Automotive Terminal Market Report Scope & Overview:

Get More Information on Automotive Terminal Market - Request Sample Report

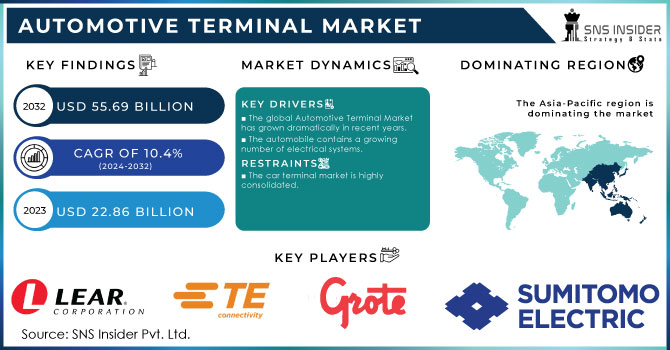

The Automotive Terminal Market size was valued at USD 22.86 billion in 2023 and is expected to reach USD 55.69 billion by 2032 and grow at a CAGR of 10.4% over the forecast period 2024-2032.

The automotive terminal market is driven by a several of key factors. Notably, there has been an increase in the number of electric vehicle sales by 30% over the year, which is indicative of a rise in vehicle electrification. Due to intricate electrical systems, these vehicles need many more terminals. Furthermore, ADAS technology has been popularized in recent times. This means that it would require complex wiring and strong terminal points for services like automatic emergency braking and adaptive cruise control to work properly. Consequently, this automotive terminal market has also grown due to strict government safety regulations that advocate for electronic stability control and tire pressure monitoring systems which heavily depends on terminals. Lastly, there is rise in demand for infotainment and connectivity features such as built-in navigation systems as seen from a 25% increase in vehicles fitted with these functions over the last two years.

Moreover, the introduction of demanding safety standards requiring advanced driver assistance systems (ADAS) has led to an upswing in the use of terminals by manufacturers in their security and safety products thus leading to almost 25% growth rate witnessed within this segment in last decade. Furthermore, infrastructure investments in charging stations for electric vehicles are indirectly stimulating the automotive terminal market, as these stations require strong electrical connections.

MARKET DYNAMICS:

KEY DRIVERS:

-

The global Automotive Terminal Market has grown dramatically in recent years.

On a global scale, the Automotive Terminal Market has grown significantly in recent years. This growth can be due to technical breakthroughs, increased vehicle electrification, and rising demand for improved connection solutions in autos. These factors have all contributed to the market's rapid growth.

-

Government mandates are supporting the growing demand for car safety systems.

-

The automobile contains a growing number of electrical systems.

-

The installation of cutting-edge safety systems is governed by legislation.

RESTRAINTS:

-

The car terminal market is highly consolidated.

The vehicle terminal market is highly concentrated, with a few prominent businesses controlling a sizable market share. This concentrated landscape is frequently the product of mergers, acquisitions, and strategic alliances among significant market participants. This tendency of consolidation has an impact on competitive dynamics and market developments in the automotive terminal sector.

-

On the contrary, the difficulties of long-term reliability for battery terminals is anticipated to hinder market performance.

-

Terminals that are capable of meeting the standards for vibration handling.

OPPORTUNITIES:

-

Effective use of energy E-Mobility.

The automobile terminal market is highly consolidated, with a few prominent competitors controlling a sizable market share. This concentrated landscape is frequently the product of mergers, acquisitions, and strategic collaborations among significant industry participants. This consolidation tendency has an impact on competitive dynamics and market developments in the automotive terminal sector.

-

Vehicles that are linked, automated, or semi-autonomous in the future

-

Future networked, autonomous, and semi-autonomous automobiles: a perspective.

-

People in the region are becoming more aware of the benefits of green vehicles.

CHALLENGES:

-

High voltage terminal design concerns

To prevent electrical arcing, assure user safety, and maintain component integrity, high voltage terminal design necessitates thorough insulation, safety standards, and heat dissipation strategies. To manage the higher power requirements and potential risks associated with high voltage systems, it is critical to balance compactness with durability.

-

Battery terminal long-term reliability challenges

-

There are issues with the design of the high voltage terminals.

-

Battery terminals pose a challenge in terms of long-term reliability.

MARKET SEGMENTATION:

By Vehicle Type:

The automotive terminal market is characterized by unique features across PC, LCV and HCV segments. In terms of market share, passenger cars in 2023 dominated at about 60% due to their high numbers but fewer terminal counts per vehicle. Being affected by terminal aesthetics in the design, trends for small sizes and increasing electronic content that led to terminals demand as well. Conversely, LCVs have a lower unit volume but require strong terminal designs as they operate under harsh conditions and have high electrical loads compared to the rest of the vehicles accounting for 30% of total market share. The HCV segment has the largest critical system requirements for which it demands high-current terminals with its small overall volumes contributing to merely 10%.

Market, By Application:

The global market has been divided into Body Control & Interiors, Safety & Security, Cooling, Engine & Emission Control, Infotainment, Lighting systems, and Battery System Based on applications segment. Cooling, Engine & Emission Control led the automotive terminal market. Increasing electronic content for cooling, engine management, and gas treatment drive this segment. Automotive terminals' fastest-growing segment is battery systems.

Market, By Current Ratings:

The global market has been divided into Below 40 Ampere, 41–100 Ampere, and Above 100 Ampere based on the current rating segment. Above 100 Ampere will have the highest CAGR in the automotive terminal industry. 41–100 Amps and below 40 Amps follow. Below 40 Ampere is anticipated to have the highest share of the automotive terminal market due to its ubiquitous use in-car electronics.

REGIONAL ANALYSIS:

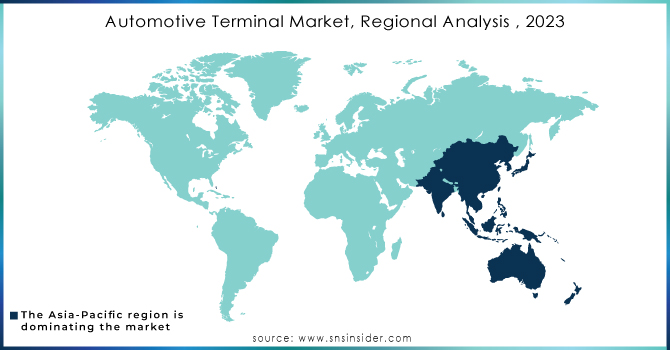

As part of North America, the automotive terminal market as well as Canada and Mexico; South America, specifically Brazil and Argentina; Europe as a whole; Turkey; Russia; North America as a whole; Japan; China; India; South Korea; Australia; Southeast Asia; and the rest of Asia-Pacific (APAC), including Singapore (MEA). It is anticipated that the Asia-Pacific region will hold the largest proportion of the regional market. Additionally, it is anticipated that this region will have the highest market value in the region. It is anticipated that the Asia-Pacific region will manufacture the most quantity of automobile terminals for the market. It is anticipated that the market would expand at a rate that is second highest in North America. It is anticipated that the growth rate of the European Union will remain the third highest until at least 2027.

The Asia Pacific market is expected to have the biggest market share and grow at a considerable CAGR over the forecast period. The region's market growth can be linked to increased car manufacturing and regulatory rules addressing vehicle active and passive safety. Increased infrastructure investment, construction activity, and automobile sales are also expected to support growth in this region. A highly concentrated market and terminals capable of meeting vibration requirements are two main limitations for the global automotive terminal market. The advantages of mechatronics systems over traditional mechanical systems contribute to user-friendliness and cost-effectiveness.

Need any customization research on Automotive Terminal Market - Enquiry Now

KEY PLAYERS:

TE Connectivity Ltd. (Switzerland), Lear Corporation (U.S.), Sumitomo Electric Industries, Ltd. (Japan), Grote Industries (U.S.), Delphi Plc (U.K), and Furukawa Electric Co., Ltd. (Japan). PKC Group (Finland), Molex, LLC (U.S.), Keats Manufacturing Co. (U.S.), and Viney Corporation Limited (India) are some of the affluent competitors with significant market share in the Automotive Terminal Market.

RECENT DEVELOPMENT:

-

Xiaomi announced in February 2023 the launch of a smart auto key in collaboration with BMW, which will be available in the second quarter of this year.

-

In October 2022, STMicroelectronics (ST), a Dutch semiconductor manufacturing company, introduced the ST25R3920B, which is said to be the first Car Connectivity Consortium (CCC)-certified NFC Forum IC for Digital Key applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 22.86 Billion |

| Market Size by 2032 | US$ 55.69 Billion |

| CAGR | CAGR of 10.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Current Ratings (Below 40 Ampere, 41–100 Ampere, Above 100 Ampere) • By Application (Body Control & Interiors, Safety & Security, Cooling, Engine & Emission Control, Infotainment, Lighting System, Battery System) • By Vehicle Type (Passenger cars, LCV, HCV) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | TE Connectivity Ltd. (Switzerland), Lear Corporation (U.S.), Sumitomo Electric Industries, Ltd. (Japan), Grote Industries (U.S.), Delphi Plc (U.K), and Furukawa Electric Co., Ltd. (Japan). PKC Group (Finland), Molex, LLC (U.S.), Keats Manufacturing Co. (U.S.), and Viney Corporation Limited (India) |

| Key Drivers | • The global Automotive Terminal Market has grown dramatically in recent years. • Government mandates are supporting the growing demand for car safety systems. • The automobile contains a growing number of electrical systems. • The installation of cutting-edge safety systems is governed by legislation. |

| Restraints | • The car terminal market is highly consolidated. • On the contrary, the difficulties of long-term reliability for battery terminals is anticipated to hinder market performance. • Terminals that are capable of meeting the standards for vibration handling. |