Automotive Spark Plug Market Report Scope & Overview:

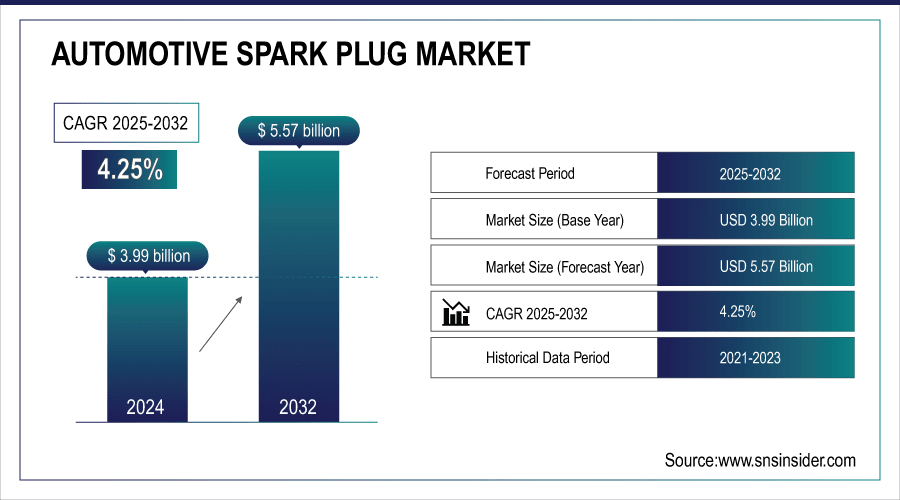

The Automotive Spark Plug Market size was valued at USD 3.99 Billion in 2024 and is projected to reach USD 5.57 Billion by 2032, growing at a CAGR of 4.25% during 2025–2032.

The automotive spark plug market is driven by the growing demand for reliable, high-performance ignition systems across passenger cars, commercial vehicles, and motorsport applications. Spark plugs must withstand high temperatures and pressures while delivering consistent sparks to optimize engine efficiency and power output. Key factors influencing demand include material type (copper, platinum, or iridium), heat range, electrode design, thread size, and spark gap. Technological advancements in fine-wire and precious-metal electrodes improve ignitability and durability. Rising adoption of performance and aftermarket upgrades, combined with stringent emission standards, is fueling growth in the global automotive spark plug market.

Published: Jun 4, 2025 Ignition Components in High-Performance Engines – High-performance engines generate high power relative to size and operate under extreme conditions, requiring ignition systems that deliver strong, consistent sparks at high rpm. Components include spark plugs, ignition coils, wires, distributors (older systems), and ignition control modules, all crucial for precise combustion timing and engine efficiency.

To Get More Information On Automotive Spark Plug Market - Request Free Sample Report

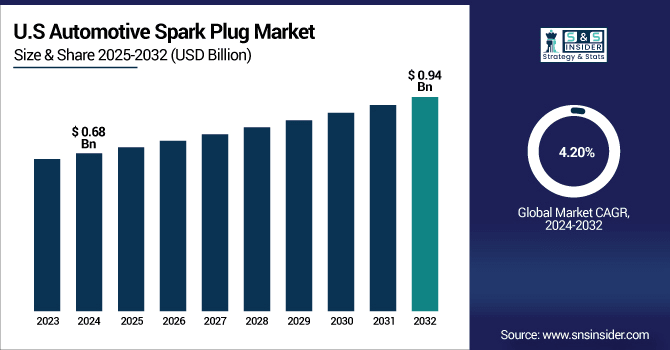

The U.S. Automotive Spark Plug Market size was valued at USD 0.68 Billion in 2024 and is projected to reach USD 0.94 Billion by 2032, growing at a CAGR of 4.20% during 2025–2032. Automotive Spark Plug Market growth is driven by increasing demand for high-performance and fuel-efficient vehicles, rising vehicle production, technological advancements in spark plug materials, and stricter emission regulations boosting replacement and aftermarket sales.

Automotive Spark Plug Market Drivers:

-

Rising Counterfeit Automotive Parts Boost Demand for Genuine Components

The rise in counterfeit automotive parts is driving market awareness and demand for genuine components. Counterfeits, increasingly sold online from Asia, include ignition coils, fuel injectors, key fobs, spark plugs, and air bags. Because counterfeit parts often fail to meet safety and performance standards—air bags, for example, may not deploy properly in crashes—OEMs and regulators are taking stronger measures to protect consumers. This includes testing, law enforcement training, Customs seizures, and legal action against importers. As a result, vehicle owners and service providers are increasingly seeking verified, high-quality parts, boosting genuine aftermarket and OEM sales.

Published: June 20, 2025 – Rising counterfeit automotive parts, especially smaller components like ignition coils, fuel injectors, key fobs, and spark plugs, are increasingly sold online from Asia, posing safety risks, particularly with air bags that often fail in crashes.

Automotive Spark Plug Market Restraints:

-

High Costs and Counterfeit Parts Limit Global Spark Plug Adoption

The global automotive spark plug market faces several challenges that could hinder its growth. Premium spark plugs, such as iridium and platinum types, carry high costs, discouraging price-sensitive consumers and small repair shops. Modern engines’ technical complexity demands precise spark plug specifications, making replacement and installation difficult for non-professional users. The increasing circulation of counterfeit and low-quality parts further undermines consumer confidence and can cause engine damage, reducing repeat purchases of genuine components. Additionally, fluctuating raw material prices and supply chain disruptions create uncertainty, limiting broader adoption and slowing overall market expansion.

Automotive Spark Plug Market Opportunities:

-

Rising Demand for Premium Spark Plugs Fuels Aftermarket Growth

The automotive aftermarket presents a strong opportunity due to growing demand for durable, high-performance spark plugs. Modern vehicles require reliable ignition components that can withstand higher engine temperatures and pressures, driving preference for premium materials like iridium and platinum. As the vehicle parc expands, the need for replacement and upgraded spark plugs increases, allowing aftermarket players to broaden their product offerings. This trend supports innovation in spark plug design, enhances brand recognition, and opens revenue growth avenues. Overall, the shift toward long-lasting, efficient ignition components is a key factor propelling aftermarket market expansion.

Published: November 19, 2024 – Niterra launched seven double precious metal spark plugs for 4-wheel vehicles in the EMEA region, covering a car parc of 5.4 million vehicles in 2024, expected to rise to 6.49 million in 2025, boosting aftermarket coverage.

Automotive Spark Plug Market Segment Highlights:

-

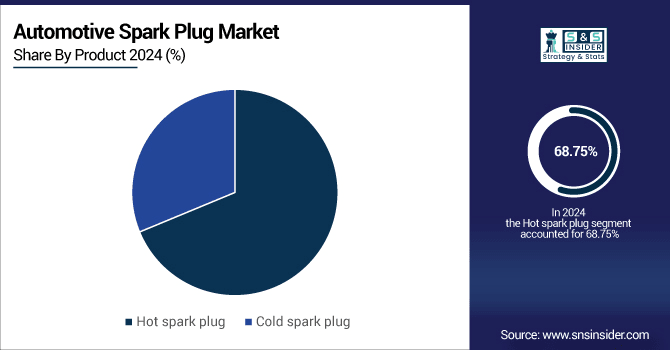

By Product: Hot spark plugs dominate with 68.75% in 2024, Cold spark plugs grow faster with a CAGR of 7.05%,

-

By Electrode Material: Platinum leads at 39.25% in 2024 while iridium grows strongly at a CAGR of 5.70%,

-

By Sales Channel: OEM is the largest at 54.5% in 2024, with a CAGR of 3.51%, while aftermarket grows faster at 5.08% CAGR, reaching 48.5%.

-

By Vehicle Type: Passenger cars dominate at 49.25% in 2024 (3% CAGR), commercial vehicles grow faster at 6.03% CAGR,

Automotive Spark Plug Market Segment Analysis:

By Product, Hot Plugs Lead While Cold Plugs Gain Momentum

Hot spark plugs remain the dominant choice due to reliability, while cold spark plugs are growing faster, driven by demand for high-performance and fuel-efficient engines. This trend highlights shifting consumer preferences and opportunities for manufacturers to expand offerings and meet evolving vehicle performance requirements.

By Electrode Material, Platinum Dominates While Iridium Gains Popularity

Platinum spark plugs continue to lead the market due to their durability and performance, while iridium spark plugs are growing rapidly, driven by demand for high-efficiency and long-lasting ignition components. This shift presents opportunities for manufacturers to focus on advanced materials and meet evolving engine requirements.

By Sales Channel, OEM Leads While Aftermarket Expands Rapidly

OEM remains the largest sales channel due to strong manufacturer partnerships, but the aftermarket segment is growing faster, driven by increasing demand for replacement and upgraded spark plugs. This trend offers opportunities for suppliers to expand distribution, enhance brand presence, and cater to both vehicle manufacturers and independent service providers.

By Vehicle Type, Passenger Cars Lead While Commercial Vehicles Grow Faster

Passenger cars remain the dominant segment due to their large volume and widespread use, while commercial vehicles are growing at a faster pace, driven by increasing fleet expansion and demand for durable spark plugs. This trend creates opportunities for manufacturers to cater to both segments and address evolving vehicle performance needs.

Automotive Spark Plug Market Regional Highlights:

-

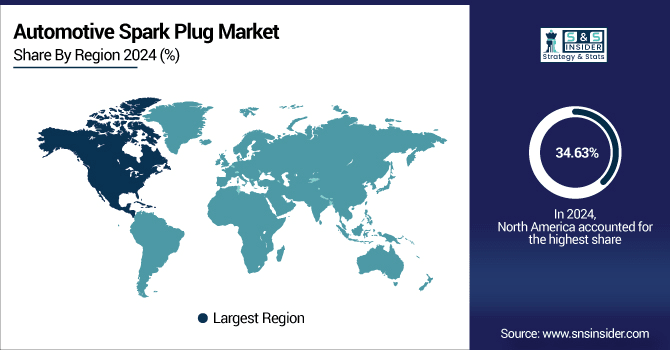

By Region – Dominating: North America (34.63% in 2024 → 32.38% in 2032, CAGR 3.38%)

-

Fastest-Growing Region: Asia-Pacific (20.88% in 2024 → 26.13% in 2032, CAGR 7.17%)

-

Europe: 24.88% → 24.13% (CAGR 3.85%)

-

South America: 9.88% → 9.13% (CAGR 3.22%, declining)

-

Middle East & Africa: 9.75% → 8.25% (CAGR 2.08%, declining)

Automotive Spark Plug Market Regional Analysis:

North America Automotive Spark Plug Market Insights:

North America leads the Automotive Spark Plug Market, driven by high vehicle ownership, strong demand for replacement parts, and widespread adoption of premium and high-performance spark plugs. Steady aftermarket growth and focus on fuel-efficient, technologically advanced vehicles further support market expansion and create opportunities for manufacturers to strengthen their regional presence.

Get Customized Report as Per Your Business Requirement - Enquiry Now

-

U.S. Automotive Spark Plug Market Insights:

The U.S. leads North America’s Automotive Spark Plug Market, driven by rising vehicle production, aftermarket demand, and adoption of high-performance, fuel-efficient spark plugs.

Asia-Pacific Automotive Spark Plug Market Insights:

Asia-Pacific is the fastest-growing region in the Automotive Spark Plug Market, driven by increasing vehicle production, rising replacement demand, and adoption of advanced spark plug technologies. Strong demand from passenger cars, commercial vehicles, and two-wheelers, coupled with growing disposable incomes and industrialization, positions the region as a key opportunity for manufacturers.

-

China Automotive Spark Plug Market Insights:

China leads Asia-Pacific in electric outboard adoption, driven by high vehicle production, strong replacement demand, and rapid industry growth.

Europe Automotive Spark Plug Market Insights:

The European Automotive Spark Plug Market is expanding steadily, supported by established automotive industries, rising replacement demand, and increasing adoption of advanced spark plug technologies. Growth is driven by passenger cars and commercial vehicles, along with a focus on fuel efficiency and emissions compliance, creating opportunities for manufacturers to expand product offerings and strengthen market presence.

-

Germany Automotive Spark Plug Market Insights:

Germany dominates the European automotive spark plug market due to its large vehicle parc, strong automotive manufacturing base, high replacement demand, and early adoption of advanced spark plug technologies.

Latin America Automotive Spark Plug Market Insights:

The Latin American Automotive Spark Plug Market is emerging, driven by growing vehicle ownership, increasing replacement demand, and gradual adoption of modern engine technologies. Market growth is supported by passenger cars, commercial vehicles, and two-wheelers, offering opportunities for manufacturers to strengthen aftermarket presence and cater to evolving regional automotive needs.

-

Brazil Automotive Spark Plug Market Insights:

Brazil leads the Latin America automotive spark plug market due to its large vehicle parc, growing automotive production, and strong demand for replacement and high-performance spark plugs across passenger and commercial vehicles.

Middle East & Africa Automotive Spark Plug Market Insights:

The Middle East & Africa automotive spark plug market is growing steadily, driven by increasing vehicle sales, rising demand for reliable replacement parts, and gradual adoption of advanced spark plug technologies. Growth is supported by both passenger cars and commercial vehicles, creating opportunities for manufacturers to expand regional market presence and aftermarket offerings.

-

Saudi Arabia Automotive Spark Plug Market Insights:

Saudi Arabia dominates the Middle East & Africa automotive spark plug market due to its large vehicle parc, strong automotive demand, and increasing focus on maintenance and replacement parts across passenger and commercial vehicles.

Automotive Spark Plug Market Competitive Landscape:

DENSO Corporation is a leading global supplier of advanced automotive technology, systems, and components. Founded in 1949 as a division of Toyota Motor Corporation, DENSO became an independent company in 1959. It specializes in manufacturing a wide range of products, including powertrain control systems, electronic systems, and thermal systems. DENSO is recognized for its commitment to innovation and sustainability in the automotive industry. Niterra Co., Ltd., formerly known as NGK Spark Plug Co., Ltd., is a prominent manufacturer specializing in spark plugs, oxygen sensors, and technical ceramics. Founded in 1936, the company has evolved to serve various industries, including automotive, medical, and environmental sectors. In April 2023, the company rebranded to Niterra to reflect its broader focus on sustainability and innovation

-

In September 1, 2025, DENSO announced the transfer of its spark plug and exhaust gas sensor business to Niterra, aiming to enhance internal combustion engine technologies while focusing on electrification and clean energy initiatives. The transfer awaits regulatory approvals.

Automotive Spark Plug Market Key Players:

-

Niterra Co., Ltd.

-

DENSO Corporation

-

Robert Bosch GmbH

-

Tenneco Inc.

-

Valeo SE

-

Hyundai Mobis

-

General Motors Corp.

-

Pulstar

-

Autolite (First Brands Group LLC)

-

Torquemaster Spark Plugs

-

Stitt Spark Plug Company

-

KLG Spark Plugs

-

E3 Spark Plugs

-

HKS Co., Ltd.

-

Federal Mogul Powertrain Otomotiv A.Ş.

-

BRISK Tábor a.s.

-

BorgWarner Inc.

-

Champion

-

NGK Spark Plugs

-

AC Delco

| Report Attributes | Details |

| Market Size in 2024 | USD 3.99 Billion |

| Market Size by 2032 | USD 5.57 Billion |

| CAGR | CAGR of 4.25% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Hot spark plug and Cold spark plug) • By Electrode Material (Copper, Platinum, Iridium and Others) • By Sales Channel (OEM and Aftermarket) • By Vehicle (Passenger car, Commercial vehicle and Two-wheeler) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Niterra Co., Ltd., DENSO Corporation, Robert Bosch GmbH, Tenneco Inc., Valeo SE, Hyundai Mobis, General Motors Corp., Pulstar, Autolite (First Brands Group LLC), Torquemaster Spark Plugs, Stitt Spark Plug Company, KLG Spark Plugs, E3 Spark Plugs, HKS Co., Ltd., Federal Mogul Powertrain Otomotiv A.Ş., BRISK Tábor a.s., BorgWarner Inc., Champion, NGK Spark Plugs, AC Delco. |