Autonomous Trucks Market Report Scope & Overview:

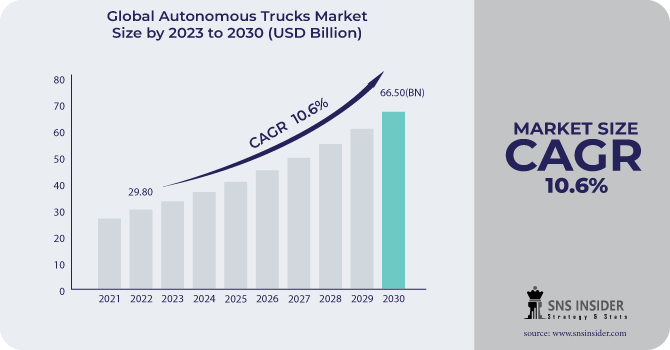

The Autonomous Trucks Market size is expected to reach USD 66.50 Bn by 2030, the market was valued at USD 29.80 Bn in 2022 and will grow at a CAGR of 10.6% over the forecast period of 2023-2030.

Autonomous trucks, sometimes referred to as self-driving trucks or driverless trucks, are autos that can drive themselves thanks to sophisticated technology and artificial intelligence (AI) systems. These vehicles can completely transform the trucking and logistics sectors by performing a variety of transportation and delivery activities on their own. AI algorithms, GPS, computer vision, sensors including Lidar, radar, and cameras, and computer vision are just a few of the technology that autonomous trucks rely on. Together, these systems let the truck to sense its environment, make judgments, and manage its actions.

Autonomous Trucks usually save costs up to 45% which will be the key driving factor. This can also disrupt the current logistics systems across industries.

Get More Information on Autonomous Trucks Market- Request Sample Report

Proponents contend that human error, which is a substantial contributor to trucking accidents, has the potential to be reduced in accidents involving autonomous vehicles. Continuous operation makes autonomous trucks less likely to require driver breaks, which could improve the effectiveness of freight transportation. By doing away with the necessity for human drivers, trucking businesses can save money on labour and other costs. Long-distance freight transportation, local deliveries, and warehouse or shipping port logistics can all be handled by autonomous trucks. In order to reduce wind resistance and fuel consumption, they can also be used into platooning systems, where several trucks follow closely behind a lead vehicle. It is anticipated that the adoption of autonomous trucks would have a substantial impact on the smart transportation industry, perhaps enhancing safety and efficiency while lowering operating expenses. The pace of widespread adoption, however, may vary depending on legislative changes, technology breakthroughs, and public acceptance.

Market Dynamics:

Driver

-

The rising demand for autonomous trucks in commercial zones.

In commercial areas, autonomous vehicles may result in lower operational expenses. They are economical for repeated jobs like moving containers in ports or shuffle products inside a big warehouse because they do not need wages, benefits, or breaks. Autonomous vehicles have a 24/7 operational capability, boosting the output and throughput of commercial zones. This is especially useful in environments like manufacturing plants, where just-in-time production and delivery schedules are essential. Benefits for the environment include reduced pollution in commercial areas due to autonomous trucks' ability to be designed for fuel-efficient driving. For locations with severe environmental rules, this is crucial.

Restrain/Challenge

-

High maintenance cost and the infrastructural concerns for undeveloped nations

Opportunity

-

The rising technological advancement in logistic industry along with high adaptability of digitalization and autonomy

Predictive maintenance, demand forecasting, and route optimization are all made possible by advanced analytics and machine learning algorithms. Logistics firms can cut operational expenses and proactively adjust to changing conditions. Autonomy in logistics comprises robotic material handling devices, automated warehouses, and autonomous vehicles (such as drones and self-driving trucks). These technologies increase efficiency and rely less on human labour as a response to shifting needs and labour shortages. The adaptability percentage will be shifting from 23% as of now to 73% during the forecasted period.

Impact of Russia Ukraine War:

There might be new markets for autonomous trucks to enter or existing markets to change depending on the geopolitical ramifications of the conflict. The target markets and strategy of autonomous trucking companies may need to change correspondingly. Concerns about cyber security include the possibility of assaults on autonomous car systems due to heightened tensions and conflicts. In such circumstances, ensuring the cybersecurity of autonomous trucks becomes even more important. Geopolitical concerns may have an impact on international research alliances and collaborations in the field of autonomous trucks. The development of autonomous vehicle technology could be slowed down by restrictions on collaboration or data sharing. The shortage of raw materials was experienced by the major players operating in this market because of the war. This resulted in drop of production volumes by 15%.

Market Segmentation

By Level of Autonomy

-

Level 1

-

Level 2

-

Level 3

-

Level 4

By Truck Type

-

Light Duty Trucks

-

Medium Duty Trucks

-

Heavy-Duty Trucks

By Industry Type

-

Manufacturing

-

Construction & Mining

-

FMCG

-

Others

.png)

Get Customized Report as per your Business Requirement - Request For Customized Report

Regional Coverage

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Regional Analysis

North America was the region which was having the highest share because of rising demand and high commercial zones. An important center for the development and testing of autonomous trucks has been North America, notably the United States. Autonomous truck testing has been ongoing on American highways by businesses like Tesla, Waymo, and TuSimple. The interest in autonomous trucking for long-distance transportation has been particularly strong in Canadian provinces with major freight routes, such as Ontario.

APAC will be the region with the highest CAGR growth rate because China has made significant investments in driverless vehicles, particularly trucks. Businesses like TuSimple and FAW are developing autonomous trucks. Japanese businesses, including Toyota, are investigating the use of autonomous trucks for both domestic and international logistics and shipping. In remote logistics and mining sectors, Australia has been testing autonomous trucks.

Key Players

The major key players are TuSimple, Waymo, Embark Trucks, Tesla, Caterpillar, AB Volvo, Daimler, Continental AG, Robert Bosch, Aptiv and others.

Embark Trucks-Company Financial Analysis

Recent Industry Developments:

TuSimple; The company is among the first which received the fully driverless test license in China. This can improve the company’s foothold in China market.

Caterpillar: The company has achieved 2 billion tonnes hauled with autonomous trucks system. This is improving the company’s overall brand image and also giving them an overall competitive advantage.

| Report Attributes | Details |

| Market Size in 2022 | US$ 29.80 Billion |

| Market Size by 2030 | US$ 66.50 Billion |

| CAGR | CAGR of 10.6 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Level of Autonomy (Level 1, Level 2, Level 3, Level 4) • By Truck Type (Light Duty Trucks, Medium Duty Trucks, Heavy-Duty Trucks) • By Industry Type (Manufacturing, Construction & Mining, FMCG, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | TuSimple, Waymo, Embark Trucks, Tesla, Caterpillar, AB Volvo, Daimler, Continental AG, Robert Bosch, Aptiv |

| Key Drivers | • The rising demand for autonomous trucks in commercial zones. |

| Market Opportunity | • The rising technological advancement in logistic industry along with high adaptability of digitalization and autonomy. |