Baking Enzymes Market Report Scope & Overview:

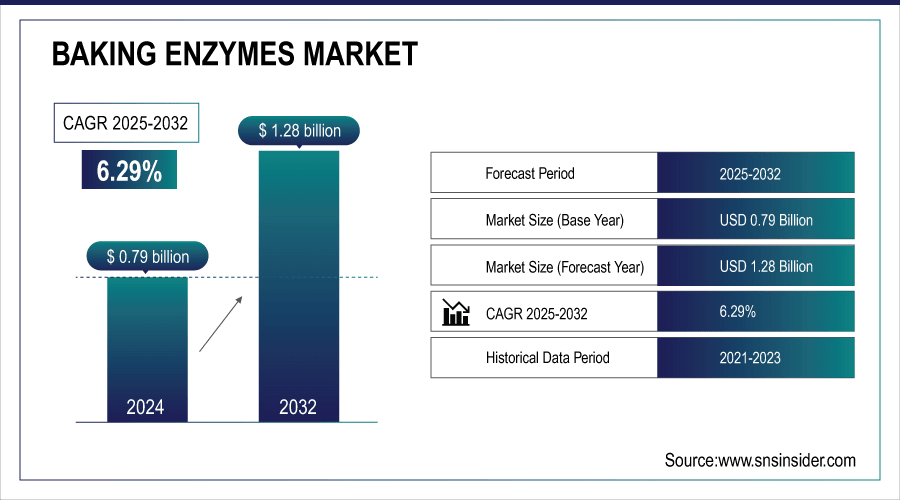

The Baking Enzymes Market size was valued at USD 0.79 Billion in 2024 and is projected to reach USD 1.28 Billion by 2032, growing at a CAGR of 6.29% during 2025-2032.

The global market is segmented including information on dynamics, segmentation by product, application, form, source and regional performance. This growth is primarily propelled by increasing consumer preference for clean-label baked goods, increasing penetration of bakery industry, and innovative enzymatic formulations that maintain bread quality, texture, and shelf-life. Baking enzymes are anticipated to remain steady in adoption across industrial and retail bakery industries globally through the forecast period, on the back of continued market growth, supported by health trends and technological developments.

-

Around 72% of consumers prefer baked goods made with natural or additive-free ingredients.

-

Innovative formulations, such as high-fiber or protein-enriched breads, now represent over 30% of new bakery product launches annually.

To Get More Information On Baking Enzymes Market - Request Free Sample Report

Baking Enzymes Market Trends:

-

Rapid urbanization and changing lifestyle patterns, along with rising disposable income, are increasing the demand for bakery products such as bread, cakes, and pastries.

-

Baking enzymes play a key role in large-scale bakeries by improving production efficiency, dough handling, product texture, and reducing waste.

-

Manufacturers are increasingly switching to enzyme-based formulations to maintain quality, texture, freshness, and shelf-life in high-volume baking operations.

-

Growing consumer preference for soft, fresh, and high-quality baked goods is driving the adoption of innovative enzyme-assisted baking solutions.

-

Expansion of bakery outlets in emerging regions requires region-specific enzyme solutions for breads, pastries, and biscuits.

-

Local and global enzyme suppliers can collaborate to deliver full solutions that enhance production efficiency, minimize waste, and support sustainable baking practices.

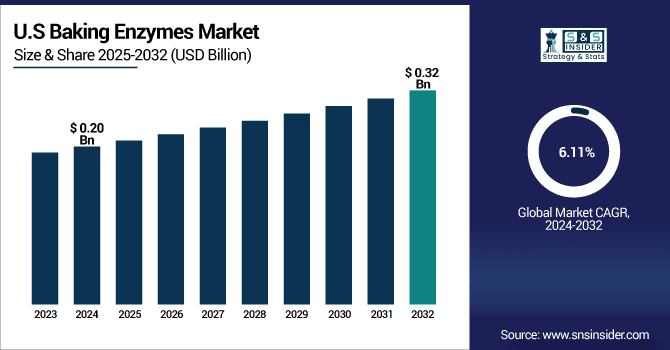

The U.S. Baking Enzymes Market size was valued at USD 0.20 Billion in 2024 and is projected to reach USD 0.32 Billion by 2032, growing at a CAGR of 6.11% during 2025-2032. In the U.S., the growth of market in terms of value is intended through increasing order of bakery products such as bread, cakes & pastries at both household and foodservice sectors. Baking enzymes are steadily being adopted due to high consumer preferences for high-quality, clean-label, and functional bakery products as well as advancements in enzyme technology that improves dough handling, texture, and freshness. It is driving the expansion of mass and artisan bakeries throughout the nation.

Baking Enzymes Market Growth Drivers:

-

Rapid Expansion of the Bakery Industry Globally Boosts Demand for Baking Enzymes Solutions

Urbanization along with changing lifestyle patterns and rising disposable income are driving exponential growth of bakery industry, leading to higher consumption of bread and cake and pastries. Baking enzymes are essential in large-scale bakeries because they improve production efficiency, dough handling, and waste and are widely used in commercial and industrial applications. In order to respond to growing demand while keeping all the features of the product including texture and quality, manufacturers are switching to enzymes-based solutions. Baking and bakery consumption is exponentially growing, especially in the emerging markets and is expected to create brisk opportunities for the baking enzymes market.

-

Around 70% of urban consumers report increased bread and pastry consumption due to convenience and ready-to-eat options.

-

Innovative flavors and inclusions, such as nuts, seeds, and superfruits, appear in over 25% of new bakery launches.

Baking Enzymes Market Restraints:

-

High Cost and Complex Production Processes Limit Baking Enzymes Adoption Among Small Bakeries Worldwide

Although enzyme production and formulation costs are still high and represent a significant investment barrier for small bakeries and artisanal producers, Widespread use is complicated by the optimization of enzyme blends and storage conditions. Market penetration is slow because smaller bakeries have limited budgets and so they use conventional ingredients. Moreover, the requirement for expert knowledge in managing and integrating enzymes into bakery processes may serve as an impediment, especially in developing regions where bakery operations are less sophisticated from a technology standpoint.

Baking Enzymes Market Opportunities:

-

Expansion Of Bakery Operations in Emerging Economies Offers Significant Growth Opportunities for Enzyme Adoption

Urbanization coupled with increasing disposable income has bolstered the growth of bakery outlets in the Asia-Pacific, Latin American and Middle Eastern emerging markets. This expansion increases the demand for baking enzymes to ensure product quality, shelf-life and production efficiency in high-volume operations. Regional market opportunity is matched by regional enablement; both local manufacturers and global enzyme suppliers can take advantage of this by focusing on the delivery of full solutions for region-specific enzymes for breads, pastries and biscuits together can embrace a sustainable future and excel in the rapidly growing bakery market in these regions.

-

Over 65% of consumers prefer freshly baked bread and pastries with soft texture and longer freshness.

-

Exotic flavors and inclusions such as superfruit, nuts, and seeds account for 20–25% of new bakery products, reflecting changing consumer preferences.

Baking Enzymes Market Segment Analysis:

-

By Product, Carbohydrase held the largest share of around 42.40% in 2024, whereas Lipase is projected to be the fastest-growing segment with a CAGR of 8.10%.

-

By Application, Bread segment dominated the market with approximately 40.50% share in 2024, while Cookies & Biscuits segment is expected to register the highest growth with a CAGR of 7%.

-

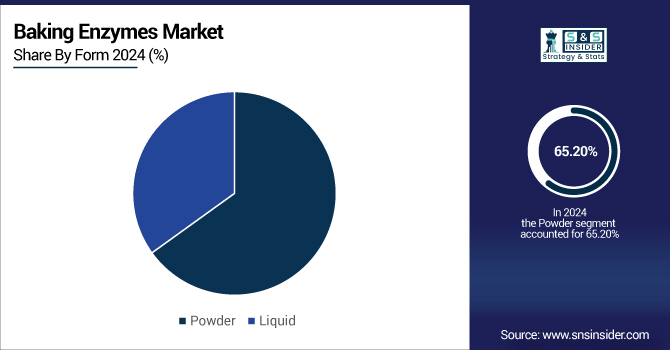

By Form, Powder accounted for the leading share of nearly 65.20% in 2024, whereas Liquid segment is anticipated to be the fastest-growing segment with a CAGR of 7.10%.

-

By Source, Microbial segment led the market with about 65.10% share in 2024, while Plant-Based segment is forecasted to grow the fastest at a CAGR of 6.29%.

By Form, Powder Segment Lead While Liquid Segment Registers Fastest Growth

In 2024, the Baking Enzymes Market was led by powder segment, with the powder segment having the highest share of revenue, almost 65.20% during the forecast period due to the ease of handling, as well as better shelf-life, and greater stability at storage conditions, making it suitable for use in an industrial bakery environment. DSM Food Specialties provide plenty of powdered enzymes which are extensively utilized by the baking sector. Liquid segment is anticipated to record a fastest CAGR of around 7.10% over the forecast period of 2025-2032, due to its improved solubility, rapid action in the dough, and its ability to be fed into automated production lines in commercial bakeries.

By Product, Carbohydrase Leads Market While Lipase Registers Fastest Growth

In 2024, the Baking Enzymes Market was led by the Carbohydrase segment, accounting for over 42.40% of revenue owing to its essential functionality in improving texture, dough handling, and shelf-life of bread and pastry. As a top enzyme producer, Novozymes has an extensive portfolio of carbohydrase products that provide dough strength and enhance baking efficiencies. On the basis of type, lipase segment is expected to witness a fastest CAGR of more than 8.10% during the forecast period of 2025-2032, providing an increase in flavor and aroma in cakes, biscuits, and premium bakery applications.

By Application, Bread Segment Dominate While Cookies & Biscuits Segment Shows Rapid Growth

In 2024, Bread segment led the Baking Enzymes Market with approximately 40.50% revenue share due to worldwide consumption of bread and enzymes are crucial in enhancing the consistency, softness, and shelf-life of dough. AB Enzymes offers specific enzyme solutions to assist bread manufacturers in ensuring consistent quality. Based on type, the Cookies & Biscuits segment is anticipated to grow at the fastest CAGR of about 7% during 2025-2032, owing to the increasing desire for packaged snacks among consumers along with advancements improving texture and shelf stability.

By Source, Microbial Segment Lead While Plant-Based Segment Grows the Fastest

The Baking Enzymes Market was dominated by the Microbial segment, which holds the largest revenue share of around 65.10%. These enzymes are highly efficient, can produce large amounts of products consistently, and have large-scale production capabilities. Chr. An important supplier of microbial enzymes for various bakery uses is Hansen. The Plant Based segment (Plant-Based segment) dominates the bakery products market, with the highest CAGR of approximately 6.29% during the forecast years 2025-2032 due to a rising consumer focus towards natural, vegan and clean-label products while keeping the required functionality properties in the process of bakery production.

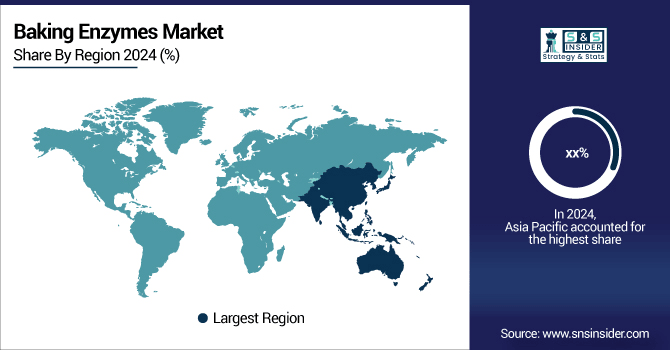

Asia Pacific Baking Enzymes Market Insights:

The Asia Pacific segment is expected to register the highest CAGR of nearly 6.45% over the forecast period 2025-2032. Urbanization is increasing, bakery activities are becoming wider and income is growing, so the demand for baked goods is increasing. However, manufacturers in China, India, and Japan are expected to adopt advanced enzyme solutions with increasing awareness among the end-users for clean-label and functional bakery products, causing the market to grow positively. Both domestic as well as global enzyme manufacturers can benefit from the emerging markets in the region.

Get Customized Report as Per Your Business Requirement - Enquiry Now

North America Baking Enzymes Market Insights:

In 2024, North America region held the Baking Enzymes Market largest revenue share, valued at approximately 35.20%. Such is due to the established bakery industries, high demand for quality baked products, and foregoing adoption of enzyme-based production technologies. The region's emphasis on quality control, innovation, and commercial bakery production, on large scales, has also reinforced the region's lead and a prominent global revenue contributor.

Europe Baking Enzymes Market Insights:

The Europe Baking Enzymes Market has been growing owing to the fuelling demand for premium and artisanal bakery products. Due to fast adoption of clean-label and functional baked goods by consumers, manufacturers are focusing on implementation of advanced enzyme solutions. The spread of industrial bakers with stringent quality parameters and ongoing technological advancements augment the growth of the market. Countries such as Germany, France, and the UK are at forefront of enzyme adoption and products throughout the region.

Latin America (LATAM) and Middle East & Africa (MEA) Baking Enzymes Market Insights:

Middle East & Africa and Latin America Baking Enzymes Markets are expected to gain from increasing volume of bakery consumption, growth in industrial bakeries, and high demand for high-quality, clean-label-baked goods. The enhancing of product quality, texture, and shelf-life among the regions are leading the development of enzymes in the driven countries such as UAE, Saudi Arabia, Brazil, and Argentina.

Competitive Landscape Baking Enzymes Market

Novozymes is a divisive Danish company which specializes in producing enzymes. This enzyme plays the role of Novamyl® and contributes to retaining the fluffiness and extensibility of the crumb in bread on storage, giving bread extended freshness. Providing even fresher-than-fresh texture and allowing for recipe optimization further extending freshness and reducing food waste, Novamyl® BestBite does just that.

-

In May 2024, Novozymes introduced Novamyl® BestBite, an enzyme solution designed to enhance the freshness and texture of baked goods. This product aims to extend shelf life and reduce food waste by maintaining softness and moistness in bread and other baked items.

DSM-Firmenich is a global science-based company active in health, nutrition and materials. Their BakeZyme® Master enzyme helps with a complex carbohydrate breakdown into simple sugars in food processing, which can help to improve dough handling. With a specialty in cake crumb structure improvement, CakeZyme® allows cake manufacturers to create a finer and more even crumb structure, be it pound cake, muffin, etc.

-

In August 2024, DSM-Firmenich's BakeZyme® Master is a premium maltogenic amylase enzyme that helps bread producers maximize freshness, resilience, and foldability in baked goods. It is particularly beneficial for on-the-go sandwiches and tortilla wraps.

Kerry Group is a world leader in taste and nutrition, serving innovative enzyme solutions for the baking industry. Mörrison: Their Fermentation™ Fresh Rich enzyme solution provides superior and prolonged retention of soft, fresh, and moist perception over shelf life in sweet baked goods. Biobake™ EgR will cut in excess of 30% of the egg content in bakery applications on muffins, croissants and donuts without any change in dough handling or quality of the product.

-

In November 2024, Kerry Group launched Biobake™ Fresh Rich, an innovative enzyme solution for sweet baked goods. This product delivers longer-lasting softness, freshness, and moistness perception over shelf life, contributing to reduced food waste.

Baking Enzymes Market Key Players

Some of the Baking Enzymes Market Companies are:

-

Novozymes A/S

-

Royal DSM

-

AB Enzymes (GmbH)

-

DuPont (including Danisco)

-

Advanced Enzymes Technologies Limited

-

Amano Enzyme Inc.

-

Puratos Group NV/SA

-

Maps Enzyme Limited

-

SternEnzym GmbH & Co. KG

-

Aumenzymes (Aum Enzymes)

-

Engrain

-

Dyadic International Inc.

-

Corbion

-

International Flavors & Fragrances Inc. (IFF)

-

Cargill, Incorporated

-

ADM (Archer Daniels Midland)

-

Associated British Foods plc

-

Kerry Group plc

-

AAK AB

-

British Bakels

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 0.79 Billion |

| Market Size by 2032 | USD 1.28 Billion |

| CAGR | CAGR of 6.29% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Carbohydrase, Protease, Lipase and Others) • By Application (Bread, Cakes & Pastries, Cookies & Biscuits and Others) • By Form (Powder and Liquid) • By Source (Microbial and Plant-Based) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Novozymes A/S, Royal DSM, AB Enzymes (GmbH), DuPont, Advanced Enzymes Technologies Limited, Amano Enzyme Inc., Puratos Group NV/SA, Maps Enzyme Limited, SternEnzym GmbH & Co. KG, Aumenzymes (Aum Enzymes), Engrain, Dyadic International Inc., Corbion, International Flavors & Fragrances Inc. (IFF), Cargill, Incorporated, ADM (Archer Daniels Midland), Associated British Foods plc, Kerry Group plc, AAK AB and British Bakels. |