Wireless Sensor Network Market Size & Trends:

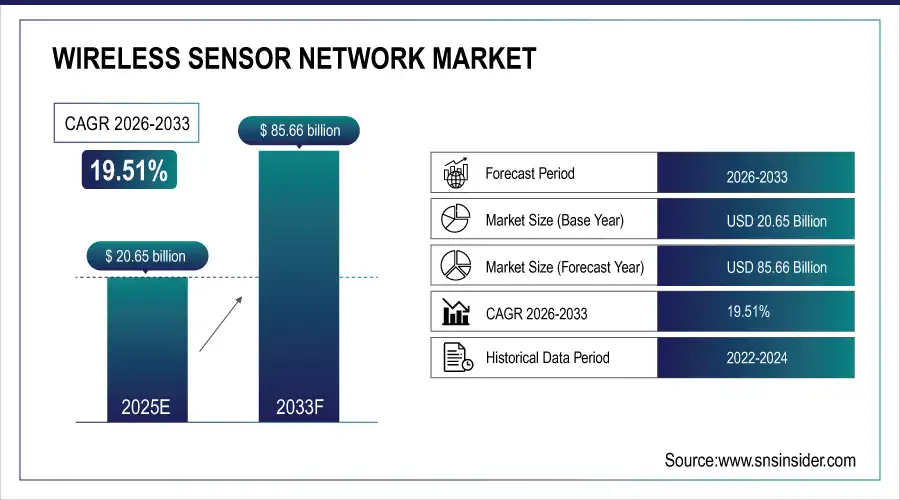

The Wireless Sensor Network Market size was valued at USD 20.65 Billion in 2025E and is projected to reach USD 85.66 Billion by 2033, growing at a CAGR of 19.51% during 2026-2033.

The Wireless Sensor Network Market is expanding due to the rising adoption in industrial automation, smart cities, and connected healthcare systems. Increasing demand for real-time monitoring, energy efficiency, and predictive maintenance is driving deployments. The growth of IoT, AI integration, and 5G connectivity further accelerates adoption. Falling sensor costs and advances in low-power technologies are making solutions more accessible. Together, these factors position WSNs as a critical enabler of digital transformation across industries.

Over 75% of industrial IoT deployments now integrate wireless sensor networks for real-time monitoring, reducing maintenance costs by up to 30% through predictive analytics.

To Get more information On Wireless Sensor Network Market - Request Free Sample Report

Wireless Sensor Network Market Trends

-

The integration of wireless sensor networks with IoT platforms is transforming industries by enabling real-time data collection, monitoring, and predictive analytics, driving efficiency in manufacturing, healthcare, and smart cities.

-

Artificial intelligence is increasingly embedded within WSNs, enhancing decision-making through advanced analytics, anomaly detection, and predictive maintenance, allowing businesses to optimize processes and reduce operational risks.

-

Smart city projects are fueling WSN adoption for traffic monitoring, air quality control, waste management, and public safety, improving urban efficiency, sustainability, and citizen-centric services globally.

-

Advances in low-power chipsets, energy harvesting technologies, and optimized communication protocols are extending the lifespan of wireless sensor networks, reducing maintenance costs, and supporting large-scale, long-term deployments.

-

Wireless sensor networks are revolutionizing healthcare by powering remote patient monitoring, wearable devices, and hospital automation systems, enabling proactive treatment, personalized medicine, and improved overall patient outcomes.

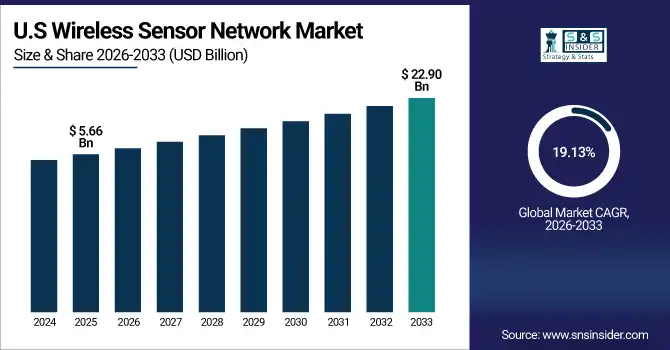

The U.S. Wireless Sensor Network Market size was valued at USD 5.66 Billion in 2025E and is projected to reach USD 22.90 Billion by 2033, growing at a CAGR of 19.13% during 2026-2033. Wireless Sensor Network Market growth is driven by rapid adoption of IoT and smart manufacturing, increasing investments in industrial automation, healthcare digitization, and smart city projects, alongside technological advancements in low-power sensors, AI integration, and robust government support for digital infrastructure.

Wireless Sensor Network Market Growth Drivers:

-

Growing IoT Adoption, Smart Infrastructure Development, and Increasing Industrial Automation Accelerating Wireless Sensor Network Deployment Globally.

The widespread adoption of IoT devices and connected technologies is fueling wireless sensor network demand. Industrial automation, healthcare digitization, and smart city initiatives require real-time data monitoring and energy-efficient connectivity. Rising need for predictive maintenance, asset tracking, and environmental monitoring further strengthens adoption across diverse industry verticals.

Over 65% of industrial IoT deployments now rely on wireless sensor networks for predictive maintenance, reducing equipment downtime by up to 25% and cutting maintenance costs by 20–30%.

Wireless Sensor Network Market Restraints:

-

High Deployment Costs, Power Consumption Concerns, and Data Security Challenges Hindering Wireless Sensor Network Market Expansion

Despite rapid growth, high upfront installation costs and maintenance challenges restrain widespread WSN adoption. Limited battery life, power management issues, and integration complexities raise concerns for large-scale deployments. Additionally, increasing risks of cyberattacks and data breaches create security challenges, discouraging adoption in highly sensitive industrial, defense, and healthcare applications without robust protection measures.

Wireless Sensor Network Market Opportunities:

-

Integration of AI, 5G Connectivity, and Edge Computing Unlocks Next-Generation Wireless Sensor Network Applications

Emerging technologies such as AI-driven analytics, edge computing, and 5G connectivity create new opportunities for WSN adoption. These advancements enable ultra-low latency, higher data processing at the edge, and predictive insights. Expanding applications in autonomous vehicles, precision agriculture, and remote patient monitoring highlight untapped potential, positioning WSNs as a cornerstone technology for future intelligent systems and connected infrastructure worldwide.

AI-powered edge analytics in WSNs can reduce cloud data transmission by up to 70% while improving response times to under 10ms, critical for autonomous vehicle and industrial control systems.

Wireless Sensor Network Market Segment Analysis

-

By Product: In 2025, biosensors led the wireless sensor network market with a 35.67% share, while gas sensors are projected to be the fastest-growing segment, registering a CAGR of 12.56%.

-

By Application: Industrial automation dominated the market in 2025 with a 38.65% share, whereas smart transportation is expected to expand at the fastest pace with a CAGR of 15.32%.

-

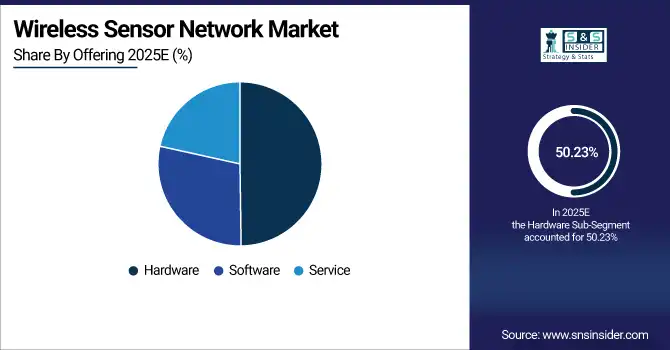

By Offering: Hardware accounted for the largest share of the market at 50.23% in 2025, while software is anticipated to grow the fastest, recording a CAGR of 13.48%.

-

By Industry Vertical: The industrial segment led the market with a 34.11% share in 2025, while healthcare is projected to be the fastest-growing vertical, advancing at a CAGR of 15.82%.

By Product, Biosensors Leads Market While Gas Sensors Registers Fastest Growth

In 2025, Biosensors dominate the product segment of the wireless sensor network market due to their extensive use in healthcare, pharmaceuticals, and environmental monitoring. Their ability to provide real-time health data, disease diagnostics, and bio-monitoring supports growing demand. At the same time, gas sensors are witnessing the fastest growth, driven by rising applications in industrial safety, pollution monitoring, and smart city infrastructure. Increasing concerns over air quality, emission regulations, and workplace safety strongly boost adoption of wireless gas sensing solutions.

By Application, Industrial Automation Dominate While Smart Transportation Shows Rapid Growth

Industrial automation leads the application segment as wireless sensor networks play a critical role in predictive maintenance, asset monitoring, and process optimization within manufacturing and energy sectors. They enhance productivity, reduce downtime, and improve operational efficiency. Meanwhile, smart transportation is experiencing rapid growth due to rising deployment of WSN in intelligent traffic management, connected vehicles, and EV infrastructure. These networks enable better route planning, congestion reduction, and road safety improvements, aligning with the growing adoption of smart mobility solutions globally.

By Offering, Hardware Lead While Software Registers Fastest Growth

Hardware remains the largest segment in the wireless sensor network market, as sensors, nodes, and gateways are essential components enabling real-time data acquisition and transmission. The demand for durable, low-power, and cost-effective hardware is steadily increasing. However, software is emerging as the fastest-growing offering, fueled by the need for advanced data analytics, AI-driven platforms, and cloud-based WSN management systems. Software enhances performance through predictive insights, network optimization, and security solutions, providing significant value addition to hardware-centric deployments in diverse industries.

By Industry Vertical, Industrial Lead While Healthcare Grow Fastest

The industrial sector dominates the WSN market due to the rise of Industry 4.0, where predictive maintenance, robotics, and process automation rely heavily on sensor networks. Adoption in energy, oil & gas, and smart factories is accelerating growth. Healthcare, however, is the fastest-growing vertical, with applications ranging from remote patient monitoring and smart wearables to hospital automation. Rising demand for personalized healthcare, telemedicine, and proactive disease management is boosting the role of WSNs in transforming medical services and patient outcomes.

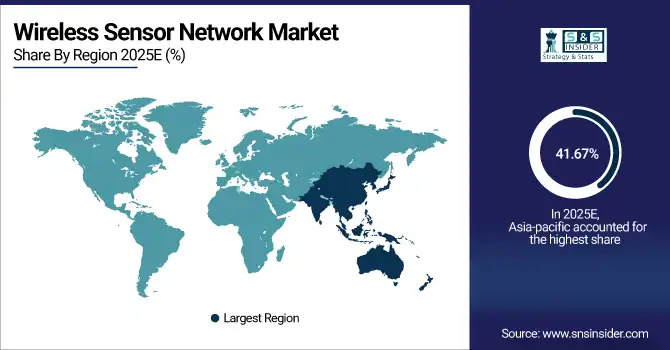

Wireless Sensor Network Market Regional Analysis:

Asia-pacific Wireless Sensor Network Market Insights

In 2025E Asia-Pacific dominated the Wireless Sensor Network Market and accounted for 41.67% of revenue share, this leadership is due to the advanced industrial automation, defense applications, and healthcare digitalization. Strong IoT ecosystem supports adoption in enterprises. U.S.-based companies lead innovation in low-power, AI-enabled sensors. Government funding enhances deployment in smart infrastructure. The region remains a hub for high-value WSN solutions.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Wireless Sensor Network Market Insights

The U.S. holds the largest share in North America’s WSN market due to robust R&D and innovation. Smart city projects, healthcare digitization, and defense applications drive adoption. Technology leaders invest heavily in advanced sensor design.

Asia-pacific Wireless Sensor Network Market Insights

Asia-pacific is expected to witness the fastest growth in the Wireless Sensor Network Market over 2026-2033, with a projected CAGR of 20.27% due to rapid urbanization, industrial automation, and smart city initiatives. Countries like China, Japan, and India are driving adoption in manufacturing, transportation, and healthcare. Growing IoT penetration supports demand for advanced sensors. Government initiatives for Industry 4.0 further boost investments.

China Wireless Sensor Network Market Insights

China dominates the Asia-Pacific WSN market with large-scale adoption across smart cities, manufacturing, and automotive sectors. Heavy government support for digital infrastructure accelerates growth. Domestic players expand sensor production capabilities.

Europe Wireless Sensor Network Market Insights

Europe’s WSN market is fueled by Industry 4.0 adoption, environmental monitoring, and smart mobility. Germany, France, and the UK lead regional growth. Strong regulatory frameworks ensure reliable deployments. Focus on energy efficiency supports advanced sensor demand. WSN adoption in automotive and healthcare accelerates further market expansion.

Germany Wireless Sensor Network Market Insights

Germany leads Europe’s WSN market with widespread use in industrial automation and automotive manufacturing. Industry 4.0 initiatives boost deployment density. German companies emphasize precision and reliability in sensors.

Latin America (LATAM) and Middle East & Africa (MEA) Wireless Sensor Network Market Insights

The Wireless Sensor Network Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the smart city projects, industrial automation, and renewable energy initiatives. Brazil and Mexico lead adoption in LATAM, while the UAE and Saudi Arabia dominate MEA deployments. Limited local manufacturing in LATAM creates reliance on imports, while Africa shows rising use in agriculture and utilities. Healthcare digitalization and IoT investments further accelerate demand.

Wireless Sensor Network Market Competitive Landscape:

Honeywell International Inc. plays a vital role in the Wireless Sensor Network market with advanced sensing and control solutions. The company focuses on industrial automation, energy efficiency, and safety monitoring. Its WSN-enabled products improve data-driven decision-making in aerospace, manufacturing, and building management.

-

In October 2024, Honeywell and Qualcomm expanded collaboration to develop AI-powered intelligent solutions for the energy sector, integrating secure wireless sensors and connectivity to improve system monitoring and operational efficiency.

STMicroelectronics is a leading semiconductor provider advancing Wireless Sensor Network technologies through its broad portfolio of MEMS sensors and low-power solutions. The company emphasizes IoT applications, automotive safety, and industrial automation. Its innovative sensor platforms support energy efficiency and reliable data transmission. With strong R&D, STMicroelectronics enhances WSN adoption in smart devices, healthcare monitoring, and connected infrastructure.

-

In July 2025, STMicroelectronics announced acquisition of NXP’s MEMS sensor business for up to US$950 million, enhancing its sensor portfolio for automotive safety and industrial monitoring applications.

TE Connectivity Ltd. is a global leader in connectivity and sensor technologies, significantly contributing to Wireless Sensor Network development. Its rugged, high-performance sensors are widely used in automotive, industrial, and medical sectors. TE focuses on enabling real-time monitoring and predictive maintenance. The company’s expertise in connectivity ensures reliable WSN deployments, driving efficiency, safety, and operational productivity across diverse applications.

-

In April 2024, TE Connectivity expanded its IoT wireless pressure sensor portfolio, launching the 65xxN (short-range) and 69xxN (long-range) wireless pressure sensors for condition monitoring via BLE 5.3 and extended coverage.

Siemens AG leverages its strong industrial automation expertise to drive Wireless Sensor Network adoption in manufacturing, energy, and smart infrastructure. The company integrates WSN into Industry 4.0 solutions, enabling predictive maintenance, process optimization, and sustainable operations. Siemens’ digital platforms and IoT ecosystem enhance data-driven decision-making, reducing downtime while improving efficiency.

-

In November 2024, Siemens secured a contract to retrofit 60 government buildings in the UAE with IoT sensors and software aimed at reducing energy and water consumption by 27% per annum under a decarbonization initiative.

Wireless Sensor Network Companies are:

-

Honeywell International Inc.

-

TE Connectivity Ltd.

-

Siemens AG

-

Texas Instruments Incorporated

-

ABB Ltd.

-

Bosch Sensortec

-

NXP Semiconductors

-

Schneider Electric SE

-

General Electric Company

-

Analog Devices Inc.

-

Infineon Technologies AG

-

IBM Corporation

-

Sensirion AG

-

Cisco Systems Inc.

-

Qualcomm Inc.

-

Intel Corporation

-

Murata Manufacturing Co. Ltd.

-

Broadcom Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 20.65 Billion |

| Market Size by 2033 | USD 85.66 Billion |

| CAGR | CAGR of 19.51% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Biosensors, Temperature Sensor, Pressure Sensor, Humidity Sensors and Gas Sensors), • By Application (Home and Building Automation, Industrial Automation, Military Surveillance and Smart Transportation) • By Offering (Hardware, Software and Service) • By Industry Vertical (Consumer Electronics, Industrial, Automotive and Transportation, Aerospace and Defense, Healthcare and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Honeywell International Inc., STMicroelectronics, TE Connectivity Ltd., Siemens AG, Texas Instruments Incorporated, Emerson Electric Co., ABB Ltd., Bosch Sensortec, NXP Semiconductors, Schneider Electric SE, General Electric Company, Analog Devices Inc., Infineon Technologies AG, IBM Corporation, Sensirion AG, Cisco Systems Inc., Qualcomm Inc., Intel Corporation, Murata Manufacturing Co. Ltd., Broadcom Inc. |