Robo Advisory Market Size & Trends:

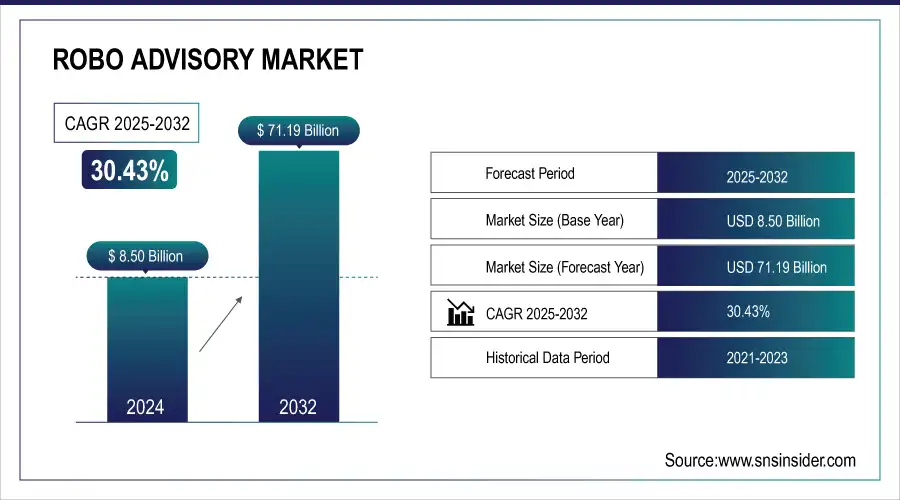

The Robo Advisory Market size was valued at USD 8.50 Billion in 2024 and is projected to reach USD 71.19 Billion by 2032, growing at a CAGR of 30.43% during 2025-2032.

To Get more information On Robo Advisory Market - Request Free Sample Report

The Robo Advisory Market is growing steadily owing to the increasing technology prevalence in its application area, investment management and wealth advisory services. A new wave of automated platforms, artificial intelligence, and algorithm-based tools are being harnessed to improve portfolio allocation, risk assessment, and personalized financial planning. Technology as its impact expands over the industry, yet the human advisors are still dominant in their client approach, trust bond, and providing complete financial services to the clients through the spectrum. The market is driven by rising demand for excessive price-potential investment solutions with broader alternative asset access and growth of digital monetary systems among retail and excessive-net-value investors. Diversity tied to demographics steers adoption but at the firm lever a working angle through which AI at is being embedded into operations via automation to improve service efficiency and client outcomes.

In Aug 2025, Even though Retail investors skepticism on AI as financial advisor remains high, with only ~30% trusting AI suggested recommendations. Wealth management is a field where personal relationships are of supreme importance, and AI is being used as an aid to human advisors rather than replacing them.

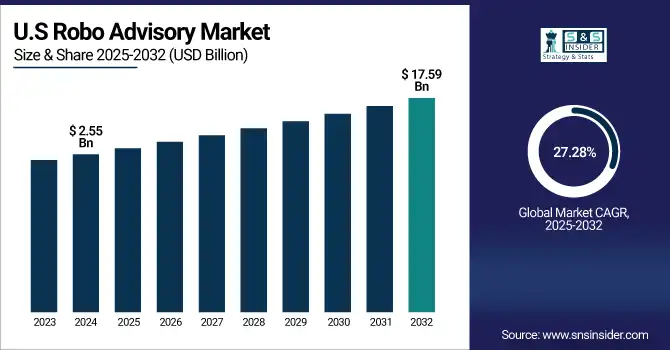

The Robo Advisory Market size was valued at USD 2.55 Billion in 2024 and is projected to reach USD 17.59 Billion by 2032, growing at a CAGR of 27.28% during 2025-2032. The areas with most studies driving the Robo Advisory Market Growth are high adoption of AI-driven investment platforms, growing demand for cost-effective and customized wealth management solutions, and growing reach of retail and high-net-worthy investors. Market trends involve increased acceptance of algorithm prescribed portfolio allocation, digital advisory and hybrid human-AI advisory models that are generally making it easier for the new age of adviser in the areas of productivity, trust and Client relationship.

Robo Advisory Market Trends are adoption of AI and machine learning for creating personalized portfolio suggestions, Hybrid models combining human advisors and automated platforms, increasing adoption of roboadvisory services among retail and high-net-worth investors. These platforms are gaining in sophistication and include the alternative assets, lifecycle-based planning and dynamic portfolio monitoring capabilities. The digital solutions are increasing at cost-effective rates, convenient for the customers, and also compliant with efficacy, which is boosting the wealth management awareness along with the increasing technological advancement all over the globe thus, creating opportunities of the market growth worldwide.

Robo Advisory Market Dynamics:

Drivers:

-

Strategic Collaborations and Innovation Accelerate Robo Advisory Adoption

Collaborations like this allow for the seamless integration of next-level AI-powered portfolio management, goal-based planning, and digital investment solutions, making platforms more efficient and scalable. Having a greater level of technological sophistication increases user trust and lowers barriers to access, paving the way for adoption by both retail and high-net-worth investors. Moreover, the creation of new business models and promotional partnerships empower Robo Advisory providers to deliver customized wealth management services efficiently and cost effectively. Thus, all of these factors altogether drive the market growth owing to which Robo Advisory platforms exercised as an effective substitute to traditional financial advisory services and aids in the overall digital transformation of wealth management sector.

August 11, 2025, Japan’s fintech market is being reshaped by foreign founders and strategic M&A, fostering innovation and creating serial entrepreneurial opportunities. Successful ventures like Paidy and MoneyTree highlight the importance of local adaptation, digital payments, and emerging technologies such as blockchain and Web3 in driving growth.

Restraints:

-

Investor Confidence and Regulatory Barriers Slow Robo Advisory Expansion

Persistent skepticism among investors regarding AI-driven recommendations restrains the growth of the Robo Advisory Market. Low trust levels cause slower adoption, particularly among retail clients who value personalized human guidance and emotional intelligence in financial decisions. The changing regulatory framework and compliance requirements create operational complexities for the Robo Advisory providers, restricting them from rapid deployment as well as innovations. In addition, security issues of data privacy and cyber-weapons lower trust from investors, limiting the growth of the market. Together, these impediments limit the mass adoption of automated wealth management platforms, making it difficult for providers to scale effectively. Hence, even though technology has made a lot of progress, trust, regulatory, and security issues are still major hindrances to market expansion.

Opportunities:

-

Digital Platforms and AI Personalization Expand Robo Advisory Reach

The increasing adoption of AI-powered digital advisory platforms presents a significant growth opportunity for the Robo Advisory Market. Robo.advisors for retail investors fails to react to knowledge spots, poor portfolio decisions, know-how gap and information bombardment; building tools that address these aspects, personalized recommendations & portfolio data along with education issues. By adding simple and interactive portals available over desktop and mobile programs, providers can produce a better interaction and assist the investors to make a better decision. Smart organizations are utilizing humiliating low-cost AI designing the present wealth management for the long haul including tech-hungry retail and the high-net-worth segments rushing to markets with partnered organizations.

As its first MPF Robo-Advisory portal, Manulife partnered with AutoML Capital and Syfe to launch an AI-powered portfolio insights and personalized investment recommendation service to enable long-term retirement investment strategies. The platform is designed to educate members, streamline the management of retirement portfolios and enable proactive investment decisions with interactive digital tools via desktop and mobile.

Challenges:

-

Investor Confidence and Digital Barriers Slow Robo Advisory Expansion

The Robo Advisory Market faces several challenges that can slow its expansion. Limited trust in AI-generated investment recommendations causes slower adoption, particularly among retail investors who prefer personalized human guidance. Additionally, gaps in digital literacy and financial knowledge restrict effective utilization of automated platforms. Technology limitations, such as algorithm accuracy, data privacy concerns, and cybersecurity risks, further undermine user confidence. Regulatory compliance and evolving legal frameworks create operational complexities for providers, limiting rapid rollout and innovation. These factors collectively hinder market penetration and scalability, making it difficult for Robo Advisory firms to fully capitalize on digital transformation and achieve widespread adoption across diverse investor segments.

Robo Advisory Market Segmentation Outlook:

By Type

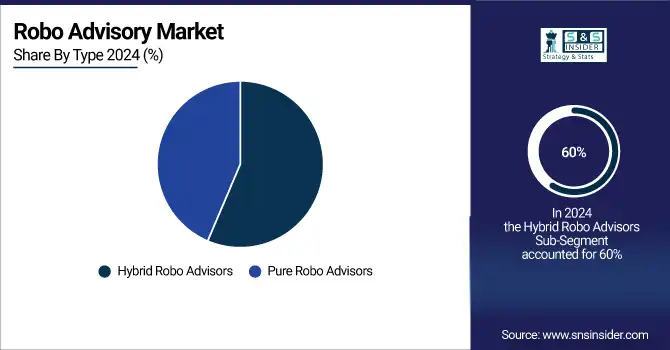

In 2024, the Hybrid Robo Advisors segment accounted for approximately 60% of Robo Advisory market share, as a hybrid model includes human advisory in addition to AI-driven strategy & portfolio execution, which together attract trust and personalization for the investors while at the same time improving the efficacy of portfolio management by leveraging the latest technologies.

The Pure Robo Advisors segment is expected to experience the fastest growth in the Robo Advisory market over 2025-2032 with a CAGR of 31.87%, due to the growing acceptance of automated investment solutions, including, fully automated, AI based, economical personalized portfolio management system. Digital literacy is on the rise while the demand for low-cost solutions and growing acceptance of algorithm-based advisory services is expected to further expedite the penetration of segment into the market.

By Provider

In 2024, the Fintech Robo Advisors segment accounted for approximately 41% of Robo Advisory market share, due to technology disruptive innovation driven competitive advantage based on user-centric digital platforms. The segment has become popular with retail & HNW clients with agile fintech startups providing these AI-backed, low-cost investment offerings. Combined with its continuous technology advancement, there is no question that it underpins a market formation and adoption.

The Banks segment is expected to experience the fastest growth in the Robo Advisory market over 2025-2032 with a CAGR of 32.74%, Traditional banks are increasingly integrating AI-driven robo-advisory solutions into their offerings to enhance customer experience, improve portfolio management, and provide personalized investment guidance. Growing digital adoption, strategic partnerships with fintech firms, and demand for hybrid wealth management solutions are expected to drive rapid market expansion for this segment.

By Service Type

In 2024, the Direct Plan-based/Goal-based segment accounted for approximately 60% of Robo Advisory market share, reflecting strong demand for personalized, goal-oriented investment solutions. Investors increasingly prefer platforms that provide automated portfolio recommendations aligned with their financial objectives. The segment’s growth is driven by AI-powered tools, user-friendly interfaces, and enhanced educational resources, enabling retail and high-net-worth clients to actively manage their investments.

The Comprehensive Wealth Advisory segment is expected to experience the fastest growth in the Robo Advisory market over 2025-2032 with a CAGR of 31.87%, due to increasing demand for fully integrated wealth management solution that provides automated investing with human advisor customizing innovative investment strategies across wealth asset classes. The segment has been witnessing growing adoption across both the retail and high-net-worth investor segment owing to sophisticated AI-based analytics, personalized portfolio recommendations, integrated financial planning tools.

By End User

In 2024, the High Net Worth Individuals segment accounted for approximately 65% of Robo Advisory market share, reflecting strong adoption among affluent investors seeking personalized, technology-driven portfolio management. The segment’s growth is driven by demand for sophisticated investment strategies, AI-powered recommendations, and hybrid advisory models that combine automation with expert human guidance, enabling efficient wealth management and enhanced financial decision-making.

The Retail Investor segment is expected to experience the fastest growth in the Robo Advisory market over 2025-2032 with a CAGR of 32.06%, Rising digital adoption, increasing financial literacy, and demand for low-cost, automated investment solutions are driving this expansion. AI-powered platforms offering personalized portfolio recommendations and goal-based planning are attracting retail clients, enabling them to make informed investment decisions while enhancing engagement and broadening the overall market reach.

Robo Advisory Market Regional Analysis:

In 2024 North America dominated the Robo Advisory Market and accounted for 44% of revenue share. The advancement of technology infrastructure in the region, the high digital adoption rates, and the wide availability of information about AI-powered investing platforms have resulted in the region having such a leadership position. Dominance of a hybrid advisory model deepens its penetration as FinTech startups and financial institutions complement the offering. Moreover, the supportive regulatory environment and the increasing need for cost-effective and hyper-personalized wealth management services by the companies operating in North America continue to dominate the global landscape.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia-Pacific is expected to witness the fastest growth in the Robo Advisory Market over 2025-2032, with a projected CAGR of 32.47%, Rapid digitalization, a surge in innovative solutions traction coupled with rising cognizance for AI-powered investment Platforms is contributing to the market growth. The propensity towards tailored wealth management service delivery at lower costs among retail and high-net-worth investors will underpin fast-tracked adoption trends across the region, and is expected to grow.

In 2024, Europe emerged as a promising region in the Robo Advisory Market, driven by increasing adoption of AI-powered investment platforms and growing interest in digital wealth management solutions. Supportive regulatory frameworks, rising investor awareness, and the presence of established financial institutions enhance market potential. Additionally, demand for personalized, cost-efficient portfolio management services among retail and high-net-worth clients positions Europe as a key growth region in the global Robo Advisory Market.

Latin America (LATAM) and the Middle East & Africa (MEA) regions are witnessing steady growth in the Robo Advisory Market, with growing digital adoption and increasing awareness of automated investment solutions. A rising demand and intensifying interest among retail and high-net-worth investors is driven by the deepening penetration of the internet and mobile and an increasing preference for customized portfolio management. Although not having the technological build up infrastructure and regulation to move up fast, these regions are nevertheless potential growth avenues for market players to introduce AI-powered, affordable and accessible mass wealth platforms to then slowly observe a sustainable growth in the market.

Robo Advisory Companies are:

The Key Players in Robo Advisory Market are Betterment LLC, Fincite GmbH, Wealthfront Corporation, The Vanguard Group, Inc., The Charles Schwab Corporation, Ellevest, Inc., Ginmon Vermögensverwaltung GmbH, Wealthify Limited, SoFi Technologies, Inc., SigFig Wealth Management, LLC, Personal Capital Corporation, Acorns Grow Incorporated, Fidelity Investments, UBS Group AG, Allianz SE, JP Morgan Chase & Co., Morgan Stanley Wealth Management, Interactive Brokers LLC, M1 Finance, Qplum Technologies and Others.

Recent Developments:

-

In Sept 2024, Vanguard reduced the minimum investment for its Digital Advisor robo-advisory platform from USD 3,000 to just USD 100. This move aims to attract more retail investors by providing accessible, low-cost automated investment solutions and expanding adoption of digital wealth management services.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 8.50 Billion |

| Market Size by 2032 | USD 71.19 Billion |

| CAGR | CAGR of 30.43% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type(Pure Robo Advisors AND Hybrid Robo Advisors) • By Provider(Fintech Robo Advisors, Banks, Traditional Wealth Managers and Others) • By Service Type(Direct Plan-based/Goal-based and Comprehensive Wealth Advisory) • By End User(Retail Investor and High Net Worth Individuals) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | The Robo Advisory Market Companies are Betterment LLC, Fincite GmbH, Wealthfront Corporation, The Vanguard Group, Inc., The Charles Schwab Corporation, Ellevest, Inc., Ginmon Vermögensverwaltung GmbH, Wealthify Limited, SoFi Technologies, Inc., SigFig Wealth Management, LLC, Personal Capital Corporation, Acorns Grow Incorporated, Fidelity Investments, UBS Group AG, Allianz SE, JP Morgan Chase & Co., Morgan Stanley Wealth Management, Interactive Brokers LLC, M1 Finance, Qplum Technologies and Others. |