Baggage Handling System Market Report & Overview:

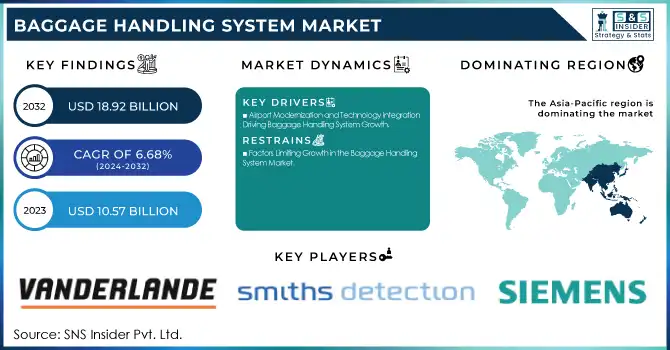

The Baggage Handling System Market size was valued at USD 10.57 billion in 2023 and is expected to grow to USD 18.92 billion by 2032 and grow at a CAGR of 6.68% over the forecast period of 2024-2032. Market growth is propelling from increasing air passenger traffic, airport expansions, and the adoption of automated baggage handling solution. Increasing adoption of RFID in the interest of better tracking and fewer baggage losses. Operational efficiency metrics show increased throughput of baggage, leading to decreased dwell-time delays. Baggage Handling System Market Cloud Reinforces Passenger Tracking for Enhanced Competition Sustainability initiatives are being promoted for energy-efficient baggage handling systems in order to lower operational costs. Security improvements such as AI-powered baggage screening are cutting error rates. In addition, trends such as smart airport, digital transformation are further driving the market for advanced baggage handling technologies globally.

Get More Information on Baggage Handling System Market - Request Sample Report

Baggage Handling System Market Dynamics:

Drivers:

-

Airport Modernization and Technology Integration Driving Baggage Handling System Growth

Airport expansion and modernization is a major growth factor for the baggage handling system market and significant investments are being made in such projects. Physical improvements/overhauls: Facilities such as Brussels Airport, Baltimore/Washington International, Palm Springs Airport, and Cincinnati/Northern Kentucky International Airport are investing in enhancements that will allow the systems at these facilities to be much more efficient and able to handle increased passenger volumes. Conveyor systems are used in 86% of North American airports, while 69% of those airports use carousels, but 53% of participants cite reliability issues and 50% report a capacity constraint. 53% of airports are integrating RFID tracking and 31% are implementing AI/ML solutions to solve those challenges. The rise of air travel is fueling the demand for automation, which is driving the new advanced baggage handling technology to ensure the seamless execution of operations while enhancing passenger experience.

Restraints:

-

Factors Limiting Growth in the Baggage Handling System Market

The dependability of the system and downtime problems lead to non-optimal performance of the baggage process, requiring operational expenses and time delays. Many of them also have outdated infrastructure and capacity constraints that hinder their ability to cope with rising passenger numbers. Case studies, the worst of which is the Denver baggage fiasco, demonstrate the dire impact of outdated systems, and research shows that predictive maintenance and automation can increase efficiency. While intelligent baggage handling solutions are gaining traction, the implementation costs and complexity in integration with existing airport operations delay their adoption. With these limitations in mind, modernization efforts must continue to result in seamless baggage processing and sustained growth in the market

Opportunities:

-

Air Travel Surge Fueling Innovation in Baggage Handling Systems

A surge in air travel worldwide is creating strong demand for efficient baggage handling systems. With the increase in passenger traffic, airports are under pressure to optimize baggage processing, minimize waiting times, and improve overall operational efficiency, which can lead to overcapacity and logistical issues. With high passenger volumes, existing infrastructure is often stressed, leading to bottlenecks and mishandlings. In response, airports have been investing in technology like automated check-in, RFID tracking systems, and AI-driven sorting systems that can augment both speed and accuracy. Automated baggage handling solutions are being implemented to manage peak travel dates, which can enhance passenger experience while optimizing operational costs. With the growing number of air travellers, it is increasingly important that airports keep up by implementing state-of-the-art baggage handling technologies to ensure efficient operations and cater to the changing needs of passengers.

Challenges:

-

Mitigating Cybersecurity Threats in Baggage Handling Systems

With the increasing digitalization of baggage handling systems, cybersecurity risks have become a major concern. With the advanced levels of interconnected networks, IoT devices, and cloud-based systems on which modern systems rely, they are at a finding themselves wherein they are more prone to cyberattacks in the form of ransomware attacks, data breaches, and system unavailable fill obstacles. A security breach can result in security breaches of baggage handling, schedule delays, and multi-million dollar airport and air-carrier financial losses. Consequently, industry stakeholders are focusing on developing robust cybersecurity frameworks, such as data encryption, multi-factor authentication, and real-time threat detection. Regulatory compliance regarding aviation cybersecurity and continuous system monitoring are crucial in protecting operations. Strengthening cybersecurity in baggage handling systems not only ensures data integrity but also enhances operational efficiency and passenger trust in airport services.

Baggage Handling System Market Segment Analysis:

By Type

The Destination Coded Vehicle (DCV) segment held the largest revenue share of 76% in the baggage handling system market in 2023, driven by its efficiency in transporting baggage with minimal manual intervention. As DCVs transport baggage from the check-in to the aircraft with little, if any, human interaction. DCVs run on an automated network, providing exact baggage routing, lower transfer times, and improved safety. Major airports prefer DCV systems for their scalability, high throughput, and integration with advanced tracking technologies (e.g., RFID solution). The growing need of realized baggage handling in hub airports and the rising degrees of international air vacation push this segment to dominate the industry. As airport modernization continues DCV is still the preferred choice to optimize baggage transportation and enhance airport efficiency.

The conveyor segment is the fastest-growing in the baggage handling system market, projected to expand significantly from 2024 to 2032. The growing demand for high-speed baggage transportation, automation of airport operations, and the need for minimal human intervention are driving the growth of market. This offers seamless baggage flow, industrialization of the sorting procedure, and improvement in operational proficiency, owing to which various small and large airports consider it as a more favorable solution. Adoption is further accelerated by the introduction of advanced technologies like RFID tracking, AI-driven monitoring and predictive maintenance. With airports worldwide investing in modernization and expansion, the conveyor segment is set to witness strong demand, ensuring faster baggage processing and improved passenger experience.

By Technology

The Radio-Frequency Identification (RFID) segment dominated the baggage handling system market with a 74% revenue share in 2023, Due to the higher tracking accuracy it provides compared to the traditional ones that contributed to minimizing baggage mismanagement. Real-time baggage monitoring with RFID technology reduces loss and increases operational flow in the airport. RFID Tags do not need a line of sight, unlike barcode-based systems, allowing for rapid scanning and increased throughput. To increase passenger experience and comply with industry regulations, key airports around the globe are increasingly adopting RFID. As mentioned earlier, solutions incorporated with AI and cloud-based analytics are enhancing the baggage handling process. As airports focus on automation and error reduction, RFID adoption is expected to grow, reinforcing its leadership in the market.

The barcode segment is the fastest-growing in the baggage handling system market over the forecast period 2024-2032, offers the cost benefits and is being widely adopted. Airports still prefer to implement bike-based baggage tracking by using barcodes, as it is a cheaper option than RFID systems. Recent barcode scanners have less error and increased speed to process the baggage》. Barcode reliability has further improved with the introduction of AI-powered image recognition and cloud-based tracking Additionally, increasing air travel demand and airport expansion projects are fueling investments in automated barcode scanning solutions.

By Application

The airport segment dominated the baggage handling system market in 2023, accounting for approximately 78% of total revenue. This dominance is increasing number of air passengers, airports expansion and new baggage handling equipment modernization are propelling this dominance. Yellen opens door to more sanctions on terrorist groups TSA has earlier launched its 2021 five-year plan to elevate efficiency levels further in baggage claim at all major international airports in the US, with the usage of automated sorting, RFID tracking, and AI-based baggage management systems to shorten delays and to improve passenger experience. Demand is further driven by the need for high-speed baggage processing, security screening, and seamless connections between terminals. Government regulations requiring advanced baggage screening technologies also drive growth in this segment. With global air traffic expected to rise, airports will continue to drive the demand for advanced baggage handling solutions, ensuring efficiency and reliability in operations.

The marine segment is the fastest-growing sector in the baggage handling system market, driven by the rapid expansion of cruise tourism and seaport modernization initiatives. As passenger numbers continue to rise, leading cruise lines and ferry operators are focusing on automated baggage handling solutions to increase efficiency, security, and passenger comfort. Implementing RFID tagging and AI-enabled sorting systems boosts baggage flow, minimizes mishandling, and streamlines check-in. The increasing investments in smart port infrastructure and integrated logistics systems is also expected to enhance the market growth.. Additionally, growing investments in smart port infrastructure and integrated logistics systems are accelerating market growth.

Baggage Handling System Market Regional Analysis:

The Asia-Pacific region dominated the baggage handling system market with a 46% revenue share in 2023, owing to rapid airport expansion, increasing air passenger traffic, government investment for the development of aviation infrastructure. Countries like China, India, and Japan are modernizing their airports with automated baggage handling solutions, including RFID tracking and AI-based sorting systems, to enhance operational efficiency. The explosion of low-cost carriers and the growing popularity of international travel and trade are only adding to this demand for advanced technologies in baggage handling. Also, the region market leadership is further reinforced by the investment into seamless baggage operations for major infrastructure projects such as Beijing Daxing International Airport and New Delhi’s IGI Airport expansions.

North America is projected to be the fastest-growing region in the baggage handling system market over the forecast period (2024-2032), driven by rising air passenger traffic, airport modernisation projects, and implementation of advanced automation technologies. But some major U.S. airports are investing in smart baggage handling solutions including WIFI tracking, AI sorting, and automated conveyors that can help make it easier to transport bags without losing as many route to the destination, and the trend is being followed by most major Canadian airports, including Dallas/Fort Worth International Airport and Toronto Pearson International Airport. Report further states that growing government initiatives regarding aviation infrastructure development, as well as increasing demand for hassle-free passenger experience, is expected to boost the market growth. The region’s focus on reducing system downtime and improving reliability further strengthens its expansion potential.

Need any customization research on Baggage Handling System Market - Enquiry Now

Baggage Handling System Market Key Players

Some of the Major Key Players in Baggage Handling System Market along with their product:

-

Vanderlande Industries (Netherlands) – (Automated Baggage Handling Systems, DCV, Conveyors)

-

Siemens (Germany) – (Baggage Screening Systems, RFID, Automation Solutions)

-

Daifuku Co., Ltd. (Japan) – (Airport Baggage Handling Systems, DCV, Robotics)

-

BEUMER GROUP (Germany) – (Baggage Handling Conveyors, Sortation Systems, RFID Solutions)

-

Pteris Global Limited (Singapore) – (Airport Baggage Handling & Security Screening Systems)

-

SITA (Switzerland) – (Baggage Tracking Software, RFID, Self-Service Kiosks)

-

Fives (France) – (Automated Baggage Handling Systems, Sorters, Robotics)

-

Babcock International Group PLC (UK) – (Baggage Screening, Security & Maintenance Solutions)

-

Smiths Detection Group Ltd. (UK) – (Explosive Detection Systems, Baggage Scanners)

-

G&S Airport Conveyor (USA) – (Baggage Conveyors, Carousels, Sortation Systems)

-

B2A Group (France) – (Baggage Handling Robotics, DCV, Automated Sorting)

-

Logplan (USA) – (Baggage Handling System Design & Consulting)

-

Alstef Group (France) – (Automated Baggage Handling, AI-based Sortation Systems)

-

Crisplant (Denmark) – (High-speed Baggage Handling, RFID, DCV Systems)

-

Materna IPS (Germany) – (Self-Service Bag Drop, RFID, Baggage Software Solutions)

List of Suppliers who Provide raw material and component in Baggage Handling Systems market:

-

Forbo Movement Systems

-

Tratec Solutions

-

BEUMER Group

-

Indpro Engineering Systems Pvt. Ltd.

-

Ammeraal Beltech

-

Flexco

-

NORD DRIVESYSTEMS

-

SICK AG

-

Transnorm

-

Nerak

Recent Development

-

April 16, 2024 – Siemens Logistics introduced a new 3D SCADA simulation module within its BagIQ system at Passenger Terminal Expo, enabling fast system layout import for BHS optimization. The company also showcased TrayFleet 360, a predictive maintenance solution that detects damage and dirt on baggage trays to enhance operational efficiency.

-

April 22, 2024 – Beumer Group launched a Customer Diagnostic Center to help airports optimize baggage handling using advanced data models and real-time diagnostics. The center offers 24/7 support, predictive analysis, and system performance improvements to prevent downtime and enhance efficiency.

| Report Attributes | Details |

| Market Size in 2023 | USD 10.57 Billion |

| Market Size by 2032 | USD 18.92 Billion |

| CAGR | CAGR of 6.68% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Destination coded vehicle (DCV), Conveyor) • By Technology (Radio-Frequency Identification (RFID), Barcode) • By Application (Airport, Railway, Marine) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Vanderlande Industries (Netherlands), Siemens (Germany), Daifuku Co., Ltd. (Japan), BEUMER GROUP (Germany), Pteris Global Limited (Singapore), SITA (Switzerland), Fives (France), Babcock International Group PLC (UK), Smiths Detection Group Ltd. (UK), G&S Airport Conveyor (USA), B2A Group (France), Logplan (USA), Alstef Group (France), Crisplant (Denmark), Materna IPS (Germany). |