Automotive Tire Market Report Scope & Overview:

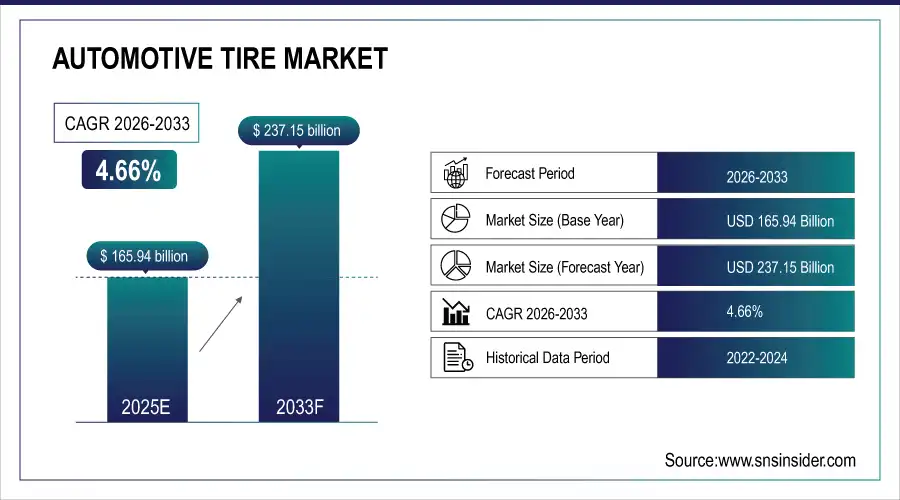

Automotive Tire Market was valued at USD 165.94 billion in 2025E and is expected to reach USD 237.15 billion by 2032, growing at a CAGR of 4.66% from 2026-2033.

The growth of the Automotive Tire Market is driven by rising vehicle production, increasing demand for replacement tires, and advancements in tire technology enhancing durability and fuel efficiency. Growing adoption of electric and hybrid vehicles is spurring the development of specialized tires, while expanding road infrastructure and higher disposable incomes in emerging economies further support market growth. Additionally, the surge in e-commerce logistics and transportation fleets boosts tire demand globally.

The Federal Motor Carrier Safety Administration (FMCSA) conducts ongoing studies of commercial vehicle tire integrity and “intelligent tire” solutions to inform future federal safety regulation.

Furthermore, China produced 1.1869 billion rubber tires in 2024, recording a 9.2% year-on-year increase, according to the National Bureau of Statistics of China.

Automotive Tire Market Size and Forecast

-

Market Size in 2025: USD 165.94 Billion

-

Market Size by 2033: USD 237.15 Billion

-

CAGR: 4.66% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Automotive Tire Market - Request Free Sample Report

Automotive Tire Market Trends

-

Rising global vehicle production and increasing demand for passenger and commercial vehicles are driving the automotive tire market.

-

Growing adoption of radial, run-flat, and energy-efficient tires is boosting market growth.

-

Expansion of electric and hybrid vehicles is fueling demand for low-rolling-resistance and durable tires.

-

Increasing focus on safety, performance, and fuel efficiency is shaping consumer preferences and regulations.

-

Advancements in tire materials, tread design, and smart tire technologies are improving longevity and monitoring capabilities.

-

Rising replacement tire demand and aftermarket growth are supporting market expansion.

-

Collaborations between tire manufacturers, automotive OEMs, and technology providers are accelerating innovation and global penetration.

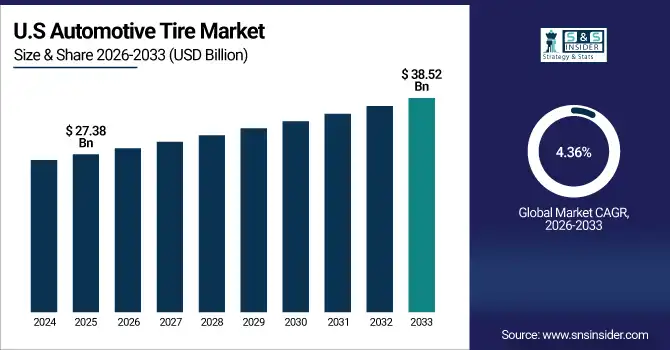

U.S. Automotive Tire Market was valued at USD 27.38 billion in 2025E and is expected to reach USD 38.52 billion by 2032, growing at a CAGR of 4.36% from 2026-2033.

The growth of the U.S. Automotive Tire Market is driven by rising vehicle replacement rates, expansion of electric vehicle sales, and increasing demand for premium and all-season tires. Technological advancements and a strong aftermarket network further fuel market expansion.

Automotive Tire Market Growth Drivers:

-

Increasing Vehicle Production and Rising Demand for Replacement Tires Accelerate the Growth of the Automotive Tire Market Worldwide

Rising global vehicle production, combined with a surge in replacement tire demand, significantly contributes to the growth of the automotive tire market. Expanding automotive ownership in developing economies and the growing middle-class population increase the need for both OEM and aftermarket tires. Additionally, advancements in tire technology such as low rolling resistance and longer tread life boost adoption across all vehicle segments, ensuring better fuel efficiency and performance, thereby driving substantial market expansion globally.

-

Global vehicle production hit 92 million units in 2024 according to OICA (International Organization of Motor Vehicle Manufacturers), with China leading at over 31 million vehicles produced, supported by robust domestic demand and rising middle-class ownership.

-

Pirelli applied AI to develop over 100,000 tire compounds for its new P Zero family, reducing rolling resistance and enhancing tread life direct company innovation leading to performance and efficiency gains.

Automotive Tire Market Restraints:

-

Fluctuating Raw Material Prices and Rising Manufacturing Costs Significantly Hamper Profit Margins of Tire Manufacturers Globally

Volatility in raw material costs, especially natural rubber, synthetic rubber, and crude oil derivatives, directly impacts tire production expenses. Frequent price fluctuations make it difficult for manufacturers to maintain stable pricing and profit margins. Additionally, rising energy costs, labor charges, and logistics expenses further strain profitability. These economic pressures often result in higher retail prices for consumers, slowing down tire replacement cycles and creating challenges for manufacturers to sustain competitiveness in the global market.

Automotive Tire Market Opportunities:

-

Technological Advancements in Smart and Connected Tires Open New Revenue Streams for Manufacturers and Aftermarket Players

Integration of IoT and sensor technologies in tires is transforming the automotive landscape. Smart tires equipped with pressure, temperature, and wear sensors enable real-time performance monitoring and predictive maintenance. These innovations improve safety, reduce downtime, and enhance driving efficiency. The growing adoption of connected vehicle ecosystems and fleet management platforms further boosts demand for intelligent tire solutions, creating new business models and opportunities for tire manufacturers and service providers globally.

|

Company |

Smart Tire/IoT Advancements & Statistics |

Source/Highlights |

|

Michelin |

MICHELIN Connected Mobility offers predictive analytics and TPMS services for fleets in EU and globally. Smart Predictive Tire sends real-time status and weekly diagnostics, reducing downtime and boosting maintenance efficiency. |

Fleet services deployed widely, enhancing operational efficiency for connected tire fleets. |

|

Bridgestone |

Surpassed 200 million tire pressure readings in 2023 with Fleet Care IoT system monitoring fleet health. Real-time temperature/pressure readings and strain sensors provide load data to aid predictive maintenance. |

Bridgestone Fleet Care technology integrates hardware and software to proactively reduce downtime and improve safety. |

|

Goodyear |

Smart connected tires reduce braking distance by up to 30%. The SightLine suite integrates sensor intelligence in all new products by 2027. Sensors transmit wear, pressure, load, and road condition data within connected vehicle ecosystems. |

Expanding use of tire sensor data in fleet safety and vehicle performance improvements. |

|

Continental |

ContiConnect Lite app and digital management solutions enable predictive maintenance, reduce emissions, save 2% fuel, and extend tire life by 10%. Widely adopted in municipal/public transport fleets and logistics. |

Real-time tire monitoring drives efficiency and sustainability goals. |

|

Pirelli |

Cyber Tyre sensors awarded V2X Innovation of the Year 2025. Collects data for advanced vehicle control and road infrastructure planning. Integrated into digital vehicle and smart city systems, leading in luxury and expanding to mainstream segments. |

Cutting-edge sensor technology contributing to smart mobility ecosystems. |

|

Sumitomo Rubber Industries |

Developed “Sensing Core” cloud-based tire wear monitoring. AI R&D on Enasave Next III maintains high performance and reduces deterioration. Integrates with CASE vehicles and MaaS models. |

Focus on connected car ecosystems and advanced AI tire management. |

|

Apollo Tyres |

Investing approximately ₹500 crore in smart tire development. Market CAGR expected at 20% (2023-28). Integrating pressure/temp sensors for real-time fleet safety and operating digital supply chains. |

Responding to growing demand in Asia and India with smart tire technology and services. |

Automotive Tire Market Segment Highlights

-

By Distribution Channel, Aftermarket dominated with ~63% share in 2025; OEM fastest growing (CAGR).

-

By Application, Passenger Cars dominated with ~71% share in 2025; Two-Wheelers fastest growing (CAGR).

-

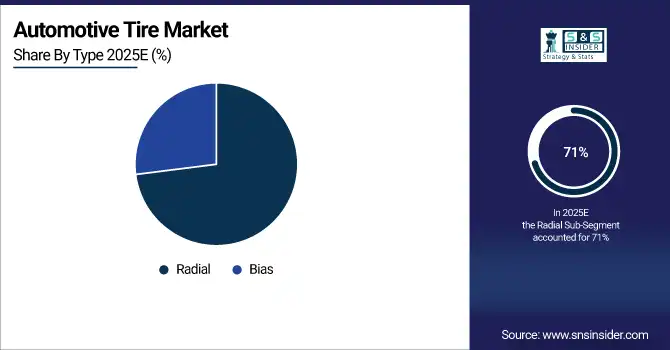

By Type, Radial dominated with ~71% share in 2025; Radial fastest growing (CAGR).

-

By Rim Size, 15 to 20 Inches dominated with ~51% share in 2025; 15 to 20 Inches fastest growing (CAGR).

Automotive Tire Market Segment Analysis

By Distribution Channel

Aftermarket segment dominated the Automotive Tire Market with the highest revenue share in 2025 due to the growing replacement demand from aging vehicle fleets, frequent tire wear, and consumer preference for affordable tire options. Expanding e-commerce channels and accessibility of multi-brand retail outlets further supported the segment’s leading position.

OEM segment is expected to grow at the fastest CAGR from 2026–2033 owing to rising global vehicle production, increasing adoption of premium tires in new vehicles, and automakers’ focus on fuel efficiency and safety standards. Technological integration and expansion of EV manufacturing also contribute to the segment’s accelerated growth rate.

By Application

Passenger cars segment dominated the Automotive Tire Market with the highest revenue share in 2025, driven by high passenger car ownership, rapid urbanization, and strong replacement demand. The popularity of sedans, SUVs, and electric cars further increased tire consumption across OEM and aftermarket distribution channels globally.

Two-wheelers segment is expected to grow at the fastest CAGR from 2026–2033 due to rising demand for cost-effective urban mobility solutions, especially in developing countries. The growing number of electric two-wheelers and enhanced tire durability suited for varied terrains also stimulate consistent growth in this segment over the forecast period.

By Type

Radial segment dominated the Automotive Tire Market with the highest revenue share in 2025 and is expected to grow at the fastest CAGR from 2026–2033. This dominance is driven by superior durability, fuel efficiency, and better traction compared to bias tires. Radial tires offer enhanced ride comfort, improved heat dissipation, and longer lifespan, making them the preferred choice for both passenger and commercial vehicles. Increasing vehicle production and demand for high-performance tires further accelerate radial tire adoption globally.

By Rim Size

15 to 20 Inches segment dominated the Automotive Tire Market with the highest revenue share in 2025 and is expected to grow at the fastest CAGR from 2026–2033. The segment’s strength is attributed to the rising popularity of SUVs, crossovers, and premium passenger vehicles that require mid-sized rims for performance and aesthetics. Growing consumer preference for better handling, stability, and safety has further boosted demand for 15–20-inch tires in both OEM and aftermarket channels.

Automotive Tire Market Regional Analysis

North America Automotive Tire Market Insights

North America held a significant position in the Automotive Tire Market in 2025, supported by strong vehicle ownership, growing replacement tire demand, and rising electric vehicle adoption. The region’s advanced manufacturing infrastructure, extensive distribution networks, and focus on performance and sustainable tire technologies enhance its market standing. Continuous innovation in tire design and material efficiency further strengthens North America’s role as a key contributor to the global automotive tire industry.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Automotive Tire Market Insights

Asia Pacific dominated the Automotive Tire Market with the highest revenue share of about 54% in 2025. This dominance is driven by the region’s massive vehicle production base, rapid urbanization, and growing demand for passenger and commercial vehicles. Expanding road infrastructure, increasing disposable income, and the strong presence of major tire manufacturers such as Bridgestone, Yokohama, and Sumitomo Rubber further strengthen Asia Pacific’s leadership in the global automotive tire market.

Europe Automotive Tire Market Insights

Europe held a significant position in the Automotive Tire Market in 2025, driven by the presence of leading tire manufacturers, strong automotive production, and growing demand for eco-friendly and high-performance tires. Strict EU regulations promoting fuel efficiency and low-emission vehicles encourage innovation in tire design. Rising electric vehicle adoption, along with increasing replacement cycles and premium vehicle sales, further supports Europe’s sustained growth and technological advancement in the automotive tire industry.

Middle East & Africa and Latin America Automotive Tire Market Insights

The Middle East & Africa and Latin America hold emerging positions in the Automotive Tire Market in 2025, driven by increasing vehicle ownership, infrastructure development, and expanding aftermarket demand. Rising disposable incomes and improving road networks are boosting tire consumption across both regions. Growth in commercial fleets, coupled with the gradual shift toward radial and all-season tires, is fostering modernization. Additionally, expanding import networks and local manufacturing initiatives enhance regional market potential.

Automotive Tire Market Competitive Landscape:

Pirelli & C. S.p.A.

Pirelli & C. S.p.A. stands as a global leader in tire manufacturing, recognized for its focus on performance, safety, and sustainability. The company integrates eco-friendly materials and advanced technologies to create high-efficiency tires with lower environmental impact. Pirelli continues to innovate in both premium and electric vehicle segments, driving forward with its commitment to circular economy principles and sustainable mobility.

-

2025: Launched the first standard production tire made with over 70% bio-based and recycled materials, marking a major advancement in sustainable tire manufacturing.

-

2023: Introduced the P Zero E, the first Ultra High Performance (UHP) tire composed of more than 55% bio-based and recycled materials.

Michelin

Michelin remains a pioneer in sustainable mobility and tire innovation, emphasizing safety, durability, and fuel efficiency. The company’s R&D investments aim to achieve 100% sustainable materials across all products by 2050. Michelin continues to enhance performance through advanced tread designs and intelligent tire technologies, catering to diverse market needs from passenger cars to heavy-duty vehicles.

-

2025: Introduced the MICHELIN X® Works Z2 & D2 tire range, designed for demanding conditions and delivering consistent traction and grip throughout the tire’s lifespan.

Hankook Tire & Technology

Hankook Tire & Technology drives innovation in performance, safety, and sustainability through continuous R&D and ESG initiatives. The company is expanding its footprint in the premium tire market and strengthening its commitment to carbon neutrality and eco-friendly product lines. Hankook’s focus on adaptive technology and smart mobility aligns with the automotive industry’s shift toward sustainability and electrification.

-

2025: Released its 2024/25 ESG Report, detailing sustainability performance and goals, underscoring a commitment to green innovation.

-

2024: Launched the Weatherflex GT tire, engineered for all-climate performance across 37 sizes, with further expansions planned through 2025.

Goodyear Tire & Rubber Company

Goodyear Tire & Rubber Company continues to lead in tire innovation through sustainable materials, smart mobility solutions, and digital integration. The company’s focus on EV-ready tire technologies and connected services enhances performance, safety, and cost efficiency. Goodyear is also restructuring operations for long-term profitability, prioritizing sustainability and advanced analytics in fleet management.

-

2025: Unveiled the ElectricDrive Sustainable Material (EDS) tire at the China International Import Expo, featuring recycled and bio-based materials for EV applications.

-

2024: Introduced a subscription-based tire service integrating predictive analytics to optimize fleet operations and reduce total cost of ownership.

-

2024: Announced the sale of its Off-the-Road (OTR) tire business to Yokohama Rubber for $905 million and the closure of its Shah Alam, Malaysia plant as part of a $1 billion cost-reduction initiative.

Continental AG

Continental AG combines precision engineering with sustainability, offering advanced digital tire technologies that enhance safety, fuel efficiency, and fleet performance. The company’s innovation strategy focuses on reducing CO₂ emissions through lightweight designs and low-rolling-resistance tires. Continental continues to develop solutions tailored to the logistics and transport sectors, promoting cleaner and more efficient operations.

-

2024: Launched the Conti Eco Gen 5 tire line for trucks, optimizing fuel consumption and CO₂ emissions in line with green transport objectives.

Sumitomo Rubber Industries (Dunlop)

Sumitomo Rubber Industries, under the Dunlop brand, delivers high-quality tires emphasizing comfort, safety, and durability. The company invests heavily in R&D to integrate eco-friendly technologies and advanced materials into its tire lineup. Sumitomo’s global strategy aligns with evolving consumer demands for premium, sustainable, and performance-driven tire solutions.

-

2024: Introduced the DUNLOP SPORT MAXX LUX, a premium comfort tire series offering quiet performance and steering precision, available in 72 sizes.

Yokohama Rubber Co., Ltd.

Yokohama Rubber Co., Ltd. continues to expand globally through innovation, sustainability, and strategic acquisitions. The company’s tire portfolio caters to both premium passenger and off-road segments, integrating advanced materials for performance and environmental efficiency. Yokohama’s growth strategy focuses on enhancing product diversity and strengthening global competitiveness.

-

2024: Introduced the ADVAN V61, a high-performance SUV tire catering to automakers’ requirements.

-

2024: Acquired Goodyear’s OTR tire business for $905 million, strengthening its position in the global off-road tire market.

Key Players

Some of the Automotive Tire Market Companies

-

Michelin

-

Bridgestone

-

Goodyear

-

Continental

-

Pirelli

-

Sumitomo Rubber Industries

-

Hankook Tire

-

Yokohama Rubber

-

Toyo Tire

-

Kumho Tire

-

Maxxis International

-

Linglong Tire

-

ZC Rubber

-

Apollo Tyres

-

MRF Tyres

-

JK Tyre

-

CEAT Limited

-

Nokian Tyres

-

Giti Tire

-

Sailun Tire

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 165.94 Billion |

| Market Size by 2033 | USD 237.15 Billion |

| CAGR | CAGR of 4.66% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Radial, Bias) • By Application (Passenger Cars, LCV, HCV, Two-Wheelers) • By Season Type (Summer Tire, Winter Tire, All-Season Tire) • By Rim Size (Less Than 15 Inches, 15 to 20 Inches, More Than 20 Inches) • By Distribution Channel (Aftermarket, OEM) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Michelin, Bridgestone, Goodyear, Continental, Pirelli, Sumitomo Rubber Industries, Hankook Tire, Yokohama Rubber, Toyo Tire, Kumho Tire, Maxxis International, Linglong Tire, ZC Rubber, Apollo Tyres, MRF Tyres, JK Tyre, CEAT Limited, Nokian Tyres, Giti Tire, Sailun Tire |