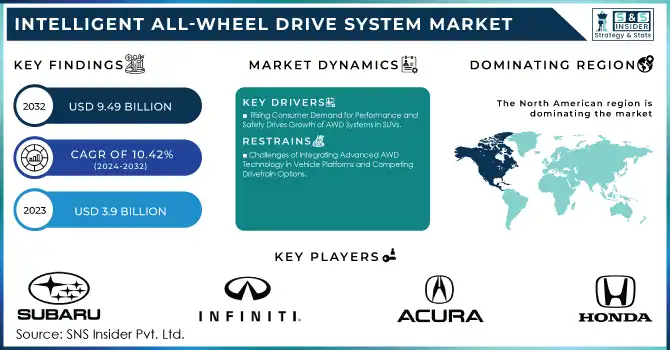

The Intelligent All-Wheel Drive System Market was valued at USD 3.9 billion in 2023 and is expected to reach USD 9.49 billion by 2032, growing at a CAGR of 10.42% over the forecast period 2024-2032.

To get more information on Intelligent All-Wheel Drive System Market - Request Free Sample Report

The intelligent AWD system market is gaining traction majorly due to increasing demand for safer, more efficient, and performance-oriented vehicles. AWD offers additional stability and traction on the road, especially in inclement weather like snow, rain, and ice making it a desirable trait for many consumers in regions with less predictable weather patterns. Additionally, the popularity of electric vehicles (EVs) and hybrid models is also increasing the demand for cutting-edge AWD systems, requiring advanced torque control and energy distribution to maximize vehicle efficiency and performance. Moreover, growing preference towards SUVs and crossovers, which usually come with AWD systems, is another factor also driving the market growth. SUVs made up an impressive 45% of global vehicle sales in 2023, and more than 65% of SUVs sold in the U.S. had an AWD system an increasingly common feature, prized for its safety and performance advantages. Sales of EVs grew to 14 million units, which is 14% of all car sales in the world with a lot of new models adopting high-grade AWD technology that provides effective torque distribution with suitable adjustability.

Technological advancements in AWD systems, especially the combination of intelligent and electronically controlled systems, are another major factor that drives market growth. Such systems offer greater efficiency in power distribution for a vehicle, able to adjust in real-time to road conditions and driving style. The demand is likely to go up as automotive manufacturers target innovations by incorporating AWD systems in various automobile types, including luxury cars, commercial vehicles, etc. In addition, ramping up government regulations on vehicle emissions and safety is pushing manufacturers to develop more advanced AWD technologies to comply with these regulations, therefore driving the growth of the AWD market. In 2023, more than 30% of new EVs and hybrids provide high and low-range AWD via dual-motor systems offering up to 360 miles of range (Tesla Model Y). In Europe and North America, 90% of Subaru vehicles sold in snow-prone areas are configured with AWD safety technology as well as Eyesight. Also, over 70% of luxury SUVs solved this dilemma, integrating intelligent AWD systems (e.g., 4MATIC for Mercedes-Benz vehicles and xDrive for BMW vehicles) and satisfying both regulatory and consumer demands for enhanced performance and safety.

MARKET DYNAMICS

KEY DRIVERS:

-

Rising Consumer Demand for Performance and Safety Drives Growth of AWD Systems in SUVs

The increasing demand for improved performance of vehicles and better driving experience from consumers has created a major market driver for the growth of Intelligent All-Wheel Drive (AWD) systems. Given consumers are more in demand for better capable and practical vehicles, AWD systems are considered a must-have feature, especially in high-performance and luxury vehicles. Providing better traction, cornering, and off-road performance for those living in mountainous regions or other areas affected by heavy snow, these systems are greatly aimed at better performance and desirable for people living in the region. Also adding to the trend in the consumer space is increasing recognition of the safety and traction control abilities of AWD systems over a wet or uneven surface. A prime example of this can be seen in the rapidly rising popularity of AWD-fitted SUVs, one of the fastest-growing segments of the automotive world today. The Toyota RAV4 sold 248,295 units in 2023-2024, followed by the Subaru Outback and Crosstrek at 81,703 and 79,500 units respectively. AWD-equipped models such as the Mazda CX-5 moved 70,214 units and even the Jeep Wrangler managed to sell 77,204 units, highlighting the undeniable appeal of the system in both mainstream and luxury SUV segments.

-

Technological Advancements in AI and Machine Learning Drive Growth of Intelligent AWD Systems in EVs

The key factor is the technological progress in the automotive industry especially in the development of automotive manufacturing systems about the integration of AI and machine learning to become more intelligent AWD systems. In this way, these technological breakthroughs enable more efficient and dynamic distribution of power between the axles of the vehicle to be optimized for fuel economy and maximize real-time performance depending on road conditions. Take intelligent all-wheel drive (AWD) systems in electric vehicles (EV) as an example, where intelligent AWD systems play a key role in managing battery power by distributing torque exactly where it is needed to maintain the balance and efficiency of the vehicle. In addition, these systems allow manufacturers to provide more tailored driving modes, giving drivers the ability to toggle between various flavors of AWD depending on how they feel or what the road is like. The growing technological advances in these systems provided by car manufacturers are likely to create a significant demand for advanced AWD technology (to enhance performance along with safety), substantially driving market growth. More than 50% of new electric SUVs in 2023 were equipped with AI-driven intelligent AWD systems, such as the Tesla Model X which optimizes power-battery efficiency using machine learning. BMW added AI AWD to 20+ models and Toyota believes that 90% of its 2024 EV lineup will feature AI AWD. With more and more customers seeking better performance and efficiency, even brands such as Audi and Ford are adopting AI-based torque vectoring, with 60% of new EVs planned to include the tech.

RESTRAIN:

-

Challenges of Integrating Advanced AWD Technology in Vehicle Platforms and Competing Drivetrain Options

One key restraint is the complexity of implementing high-technology AWD within existing vehicle platforms. This complexity requires extensive engineering modifications and can delay production or render vehicles incompatible, especially when manufacturers migrate from conventional AWD systems to more advanced electronic or hybrid ones. The troubling part of this technical hurdle is that it slows down the rate of adoption something many automakers with existing production lines or companies that target the mass market don't particularly benefit from. It also faces tougher competition from alternative drivetrains, like front-wheel drive (FWD) and rear-wheel drive (RWD) systems, which tend to be much simpler, lighter, and cheaper than all-wheel drive. This makes them especially attractive for small vehicles, and in markets where fuel economy takes precedence of off-road or all-weather ability. Finally, the often-reported reliability of the complicated AWD systems used on consumer vehicles and their potentially high maintenance costs can scare off potential buyers, especially in developing markets where reliability is considered a high priority.

KEY MARKET SEGMENTS

BY PRODUCT TYPE

In 2023, Front Wheel Drive (FWD) systems held a market share of 47.89% owing to its cost-effectiveness, simplicity, and fuel efficiency. FWD systems are common in smaller vehicles, like compact cars and sedans, which typically value efficiency over off-road and high-performance capabilities. This also means systems that are lighter, more fuel efficient, and more compact, which is better suited to the needs of mainstream, value-conscious consumers looking for cars through which to access personal transportation. Furthermore, facts support FWD systems as they have recorded little to no issues in their years of use, this reinforces its popularity in markets where practicality and lower operational cost are favored.

All-wheel drive (AWD) systems are anticipated to witness the largest CAGR over the period 2024 - 2032, as consumer preference shifts towards improved vehicle performance, safety, and versatility. AWD All-wheel drive (AWD) comes in various versions, but generally, these systems work by sending power to all four wheels, which offers enhanced traction and stability in low-grip situations like snow or rain, making it prevalent in SUVs, crossovers, and high-performance cars. In addition, with the increasing demand for electric vehicles (EVs), AWD systems are also gaining momentum, as an efficient control of power distribution of electric drivetrains is enabled. The demand for electric AWD vehicles– especially in the luxury and high-performance classes– and the growth of SUVs and crossovers in markets all over the world are contributing to the rapid growth of AWD systems in the next decade.

BY TECHNOLOGY TYPE

Mechanical AWD systems had the majority of the share in 2023 at 46.8%. Strong and reliable, these systems appeal to mass-market car makers, too, with a cost advantage. Mechanical AWD systems are a well-established technology in conventional internal combustion engine (ICE) automobiles, especially for light commercial and utility vehicles. The impressive off-road ability of all-terrain tires has made them the standard on many SUVs and other vehicles capable of off-road driving, further securing their market position. This simplicity and robust functionality also make mechanical systems a favorite among many automakers looking to strike a performance-to-cost balance, which leads to high-volume production and mainstream consumer demand.

Electronic AWD systems to have the highest CAGR between 2024-2032. This growth is fueled by the trends of vehicle electrification and a need for more responsive, efficient, and custom driving experiences. Such systems can dynamically deliver torque and power, making them well-suited for the unique performance and energy efficiency needs of electric and hybrid vehicle designs. Electronic AWD systems have gained traction with the increasing transition to EVs since controlling power distribution is so critical for maximizing battery life and balancing vehicle weight as more and more EVs are arriving with a motor at each axle. Pulling together all the pieces of electronics directly related to the car systems allows for greater interaction between vehicle systems, with improved overall performance, safety, and response developed through various adaptive measures in the ability to respond in real-time to road conditions. With the automotive industry moving towards more intelligent, more efficient technologies, it all bodes well for electronic AWD systems.

BY VEHICLE TYPE

Passenger Vehicles led the market segment for Intelligent All-Wheel Drive (AWD) systems at 53.6% market share in 2023. Such domination can be traced to the growing consumer preference toward SUVs, crossovers, and luxury vehicles, which usually come equipped with all-wheel drive for enhanced performance, safety, and traction. AWD provides better handling, stability, and driving comfort so it is a profitable selling point for passenger vehicles, especially in adverse weather regions. This, in addition to the growing trend toward electrification where an increasing number of customers are increasingly drawn to greener but performance-driven vehicles, boosts the number of AWD models.

The Light Commercial Vehicles (LCVs) segment is projected to exhibit the highest CAGR from 2024-2032. Increasing demand for delivery vehicles, urban transport, and last-mile logistics applications wherein AWD systems offer enhanced traction and stability advantage in low-friction surfaces or under rugged operating conditions is driving growth in this sector. Light commercial vehicles are being offered more and more with AWD systems as rising e-commerce highlights the need for effective logistics and distribution networks. The trend of acceptance of electric LCVs, typically equipped with a more technically advantageous AWD configuration that runs on electric power for better torque distribution for improved efficiency further pushes this category toward remarkable growth.

BY PROPULSION

ICE vehicles accounted for 74.3% of the Intelligent All-Wheel Drive (AWD) market in 2023. The dominance of ICE vehicles is mainly due to the mature ecosystem surrounding ICE vehicles and their penetration in the auto market. All-wheel-drive (AWD) systems have been used for many years in internal combustion engine (ICE) vehicles and continue to be used in the SUV and truck segments for performance, safety, and traction in difficult driving environments. ICE vehicles remain affordable, have technology that is well understood, and have established production processes, so they are expected to continue to be the consumer vehicle choice in regions with the lowest EV penetration. Third, the global vehicle fleet is still heavily dependent on ICE technology, which means ICE AWD will still dominate the AWD market.

Electric Vehicles (EVs) are projected to have the highest CAGR between 2024 and 2032, due to the increasing propensity for electric vehicles and sustainable transportation. AWD systems are inherently advantageous for EVs, as those electric motors can transmit power (and, therefore, torque) more efficiently by distributing it among as many as four driven wheels to maximize traction. The trend towards EVs, with factors such as environmental concerns, stricter emission norms, and larger adoption of renewable energy, has prompted EV manufacturers to adopt many advanced AWD systems in their vehicles to fulfill consumer needs for performance and efficiency. Additionally making AWD systems more common on EVs is the introduction of EV-specific platforms that enable flexible distribution of power across axles. Coupled with government incentives and consumer acceptance of EVs, this trend is projected to boost the adoption rate of AWD-equipped electric vehicles at an accelerated pace.

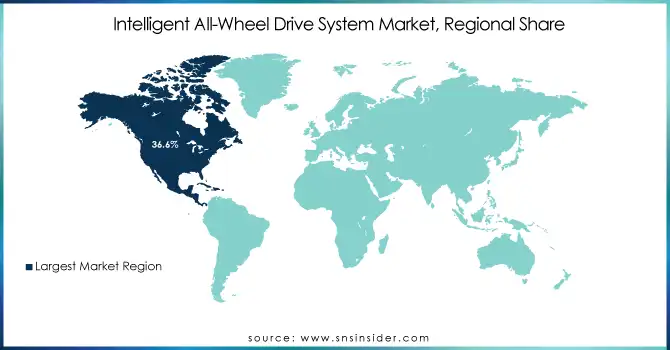

REGIONAL ANALYSIS

The North American region dominates the intelligent all-wheel-drive (AWD) system market, holding the highest share of 36.6% in the global market in 2023. That dominance is due in part to the high demand among American consumers for SUVs, crossovers, and electric vehicles (EVs) that are often fitted with AWD systems for added safety and performance. With heavyweights like Ford, General Motors, and DaimlerChrysler making most of their vehicles in the region, the automobile market is very sophisticated about all-wheel drive and provides it as an option in a variety of vehicles. In addition, American buyers love high-end, performance vehicles, which naturally come equipped with AWD for better cornering, particularly in bad conditions. Tesla Model X The Tesla all-electric model x is an all-electric and all-wheel-drive (AWD) seven-passenger SUV that has become a benchmark in the electric and AWD market segments.

Asia Pacific is projected to have the fastest CAGR during 2024 and 2032. This is supported by the rapid growth of both automotive and EV markets in the region. Indeed, the rise of global electric vehicle leaders like Chinese manufacturers BYD, NIO, and XPeng is increasingly in step with the electrification of AWD, allowing EV vehicles to have blistering performance with a dramatic increase in energy efficiency and more importantly, range. The SUV and crossover craze, propelled by models such as the Honda CR-V and Toyota RAV4, is also driving demand for AWD systems in regions such as China, India, and Japan. Also, countries like China are pushing charges and manufacturers to adopt AWD in electric vehicles through subsidies and infrastructure plans. The growing middle class and rising disposable incomes are also catalysts for the rise of AWD-enabled passenger and commercial vehicles in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players

Some of the major players in the Intelligent All-Wheel Drive System Market are:

-

Honda (i-VTM4, SH-AWD)

-

Acura (SH-AWD, Super Handling AWD)

-

Infiniti (Intelligent AWD, QX60 AWD)

-

Audi (Quattro, Quattro Ultra)

-

Subaru (Symmetrical AWD, EyeSight AWD)

-

BMW (xDrive, M xDrive)

-

Mercedes-Benz (4MATIC, 4MATIC+ AWD)

-

Ford (Intelligent AWD, PowerShift AWD)

-

Toyota (AWD-i, E-Four AWD)

-

Nissan (Intelligent AWD, All-Wheel Drive Hybrid)

-

Mazda (i-Activ AWD, i-Activ Drive)

-

Porsche (PTM AWD, Porsche Traction Management)

-

Land Rover (Terrain Response AWD, All-Terrain Progress Control)

-

Jaguar (AWD with Intelligent Driveline Dynamics, Jaguar F-Type AWD)

-

Volvo (AWD, On-Demand AWD)

-

Tesla (Dual Motor AWD, AWD Performance)

-

Rivian (Rivian AWD, Quad-Motor AWD)

-

Lucid Motors (AWD, Dual Motor AWD)

-

Drako Motors (Quad Motor AWD, GTE Supercar AWD)

Some of the Raw Material Suppliers for Intelligent All-Wheel Drive System Companies:

-

BASF

-

Dupont

-

ArcelorMittal

-

SKF

-

Schaeffler

-

BorgWarner

-

Magna International

-

ZF Friedrichshafen

-

Bosch

-

Daimler AG

RECENT TRENDS

-

In April 2024, Li Auto Inc., a leader in China's new energy vehicle market, launched the Li L6, a premium five-seat family SUV featuring an intelligent all-wheel-drive system as part of its standard configuration.

-

In July 2024, the 2025 Nissan Rogue introduces the new Rock Creek edition, featuring a standard Intelligent All-Wheel Drive system for enhanced adventure capabilities. It also includes ProPILOT Assist 2.

-

In June 2024, BMW will launch the 2025 M5, equipped with the new M xDrive intelligent all-wheel-drive system for superior performance and handling. This advanced AWD technology enhances driving dynamics, making the M5 a top choice for enthusiasts.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 3.9 Billion |

|

Market Size by 2032 |

USD 9.49 Billion |

|

CAGR |

CAGR of 10.42% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Product Type (Front Wheel Drive, All Wheel Drive, Rear Wheel Drive) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Honda, Acura, Infiniti, Audi, Subaru, BMW, Mercedes-Benz, Ford, Toyota, Nissan, Mazda, Porsche, Land Rover, Jaguar, Volvo, Tesla, Rivian, Lucid Motors, Drako Motors, Zoox |

|

Key Drivers |

• Rising Consumer Demand for Performance and Safety Drives Growth of AWD Systems in SUVs |

|

RESTRAINTS |

• Challenges of Integrating Advanced AWD Technology in Vehicle Platforms and Competing Drivetrain Options |