Cold Chain Equipment Market Report Scope & Overview:

Get More Information on Cold Chain Equipment Market - Request Sample Report

The Cold Chain Equipment Market was valued at USD 21.40 billion in 2023, and it is expected to reach USD 110.41 billion by 2032, registering a CAGR of 20.06% from 2024 to 2032.

The use of cold chain equipment has become a critical tool for the food and beverage industry since its technology is linked to food safety, food hygiene, health benefits, and environmental benefits. The industry has highly relied on the processed food sector due to changing lifestyles, rapid urbanization, and population increase as well as increased purchasing power. According to the World Population Review, it has been estimated that 4.3 billion or about 55% of the global population are currently living in towns and cities. Further, the type of food being consumed has also favored the use of cold chain equipment since most people prefer consuming frozen and processed food. In addition, the international business of fish and meat has also boosted the demand for temperature-controlled storage capacity. Commission of email purchase is among the reasons suspected to have influenced the high demand for cold chain equipment.

India is the world leader in milk production and number two in the production of fruits and vegetables. This country also produces a significant amount of meat, seafood, and poultry. However, food and agriculture are substantially lost due to the ineffective cold supply chain. Thus, as the Food and Agriculture Organization states, every year about 1.3 billion tonnes are lost. This equals one-third of the production result. These losses vary from USD 8 to USD 15 billion. Therefore, the cold chain sector’s development is of crucial importance to avoid such issues forming. Alternatively, the pharmaceutical field is another vital area requiring a well-handling cold supply chain network. Hence, the necessity for vaccines and other pharma raw materials storage and transportation, as well as life-saving drug delivery, promoted a highly efficient and strong cold supply chain network.

Cold Storage is a vital preliminary requirement for preserving perishable agricultural products. The major components are demand/entrepreneur driven, and the government assists in the drawl of credit linked subsidies for the same. The subsidy is 35% of project cost in general areas and 50% in hilly and scheduled areas through State Horticulture Mission. One important credit-linked scheme is to check/post-harvest loss of perishables of agriculture and horticulture. Financial Support is also given for providing pre-cooling units, cold room, pack houses, integrated pack house, preservation unit, reefer transport, ripening chamber etc. Mission for Integrated Development of Horticulture provides financial support for cold storage under the cold chain.

MARKET DYNAMICS

DRIVERS

Increased food safety means more stringent standards and current equipment of the cold chain.

Governments all over the world tend to implement higher food safety requirements. It means that all companies dealing with the manufacture, transportation, and storage of products, especially perishable products, must be equipped with the most modern and effective cold chain equipment. Such compliance will guarantee the maintenance of both food and medicines at an acceptable temperature, and there will thus be no risks to food entry and sales.

According to, the U.S. Food and Drug Administration provides that the FSMA Food Safety Modernization Act imposes strict safety requirements on cold chain storage units, focusing on microbiological, water, and sanitation safety to avoid pollution. The facility should include risk-focused specifications for prevention-requiring controls and be equipped with modern monitoring equipment that enables the detection of risks. Sanitary transport rules also require that cold chain storage equipment support the conditions to ensure safe food during transport and, therefore, the demand for reliable, advanced, and sanitary equipment is rising. Furthermore, every facility should implement a food defense plan to ensure security against deliberate pollution. This implies that the equipment should be traceable by location and be securely locked. Third-party certification affects the choices of numerous clients of food chain storage equipment that comply will be selling much better than not inspected ones. Under the Foreign Supplier Verification Program, importers must verify that foreign suppliers’ equipment complies with U.S. standards. The FFVP is an incentive scheme that motivates high-quality, certified units to be bought. The Voluntary Qualified Importer Program enforces the most stringent safety and quality requirements achievable and takes into account the impact of obligatory adherence to these standards in the general dynamics. One of the most important impediments is compliance costs that are predicted to grow creating incentives to invest in more sophisticated compliant storage units and, in their turn, fostering innovation in the industry.

New technology with smart monitoring and solar-powered storage can make cold chain more efficient and enable it to operate even in remote areas.

Cold chain is a vital element for many industries that operate with perishable goods, including food, pharmaceuticals and some chemicals, among others. Modern technology, such as smart monitoring and solar-powered storage solutions can address some of the issues long-associated with these systems, such as maintaining the temperature and monitoring the state of the cargo, as well as providing the system with a consistent source of energy, which increases the overall efficiency of cold chain equipment.

The type of energy storage that is most commonplace in the power grid is pumped hydropower. The storage technologies that are most regularly with solar power plants are either electrochemical storage or thermal storage. There are other types of storage that may be fast-discharging or high-capacity, which might allure grid operators.

The most obvious problem with PV panels efficiency is solar intermittency. The half of a 24 hour-day is not visible except for a very brief period at extreme latitudes and times of the year. Solar power users need other power sources to use for the power that they need after sunset, and utilities cannot rely on solar power alone to provide the electricity for their customers. One solution to storing solar power to use at night is to capture extra energized during daylight hours and store the energy. However, storage problems are typical. For example, batteries add to the cost of solar power installation. The cost of batteries to provide solar power for a home not including battery installation, maintenance, and lifetime replacement costs to store energy is between $8,000 and $10,000.

Smart monitoring is made possible by the internet of things that continuously monitors the state of objects and reports the data to a central database. In the case of monitoring the cold chain, these are the sensors placed in storage units and in transport. These sensors continuously monitor temperature, humidity and location, uploading the data to a central system. This enables the logistic crew to receive a warning and transport the goods away if the freezing conditions are not met and the food starts to spoil. On the other hand, if the temperature becomes close to freezing and threatens to damage the cargo, the food can be quickly taken out.

RESTRAIN

No reliable power and cold storage in poor countries makes it hard for the cold chain equipment market to grow there.

Power supply and lack of cold storage infrastructure render poor country’s unpopular destinations for cold chain equipment. This is associated with power outages, which occur on both irregular and frequent bases in such countries. In Sub-Saharan Africa and some parts of India, where the power supply devices are not steady, it is difficult for cold storage equipment to maintain consistent cooling. Perishable items such as food and pharmaceuticals cannot be stored or transported when the cold chains are not operational. the poor country’s do not have enough capital to create proper lighting during cold storage. Transporting the fresh perishable goods to various places immediately after the harvest is a challenge in the poor country hence excessive products, which are perishable go to waste. These challenges in these countries disallow the growth of the cold chain equipment market.

Prices of steel and copper, key materials in cold chain equipment, can swing, affecting how much it costs to make.

There are significant price fluctuations of steel and copper that are essential materials for the production of the cold chain equipment. Prices of these metals are often driven by the global market processes, such as supply chain disruptions, escalating military conflicts, and diving of the world economy. Regions of Latin America and certain parts of Southeast Asia display high volatility of the economies. The supplies are battling with these price fluctuations while attempt to produce the end-products at the viable costs. When there are high prices for metals, the price of the final product is higher, and the product can be less affordable, which can hinder the growth of the market in the volatile regions.

KEY MARKET SEGMENTATION

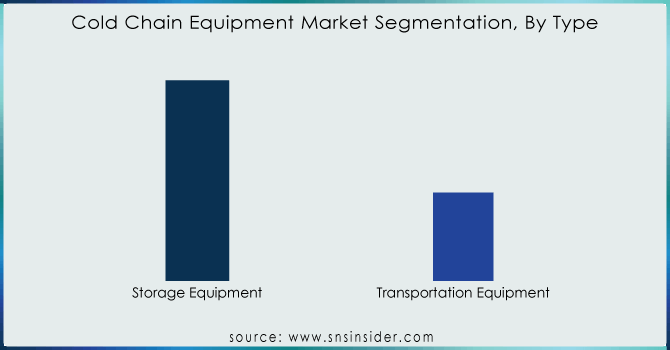

By Type

In 2023, the storage equipment segment accounts for a major share in the total market and is estimated at 74.75% in forecasted period. The types of storage equipment are cold rooms, refrigerators, freezers, and others. These are designed to be at a particular range of temperature suitable for the product stored in it.

Transportation equipment is expected to be the fastest CAGR and at a value of 20% over the selected period of 2023. These will be based on the mode of transport of vehicle and also, the specific requirements of the product being transported outside. The types of equipment based on this are refrigerated trucks, containers, vans and ships with refrigeration, air cargo containers, and others.

Need any customization research on Cold Chain Equipment Market - Enquiry Now

By Application

The fish, meat, & seafood category is projected to hold a market share of 20.75% in 2023. Refrigerated storage of fish, meat, and seafood is highly essential as meat becomes a perfect breeding ground for harmful bacteria the moment the animal is slaughtered. Food, meat, and seafood are among the high-risk commodities that should be refrigerated. As such, refrigeration solutions play a pivotal role in seeing to it that the quality of the commodities in question is maintained and that the shelf life of the same is extended. The rate of multiplication of bacteria in meat stored between 5°C and 63°C is very fast. For fish, meat, and seafood products, the best temperature for storage is at the 0°C and 5°C range.

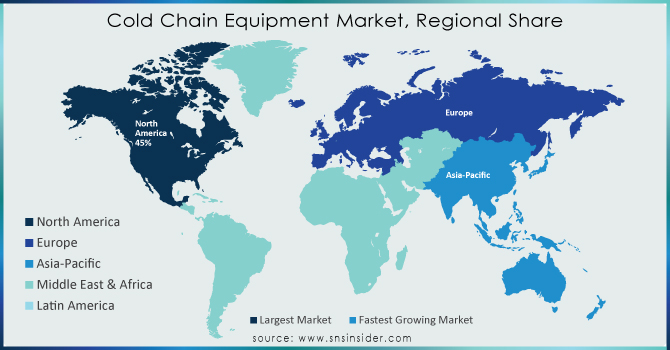

REGIONAL ANALYSIS

North America was the leading region in the overall market in 2023, with a share of 45.0%. The cold chain equipment market in North America was a very well-conceived and a well-established market in many of the end-use markets such as the food, pharmaceutical, and chemical sector. The region is home to many of the major companies that provide cold chain equipment solution. One of the examples would be the Lineage Logistics which is the world’s largest temperature-controlled warehousing and logistics company.

Asia Pacific is anticipated to grow at the highest CAGR of 23.5% during the forecasted period. The market is in the expansion mode as increasing needs for the provision of fresh and frozen foods, medicines, and other perishable products are inevitable in the region. Many of the most heavily and densely populated areas in the world are in Asia Pacific and there is a growing awareness of maintaining the quality and safety factor while in transit or during storage.

Key Players

Some of the major players in the Cold Chain Equipment Market are Thermo King, Carrier Transicold, Zanotti SpA, Viessmann, Schmitz Cargobull, Fermod, Intertecnica, ebm-papst Group, CAREL, Bitzer, Kelvion, Incold S.p.A., Rivacold srl, Kason Industries, Inc., CHG Europe BV and other players.

Thermo King-Company Financial Analysis

Recent Developments

In February 2024: Through a strategic partnership with Canadian Pacific Kansas City (CPKC), Americold Realty, a temperature-controlled warehousing and transportation company, announced plans to establish its first site and co-locate Americold warehouse facilities on the CPKC network. By fusing CPKC's vast rail network with its cold storage capabilities, Americold would be able to offer a unique product and serve a larger number of clients in North America.

In March 2023: Trane Technologies, a worldwide pioneer in climate innovation, endorsed the use of fossil-free hydrotreated vegetable oil fuel as a sustainable replacement for diesel fuel in Thermo King cold chain solutions. While the use of HVO fuel improves product performance, allowing for a 90% reduction in greenhouse gas emissions and more than 30% in particulate matter. The endorsement came after extensive tests, including a successful pilot with a national food distributor.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 21.40 Bn |

| Market Size by 2032 | US$ 110.41 Bn |

| CAGR | CAGR of 20.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type: (Storage Equipment (On-grid (Walk-in coolers, Walk-in freezers, Ice-lined refrigerators, Deep freezers), Off-grid (Solar Chillers, Milk Coolers, Solar powered cold boxes, Others), Others), Transportation Equipment) • By Application: (Fruits & Vegetables, Fruit & pulp concentrates, Dairy Products, Fish, Meat, & Seafood, Processed Food, Pharmaceuticals, Bakery & Confectionaries, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Thermo King, Carrier Transicold, Zanotti SpA, Viessmann, Schmitz Cargobull, Fermod, Intertecnica, ebm-papst Group, CAREL, Bitzer, Kelvion, Incold S.p.A., Rivacold srl, Kason Industries, Inc., CHG Europe BV |

| Key Drivers | • Increased food safety means more stringent standards and current equipment of the cold chain. • New technology with smart monitoring and solar-powered storage can make cold chain more efficient and enable it to operate even in remote areas. |

| Market Restraints | • No reliable power and cold storage in poor countries makes it hard for the cold chain equipment market to grow there. • Prices of steel and copper, key materials in cold chain equipment, can swing, affecting how much it costs to make. |